Simple cash audit. Cash audit plan and program Cash audit plan table

Introduction

3.3 Audit Money

Conclusions and offers

Bibliography

Applications

Introduction

During the functioning of the economy, many calculations are carried out. Each enterprise, in the process of operation, makes payments to suppliers for fixed assets purchased from them, inventory items and services rendered; with buyers and customers - for purchased goods, works and services.

IN modern conditions functioning of the domestic economy, it is almost impossible to manage business entities without obtaining timely and reliable economic information, the most significant part of which comes from a well-established accounting system. Currently, no organization, regardless of departmental affiliation and forms of ownership, can function without maintaining accounting, since only accounting data provides complete information about the property and financial condition of the organization.

Managing a modern business is accompanied by the need to solve problems of varying complexity. Increasingly, organizations and individual entrepreneurs are faced with the problem of non-repayment of debts from unscrupulous counterparties. The conflicts of interest that arise in this case have already become an integral part of the life of society.

The relevance of the work lies in the fact that in the process of financial and economic activities, organizations have settlement relationships that reflect mutual obligations associated with settlements with suppliers for fixed assets purchased from them, raw materials, materials and other inventory items, work performed and services rendered ; with customers - for goods purchased by them, finished products; with a budget and tax authorities- for various types of payments; with other bodies and persons - for various business transactions.

audit cash control

Control over cash flow, settlements and bank credit is one of the main tasks for enterprises.

All this gives particular importance to cash accounting as the most important tool for managing cash flows, monitoring the safety, legality and efficiency of the use of funds, maintaining the daily solvency of the organization, and predetermines the choice of topic thesis.

All of the above determined the choice of this topic for work.

The purpose of this study is to conduct an audit of funds at a specific enterprise.

This goal requires solving the following tasks:

-study of the economic content and objectives of cash audit;

-study of regulations governing cash accounting;

-study of features internal control at a specific enterprise;

-conducting an audit of funds;

-searching for ways to improve cash accounting methods.

The object of the research carried out in this work is the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU. The subject of the study is transactions with funds in the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU.

The information base of this work is: statistical material for 2010-2012, decrees and legislative acts of the government of the Russian Federation, publications of economic magazines and newspapers, works of Russian and foreign authors dealing with and researching the problems of accounting and auditing of funds, as well as internal documentation of the enterprise FSUE Uchkhoz "Prigorodnoye" ASAU.

1. Theoretical aspects cash audit

1.1 Concept and classification of funds

We can say that the prerequisite for the emergence of accounting as a separate branch of knowledge and sphere of professional activity is the emergence of a universal meter of economic objects and operations - money. Based on the fact that accounting generates data on the results of economic activity in monetary terms, the issues of cash accounting always remain relevant both from the perspective of the theory of organizing settlement operations and for practicing accountants.

Money is a legal tender that is used to carry out transactions, i.e. purchases of goods, services, resources.

Money is a type of financial asset. There are monetary financial assets and non-monetary financial assets (stocks, bonds, bills, etc.), the value of which lies in the fact that they generate income (dividends, interest). The value of money lies in its high liquidity.

Liquidity is the ability of an asset to be quickly and costlessly exchanged for any other asset or converted into an accepted means of payment in the economy - money. All assets have this ability, although different assets have different degrees of liquidity. Cash has the property of absolute liquidity.

The amount of money circulating in the economy is called the money supply and represents the amount of money supply in the country. The question “how much money is in the state” turns out to be quite complex: it all depends on what is considered money.

Money is a special commodity that is a universal equivalent of the value of other goods and services. Money acts as a special object of civil law (Article 128 of the Civil Code of the Russian Federation). Qualify as generic, divisible and replaceable things that can be individualized if they are in circulation in the form paper banknotes, by specifying the number. Money is movable property (Article 133 of the Civil Code of the Russian Federation). They may be the subject of some civil transactions: loan agreements, donations, loan agreements.

This object of civil law is specified in Article 140 of the Civil Code of the Russian Federation by indicating that the legal tender, obligatory for acceptance at face value throughout the Russian Federation, is the ruble. The cases, procedure and conditions for the use of foreign currency on the territory of the Russian Federation are determined by law or in the manner established by it.

The existing variety of terms etymologically related to the category “cash” leads to the fact that in practical activities, reporting users, when describing the economic essence of phenomena, operate with different concepts, investing in them the same meaning: money, cash, cash flow, cash flows , financial flows, monetary resources and monetary assets. Each of these concepts in regulatory documents and scientific literature has its own definitions that reveal and complement their meaning. They are used differently by economists in interpreting economic phenomena and lead accountants to misunderstandings when preparing cash statements.

An analysis of the definitions set out in the specialized literature has shown that a clear, unified and consistent interpretation has not been achieved in theoretical studies. The differences consist either in the identification of the essence of the pair of concepts “cash and cash resources” and the second pair - “cash resources and cash flows”, or in the divergence of their semantic and economic content.

As for accounting, regulations governing the accounting of funds and the disclosure of information about them in accounting (financial) statements also use different terminology (Table 1.1). A semantic analysis of the new PBU 23/2011 “Cash Flow Statement” indicates the difference between the concepts of “cash” and “cash flows,” which will be discussed below (the concept of “cash resources” does not appear in the text).

Table 1.1 - Use of the concepts "cash", "cash flows" and "cash equivalents" in accounting regulations

Chart of Accounts PBU 4/99 "Accounting Statements of an Organization" PBU 23/2011 "Cash Flow Statement" Section V "Cash". The accounts in this section are intended to summarize information on the availability and movement of funds in Russian and foreign currencies held at the cash desk, in settlement, currency and other accounts opened in credit organizations within the country and abroad, as well as valuable papers, payment and monetary documentsSection IV "Contents of the Balance Sheet". Numerical indicators as of the reporting date (availability). Current assets: item "Cash" (current accounts, foreign currency accounts, other funds); article "Financial investments" Reflects the organization's payments and receipts of cash and cash equivalents to the organization (hereinafter referred to as the organization's cash flows), as well as the balances of cash and cash equivalents at the beginning and end of the reporting period (clause 6)

The term “cash” is present in every analyzed regulatory document, but none of them has a clear definition of it. It should be noted that the text of each regulatory act necessarily specifies the area of information about funds that it regulates. Either this is data on cash balances, or on their movement (in italics in the table). These clarifications are directly related to the correct understanding of the concepts discussed.

One of the most successful, in our opinion, definitions of cash is the definition given in the Financial and Economic Encyclopedia “Cash (English cash) is the most important type of financial assets that represent funds in Russian and foreign currencies, easily marketable securities, payment and monetary documents."

Cash supports virtually all aspects of operating, investing and financing activities. “The continuous process of cash flow over time is a cash flow, which is figuratively compared to the “financial circulatory system” that ensures the viability of the organization.”

An analysis of the positions of various authors regarding the use of the term “monetary resources” allowed us to draw the following conclusions. Firstly, it is used commercial banks in relation to their creation of reserve funds that contribute to solving the problems of increasing competitiveness, sustainability, etc. Secondly, the term in question is used by specialists in the field management accounting and financial management in developing a specific cash flow management strategy, which is based on the optimal use of available cash resources and their expected growth. There are contradictions in terminology here: cash resources are interpreted as expected cash receipts, while cash resources are used funds. And in this vein, the use of the term “monetary resources”, in our opinion, is not correct.

Thus, cash is the basis for the functioning of every enterprise, therefore, improving the methods of accounting for it, as well as control over its storage and use should be well organized.

1.2 Regulatory framework, meaning and objectives of cash audit

System regulatory regulation accounting, developed by the Department of Accounting Methodology and Reporting of the Ministry of Finance of the Russian Federation, consists of documents at four levels: legislative, regulatory, methodological and organizational.

The basic principles of accounting in the Russian Federation are formulated in Federal Law dated December 6, 2011 N 402-FZ “On Accounting” (as amended on July 23, 2013).

The banking system of the Russian Federation includes the Bank of Russia, credit organizations, as well as branches and representative offices of foreign banks. Legal regulation of banking activities is carried out by the Constitution of the Russian Federation, the Federal Law “On Banks and Banking Activities”, the Federal Law “On the Central Bank of the Russian Federation (Bank of Russia)”, other federal laws, and regulations of the Bank of Russia.

Federal Law of May 22, 2003 N 54-FZ (as amended on July 2, 2013) “On the application of control cash register equipment when making cash payments and (or) payments using payment cards"

Basic rules for maintaining accounting records, as well as compiling and presenting financial statements are set out in the Regulations on accounting and financial reporting in the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n (as amended on December 24, 2010).

Based on the Law on Accounting and the Regulations on Accounting and Financial Reporting in the Russian Federation, the Ministry of Finance of Russia develops regulations (standards) on accounting.

Regulations on the procedure cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation (approved by the Bank of Russia on October 12, 2011 No. 373-P).

Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 N 383-P) (as amended on July 15, 2013) (Registered with the Ministry of Justice of Russia on June 22, 2012 N 24667).

Regulations on the procedure for conducting cash transactions and the rules for storing transportation and collection of banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation (approved by the Bank of Russia on April 24, 2008 No. 318-P) (as amended on February 7, 2012) (Registered with the Ministry of Justice of the Russian Federation on May 26, 2008 .2008 No. 11751).

Order of the Ministry of Finance of the Russian Federation dated October 17, 2011 No. 133n “On approval of the Administrative Regulations for the implementation of the Federal tax service state function to exercise control and supervision over the completeness of accounting for cash proceeds in organizations and individual entrepreneurs" (Registered with the Ministry of Justice of the Russian Federation on January 16, 2012 No. 22906).

Accounting Regulations "Accounting Policy of the Organization". PBU 1/2008. It is especially important since the Regulation establishes the basis for the formation (selection and justification) and disclosure (publicity) of the accounting policies of organizations that are legal entities under the legislation of the Russian Federation (except for credit institutions and budgetary institutions) .

Since 2012 Central Bank of the Russian Federation, changes have been made to the accounting practice of the enterprise by adopting a new Regulation dated October 12, 2011 N 373-P “On the procedure for conducting cash transactions” (hereinafter referred to as Regulation N 373-P). In accordance with current legislation, credit institutions do not check the cash discipline of legal entities.

The accounting regulations "Statement of cash flows" (PBU 23/2011), approved by order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n, for the first time in Russian practice introduced the concept of "cash equivalents", considering it as data on highly liquid financial investments that can be easily converted into a known amount of cash and which are subject to an insignificant risk of changes in value."

Note that the composition of cash equivalents in PBU 23/2011 is not clearly stated, while these components of cash flows are the main difference between the content of domestic reporting and reporting prepared in accordance with IFRS requirements.

Russian accountants have problems identifying and classifying such accounting items as cash, financial investments or liabilities. Hence, domestic reporting loses its information content and objectivity when assessing the solvency of an organization (there are from 16 to 20 coefficients). In the domestic chart of accounts, such a category as “cash equivalents” is not highlighted as a separate object.

1.3 Methodology for conducting a cash audit

The audit of cash transactions is a complex and labor-intensive section of the audit, requiring responsibility, composure and attention from the auditing auditors and assistants.

The main purpose of the audit of cash transactions is to verify the completeness and timeliness of the receipt of funds, the legality and reliability of the registration and reflection of completed transactions in their movement.

To achieve this goal, it is necessary to solve the following verification tasks:

-checking the compliance of the availability and flow of funds in the balance sheet and in the cash flow statement with accounting data;

-verification of primary accounting documents for cash transactions;

-checking the correctness of account assignments (postings) for cash transactions;

-checking the compliance of document data and analytical and synthetic accounting registers;

-checking the results of cash register inventories;

-checking the conditions for ensuring the safety of funds;

-checking the control system for the availability and movement of funds;

-checking the completeness and timeliness of cash delivery to the bank, compliance with the cash register limit and cash settlement limit;

-checking other aspects of the procedure for conducting cash transactions. Objects of inspection include:

-account 50 "Cash", other cash accounts and accounts corresponding to them;

-financial (accounting) statements of the audited organization in terms of the lines on which these funds are reflected.

By analogy with checking other sections of accounting, an audit of cash transactions is carried out in 3 stages.

The preparatory stage includes:

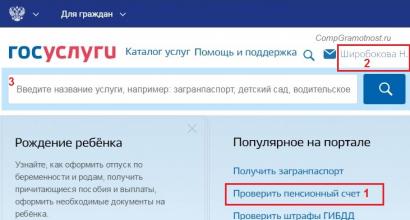

-familiarization with the conditions for carrying out cash transactions (studying the details of the relationship with the bank; the procedure for processing cash transactions) - Fig. 1.1;

-assessment of the state of internal control over the movement and safety of cash and other valuables in the cash register.

Figure 1.1 - Scheme of the preparatory stage of checking cash transactions

When studying the details of your relationship with the bank, you should familiarize yourself with at least two documents:

-an agreement with the bank on servicing a bank account;

-with the expectation of establishing a cash balance limit for the organization and obtaining permission to spend cash from the proceeds received at its cash desk.

2. The main stage includes checking the procedure for registration and accounting of cash transactions of the audited entity. If you have cash proceeds and cash register equipment (CCT), the verification becomes much more complicated. The main stage of the audit contains a large number of audit procedures that make it possible to identify possible violations in the conduct of cash transactions. The volume and nature of the procedures depend on the results of the assessment of the internal control system at the preliminary stage, the nature and scale of the organization’s activities.

Figure 1.2 - Scheme of the main stage of checking cash transactions

The final stage includes the preparation of reporting documents on the inspection carried out, the preparation of written information to the management of the inspected entity.

Based on the research carried out in the first chapter, the following conclusions must be drawn.

Cash includes assets of an enterprise that have liquidity closest to cash.

Cash is a “thin place” for abuse, both from employees of the organization and third parties. Therefore, detailed and prompt accounting of cash flows with the maximum level of detail is extremely necessary. The efficiency requirements for cash accounting are higher than for other types of accounting.

Setting up prompt and transparent accounting of cash and non-cash funds is one of the main tasks.

Accounting for settlement transactions should be structured in such a way as to help strengthen monetary relations, ensure acceleration of settlements and stability of operation national economy. It is designed to promote the proper use of funds and their safety.

Accounting must exercise constant control over the timely and complete receipt of funds at the enterprise's cash desk, control the sale of securities, transactions on payment and monetary documents, the timeliness and completeness of the delivery of funds to bank institutions and ensure the safety of national and foreign currency throughout their movement.

2 Organizational and economic characteristics of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU

2.1 a brief description of FSUE Uchkhoz "Prigorodnoye" ASAU

The organization FSUE Uchkhoz "Prigorodnoye" AGAU was registered on August 6, 1991. Registrar - Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the Industrial District of Barnaul, Altai Territory.

Type of ownership of FSUE Uchkhoz "Prigorodnoye" AGAU - Open joint-stock companies.

Form of ownership of FGUP Uchkhoz "Prigorodnoye" AGAU - Federal property.

Principal activities of FSUE Uchkhoz "Prigorodnoye" AGAU: growing grain, industrial and other agricultural crops not included in other categories (01.11), wholesale trade of live animals (51.23), wholesale trade of dairy products, eggs, edible oils and fats (51.33) .

The educational and experimental farm "Prigorodnoye" of the Altai State Agrarian University is a federal state unitary enterprise. The educational farm acquired this status in accordance with the Civil Code of the Russian Federation and was issued by order of the Ministry Agriculture and food of the Russian Federation dated 01.08.1997 No.-345. The educational farm was created in 1956 on the basis of economically weak collective farms and state fund lands. In 1958, it was transferred to the Altai State Agrarian University, which was called the Altai Agricultural Institute, as a training and experimental farm.

Uchkhoz is located in the northwestern part of the suburban area of Barnaul. On the territory of the farm there are 3 settlements: the village. Vlasikha, village Novo-Mikhailovka, village. Suburban. The central estate of the educational farm is located in the village. Prigorodny, 20 km from Barnaul. The address of the educational farm is as follows: 656922 Barnaul 22, st. Novosibirskaya, 44.

The authorized capital of the educational farm at the time of registration was 22 million rubles. According to the chief economist, because The educational farm does not have the status of a joint stock company, etc., then, accordingly, the authorized capital does not have a structure.

The agricultural farm has two main branches of production: crop production and livestock production.

To service the main branches of agricultural production, a vehicle fleet, a central repair shop, and a construction shop combining a sawmill, a carpentry shop and a repair and construction team have been organized on the central estate. In addition, the farm has two departments, each of which has three teams.

The organizational and management structure is presented schematically in Appendices 1 and 2.

The land area is 9640 hectares, including farmland 8355 hectares and is located 20 km from the regional center of Barnaul in the moderately arid steppe zone.

The climate of the Industrial District, in which the educational and experimental farm is located, is characterized by sharp continentality. The average temperature in January is 17.7?C, in July +18.9?C. The maximum temperature on some summer days reaches +35 to +38?C heat, and on winter days - 48 to 55?C frost. The winter period lasts on average 170 days. The height of the snow cover reaches 14 cm on the last day of November, increasing to a maximum of 35 cm in the first ten days of March.

The results of the economic activities of an educational farm are determined by a number of indicators. The main activities of an agricultural enterprise and the efficiency of its functioning are judged by specialization and size of production.

The main land fund for land use is represented by soils of the chernozem type of soil formation, which are formed on medium and heavy loams.

The main statutory tasks of the educational farm:

providing conditions for practical training of students;

production of agricultural products based on the use of modern scientific and technical achievements and zonal agricultural technologies;

creating conditions for conducting scientific research, production testing of new scientific developments;

production of knowledge-intensive products: elite grain seeds and fodder crops, breeding young animals of large cattle.

The agricultural farm includes two departments, each of which has two teams - field cropping and livestock breeding. To serve the main industries of the village. - X. production on the central estate of the educational farm there is a car park, a central repair shop, a construction shop that combines a sawmill, a carpentry shop and a repair and construction team.

The material and technical base of the farm meets the needs of the farm and is a good basis for student practice and scientific research.

Let's analyze the main results of the financial and economic activities of the enterprise using Table 2.1.

Table 2.1 - Main results of financial and economic activities

No. Contents 2010 2011 2012 Deviation, (+,-) Changes, % 2011 from 2010 2012 from 2011 2011 2012 1 Revenue (net) from the sale of goods, products, works, services 9189310881910008116926-873818.42-8.032 Sebesto cost of goods, products, works, services.612.123Gross profit 93105914-5005-3396-10919-36.48-184.634 Profit (loss) from sales 93105914-5005-3396-10919-36.48-184.635 Profit (loss) before tax 915310491-20341338-1252514, 62-119,396Net profit (loss) reporting period 700110022-26433021-1266543.15-126.377 Average annual value of assets 126409.5198475.52688637206670387.557.0135.468 Average annual value of current assets 58963648826632459191442 10,042,229 Average annual value of equity capital 80522,5150228,52149846970664755,586,5743,1010 Average annual value of receivables 224319041498,5-339- 405.5-15.11-21.3011 Average annual cost accounts payable 29476.530012.532733.553627211.829.0712 Return on equity, % 8,696.67-1.23-2.02-7.90-23.27-118.4313 Return on assets, % 7.245.29-0.76-1 .95-6.04-27.00-114.3114Sales profitability, %10.135.43-5.00-4.70-10.44-46.36-192.0215Product profitability,%11.275.75-4.76 -5.53-10.51-49.02-182.8716 Asset turnover, times 0.730.550.37-0.18-0.18-24.58-32.1117 Accounts receivable turnover, times 40.9757.1566.7916, 189.6339.5016.8618 Accounts payable turnover, times 3,123,633,060.51-0.5716.30-15.6719 Number of employees, people. 249248240-1-8-0.40-3.2320 Accrued wages, thousand rubles. 325343412335853158917304.885.0721Agricultural area, ha835583558355000.000.0022Average annual output of an employee, thousand rubles. /person 369.05438.79417.0069.74-21.7818.90-4.9623 Salary and return 2.823, 192.790.36-0.4012.90-12.4724 Revenue per 1 hectare, thousand rubles. 11.0013.0211.982.03-1.0518.42-8.03

There was a significant increase in the company's assets in 2011. by 57.01% (RUB 72,066 thousand) and in 2012. by 35.46% (RUB 70,387.5 thousand). As a result, asset turnover decreased in 2011. by 24.58% in 2012 by 32.11%.

In general, in 2012 there was a significant deterioration in the activities of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU, which was reflected in a loss in the main activity and a reduction in the efficiency of using available resources.

Figure 2.1 - Dynamics of profit indicators of FSUE Uchkhoz "Prigorodnoye" ASAU in 2010 - 2012.

The general director of the organization is responsible for the organization of accounting and compliance with the law when carrying out business operations at the FSUE Uchkhoz "Prigorodnoye" ASAU, and the chief accountant is responsible for its maintenance. The chief accountant of the FSUE Uchkhoz "Prigorodnoye" AGAU, together with the head of the organization, signs documents that serve as the basis for acceptance of goods material assets, cash, settlement and credit and financial obligations.

The Order on the Accounting Policy of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU is drawn up once a year, for example, on December 29 or 30 for the next reporting year. The accounting policy has two sections: accounting policy for accounting and accounting policy for tax accounting.

The accounting policy section for accounting specifies the organization of accounting at the enterprise, the procedure for maintaining records of fixed assets and depreciation of fixed assets, accounting and amortization of intangible assets, inventories, income and expenses, the creation of reserves and the use of enterprise profits.

Thus, according to the accounting policy of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU is obliged to:

-maintain accounting records using a working chart of accounts;

-keep accounting records in journal-order form electronically using the 1C program and manually;

-accept for accounting primary documents drawn up according to the standard form of primary accounting documentation;

-keep accounting records in rubles and kopecks;

-cash settlements with the population (including individual entrepreneurs) when carrying out trade operations (performance of work, provision of services) are carried out using cash registers.

The tax accounting policy specifies the procedure for calculating VAT, corporate income tax and other taxes paid by the enterprise to the budget.

The accounting policy of the enterprise is approved by order of the director. Accounting policy is the main document regulating accounting and taxation procedures. An annex to the accounting policy is the Working Chart of Accounts; it also specifies unified accounting forms for the preparation of primary documents and internal accounting documentation.

2.2 Analysis financial condition FSUE Uchkhoz "Prigorodnoye" ASAU

Studying the assets and liabilities of the balance sheet allows you to assess the change in the composition and mobility of funds, the sources of formation of the organization’s property and the efficiency of their use.

We will analyze the aggregated balance in Table 2.2.

Table 2.2 - Analysis of the aggregated balance

Designation indicator amount, thousand rubles. share of change over the year share of factors in the change in balance last year, % share of factors in the change in the balance sheet reporting year, % 12/31/2010 12/31/2011 12/31/2012 31/12/2010 12/31/2011 12/31/2012 growth rate previous year, % growth rate reporting year, % ASSET Non-current assets A4 68 453198 734206 34452.6274.4776 ,18190.323.8395.25190.15 Inventories, VAT on acquired assets and other A3 59 40066 42763 08045.6624.8923.2911.83 (5.04) 5.14 (83.63) Accounts receivable A2 2 2341 5741 4231.720.590.53 (29.54) (9.59) (0.48) (3.77) Cash, short-term financial investments A1 2127170.000.050.016 250.00 (86.61) 0.09 (2.75 ) BALANCE 130 089266 862270 864100.00100.00100.00105.141.50100.00100.00 LIABILITY Equity capital P4 84 023216 434213 53464.5981.1078.83157.59 (1.34 ) 96.81 (72.46) Long-term liabilities P3 8 13317 48313 1516.256.554.86114.96 (24.78) 6.84 (108.25) Short-term borrowed funds P2 --6,000--2.22-149.93 Accounts payable and other short-term liabilities P1 37 93332 94538 17929.1612.3514.10 (13.15) 15.89 (3.65) 130.78 BALANCE 130 089266 862270 864100.00100.00100.00105.141.50100.00100.00

The data in Table 2.2 indicates an increase in the balance sheet currency in 2011 by 136,773 thousand rubles, or 105.4%, under the influence of non-current assets, the increase of which amounted to 130,281 thousand rubles, or 190.32%. The main source of financing for property growth was equity capital, which increased by 157.59%.

The increase in the balance sheet currency at the end of 2012 amounted to 4,002 thousand rubles, or 1.50%. The main increase occurred in non-current assets (+ 3.83%) and accounts payable and other short-term liabilities (+ 15.89%).

Financial stability is an integral part of the overall stability of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU, the balance of financial flows, the availability of funds that allow the organization to maintain its activities for a certain period of time, including servicing received loans and producing products. It largely determines the financial independence of the organization.

Table 2.3 - Analysis of absolute indicators financial stability

Indicator 12/31/201012/31/201112/31/2012 Own working capital (SOS) 15 57017 7007 190 Own working capital standard (10% of current assets) 6 1646 8136 452 Deficit/surplus 9 40610 887738 Own working capital 15 57017 7007 190 Inventories and VAT 59 40066 42763 080 Deficit/surplus of sources of financing inventories (43 830) (48 727) (55 890) Provision of inventories with own working capital, % 26.2126.6511.40 Own working capital and long-term liabilities 23 70335 18320 341 Inventories 59 40066 42763 0 80 Deficit/surplus of sources of financing of inventories (35,697) (31,244) (42,739) Provision of inventories with own working capital and long-term liabilities, % 39.9052.9632.25 Own working capital, long-term liabilities and short-term borrowed funds 23 70335 18326 341 Inventories 59 40066 42763 080 Deficit/surplus of sources of financing of inventories (35,697) (31,244) (36,739) Provision of inventories with own working capital, long-term liabilities and short-term loans and borrowings, %405342

According to the data in Table 2.3 of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU, it would be necessary to draw a conclusion about the crisis financial stability, since reserves and costs throughout the entire period under study could not be financed even with the involvement of short-term borrowed money.

Let's analyze the financial stability coefficients in Table 2.4.

Table 2.4 - Capital structure coefficients of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU in 2010 - 2012

Standard indicator 12/31/2010 12/31/2011 12/31/2012 Autonomy coefficient 0.500.650.810.79 Financial stability coefficient 0.700.710.880.84 Financial activity coefficient (leverage: debt capital to equity) 0.670.100.080.09 Security content of current assets with own working capital 0,100,250,260,11 Provision of inventories with stable sources of financing 1,000,400,530, 32Maneuverability of equity capital (own working capital to equity capital) 0.100, 190,080.03

The data in Table 2.4 indicates that most of the presented coefficients correspond to standard values. The dynamics of the autonomy coefficient indicate that both at the beginning and at the end of the period under study, a significant share of assets was formed through own funds, which is a positive trend.

According to the dynamics of the financial stability coefficient, at the beginning of the study period, 71% of assets were formed through long-term sources funds, at the end of the study period their share increased to 84%, which is a sufficient amount.

Liquidity of an enterprise is the ability of an enterprise to timely fulfill obligations for all types of payments. The greater the degree of performance ability

This indicator is used to assess the image of the organization, its investment attractiveness. The higher the level of investment attractiveness, the higher the level of solvency.

Table 2.5 - Liquidity ratios of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU in 2010 - 2012

Indicator 12/31/201012/31/201112/31/2012 Total liquidity 0.47 0.55 0.44 Absolute liquidity 0.000 0.004 0.000 Intermediate liquidity 0.06 0.05 0.03 Current liquidity 1.62 2.07 1.46

The data in Table 2.5 indicate the illiquidity of the balance sheet of the enterprise under study, which is primarily due to a lack of funds.

2.3 Analysis of funds of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU

Let's analyze the structure of cash flows using Table 2.6.

Table 2.6 - Structure and dynamics of receipts and payments

Indicator 2011 2012 change for the year value, thousand rubles. beat weight, % value, thousand rubles. beat weight, % in thousand rubles. growth rate, % Revenues Current activities 106,119 95.45 91,443 93.84 (14,676) (13.83) Investment activities 87 0.08 - - (87) (100.00) Financial activities 4,969 4.47 6 000 6.16 1,031 20.75 Total receipts 111,175 100.00 97,443 100.00 (13,732) (12.35) Payments Current activities (99,104) 89.24 (91,766) 94.07 7,338 ( 7.40) Investing activities (6,977) 6.28 (5,610) 5.75 1,367 (19.59) Financing activities (4,969) 4.47 (177) 0.18 4,792 (96.44) Total payments (111,050) 100.00 (97,553) 100.00 13,497 (12.15) Result of cash flows for the period Current activities 7,015 5,612.00 (323) 293.64 (7,338) (104.60 ) Investing activities (6,890) (5,512.00) (5,610) 5,100.00 1,280 (18.58) Financing activities - - 5,823 (5,293.64) 5,823 - Total cash flow result 125,100, 00 (110) 100.00 (235) (188.00)

During the period under study, the main source of cash inflow was current activities, but their share in the total cash inflow decreased from 95.45% in 2011 to 93.84% at the end of 2012.

3. Audit of funds of FSUE Uchkhoz "Prigorodnoye" ASAU

3.1 Assessing the internal control system

During the audit, auditors collect a large amount of various information, which is necessary for further analysis of the accounting status of the auditee. economic entity and expressing an opinion on the legality of his actions and compliance with the law. To accumulate and systematize this information, it is recommended to use special working documents that will facilitate the procedure for checking and processing the collected data, as well as drawing conclusions based on its results.

Basic requirements for the auditor’s working documents when checking cash transactions:

-all questions intended for verification must be reflected in them in a certain sequence;

-they must be easy to use and understandable to each member of the group, so that any reviewer (auditor) can subsequently draw conclusions based on the data in these working documents.

The list of documents used during verification may vary. It depends on the nature of the cash transactions being audited, the audit methodology and the assigned audit procedures.

The test survey for the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU is presented in Appendix 5.

Before the audit, the organization was tested for the possibility of conducting an audit. According to Appendix 6 of IP Khrustaleva K.A. can conduct an audit because it has all the necessary resources.

Between FSUE Uchkhoz "Prigorodnoye" AGAU and IP Khrustaleva K.A. an agreement was concluded to conduct an audit (Appendix 7). According to the price agreement protocol (Appendix 8), the cost of services is set at 108,000 rubles.

In working documents, the auditor, when describing the internal control system, notes its features or shortcomings, identifies the means of internal control that he intends to take into account in order to reduce the volume of substantive audit procedures.

Before starting the audit, I assessed the accounting and internal control system based on Table 3.1.

Table 3.1 - Test for assessing the accounting and internal control system at the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU

No. Questions Yes No I don’t know Notes 1 Is there a safe for storing cash? +2Has an agreement on full financial liability been concluded with the cashier? +3Are there surprise cash checks? +4Is the cash book generated in an automated way? +5Are the responsibilities of a cashier and an accountant combined? +

Based on the results of this table, the following can be noted: the degree of control risk is high. In this situation, it is more reasonable to conduct a complete audit of cash transactions, since the absence of an agreement on the financial responsibility of the cashier, the combination of duties of the cashier and accountant and the absence of sudden checks of the cash register reduce the effectiveness of the internal control system.

Let's test the accounting system of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU (Table 3.2).

Table 3.2 - Accounting system test

N Directions and control issues ANSWER Note 1 Have schemes been developed for recording cash transactions in the accounts? YES2 Is there a periodic reconciliation of cash book data with data from accounting registers and primary documents? YES3 Are bank statements regularly processed and reflected in accounting? YES5 Is the compliance of cash flow register data with their actual availability checked? YES

Based on Table 3.2, we can conclude that the cash accounting system at the enterprise is properly organized.

Let's determine the level of materiality.

Table 3.3 - Assessment of the level of materiality

Name of the basic indicatorValue of the basic indicator of the financial statements of the economic entity being auditedShare (%) Value used to find the level of materiality1. Sales volume1000812%2001.622. Cost of products sold1050862%2101.723. Balance currency2708642%5417.284. Equity21353410%21353.45. Short-term accounts receivable14235%71.15 Average6189.034

Since the smallest and largest values differ significantly from the average, we will discard it in further calculations.

The new arithmetic mean will be:

(2001.62 + 2101.72 + 5417.28) / 3 = 3173.5 thousand rubles.

Let's discard the largest value:

(2001.62 + 2101.72) / 2 = 2051.7 thousand rubles.

We round the resulting value to 2000 thousand rubles. This indicator is the level of materiality, and errors exceeding 2000 thousand rubles will be significant.

At the planning stage, the on-farm risk of the FSUE Uchkhoz "Prigorodnoye" AGAU is 75%, the control risk is 52%, the risk of non-detection is 11%.

Then the acceptable audit risk will be equal to:

% * 52% * 11% = 4, 3 %.

This means that after the audit, the risk of not detecting any deviations will be equal to 4.3%.

3.2 Audit plan and program

In progress tax audit Inspectors are required to check the following aspects of cash discipline:

Incoming and outgoing cash orders.

Order log.

Cash book.

Book of accounting of money issued by the cashier.

Journal of the cashier-operator. When checking the completeness of revenue accounting, inspectors require control tapes, certificate reports and a cashier-operator's journal.

Cash limit order. Inspectors will require an order even for a zero limit.

Expense reports. An advance report drawn up late or for two previously issued advances is a reason for a fine.

Order for storage and inventory of cash. Sometimes inspectors during inspections, in addition to the unified cash register, require additional internal documents from companies. In particular, an order on the storage of cash, as well as on the procedure and timing of the inventory of funds. It follows from the new procedure that it is necessary to determine the place for cash transactions, the procedure for storing and checking cash (clause 1.2, 1.11 of Regulation No. 373-P). To do this, you can place an order in free form. However, there is no fine this year for the lack of an equipped cash register. The judges also agree with this (resolution of the Twelfth Arbitration Court of Appeal dated March 26, 2012 No. A12-972/2012).

Therefore, we will take these aspects into account when drawing up an audit plan and program.

The general audit plan is presented in Appendix 9. The audit program of FSUE Uchkhoz "Prigorodnoye" ASAU is presented in Appendix 10.

3.3 Cash audit

The composition of working documents reflecting the information collected at the main stage of verification is somewhat different from working documents filled out at preparatory stage. In particular, it is recommended to include columns containing information about identified errors in these documents. Such information includes the results of checking the correctness of the posting of cash, the validity of payments, the correspondence of accounting register entries to cash book data and other working documents.

Information on the procedure for using proceeds will be reflected in the working document presented in Table 3.4. The table reflects the procedure for using proceeds agreed with the bank, then this document indicates the actual procedure for its use, which makes it possible to determine whether the established procedure is being violated.

Table 3.4 - Results of familiarization with the procedure for using proceeds

Established procedure for using proceeds In accordance with current legislation and in agreement with the bank Established purposes for which proceeds can be used - payment wages; issuance on record; travel expenses No. Identified deviations in the procedure for submitting proceeds to the bank in the procedure for using proceeds Date of the nature of the violation Date of the nature of the violation 105.08 The proceeds received were not handed over to the bank 07.08 The proceeds received at the cash desk were spent on paying wages 205.09 The money received by check for the payment of wages was partially issued for reporting

Thus, during the audit process, some violations of the procedure for submitting proceeds to the bank and the procedure for using proceeds were identified.

The balance of cash in the cash register must be determined at the end of the working day after all transactions regarding the receipt and expenditure of cash are reflected in the Cash Book.

After determining the cash balance in the cash register, all excess cash must be handed over to the servicing bank.

The Procedure for Conducting Cash Transactions does not clearly indicate for what period the cash limit should be extended: a month, a quarter, a year or more. According to the Appendix to the Procedure for Conducting Cash Operations, to calculate the cash balance limit, a settlement period is used, which is no more than 92 working days of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU.

At the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU, an annual inventory is carried out before drawing up annual financial statements. The organization has a permanent inventory commission, which includes the general director, chief accountant and persons appointed by the general director when concluding an order to conduct an inventory. Based on the results of inventories carried out in 2010 - 2012. no violations were identified, and relevant documentation was drawn up.

At the next stage of the audit, we checked the correctness of the documentation of cash transactions. As a result of checking the correctness of the cash book, it was established that the cashier of the FSUE Uchkhoz "Prigorodnoye" AGAU periodically reflected cash transactions in the cash book not every day, but once every few days. In this case, the date in the cash book was indicated as follows: “Cash for July 8-15, 2013.” Such a reflection of cash transactions is unacceptable from the point of view of current legislation, since it raises doubts about the compliance of balances with the limit established by the bank. Thus, many accountants believe that if the balance as of July 15 does not exceed the established limit, then there is no violation. However, the check may reveal a violation of the limit on any of the days from July 8 to July 15.

At the next stage, mutual verification of cash receipt orders and related documents was carried out.

a) with a journal for registering incoming and outgoing cash documents. The cash receipt order must be registered in the registration journal before it is transferred to the organization's cash desk.

When comparing these documents, the auditor checked:

-whether the numbers and dates of compilation indicated on cash receipt orders correspond to the numbers and dates indicated in the registration journal;

-whether the amounts indicated in the “Amount” line of cash receipt orders correspond to the amounts indicated in the “Amount” column of the registration journal;

-whether the content of business transactions indicated in the “Note” column in the registration journal corresponds to the content of business transactions indicated in the “Base” line in cash receipt orders.

Based on the results, a table was compiled in the following form (Table 3.5).

Table 3.5 - Summary table of incoming cash orders that are not registered in the Journal of registration of incoming and outgoing cash documents or have discrepancies with it

PKO Identified violations Data from a survey of the cashier, accountant No. date 007 16.01.13 Date of registration of the PKO in the journal one day later No explanations 02420.02.13 Amount in the PKO - 12,500 rubles. The amount in the registration journal is 12,300 rubles. No explanations

b) with a cash book. All cash receipts from FSUE Uchkhoz "Prigorodnoye" AGAU are recorded in the cash book. Data from cash receipt orders is recorded in the cash book. All cash receipt orders, together with a tear-off sheet of the cash book (cashier's report), are submitted by the cashier to the accounting department.

Based on the results, a table was compiled in the following form (Table 3.6).

Table 3.6 - Summary table of cash receipt orders that are not registered in the Cash Book or have discrepancies with it

PKOVIdentified violations Data from a survey of the cashier, accountant No. date 04112.03 Differences in the lines “Accepted from” (Andreev) and “From whom received” (Andreenko) The cashier referred to a typo

The cashier of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU 08/05/2012, according to the check, received from the bank the amount for the purchase of materials in the amount of 10,000 rubles.

Let's check the compliance of the amount of 10,000 rubles. in the next accounting documents:

-in the counterfoil of cash check No. 12029 dated 08/05/2012 - 10,000 rubles;

-in the cash receipt order No. 01 dated 08/05/2012 - 10,000 rubles;

-in the receipt part of the cash book dated 08/05/2012 - 10,000 rubles;

-in the bank statement from the current account dated 08/05/2012 - 10,000 rubles.

As a result of this audit, it was established that cash was fully and timely capitalized. This operation was documented correctly.

3.4 Summary of audit findings and suggestions for improvement

The audit was planned and performed in such a way as to obtain reasonable assurance that the accounting (financial) statements do not contain material misstatements. The audit was carried out in a continuous manner and included the study of evidence confirming the meaning and disclosure in the accounting (financial) statements of information on the financial and economic activities of FSUE Uchkhoz "Prigorodnoye" AGAU, assessment of the principles and methods of accounting, the procedure for preparing accounting (financial) statements, determination and analysis of significant estimated values used by the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU.

It is assumed that the audit provided provides sufficient grounds for expressing an auditor's opinion on the reliability in all material respects of the accounting (financial) statements of the FSUE Uchkhoz "Prigorodnoye" AGAU and the compliance of its financial (economic) transactions with the legislation of the Russian Federation.

In our opinion, cash transactions, transactions on settlement and foreign currency accounts of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU accurately reflect all financial and economic transactions carried out for April - December 2012.

The organization of accounting at the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU is built in accordance with the Federal Law "On Accounting". Responsibility for organizing accounting in organizations and compliance with legislation when carrying out business transactions lies with the head of the organization.

The accounting of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU is built using the base of the software package "1C: Enterprise 8.0". The organization carries out operational and accounting records in all areas of accounting, including cash transactions and transactions on the current account of the enterprise, maintains statistical reporting and is responsible for their accuracy in accordance with current legislation.

As a result of the audit, the following violations were identified:

.As a result of checking the correctness of the cash book, it was established that the cashier of the FSUE Uchkhoz "Prigorodnoye" AGAU periodically reflected cash transactions in the cash book not every day, but once every few days. In this case, the date in the cash book was indicated as follows: “Cash for July 8-15, 2013.”

2.The date of registration of the PKO in the journal is one day later.

.Discrepancies in the amounts of the PKO and the PKO registration log: the amount in the PKO is 12,500 rubles; the amount in the registration journal is 12,300 rubles.

.Differences in the lines of the PKO “Accepted from” (Andreev) and the Cash Book “From whom received” (Andreenko).

.The presence of corrections in some banking documents.

.Lack of certain payment documents that must confirm the fact of transactions.

.Absence of a bank mark on some payment documents.

· when identifying the fact that the cash balance limit has been exceeded, established by the management of the organization, clarify the reason, since on the day of payment of wages, exceeding the cash balance limit is allowed. The period for storing cash at the cash desk in such circumstances is no more than three working days, including the day the money is received at the bank office.

Conclusions and offers

Cash is the basis of the well-being of every enterprise, therefore, improving the methods of accounting for it, as well as monitoring its storage and use should be well organized.

It should be noted that at the enterprise under study, accounting of cash transactions is carried out in accordance with current legislation. On-farm control of the safety and use of funds on the farm is carried out by the manager and chief accountant. The accounting service is responsible for accounting at the enterprise. Accounting for cash transactions is kept on account 50, transactions on current accounts in the bank - on account 51. In accordance with the deadlines established by law, the enterprise conducts inventories of funds.

The object of the research carried out in this work is the enterprise FSUE Uchkhoz "Prigorodnoye" AGAU.

Accounting at the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU is carried out in accordance with the requirements of the current legislation of the Russian Federation and other regulatory legal acts in order to generate complete and reliable information about the organization's activities and its property status, necessary for internal users of accounting statements. Accounting of FSUE Uchkhoz "Prigorodnoye" AGAU is built using 1C: "Enterprise 7.7" The organization carries out operational and accounting records in all areas of accounting, including cash transactions and transactions on the current account of the enterprise, maintains statistical reporting and is responsible for their accuracy in in accordance with current legislation.

In the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAU, it is recommended to introduce into the accounting staff the position of an accountant-auditor, who will report directly to the chief accountant. In connection with the introduction of this position, the auditor’s accountant can be assigned the responsibility of monitoring the use of funds. As a result, the accountant-auditor will be able to constantly monitor:

¾ whether funds are stored in the servicing bank institution on the current account of the same enterprise;

¾ are settlements with other enterprises carried out non-cash through a bank establishment;

¾ whether the bank has set a cash limit and whether the amount of funds above the established limit is deposited with the bank;

¾ When identifying the fact that the cash balance limit has been exceeded, clarify the reason, since on the day of payment of wages, exceeding the limit in the cash register is allowed. The period for storing cash at the cash desk in such circumstances is no more than three working days, including the day the money is received at the bank office.

In order to avoid the formation of a large excess amount or, conversely, a deficit in the cash register of the enterprise, it is recommended to plan some cash transactions, which in due time will help to avoid the formation of a large excess amount or, conversely, a deficit in the cash register of the enterprise.

Important for the well-being of enterprises is the safety of cash payments, carefully organized accounting and control of funds, credit and settlement transactions. An audit of the cash register and cash transactions should be carried out in three main areas:

¾ cash inventory;

¾ checking the completeness and timeliness of the receipt of funds received at the cash desk;

¾ checking the correctness of money being written off as an expense.

Bibliography

1.Federal Law of December 6, 2011 N 402-FZ “On Accounting” (as amended on July 23, 2013) // Legal framework ConsultantPlus

2.Federal Law of December 30, 2008 N 307-FZ (as amended on July 23, 2013) “On Auditing Activities”

.Regulations on the procedure for conducting cash transactions and the rules for storing transportation and collection of banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation (approved by the Bank of Russia on April 24, 2008 No. 318-P) (as amended on February 7, 2012) (Registered with the Ministry of Justice of the Russian Federation

.Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation (approved by the Bank of Russia on October 12, 2011 No. 373-P).

.Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 N 383-P) (as amended on July 15, 2013) (Registered with the Ministry of Justice of Russia on June 22, 2012 N 24667).

.Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n (as amended on November 8, 2010) “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application” // Legal framework ConsultantPlus

.Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n (as amended on April 27, 2012) "On approval of accounting regulations" (together with the "Accounting Regulations "Accounting Policy of the Organization" (PBU 1/2008)", "Accounting Regulations accounting for "Changes in estimated values" (PBU 21/2008)") (Registered with the Ministry of Justice of Russia on October 27, 2008 N 12522)

.Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88 (as amended on May 3, 2000) “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results”

.Automation of enterprise management systems of the ERP-MRPII standard / Obukhov I.A., Gaifullin B.N. - M: Interface-press, 2006. - 312 p.

.Azriliyan A. Big economic dictionary. - M.: Institute new economy, 2010. - 1472 p.

.Analysis financial statements/ Edited by N.S. Plaskovoy. - M.: Eksmo, 2010. - 384 p.

.Asnin L.M. Basics of auditing. - Rostov n/d.: Phoenix, 2008. - 192 p.

.Astakhov V.P. Audit of cash transactions in foreign currency // Accounting and statistics. 2008. No. 9. P.145-148.

.Boboshko V.I. Control and audit. - M.: Unity-Dana, 2012. - 312 p.

.Bulyga R.P. Audit. - M.: Unity-Dana, 2009. - 432 p.

.Goloshchapov N.A., Sokolov A.A. Control and audit. - M.: Alfa Press, 2007. - 284 p.

.Deeva O. Eight cash documents that the inspector will certainly check // Tax Accounting. Right. 2012. No. 32 dated September 4, 2012.

.Kevorkova Zh.A. Kevorkova, Zh.A. Forensic accounting. Workshop: textbook. manual for university students studying in the specialty "Accounting, analysis and audit" / Zh.A. Kevorkova, I.V. Bakholdina. - M.: UNITY-DANA, 2012. - 208 p.

.Lemesh V.N. Revision and audit. Workshop. - Mn.: Grevtsov Publishing House, 2010. - 424 p.

.Malkina E.L. Main changes in the procedure for conducting cash transactions that came into force in 2012 // Accounting and taxes in trade and public catering. 2012. No. 2.

.Morozova Zh.A. Planning in auditing. Practical guide. - M.: LLC IIA "Nalog Info", LLC "Status Quo 97", 2008. - p.87.

.Plaskova N.S. Strategic and current economic analysis: textbook. - M.: Eksmo, 2010. - 640 p.

.Savitskaya G.V. Analysis of the efficiency and risks of business activities. Methodological aspects. - M.: Infra-M, 2010. - 272 p.

.Sidorova N.P. New rules of cash discipline in 2012 // Bulletin of NGIEI. 2012. No. 3. P.106-116.

.Smagina V.V., Pozdnyakova S.V. Accounting for cash transactions since 2012 // Bulletin of Tambov University. Series: Humanities. 2012. T.108. P.103-107.

.Sokolov Y.V., Terentyeva T.O. Accounting and auditing. Modern theory and practice. - M.: Economics, 2009. - 440 p.

.Fedorova E.A., Akharkatsi O.V., Vakhorina M.V., Eriashvili N.D. Control and audit. - M.: Unity-Dana, 2011. - 240 p.

.Chaadaev S.G., Chadin M.V. Conceptual and legal foundations of financial and economic expertise // Modern law. 2010. No. 10. P.60-63.

.Shatunova G.A. Control and revision in diagrams and tables. - M.: Eksmo, 2011. - 352 p.

.Shatunova G.A. Control and audit. - M.: Reed Group, 2011. - 464 p.

.Sheremet A.D., Suid V.P. Audit. - M.: INFRA-M, 2008. - 189 p.

Applications

Annex 1

Scheme of the organizational structure of the FSUE educational farm "Prigorodnoye" ASAU

Appendix 2

Diagram of the management structure of FSUE "Prigorodnoye" AGAU

Appendix 3

Test survey "Organization and maintenance of accounting"

Question answer Computer data processing systemsAccounting technology used (manual, computer) Computer Software used in the accounting system 1C-accounting 7.7 How regulated access to computer databases is controlled Network password Computerized accounting areas (all; if not all, then indicate which ones) All How often (if not all) printing is done accounting (tax) registers on paper Once a quarter How updating is ensured software product due to changes in legislation Provided by the software developer What changes were made to software in the current reporting (previous) periodChanging the invoice form Internal control systemIn what form is the internal control service presented (internal audit system, audit commission, etc.) Internal auditor To whom does the head of the internal control service report to the General Director Number of employees in the internal control service, people. 1Are there documented instructions for performing control functions (Yes/No) No How are the results of the work of the internal control service documented? Internal auditor reports What changes There have been no documented changes No No Special events that could affect the organization's positionWhen was the last tax audit carried out? None What is the amount of recognized claims based on the results of the last tax audit, rub. -For the current reporting period, the organization is involved in a lawsuit against the organization (indicate the amount of claims, rub.) No Accounting policyWere changes made to the accounting policies in the last reporting period (Yes/No) Not made Is there a documentary description of the accounting system Yes How often are changes made to the organization’s accounting policies Approved by the head on the recommendation of the financial director Is there a combination of methods in accounting and tax accounting (where possible) Yes Approved Are the reporting forms documented? No External environmentHas the level of competition in the industry increased over the past three years (Yes/No) Yes The level of competition is assessed as (Indicate in the types of activities): high (there is constant pressure from competitors in prices, purchase of raw materials, outflow of customers); average (same conditions with other market participants); low (competitors cannot have a significant influence or are absent) AIC - medium Features of economic activityWere new technological lines opened during the reporting period (Yes/No) No Were changes made to the organization’s technological process during the reporting period (Yes/No) No Are changes being prepared in the production process (Yes/No) Yes Contract practiceWere agreements concluded during the period under review (Yes/No): CreditNoLoanYesRentYesCollateralNoLeasingNoExport contractsNoImport contractsNo Unusual dealsAre the following types of transactions used in the organization’s practice (Yes/No): With affiliates No Assignments of claims No For cash Yes Barter transactions No Bill settlements No Appendix 6

Name (logo) of the auditing organization IP Khrustaleva K.A. No. RD Name of the audited entity FSUE Uchkhoz "Prigorodnoye" AGAU Audited period: from to

QUESTIONNAIRE ABOUT THE POSSIBILITY OF CONDUCTING AN AUDIT AT THE CUSTOMER

No. Question Answer Notes Yes No 1. INDEPENDENCE 1.1 The head or other official of the audit organization is the founder (participant) of the customer. + 1.2 Any of the officials of the audit organization is an official or accountant of the customer, or is responsible for the organization and maintenance of accounting and reporting for the customer. + 1.3 The head or other official of the audit organization is closely related to the founder (participant) or official of the customer who is responsible for organizing and maintaining accounting records and reporting. + 1.4 The director, other official of the audit organization or one of his close and/or relatives has profitable investments with the customer. + 1.5 The head or other official of the audit organization is the client’s trustee. + 1.6. Officials of the audit organization have serious private relationships with officials of the customer, such as close friendship, joint leisure activities, etc. + 1.7 The customer is a subsidiary of the audit organization. + 1.8 The customer has common founders (participants) with the audit organization. + 1.9 The audit organization owns a stake in the client’s organization. + 1.10 The audit organization provided the customer with services for maintaining or restoring accounting records, drawing up accounting (financial) statements in the period for which the audit was carried out. + 1.11 In previous years, the audit organization provided audit services to the customer. + 1.12 There is a conflict of interests between the customer and the audit organization. + 1.13. The audit organization is a debtor or creditor of the customer. + 1.14. Have there been any cases of significant delays in payment by the customer for audit services previously provided to him by the audit organization? + 1.15. The customer is the guarantor of the audit organization in relations with a third party. + 1.16. Revenue received from providing audit services to the customer constitutes a significant share of the audit organization’s income. + 1.17. A significant share of the income from the provision of audit services to the client is received by the individual auditor. + 1.18. The audit organization is involved or is at risk of being involved in any legal process involving the client. + 1.19. The audit organization was provided with excessive hospitality by the client or someone closely associated with it. + 1. 20. There are other circumstances that jeopardize the independence of the audit organization from the client (indicate which). + 2. COMPETENCE 2.1 The audit organization has employees who have the necessary competence to conduct an audit for a given customer. + 2.2 If the audit organization does not have employees with the proper competence, the audit organization may involve persons with the necessary knowledge. + 3. BUSINESS OPPORTUNITIES 3.1 The audit organization has available workers to complete the task within the required period of time, and also has the necessary material and technical base. + 3.2 If the audit organization lacks business capacity to conduct an audit, can it fill it. + 4. RISK ASSOCIATED WITH THE CUSTOMER 4.1 The customer’s accounts are in such a state that an audit is not possible + 4.2 The customer had signs of possible bankruptcy, such as problems with payments, etc. + CONCLUSIONS: The audit organization should refuse the assignment. + The audit organization can conduct an audit within the expected time frame + The audit organization should discuss with the customer the possibility of conducting an audit within the time frame ________________ +

Appendix 7

AGREEMENT No. 19

for the provision of audit services

Individual Entrepreneur Khrustaleva K.A., hereinafter referred to as the "Contractor", represented by the director, acting on the basis of the Charter, on the one hand, and __ Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU _ Hereinafter referred to as the "Customer", represented by director Shalamov N.S., acting on the basis of the _Charter_, on the other hand, we have concluded this agreement as follows:

.Subject of the agreement

1.The Contractor will provide the Customer with audit services of its financial and economic activities for the period from November 07, 2013 to November 18, 2013 in order to objectively assess the documentation of cash transactions, their synthetic and analytical accounting for January-December 2013 .

1.2.The list of issues to be studied and verified (audit plan) is attached to this Agreement and is an integral part of it (Appendix 1).

2.Duties of the parties

1.The Contractor undertakes:

1.1.Start providing the services provided for in clause 1.1 of this Agreement from November 07, 2013 and end on November 18, 2013 (the timing of the audit may change by agreement of the parties);

2.1.2.Provide practical assistance during the audit process in eliminating identified deficiencies;

1.3.Based on the results of the audit, submit a written audit report and recommendations aimed at improving the financial and economic performance of the Customer.

2.2.The customer undertakes:

2.1.Provide the necessary conditions for the work of the Contractor’s auditors (i.e. workplace, telephone communication);

2.2.2.Provide the Contractor's auditors with the documents necessary for the audit in a timely and complete manner. The customer is responsible for the accuracy of the documents provided in accordance with current legislation;

2.3.Provide, upon the Contractor's request, explanations from the Customer's officials on issues related to the audit.

3.Payment procedure

1.For the provision of services provided for in this Agreement, the Customer transfers three hundred ten thousand rubles to the Contractor’s bank account within ten days from the date of completion of the audit under this Agreement.

3.2.For late payment provided for in clause 3.1 of the Agreement, the Customer shall pay the contractor a penalty in the amount of 0.1% of the Agreement amount for each day of delay. If the delay exceeds 5 days, then the Contractor collects the amount provided for in clauses 3.1., 3.2 of the Agreement by submitting a payment request to the bank institution.

3.If, after an audit performed by the Contractor, and on issues that were subject to inspection, violations are revealed by the regulatory authorities, the Contractor undertakes to compensate the Customer for the amount of the fine resulting from the auditors’ untimely discovery of deficiencies in the Customer’s work, but within the limits of the amounts paid by the Customer to the Contractor for this audit .

4.Responsibility of the parties

1.The parties are responsible for improper fulfillment of the terms of this Agreement in accordance with the current legislation of the Russian Federation.

.Grounds for early termination of the contract

1.This Agreement cannot be terminated unilaterally, except in cases where one of the parties systematically violates the terms of the Agreement and its obligations.

5.2.In the event of a systematic violation by the Customer of its obligations, resulting in termination of this Agreement, it is obliged to pay the Contractor for the work actually performed in accordance with the audit plan (Appendix No. 1).

3.One of the parties has the right to terminate this Agreement in the event of failure to fulfill the obligations assumed by the other party.

6.Other conditions

1.If it is necessary to increase the verification period and the amount of the Contract, the parties will consider the reasons for the changes, agree on the additional scope of work and their cost in a separate Addendum to the Contract.

6.2.The Contractor guarantees the confidentiality of information (except for publicly available information, as well as cases provided for by legislative acts of the Republic of Belarus or decisions judiciary) about the activities of the Customer.

3.Disputes regarding the execution of the Agreement are resolved through negotiations. Disputes on which the parties have not reached an agreement are subject to consideration in the manner established by law Russian Federation.

4.All changes and additions to this Agreement are valid only if they are made by the parties in writing and signed by authorized persons.

5.This Agreement comes into force from the moment it is signed by the parties and is valid until the parties fully fulfill their obligations.

6.The agreement is drawn up on two sheets, in two copies, one for each party.

Legal addresses

Appendix 8

PROTOCOL

agreeing on a contract price for the provision of audit services

We, the undersigned, on behalf of the Customer, director N.S. Shalamov. _ and on behalf of the Contractor, director of the LLC, we certify that the parties have reached an agreement on the contract price for the provision of audit services in accordance with Agreement No. __19___ dated _01.10.2013 ____

according to the work plan (Appendix 1) in the amount of one hundred eight thousand rubles

The price including VAT will be 108,000 rubles.

This protocol is the basis for mutual settlements between the Contractor and the Customer.

Appendix 9

General audit plan

No. Planned types of work Period of implementation Performer Notes 1 Get acquainted with the financial and economic activities of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" AGAU 07.11 - 08.11 Khrustaleva K.A. 2 Conduct an analysis of accounting policies 09.11 Khrustaleva K.A. 3 Familiarize yourself with the procedure for preparing financial statements 10.11 Khrustaleva K.A. 4Audit of cash transactions 11.11 - 13.11 Khrustaleva K.A. 5Audit of transactions on the current account 14.11 - 16.11 Khrustaleva K.A. 6Reporting the results of the audit 11/17-18/11 Khrustaleva K.A.

Appendix 10

Audit program

p/p List of audit procedures by sections of the audit Period of implementation Performer Working documents Note. 1Analysis of accounting policies07.11-09.11Khrustaleva K.A. Accounting policy of FSUE Uchkhoz "Prigorodnoye" AGAU2 Familiarization with the procedure for preparing financial statements 10.11 Khrustaleva K.A. Accounting statements of the Federal State Unitary Enterprise Uchkhoz "Prigorodnoye" ASAAUAudit of cash transactionsKhrustaleva K.A. Checking the correctness of the documentation of cash transactions 11.11 PKO, RKO, cash book, etc. Checking the correctness, completeness and timeliness of entries in the registers of synthetic and analytical accounting of transactions for the receipt of funds 12.11 Accounting registers. accounting, cards and accounting analyses. accountsChecking the correctness, completeness and timeliness of entries in the registers of synthetic and analytical accounting of transactions for the expenditure of funds 13.11 Accounting registers. accounting, cards and accounting analyses. accounts3Audit of transactions on the current accountKhrustaleva K.A. a) availability of primary documents for transactions 14.11 Invoices for receipt and shipment of goods and materials, payment documents b) reflection on accounting accounts 11/15-16/11 Accounting registers. accounting, cards and accounting analyses. accounts 4 Audit of transactions on a foreign currency account 17.11 Accounting registers. accounting, inventory acts

Introduction

Conclusion

Applications

Introduction

Transactions with funds are typical for absolutely all organizations, regardless of their organizational and legal form. Cash belongs to the most liquid group of working capital. At enterprises, funds are in the form of cash on hand, stored in the bank on current accounts, in special accounts for designated funds, in special accounts, and are also used in the form of letters of credit, check books, deposits and financial investments in securities etc.

Cash characterizes the initial and final stages of the circulation of economic assets, the speed of which largely determines the effectiveness of all business activities. The volume of funds available to an enterprise as the most important means of payment determines the solvency of the enterprise - one of the most important characteristics of its financial position. The important role of funds in ensuring financial and economic activities necessitates the organization of continuous and timely accounting of funds and operations on their movement, monitoring the availability, safety and intended use cash and monetary documents, monitoring compliance with cash discipline. Confirmation of the authenticity of credentials is carried out through audit operations.

This work is devoted to studying the methodology for auditing funds. The relevance of the chosen topic is due to the fact that the correctness, accuracy and timeliness of cash accounting leads to an improvement in the quality of accounting work, clarity in the distribution of funds, which in turn has a positive effect on the work of the entire organization. Payments are made through cash. The timely repayment of the company's accounts payable depends on their availability. An organization's funds exist in two forms: cash and non-cash. Non-cash payments are carried out by transferring funds from the payer's account to the recipient's account using various banking operations, replacing cash in circulation. Therefore, accounting for funds and monitoring their circulation in settlement and foreign currency accounts in banks is of great importance. Internal payments are made in cash. Cash movement is carried out through cash transactions.