The main stages in the development of economic science. State regulation of the economy and its place in various economic schools of the School of State Regulation of the Economy

Currently, most economists are unanimous that the state is one of the main actors market economy. At the same time, different economic schools interpret in different ways the functions that the state should perform, as well as the extent of its intervention in the economy.

- 1. Mercantilists argued the need for state intervention in the development of the economy. However, this only applied to trade (especially foreign trade relations) and industry. The French mercantilists, for example, proclaimed the need to establish strict prohibitive import duties and advocated a protectionist policy for the development of local industry.

- 2. During the era of free competition, the views of representatives of classical school about the dangers of the active economic policy of the state. A. Smith proved the ability of the market system to self-regulate. Therefore, the state was assigned the role of a “night watchman”, which should protect the economy, but not touch anything in it. The state was only to regulate the general balance and develop economic legislation.

- 3. Keynesianism. In the XIX and XX centuries. Periodically recurring crises, inflation, unemployment, a sharp differentiation of incomes (the so-called market failures) showed the inability of the market system to ensure the normal process of social reproduction. And if the market system cannot get out of crisis situations on its own, then the state should help it in this by regulating economic life. The theoretical understanding of the active role of the state in a market economy was facilitated by the work of J. M. Keynes “The General Theory of Employment, Interest and Money”. In it, he substantiated the need public policy as a means of balancing aggregate demand and aggregate supply to bring the economy out of the crisis and ensure its stability. The economic program of Keynesianism proposed the use of various methods of state regulation of the economy. Among them are the increase in state spending, the expansion of public works, the implementation of an active anti-inflationary and tax policy, the regulation of employment, the limitation of wage growth, etc.

- 4. In the 70s. 20th century the Keynesian approach to assessing the role of the state in a market economy has been criticized. Followers of A. Smith, neoclassical , argued that the state, as well as the market, has its "failures". From the theory of public choice, we know that state bodies sometimes make suboptimal decisions, i.e., not always effective from the point of view of society. Neoclassicists argued that the market mechanism is able to ensure the overall balance of the economy without control from the center. And the role of the state should be reduced to an indirect impact on the development of the economy through a reasonable monetary credit policy.

- 5. Supporters of active state regulation of the economy are representatives of the concept institutionalism, who criticize the theories of automatic regulation of the market economy.

We see that representatives of various schools offer either the state to intervene in the economy or not. Both approaches, especially if they are absolutized, suffer from one-sidedness. Efficient development national economy implies an optimal combination of market and state regulators. At the same time, the state should not suppress the market, but help it.

The state occupies the most significant positions in France, Germany, the Scandinavian countries, Spain, and Japan. It plays a much smaller role in Canada and Australia. In developing countries and countries with economies in transition, the role of the state is significant.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

MINISTRY OF EDUCATION AND SCIENCE OF THE RUSSIAN

FEDERATION FEDERAL AGENCY FOR EDUCATION

State educational institution of higher professional education

"RUSSIAN STATE TRADE AND ECONOMIC UNIVERSITY"

South Sakhalin Institute (branch)

Department of Management and Commerce

COURSE WORK

discipline: "Industry Economics"

on the topic "State regulation of the economy and its place in various economic schools"

Yuzhno-Sakhalinsk 2011

Introduction

Chapter 1. The essence of state regulation of the economy

2.2 Main directions economic activity states

2.3 Methods of state regulation of the economy

Conclusion

List of used literature

Applications

Introduction

State regulation of the economy is a system of state measures through which it can influence the socio-economic development of society. The need to include the state in the regulation of the economy is caused by many objective reasons related to the imperfection, "failures" of the market, the contradictions that arise on it. The market, by its very nature, cannot reach a level of self-regulation that would ensure full employment, health care, universal education, public housing, environmental protection, and much more.

Today, the relevance of the topic lies in the need to develop own market and expansion of the economy, through government regulation. Thus, it is necessary to clearly define the role of the state in the economic system.

In the Russian economy, great emphasis is placed on central planning. Our economy is predominantly a market system. At the same time, the economic functions of the state play a very significant role in it. Therefore, there is a need for the participation of the state in solving the problems generated by the market. The reasons for this need include 3, p. 22-25:

The need to compensate for, eliminate or avoid negative market externalities.

Each country has its own supreme national-state interests, the guarantor and defender of which is the state, that is, there is a set of problems that only the state and no one else can solve.

The need for state regulation is determined by the tasks of solving social problems that affect the development of the economy. Thus, the state establishes minimum wages, working hours, guaranteed vacations, and the subsistence minimum. It regulates the relationship between labor and capital, determines the direction of social spending, establishes unemployment benefits, pays various types of pensions and other benefits.

Only the state can provide the economy with the necessary amount of money.

According to some economists, the state should play a huge role in choosing the further development of the economic system. State intervention is considered necessary, since the spontaneous beginnings of the market aim economic development, first of all, at making a profit by a particular enterprise or industry, and not at the development of the economy as a whole.

Thus, the participation of the state in solving the problems generated by the market ("failures" of the market) is absolutely necessary. At the same time, the state should not replace the market and can only act in a certain coordinate system. The efficiency of the market economy as a system is the boundary of state regulation.

The purpose of the work is to study the essence and methods of state regulation of the economy. To do this, you need to perform a number of tasks:

Analyze theoretical aspects state regulation;

To study the theory of economic schools of state regulation;

Consider the tools of state regulation of the economy.

At present, the Russian government proceeds from the fact that its "super task" is connected with financial stabilization, with a reduction in inflation rates. The next important problem is the creation of incentives for the economic recovery of investment activity. The problem of unemployment in the current period does not seem so dangerous yet, so it does not come to the fore in terms of the order of goals. For various reasons, the government does not yet include among the priority goals the achievement of external economic balance and environmental protection 14.

Chapter 1. State regulation of the economy

1.1 The mechanism of state regulation of the economy

Economic regulation means purposeful processes that ensure the maintenance or change economic phenomena and their connections. Regulation is one of the most important functions of the control system national economy at all its levels. Regulation is driven by laws economic development and relies on the legislative framework, on the widespread use of the system of centralized financing and lending, on the relationship of enterprises with the budget, on pricing, on the use of incentives and various economic sanctions 3, p. 31.

To understand the GRE mechanism, it is advisable to characterize its levels, objects and subjects. There are three main types of economic regulation: state, market and corporate. Their optimal combination requires an organic linkage of various levels of state economic regulation. If we take the EGR levels along the vertical, then these will be: macro-, micro-, meso-level (medium, intermediate) 3, p. 35:

1) the macro level of the national economy, and on present stage to a certain extent, the supranational level of interstate unions;

2) meso-level - individual sectors of the economy (agribusiness, fuel and energy complex, military-industrial complex), industries and regions of the country. The GRE at this level is an integral part industrial policy states;

3) micro-level - business entities (enterprise, firm), producers and consumers, sellers and buyers.

For the normal functioning of the economy and the maintenance of social stability, the following main objects should be in the field of vision of the state: the economic cycle; capital accumulation; employment; money turnover; payment balance; prices; competitive and social relations; training and retraining of personnel; environment and ecology; foreign economic relations.

For example, the essence of the state counter-cyclical policy is to stimulate demand for goods and services, investment and employment during crises and depressions; the regulation of employment is the maintenance of a normal, from the point of view of a market economy, relationship between the supply and demand of labor; regulation of competitive relations is the antimonopoly activity of the state, aimed at the demonopolization of the economy, the formation of a competitive environment in commodity markets, and the support and development of entrepreneurship. The state of the balance of payments is an objective indicator of the economy. Of course, the listed objects are completely different and may cover different levels GRE.

As for the subjects of the SRE, it is they who implement the state economic policy and are the main executors of the economic interests of society.

Subjects are supranational, national, central or federal, regional, municipal or communal (local) governments. The executors of the economic interests of society - the subjects of the GRE are the bodies of the three branches of government, built on a hierarchical principle, as well as central bank.

State regulation in the market economy is the purposeful influence of the state on the micro- and macroeconomic processes of economic development in order to maintain its stability or change in the direction necessary for society 2, p. 27-30.

Based on the essence, the goals of state regulation are determined. Economic science considers at the global level the main, highest goal of regulation and applied goals. In any country, the highest goal should be to achieve the maximum welfare of the whole society. But its implementation is possible through the achievement of applied goals, which include: the economic growth; full employment; price stability and stability national currency; foreign economic balance.

In the system of economic goals, ensuring economic growth is considered the leading specific task. Its solution is associated with the absolute and relative increase in GNP.

Ensuring economic growth is associated with another important goal - the satisfaction of the requirements of full employment. Its essence is to achieve the maximum possible and in the long term stable use of the entire able-bodied population. Specifically, the task is solved by creating new jobs and other methods of combating unemployment.

The stability of the price level and the national currency is a condition for the stability of the economy. Therefore, the achievement of this goal is the most important guideline in the actions of the state.

The solution of the three listed targets means the achievement of a relative macroeconomic balance within the national economy, and creates more favorable conditions for achieving external economic balance 2, p. 44:.

The significance and sequence of setting goals in a particular country is determined by a variety of internal and external circumstances. With regard to the conditions of Russia, the sequence of achieving the considered goals may differ markedly from the sequence characteristic of Western countries. Yes, and in the very composition of the goals there is a certain specificity, caused by the lack of maturity of market relations.

Targets are implemented on the basis of a number of specific principles of state regulation of the economy. There will be much more of them than the economic goals themselves. We list them without classifying them according to a certain order or criteria 3, p. 36-37:

The regulation of the economy requires the observance of the principle “do not interfere with the market”: observe the “rules of the game”;

Ensuring economic freedom and efficiency of entrepreneurial activity;

Development of a system of priorities in the implementation of the tasks;

Social orientation of economic regulation;

Combination of federal state, regional and municipal regulation;

Forecasting the demographic situation;

Accounting for the political situation and stability in society;

Economic feasibility, justification and boundaries (limits) of regulation, etc.

The implementation of these principles involves the creation of conditions for the production of an increasing number of goods and services on a constantly changing technological basis, minimizing costs when using limited resources, strengthening positions in the world market, creating jobs for everyone who wants and can work. This, in turn, implies economic freedom and equality of all types of economic activity, producers and consumers of products, sellers and buyers in the market so that they have freedom of choice. It should be added here that any economy (both market and non-market) does not have innate immunity against such economic diseases as inflation and monopolization. It is clear that the market economy needs a constantly pursued state anti-inflationary and anti-monopoly policy 3, p. 38:.

So, let's summarize what has been said and formulate the essence of the GRE - it is a system of measures of a legislative, executive and supervisory nature, which are carried out by authorized state institutions. Public organizations that are also involved in regulating the economy include trade unions, unions of entrepreneurs and farmers, environmental councils, etc.

Ultimately, the mechanism of economic regulation should be aimed at orienting macroeconomic development in the direction of some envisaged option along the path of deepening economic reforms and achieving a higher level and quality of life. countercyclical policy government regulation

1.2 Views of economic schools on state regulation

The modern economy is a synthesis of the market mechanism and elements of state regulation. The forms of activity and the volume of state activity in the economic sphere change with the development of society, in particular with the complication of economic ties. In this regard, the attitude towards state intervention in the market economy was different in different countries. different stages its formation and development. This can be seen in various economic schools.

The economic policy of the state in the period of initial accumulation of capital and the formation of market relations from the 15th century. until the middle of the 17th century. reflected the interests of merchant capital and industry (at that time they were combined). Views on the need for state regulation for the development of trade and industry in the country were then developed by the economic school - mercantilism (fr. mercantilisme; it. mercante - merchant, merchant). Mercantilism as an economic school developed in England, Italy and France. An outstanding representative of this school is A. Montchretien (fr.). He coined the term "political economy" for the first time. His main work is "Treatise of Political Economy" (1615).

Mercantilists considered money as the main source of wealth, more precisely, trade, and therefore the accumulation of monetary wealth can be achieved with the help of state power, support for artisans and trade protectionism in the foreign market 6, p. 77-78.

In the middle of the eighteenth century. as a reaction to mercantilism in France, a new direction of economic thought arose - physiocracy (rp.philsis - nature + kratos - power, strength, domination). Founder Fr. Quesnay - "Economic Table" (1758). The Physiocrats believed that the attention of the government should be directed not to the development of trade and the accumulation of money, but to agriculture, where, in their opinion, the wealth of society is created. In practical conclusions, the Physiocrats sought the implementation by the state of an economic policy aimed at the development of large-scale agriculture.

With the development of market relations, the entrepreneurial class, which gained strength, began to consider state intervention and the restrictions associated with it as a hindrance to their activities. The changed situation confirmed the need to create a new system of economic knowledge, which found its expression in the formation of the classical school. Outstanding representatives of this trend: V. Petty, A. Smith, D. Ricardo.

For the first time, the main ideas of the classical school were most fully substantiated by A. Smith in his "Study on the Nature and Causes of the Wealth of Nations" (1776). According to his interpretation, the market system is capable of self-regulation, which is based on the "invisible hand" - self-interest based on private property and associated with the pursuit of profit. Self-interest acts as the main driving force of economic development. One of the central ideas of A. Smith's teaching was the idea that the economy would function more efficiently if its regulation by the state was excluded 6, p. 84-86.

The best option for the state is to adhere to the policy of laisser faire (French expression: let everyone go their own way) - non-intervention of the state. English version of this expression: let it be - let everything go as it goes. Since the main regulator of the economy, according to A. Smith, is the market, therefore, he (the market) should be given complete freedom.

The classical direction dominated quite long time until the crisis phenomena of 1929-1933. did not call into question many of his provisions. Representatives of this direction believed that the mechanism of market competition automatically ensures the equality of supply and demand, and any long-term violation of this balance and deep economic crises are excluded. This was argued by the fact that in market conditions, prices, wage, interest rates are quite flexible and change quickly under the influence of supply and demand, adapting to the new market situation.

An important stage in the theoretical understanding of the role of the state in a market economy was associated with the name of the outstanding English economist J. Keynes. The ideas that revolutionized the classical views on the market economy were set forth in the book The General Theory of Employment, Interest and Money (1936). This means the emergence of a new direction in the views on the GRE - Keynesianism. Keynesian theory, based on the real facts of the first half of the 20th century, proceeded from the fact that prices, interest rates, and, in general, wages are not quite flexible in the market and change slowly in the short term, not quickly - as in classic version. Therefore, they move to the equilibrium point of aggregate supply and demand in slow motion.

Keynes believed that the classical theory could not explain how to reduce unemployment, which, becoming massive, requires more and more public funds and creates an unfavorable social situation. He explained that the essence of macroeconomic regulation lies in the management of expenditures when incomes change, which change much faster than inflexible prices and wages 12, p. 91.

Keynes believed that the state can regulate the development of the economy by influencing aggregate demand. Aggregate demand is the real amount of national production of goods that consumers, businesses and the government are willing to buy at a given price level. It was in the lack of "effective" demand that Keynesian theory saw the main cause of the crisis phenomena in the market economy.

In a purely market economy, there are no such levers, Keynes believed, which would automatically contribute to the growth of GNP. Therefore, “... our ultimate goal,” he wrote, “may be the selection of such variables that are amenable to conscious control or management by the central authorities within the economic system in which we live” 12, p. 93.

Keynesians believed that the economic policy of the state can contribute to the growth of GNP and employment. Yes, growth public spending will increase GNP and thereby increase employment. In addition, the state should stimulate the growth of investments for this purpose by increasing monetary circulation and lowering the rate of interest. Keynes also referred to investment regulation tools: increasing public investment and its efficiency, expanding public spending and purchasing goods. As a result, production will expand, additional workers will be attracted, employment will increase 12, p. 94.

Thus, the economic policy reflecting the ideas of Keynes was pursued by most of the developed countries of the world after the Second World War. It is believed that it was she who largely contributed to the mitigation of cyclical fluctuations in the economy. Considering economic instruments regulation of aggregate demand -- monetary and budget, preference was given to the budget.

Monetarism (English money - money; monetari - monetary). From the second half of the 70s - early 80s. there was an intensive search for new approaches to GRE. If employment was the central issue in the development of Keynesian theory, then the situation changed. The main problem was inflation with a simultaneous decline in production (stagflation). Keynesian recommendations increase budget spending and thus to pursue a policy of deficit financing in the changed conditions turned out to be unsuitable. Budget injections into the economy could only increase inflation, which actually happened 12, p. 99.

As a school in economics, monetarism puts monetary and credit relations at the basis of market relations. In the post-war period, the role of monetarism was revived by the famous American scientist, Nobel Prize winner Milton Friedman (Chicago school) "Counterrevolution in Monetary Theory" (1970), "Money and Economic Growth" (1973).

Unlike Keynesians, who assign money a secondary role in determining economic activity, monetarists believe that the money supply is the single most important factor affecting the level of production, employment and prices. Keynesians advocate extensive government intervention to stabilize the economy, while monetarists advocate a free market with limited government regulation 12, 103.

Supporters of the monetarist direction focus on "stable demand for money", i.e. on the constancy of the growth rate of the money supply. When a relationship is reached between the amount of money in circulation and aggregate demand, the constant growth of the money supply allows aggregate demand to respond synchronously to the growth of the natural level of real output. In this case, full employment and price stability will be achieved in the long run. At the same time, monetarists assign an important role to the Central Bank in maintaining stable and predictable growth rates of bank reserves and money supply 12, p. 106.

Consideration of two alternative options for the mechanism of monetary policy by monetarists and Keynesians shows:

1) monetarists believe that a change in the money supply, i.e. money supply, directly affects aggregate demand and then - on the volume of production in the country;

2) Keynesians in their mechanism of conducting monetary policy assign a special role to interest rates and investment spending in influencing the volume of production in the country.

It should be borne in mind that the specific monetary policy of a country is not based in its pure form on the provisions of one economic school. But at the same time, it may give more priority at this stage of development to one specific concept. So, in the USA, despite the prevailing influence of monetarism in monetary policy, it also contains the tools promoted by the Keynesians - forced regulation of the interest rate and investment spending 6, p. 89-91.

The priority role of monetarism in the development and implementation of monetary policy over the past decades in Western countries has led to a reduction in state intervention in the banking and credit sphere. In almost all Western countries, the main responsibility for monetary policy lies with the Central Bank, which seeks to influence macroeconomic processes with more flexible (indirect) methods: regulation of the amount of money in circulation; regulation of bank reserves; regulation of the amount of loans and credits provided commercial banks; interest rate regulation, etc.

The essence of monetarism can be reduced to two fundamental theses:

1. Money plays a major role in macroeconomics.

2. The Central Bank can influence the money supply, i.e. on the amount of money in circulation (growth no more than 3-5% per year).

The monetarist approach is that the market system, if it is not subject to government intervention, they believe, provides significant macroeconomic stability, as it is sufficiently competitive. Public administration is seen as bureaucratic, inefficient, and even harmful to individual initiative; it suppresses human freedom. The public sector, in their opinion, should be as small as possible. The ideological roots of monetarism go back to classical economic theory 6, p. 92.

Thus, the views of Keynesians and monetarists on the role of the state in the economy, on the private and public sectors are almost diametrically opposed. For all their inconsistency and discrepancy, one can definitely note that the differences relate to the forms and proportion of state intervention in the economy. Modern market impossible without government intervention. The market is characterized by anti-social actions and tendencies that lead to a violation of not only micro, but also macro proportions, and, consequently, to financial, economic and other crisis phenomena. Experience has shown that they are limited only by state regulators.

1.3 The role and limits of state intervention in the economy

Despite the fact that the state assumes the functions of eliminating the negative socio-economic consequences of an imperfect market, creating favorable conditions for the functioning of the national economy as a whole, its intervention in the economy should not be unlimited. The boundary, the limit of state regulation of the economy is the efficiency of the market economy as a system. Crossing this line can lead to the disappearance of economic incentives that ensure the effective functioning of the market mechanism. Excessive participation of the state in the economy, the performance of unusual functions by it contribute to the nationalization of the economy, changes in the economic system 7, p. 82.

So, the state is an integral subject of the economy in any economic system. The place and role of the state in the economy differ depending on one or another type of economic system 7, p. 83-85.

The state occupies significant positions in the traditional economy. Under the conditions of backward, primitive technology, which does not allow for economic growth, the state performs important distributive functions, redistributing a significant part of the national income. These funds are directed by the state to provide material support to the poorest segments of the population.

In a planned economy, the role of the state reaches significant proportions. This is especially characteristic of a command planned economy, which operates mainly on the basis of administrative methods of management. Under the conditions of a command planned economy, the state concentrates economic power in its hands, makes basic economic decisions (what, how much, how and for whom to produce), disposes of state property, which occupies a dominant place in the economy.

Due to the fact that the state strictly controls and patronizes enterprises, they are deprived of economic and operational independence, self-financing is proclaimed only in words. Of course, enterprises tend to focus on the market, but market requirements are not decisive. And such a market itself consists of a continuous deficit.

The state seeks to achieve a balance, proportionality in the economy through directive planning. Economic entities (enterprises, organizations) from a single planning center (ministry, committee) are informed of work plans, prices are approved, suppliers are determined and attached, and sales are regulated. State authorities strictly control the implementation of plans. The objective basis of directive planning is the presence in the economy of only one owner - the state.

Directive planning turns into administration for enterprises, which contradicts the laws of economic development. The negative features of state intervention in the economy are the bureaucratization of economic and political structures. It is no coincidence that they were called the administrative-command or administrative-bureaucratic system. Such state intervention goes beyond reasonable limits, blocks the mechanism of competition, putting in its place a state monopoly 7, p. 88.

Consequently, the excessive concentration of economic functions in the hands of the state leads to the emergence of an extreme form of a command economy - a state-owned economy. Excessive expansion of the sphere of activity of the state in the economy, the performance of functions unusual for it, contribute to a decrease in the efficiency of its functioning, a slowdown in economic growth, and the emergence of disproportions.

In a ridiculous economy, the state is freed from functions that are unusual for it (the satisfaction of fully aggregate demand, directive planning, etc.). It deals with what society cannot exist without in modern conditions and what the private sector of the economy avoids. Such an economy is based on a diversified economy, on market competition and macroeconomic regulation; the state has a strictly defined role in economic life.

Even the system of free competition does not work without the state, which assumes a certain responsibility within those limits of economic life where the market mechanism does not give the effect desired by society, since it has both positive and negative aspects (monopoly, inflation, crises, unemployment). Therefore, it is natural that the state seeks to develop a mechanism for forecasting and programming the market.

As a result, a transition should be made to a system where the market regulates the activities of enterprises and firms, and the state controls the functioning of the market in accordance with its laws. This means a minimum of state intervention in the activities of enterprises and the market. This intervention is carried out through the mechanism of state regulation of the economy, which should meet the interests of not only the state, but also the interests of enterprises, firms and workers 7, p. 89.

Currently economic basis state regulation of the economy is GDP, redistributed through the state budget and off-budget funds and state property. The effectiveness of the GRE, all other things being equal, is the higher, the higher the state revenues, the more the share of GDP is redistributed by the state, the greater the role of the public sector in the economy. But government revenues and the public sector have relative growth limits 2, p. 99.

1. The boundaries of the growth of state revenues: the boundaries of sufficient motivation for entrepreneurial activity; social boundaries of taxation of employees and middle strata; boundaries of GDP growth (opportunistic boundaries).

2. The possibilities of state ownership are also limited. The public sector cannot grow by capturing new positions in key sectors of the national economy.

So, the main boundary of the GRE is the possible discrepancy between its goals and the private interest of capital owners in conditions of relative freedom in making economic decisions.

In general terms, the permissible limits of state intervention in the economy are wide enough to ensure that reasonable measures of state regulation and an effectively functioning market mechanism make it possible to solve the main socio-economic problems. If the state tries to do more than it is measured by the market economy, then, as a rule, negative deformations of market processes occur, the efficiency of production decreases and, as a result, the level and quality of life of the people decreases. Then, sooner or later, it becomes necessary to denationalize the economy, to free it from excessive state interference 2, p. 103.

Thus, the following conclusions can be drawn from the chapter:

An important role in the economic development of society belongs to the state. The state throughout the history of its existence, along with the tasks of maintaining order, legality, organizing national defense, etc. performed certain functions in the economic sphere. Therefore, in modern conditions, non-intervention of the state in socio-economic processes is unthinkable.

Defining the goals of state regulation in a specific time period, the state is faced with the problem of conflicting goals. Therefore, the most difficult issue of state regulation is the search for an optimally harmonious system of goals.

For effective development economy, it is still necessary to more decisively remove unnecessary, burdensome functions in the economy from the state, transferring them market system. In this regard, speaking about the problem of the state and the market, the solution must necessarily be based on the market mechanism, but in no case not separately.

Chapter 2. Tools of state regulation of the economy

2.1 The main directions of economic activity of the state

One of the most important activities of the state in the social market economy is the regulation of the economy. In turn, state regulation of the economy is a system of economic measures of the state, through which it can influence the socio-economic development of society and is aimed at achieving the following goals 5, p. 241:

Creation of normal conditions for the functioning of the market mechanism;

Ensuring sustainable growth rates;

Regulation of structural changes in the economy caused by the needs of the modern scientific and technological revolution;

Ensuring social stability and social progress;

Solving environmental problems.

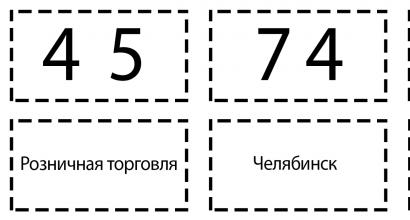

State regulation of the economy includes various areas of economic activity of the state (Appendix 1).

Creation legal basis economic activity development of legislative and regulatory documents that regulate the mechanism of functioning of the economy as a whole and its individual subjects. Through this function, the state determines the set of "rules of conduct" in the economy.

Creation of public goods - the creation and implementation of public goods is the task of the state. At the same time, the state can guarantee only such a level of consumption of public goods that the resources of the state budget allow at a given time. Their production above this level is assigned to non-governmental organizations 5, p. 242-243.

3. The implementation of antimonopoly policy can only be entrusted to the state, which, using administrative and economic measures, has an active influence on maintaining a competitive order. Antimonopoly legislation includes a set of legal acts aimed at protecting the competitive environment, counteracting monopoly and unfair competition.

4. An externality is an effect that affects firms and consumers in the production of goods and services, can be both negative and positive. For example, the construction of railways caused environmental pollution - this is a negative externality. And the construction of an irrigation system by one farmer, which improves the quality of other farmers' land without additional investment, is an example of a positive externality 5, p. 244.

5. Creation of the infrastructure of the economy - a complex of organizations that provide the conditions for reproduction, there are several types of infrastructure 5, p. 245:

Industrial (energy supply, transport and communications network);

Institutional (state administrative apparatus);

Social (educational, medical, cultural institutions);

Informational (a set of information channels and storages, information technologies).

Society is in dire need of the creation and operation of the infrastructure of the economy. At the same time, the market, due to the uncertainty of effective demand for infrastructure elements, limits its participation in this process and transfers this function to the state.

6. State entrepreneurship - the activities of state enterprises that produce goods and services necessary for the development of the national economy. The state as an entrepreneur acts, on the one hand, as a typical entrepreneur, and on the other hand, as a special "public" entrepreneur. Unlike a private entrepreneur, the state focuses not only on making a profit, but also on the provision of goods, works, services that ensure the functioning of the economy as a whole, including private capital. The expansion of state entrepreneurship is closely dependent on the possibilities of the state budget. Stimulating its development with relatively limited resources may force the state to use internal and external loans. This, in turn, will limit the financial base of state entrepreneurship 5, p. 246.

7. The redistribution of income is the withdrawal of part of the income from some persons in order to transfer them to other persons or the voluntary transfer of income by some persons to others who are more in need of them. There are various forms of income redistribution (Appendix 2).

State procurement of goods and services - this way of redistributing income mainly affects military orders, civil construction programs, and financing of capital investments in state enterprises. Public procurement of goods guarantees entrepreneurs a stable market, profit, and also contributes to solving problems of employment and welfare.

State loans and subsidies - provided to legal and individuals, local authorities at the expense of state or local budgets and special funds.

Tax redistribution of income - implies partial or complete exemption from taxes for some persons and an increased rate of their payment from others. This measure of income redistribution is aimed at achieving certain social and economic goals.

The market economy is characterized by uneven, cyclical development, which is accompanied by the loss of work, the stratification of the population by income. The state assumes the function of paying benefits to the unemployed, families with children, the disabled and other groups of the population in need of social assistance. The state supports social programs that ensure the accessibility of the population to education, healthcare, culture, physical culture and sports 5, p. 247-248.

8. Macroeconomic stabilization of the economy - a measure of state regulation is aimed at preventing, slowing down the economic downturn, consolidating and maintaining the performance of the economy at a certain level, and improving the economy. Macroeconomic stabilization is achieved mainly through fiscal and monetary policy. The main measures aimed at achieving macroeconomic stabilization include: changing government spending, taxes, etc. During a crisis, achieving economic stabilization requires emergency measures provided for by the program for stabilizing or improving the economy 5, p. 249.

9. Fiscal policy is the conscious use of spending and tax functions governments to achieve certain macroeconomic goals. If the economy operates below its capacity, then the state pursues an expansionary fiscal policy. It is carried out by increasing government spending and reducing tax rates, which, as a rule, leads to an increase in the budget deficit. To overcome inflationary gaps, a restrictive fiscal policy is used, which involves a reduction in government spending and an increase in tax rates 5, p. 250.

10. Support for small businesses. Small business is understood as a set of small and medium-sized private enterprises that are not directly included in any monopoly association and perform a subordinate role in the economy in relation to monopolies. Small business contributes to maintaining competition in a market economy, creating jobs, through tax, credit policy, the provision of services, and so on.

11. Regulation of foreign economic activity. The strengthening of the role of the state in foreign economic activity is influenced by such factors as the intensification of competition in world markets; destabilization of exchange rates; increased disequilibrium of balance of payments; huge foreign debt 5, p. 252.

Each state seeks to create favorable external conditions for the development of the national economy. Based on specific national interests, the state pursues either a policy of liberalization or protectionism. State regulation of the external environment takes place with the help of a set of measures that can be divided into customs tariffs and non-tariff regulatory measures.

12. Support for fundamental science, the implementation of a common scientific, technical and innovation policy - the constant introduction of new equipment, technologies that are the result of the achievements of scientific and technological progress, the development of inventions. Further improvement of market relations implies an even greater increase in the importance of knowledge, scientific developments, ideas, etc.

13. Ensuring environmental safety is an important function of the state in a social market economy. The second half of the 20th century showed that the extensive development of the economy is accompanied by a number of negative consequences. Among them, the destruction of ecosystems, the loss of part of the GDP. Such losses lead to negative economic, financial and social consequences. They can be eliminated either by slowing down the pace of economic development, or by implementing a set of measures to green production. In turn, the state 5, p. 253-255:

Organizes a system of control, evaluation and monitoring of changes in the state of the environment under the influence of anthropogenic impacts;

Creates a network of stationary observation stations, aerospace monitoring tools allow you to monitor changes in parameters characterizing the state of the environment;

Through laws, tax policy, administrative sanctions, it forces entrepreneurs to comply with environmental protection measures and environmental standards;

Controls the exploitation of natural resources, establishes prohibitions and restrictions on the production of certain products.

2.2 Methods of state regulation of the economy

The state performs its functions by applying various methods of influence. Methods are classified according to different criteria. There are methods of direct and indirect influence.

Methods of direct influence force the subjects of the economy to make decisions based not on an independent economic choice, but on the instructions of the state. Direct methods often have high efficiency due to the rapid achievement of economic results, but they also have disadvantages. They affect not only those agents of the market who are directly targeted by government measures, but also the subjects associated with them by market relations. In other words, direct methods violate the natural development of market processes 8, p. 124.

Methods of indirect influence create only the prerequisites for the subjects of economic relations to prefer options that correspond to the goals of economic policy when they make their own choice. Such methods include, for example, programming, providing the market sector with economic information. The disadvantage of indirect methods is a certain time lag that occurs between the moments of taking measures by the state, the reaction of the economy to them and real changes in economic results 8, p. 125.

Methods of state regulation are also classified according to organizational and institutional criteria. Here, administrative and economic methods are distinguished, let's consider such a classification in more detail 8, p. 127-129.

1. Administrative methods are based on regulatory actions related to the provision of legal infrastructure. The purpose of the measures being taken is to create certain "rules of the game" in a market economy. Administrative methods prescribe a strictly controlled line of behavior of economic agents. The administrative methods of regulating the economy include:

A ban is a ban on any activity, the recognition of any goods and services and their components as socially harmful, unnecessary, not allowed for use. For example, a state may impose a transit ban, i.e. passage through the territory under its sovereignty of persons objectionable to it, cargo and Vehicle other states for security purposes or for other reasons.

A permit is a consent issued in writing or orally by a subject of management that has the appropriate right. The state gives permission for many types of economic activity, for the import and export of a number of goods (drugs, food). For example, in the UK there is a special permit for the expansion of production capacity. It is issued by local authorities in agreement with the fire authorities, control over environment and etc.

Coercion is one of the management methods based on censure and application of penalties for violation of established norms. For example, late payment of taxes, reduction of the taxable base lead to the collection of fines from taxpayers.

2. Economic methods do not limit the freedom of choice, sometimes they expand it. An additional stimulus appears, to which the subject can either react or not pay the slightest attention, in any case, reserving the right to freely make a market decision. A change, for example, by the state in the interest rate on its debt obligations adds one more option to the number of available options for the profitable placement of savings - the purchase or sale of government securities.

In modern society, state regulation of the economy is carried out mainly on the basis of economic methods. Significant positions among economic methods are occupied by 8, p. 133-135:

Monetary policy is a set of measures in the field of monetary circulation and credit aimed at regulating economic growth, curbing inflation, ensuring employment and equalizing the balance of payments. Monetary policy includes the following instruments of regulation: regulation of the discount rate; establishing and changing the size of the minimum reserves that financial and credit organizations are required to keep in the central bank; operations of state organizations in the securities market.

Budgetary and financial policy is reduced to the purposeful activity of the state to use the budgetary and financial and monetary systems for the implementation of socio-economic policy and depends on the specific economic and political situation, as well as on the country's economic development strategy. Depending on these factors, a different degree of redistribution of national income through the budget, a greater or lesser level of centralization is envisaged financial resources within the budget system, strengthening or weakening the regulation of the use of budgetary funds, the priority of budgetary financing of certain activities, the choice of ways to achieve a balance of budget revenues and expenditures, etc.

Accelerated depreciation is depreciation at higher rates than current or average rates. The meaning of accelerated depreciation is to establish such a level of annual write-offs to the depreciation fund that exceeds the actual moral and physical depreciation of fixed capital elements. Accelerated depreciation allows you to transfer a significant part of profits to items of production costs that are not taxed. Such a policy contributes to the growth of entrepreneurs' own financial opportunities for capital investments, as well as to a decrease in the share borrowed money in the process of capital construction and modernization of capital.

AT developed countries the current regulation of the economy and state programming of the economy are applied 10, p. 355.

1. The current regulation of the economy is carried out mainly through fiscal policy. A significant role in such regulation is assigned to public spending: orders and purchases of goods and services, direct military spending, various subsidies and other expenses.

The current regulation of the economy is aimed primarily at maintaining a certain level of production and employment. In a period when economic development is characterized by high rates, measures are envisaged that deter investment and thus prevent overproduction. Such measures include a reduction in government spending on the purchase of goods and services, an increase in the cost of credit, a decrease in subsidies, and an increase in taxes 10, p. 356-357.

In the conditions of falling production volumes, rising unemployment, the opposite measures are applied: government spending increases, credit becomes cheaper, taxes are reduced. At the same time, it must be taken into account that an excessive increase in government spending, as a rule, leads to a budget deficit, to cover which additional taxes are introduced and external loans are taken.

2. State programming is a long-term, targeted regulation of the economy, which provides for the development of not only economic, but also social programs. State programming can cover the entire economy as a whole or its individual sectors, regions, individual groups of the population, and so on. There are various types of government programs, depending on the use of specific criteria, they can be divided into a number of types 10, p. 360.

1. Depending on the time period, the programs are: short-term (from 1 year to 3 years); medium-term (period of 3-5 years); long-term (drawn up for 5 years or more).

2. Depending on the programming object, there are:

The nationwide program fixes the main and desirable for society as a whole guidelines for the economic and social development. Programs focused on activities public sector and to regulate the activities of private firms.

Regional programs cover the activities of individual parts of the economy. In a number of countries, the socio-economic development of regions is carried out through regional planning.

Target programs provide for the development of specific areas (scientific research), support for certain groups of the population (pensioners, military personnel).

An emergency program is developed in cases where the economy is in a state of crisis (consequences of climate, environmental disasters, military operations, economic crises).

State programming is most common in Western Europe, as well as in Japan, less - in the US and Canada, where preference is given to the current regulation of the economy. The programming of the economy is also applied in developing countries. This is due to the fact that developing countries face problems in their development, which can be overcome through the mechanism of spontaneous regulation. economic processes impossible 10, p. 362.

Responsibility for the development of state programs lies with the state authorities, which involve well-known scientists, entrepreneurs, public figures, etc. in this process. A financial and economic justification is drawn up for the state program, the volume and mechanism of financing are approved by the state authorities. Wherein government programs are advisory (indicative) in nature, they are not mandatory for the implementation of the private sector of the economy.

Similar Documents

"For" and "against" state regulation today. Monetary policy tools and functions of the Central Bank. Goals and methods of state regulation of the economic sphere. State regulation of the economy on the example of Russia.

term paper, added 01/19/2016

The essence of state regulation of the economy, its goals and objectives. Functions, tools and methods of state regulation. Stages of interaction between the market economy and the state. Possibilities and contradictions of state regulation.

term paper, added 06/11/2010

State regulation: strategy and driving forces of economic transformation. Economy as an object of social regulation. Modern tasks of state regulation. State mechanism for regulating economic processes.

term paper, added 06/02/2010

Subject, scientific foundations and concepts of state regulation of the economy, the role and place of the state in economic systems and market economy models. The concept, essence and types of national planning and antimonopoly regulation.

course of lectures, added 01/31/2012

The concept of state regulation of prices, its methods and control of their application. Price regulation in advanced economies (on the example of France, Japan and the United States). Recommendations for improving the state regulation of prices in Russia.

term paper, added 10/12/2012

Forms and methods of state regulation in a market economy. Organization of fiscal and monetary policy. Exchange rate regulation. The concept and subjects of the world economy. Stages of development of international economic relations.

test, added 01/19/2016

The evolution of scientific views on the role of the state in a market economy. Characteristic modern models state regulation: Keynesian and neoclassical. Directions for improving the state regulation of market relations.

term paper, added 12/11/2015

Features and causes of state regulation of agricultural production. State regulation and its result in the USA and Europe. Problems of state regulation in the Republic of Belarus. The problem of land ownership.

term paper, added 09/23/2010

Concept, functions, main tools and methods of state regulation of prices. State regulation of prices for medicines in the economy Russian Federation. Significance of interaction between power structures and business, politics and economics.

term paper, added 10/08/2011

State regulation in the market economy: goals, objectives, tools. Functions of the state, directions and means of state regulation in transition economy. Stabilization and structural policy. Institutional transformations.

The role of the state in economic regulation throughout history has been, to varying degrees, the subject of economics. In any territorial entity, the state not only carried out normative activities for the legal regulation of public life, but also redistributed income, forming budgets for the implementation common functions. However, the role and boundaries of state economic activity have always been the subject of debate. Depending on the general conceptual orientation, economic scientific schools assess the essence and significance of the instruments of state regulation of the economy and the directions of economic policy in different ways. The main provisions of modern economic theories about the role of the state in the economy are presented in Scheme 1.1.

One of the first scientific schools that defined the economic functions of the state was mercantilism(XVI-XVII centuries), the largest representatives of which are T. Man, J. Stuart, J.-B. Colbert. Proceeding from the fact that the source of wealth is foreign trade, the results of which increase the amount of gold and silver in the country, the mercantilists justified the need for the existence of strict state administration measures aimed at preventing the outflow of money from the country and supporting exports.

The economic policy of supporting national producers and traders, import restrictions was called protectionism. Elements of such a policy are often used today. Developed countries in certain situations apply measures to support exporters and protect the domestic market from imports, strive for a balanced trade and balance of payments. One form of obstacle to protectionism is the World Trade Organization (WTO), created to remove economic and administrative barriers that hinder international competition.

Scheme 1.1.Basic theories of state regulation of the economy

A significant increase in scientific knowledge about the role of macroeconomic regulation was physiocratic theory(XVII century), whose representatives are F. Quesnay, A. R. Turgot. Speaking for freedom of trade, representatives of this school considered agricultural production and labor in agriculture to be the source of the wealth of the state, since only in this area a pure product is created. The merit of this school is the output of research to the macroeconomic level, the analysis of reproduction, the circulation of the social product and cash income. At the same time, a conclusion was made about the need to observe intersectoral proportions between agriculture and industry. The amount of money in circulation is determined by the needs of the relationship between the branches of production.

The theory of physiocrats raised the issue of developing sectoral priorities in economic policy (agriculture), supporting these priorities with state regulation instruments (taxes, duties).

The theoretical basis for non-intervention of the state in the economy, shared by most economists to this day, is defining the principles of a self-regulating market A. Smith, set forth in the work "A Study on the Nature and Causes of the Wealth of Nations" (1776). According to the theory of A. Smith, the mechanism of the market moves due to the rational decisions of its participants, constant adjustment is carried out due to free competition, the signals of which are given by prices. The movement of the market is directed by the "invisible hand" of supply and demand, where there is no place for government regulation. In various versions, this market model is reproduced in later liberal market economy models.

However, based on the practice of the actual functioning of the state, A. Smith explores the most important functions and tools of state functioning, such as the budget and taxes. Among the tasks of the state (monarch), A. Smith calls the creation and support of public enterprises and institutions that, for reasons of lack of profitability, will not be created by private individuals, but necessary for the whole society. In modern economic terms, this provision is expanded into a function of producing public goods and creating positive externalities. A. Smith identified the main national expenditures, which included the costs of the state for defense, justice, infrastructure (roads, bridges, ports) necessary for the development of trade, as well as the costs of training and educating the younger generation.

A. Smith paid much attention to the study of the tax system, defining its main principles: the equality of all before taxes, reliability, convenience. A. Smith considered the balance of income and expenses to be an indispensable condition for the functioning of the state: an increase in public debt can lead to the ruin of the state.

The general evolution of economic theories that deny the active role of the state in the economy was violated by the theory of J. M. Keynes (“The General Theory of Employment, Interest and Money”, 1936).

In contrast to the positions of other scientific schools Keynesianism when considering the movement of the market, he considers aggregate demand, not supply, to be primary and denies the possibility of a complete self-organization of the economy with the help of prices, wages, and interest rates. The expression of market disequilibrium is unemployment, reduction in production. Analyzing aggregate demand, J. M. Keynes showed the circumstances of insufficient investment in the economy and the need for government intervention to achieve effective use available resources and economic growth. The main problems of a market economy are unemployment and reduced investment. The state from its sources should invest financial resources in the economy, stimulate demand and thus maintain an effective balance. The source of additional investment in the economy is the state budget. Therefore, fiscal instruments of state regulation are dominant, and the budget deficit acts as one of the ways to stimulate demand.

Until the beginning of the 70s. 20th century Keynesianism was the most popular theory on which the economic policy of developed countries was based. However, later other economic theories came to the fore, which substantiated the possibility of self-regulation of the market. In the 1970s in the wake of a serious global energy crisis, two circumstances emerged: a decline in production and inflation, which received a generalized name stagflation.

According to critics of Keynesianism, this theory could not sufficiently explain the new phenomena of economic development, and their implications for economic policy in practice deepened the negative consequences.

Among these theories, the most significant is monetarism(M. Friedman "Inflation and money circulation", 1969). Monetarism as a basis for the economic policy of developed countries turned out to be in demand as the crisis of the Keynesian concept deepened, in the conditions of new phenomena of economic life - inflation and periodic recessions.

Monetarism, based on the recognition of the possibility of self-regulation of a market economy without state intervention, pays special attention to the study of monetary circulation, financial sector, analysis of the causes and methods of combating inflation. move business cycle according to monetarism, it is determined by the cyclicity of the money supply in circulation, which determines the business cycle. State investments and one of their sources - the budget deficit - will only intensify inflationary processes. Therefore, the main object of regulation should be the money supply, the constancy of its growth rates, depending on the magnitude of the growth rate of the gross domestic product. It should be noted that the regulation of the money supply is a function of non-executive power, nevertheless, it belongs to the sphere of national institutions of macroregulation - central banks (the Federal Reserve System in the USA). Macroregulation of the economy by targeting the money supply, varying interest rates, reserve requirements and other financial means indicates the need for macroregulation of the financial sector.

However, as the global economic crisis that began in 2008 showed, monetary methods of regulating the economy do not in themselves give crisis-free results - the complication of economic interrelations in global economy, apparently, requires adjustment of these methods. In almost all countries, the way out of the crisis was budget financing, an increase in the state budget deficit.

Among scientific schools that deny the active role of the state in regulating the economy, there are also various branches of modern theories of neo-institutionalism(R. Coase, J. Buchanan, D. North and others). However, based on the position of the need to determine property rights, contractual relations and the normative activities of the state in this area, representatives of the theory of public choice single out “market failures” that the state should fill, i.e. call into question the very mechanism of self-regulation of the market. Such "failures" include monopolies, information asymmetries, the need to produce public goods, and externalities. In turn, according to this theory, the state has its own "failures" (lack of reliable information, features of the political cycle, bureaucracy and corruption), so the problem lies in the optimization and efficiency of the economic functions of the state.

The practice of economic development has shown that the state's impact on market relations cannot be limited solely to regulatory activities to establish and implement property rights. recent history since the 60s. XX century., testifies to the active role of the state in the economy.

The role of the state in the financial sector has increased, its influence on stability financial system carried out primarily through macro-regulation interest rates, implementation of credit policy measures, exchange rates of the national currency. The state, carrying out purchases of goods and services for national needs, has become a subject of entrepreneurial activity, affects market prices, volumes of supply and demand. Budget, tax and financial and credit instruments act as real factors influencing economic development, stimulating and supporting stability and dynamics. State transfers to vulnerable groups of the population and, in general, investments in human capital. According to the World Bank, in three and a half decades (from 1960 to 1995) the scale of the state presence in the economies of industrialized countries has doubled.

Under these conditions, the modern economy is characterized as mixed. Its dynamics and mechanism are based on the actions of the market and the state.

In modern economic science, despite the ongoing discussions and contradictions, there is a general approach that recognizes the following areas of state activity in the economic sphere:

- - coordination of macroeconomic policy (taxes, budget, regulation of the financial sector);

- - Entrepreneurial activity on a certain scale (public procurement);

- - regulation of the activity of monopolies;

- - impact on economic growth (investment in human capital, efficiency of state institutions);

- - provision of benefits to vulnerable segments of the population (pensioners, the unemployed, the disabled).

The key tasks of theory and practice include determining the boundaries of state participation in economic processes, evaluating the effectiveness of state regulation, and searching for forms and methods that do not undermine the foundations of the market mechanism.

2 Economic schools about state regulation economy

State regulation of the economy has a long history and dates back to the end of the Middle Ages. The attitude to state intervention in the economy at different stages of its formation was different.

The merit of the first representatives of economic schools is not that they found an exhaustive answer to the question posed, but that they identified it. To pose a problem means to outline the direction in which the search should be conducted, groping, albeit in a somewhat general, vague form, for the sphere of social relations that economic theory should deal with.

The first stones in the foundation of a new branch of social knowledge were laid by the mercantilists. Mercantilists - from the Italian mercante - merchant, merchant - supporters of strong power, advocated state support for trade (especially exports). The condition for the growth of the wealth of the nation was considered not only the benefit of foreign trade relations with other countries, but also the development of its own industry, handicraft and manufacturing production, shipping, the cultivation of free land, and the involvement of the population in productive labor. Mercantilists argued that the main indicator of a country's wealth is the amount of gold. In this regard, they called for encouraging exports and restraining imports, maintaining an active trade balance(i.e. spending less than earning). Mercantilists emphasized the exclusive role of the state in the economy, as the main institution capable of managing all economic processes.

The next step in the development of economic thought was the classical school. The beginning of its formation was laid by William Petit. He believed that the state plays a major role in regulating economic processes. All his actions should be aimed at increasing the welfare of the citizens of the country, since the richer they are, the more taxes they can collect.

As you know, Adam Smith is called the ancestor of the classical school. The fact is that it was he who developed and presented the economic picture of society as a system, and not as separate theses. In his famous work “Inquiry into the Nature and Causes of the Wealth of Nations,” Smith argued that the economy is not controlled from a single center, does not obey a common plan, nevertheless, it functions according to certain rules. In accordance with the classical approach, the state should:

1. Ensure the military security of the country, people and their property;

2. Provide justice;

3. Create and maintain public institutions.

In his description of the market economy system, Adam Smith argued that it is the desire of the entrepreneur to achieve his private interests that is the main driving force of economic development, ultimately increasing the well-being of both himself and society as a whole. This is achieved, as Smith wrote, through the "invisible hand" of market laws. The desire for personal gain leads to the common benefit, the development of production and progress. Each individual takes care of himself, and society wins. Smith showed the power and importance of self-interest as an internal spring of competition and an economic mechanism. Thus, representatives of the classical school did not see the great importance of the state in regulating economic processes, since they believed that the market itself was able to regulate itself through competition.

In the 30s of the last century, after the deepest recession in the US economy, John Keynes in his book “The General Theory of Employment, Interest and Money” put forward his theory, in which he refuted the views of the classics on the role of the state. The concept put forward and defended by Keynes provides for the active intervention of the state in economic life. He did not believe in a self-regulating market mechanism and believed that in order to ensure normal growth and achieve equilibrium, outside intervention in the process of economic development was necessary. But Keynesian state regulation was aimed at preserving the market economy (competition and free pricing), that is, it did not break with the classical tradition.

In the mid 70s. and this theory turned out to be untenable, the reason was excessive government intervention in the economy. Now a new concept was needed, which, while maintaining the regulated nature of the market economy, would help the state find an "economic" mechanism for its intervention, and not an "administrative" one. This is the task that the monetarist concept, widely known today, which was developed by Milton Friedman, fulfilled. His theory, without denying the need for state intervention in the economy, reduced this intervention to "indirect" - through the regulation of the monetary sphere. Friedman, continuing the thoughts of the mercantilists, believed that the most powerful factor influencing economic activity is the change in the money supply. There is a direct relationship between the amount of money and the price level, prices are determined by the amount of money in circulation, and the purchasing power of money is determined by the price level. The money supply increases - prices rise, and vice versa, the money supply decreases - prices decrease, i.e. ceteris paribus, commodity prices change in proportion to the quantity of money.

The need for state regulation of the market economy was expressed most profoundly by Marx in his works on the capitalist mode of production. Marxism reasonably and consistently leads to the conclusion about the limitations of the capitalist mode of production in its pure form and the need to replace it with another more progressive system with the priority of the social aspect. The main drawback of the Marxist theory from the standpoint of modern domestic political economy is the conclusion about the need for a revolutionary way to change the mode of reproduction and the socio-economic system.

The attitude to state regulation of the economy at different stages of its formation was different: some scientists believed that only the state was able to ensure the stability and prosperity of the economy, some took the opposite point of view, believing that the market itself was able to regulate itself. In the general mass of modern economic doctrines, the belief about the need for state intervention in the operation of the market mechanism prevails. For the most part, economic schools disagree only on the methods and extent of such intervention.

Society is arranged in such a way that coercion to a certain extent is a condition of freedom. A market free from any state intervention can only be a theoretical abstraction. The economic reality is that the state is an active participant in market relations. Already in the period of free competition, a significant part of the productive forces outgrow the framework of classical private property, and the state was forced to take on the maintenance of large economic structures: railways, post office, telegraph, etc. In conditions of monopolistic competition, when production began to be characterized by great complexity, capital and energy intensity, the monopolies themselves turned out to be interested in strengthening the regulatory role of the state, in constant support from it in the domestic and foreign markets. The current effort of interstate integration leads to the fact that common economic processes step over national borders, form new socio-economic tasks related to defense, science, ecology, and reproduction of labor force.

economic provisions on which we can rely in the long-term socio-economic development. Therefore, conducting scientific research and developing an integrated system of state regulation of the Russian economy as a fundamental, strategic basis for the development of society in the context of the transition to market relations is an important, extremely relevant scientific and practical...

Economic strategy of the state, but also coordinates the efforts of ministries and departments, relying on the laws of the Russian Federation, decrees and orders of the President of the Russian Federation, resolutions of the Government of the Russian Federation. State regulation of the economy is carried out through administrative and economic methods. Administrative methods provide for the creation legal framework, economic legislation governing ...

A strictly defined purpose and usually form extra-budgetary trust funds, accumulated or not accumulated in the budget. state budget tax 1.3 Concept and types of tax policy Tax policy reflects the type, degree and purpose of state intervention (regulation) in the economy and varies depending on the situation in it. It is a system of...

And impact. It's justified. It is proved that the complete disregard for the regulatory role of the state in managing the economy is an idea that is alien to modern economic conditions. 1.2. Goals and forms of state regulation. As French entrepreneurs who arrived in Moscow in the autumn of 1991 at the invitation of the USSR Scientific and Industrial Union noted, “the belief that the main sign of a market ...

The origins of economic science are in the teachings of the thinkers of the ancient world, primarily the countries of the Ancient East - the cradle of world civilization. However, the very term "economy" was invented in the 5th century. BC. Greek poet Gespod, combining two words: “oikos” (house, household) and “nomos” (I know, law), which literally means knowledge, a set of rules for housekeeping. This term was introduced into scientific circulation by the representatives of ancient Greek economic thought Xenophon, who wrote a work called "Economics", and Aristotle (384-322 BC), who divided the science of wealth into economy (a set of use values) and chrematistics (the art of making money).

As an independent science, i.e. systematized knowledge about the essence, goals and objectives of the economic system, economic theory arose in the XVΙ-XVII centuries. During the period of the birth of manufactory, the expansion of domestic and foreign markets, the intensification of money circulation, such a direction in economic science as mercantilism appears. Its essence boils down to determining the source of wealth, which, in their opinion, is in the sphere of circulation. Mercantilists were representatives of trade and saw wealth itself only in money. One of the representatives of French mercantilism - Antoine Montchretien introduced into scientific circulation a new name for this discipline - "political economy". With the publication of his book "Treatise on Political Economy" (1615), economic science has been developing for more than 300 years as a science of the laws of economic management in the state (from Greek - "politeia" - state structure). From the same work, there was also a departure from the understanding of money as the only source of wealth. The teaching of W. Petty (1623-1686) serves as a transition from mercantilism to classical (genuine) science, where labor and land are already recognized as the source of wealth.