Sample payment order tax sleep income minus expenses. Payment order for the payment of tax STS Payment STS for the 4th quarter sample

In 2017, you will need to pay tax on the simplified tax system for last year. This obligation, along with the submission of the relevant declaration, organizations must fulfill no later than the last day of the first spring month. In this regard, taxpayers may have a question, what purpose of payment under the simplified tax system for the year should be reflected in the payment order when transferring the amount of this tax. Let's look at examples of this issue for both taxable objects: "income" and "income minus costs."

The procedure for paying the simplified tax system

The payer of this tax independently chooses from which object he will calculate the tax - from the proceeds or from the proceeds minus the costs, the list of which is provided for by the norms of the Tax Code of the Russian Federation.

The amount of tax payable is calculated by the payer independently based on the results of three reporting periods and one tax period.

Purpose of payment when paying tax under the simplified tax system

It is important to remember that credit organizations execute orders of payers in compliance with a certain procedure.

The form of the payment order and its details are reflected in the Rules approved by the Bank of Russia on June 19, 2012 (hereinafter referred to as Rules No. 383-P).

All details of the payment order are important for the correct identification of the payment by the credit institution and the correct execution of the payer's will for the transfer Money. If there are inaccuracies in the payment order (including when specifying the purpose of the payment for the simplified taxation tax), this may lead to an erroneous transfer of funds or incorrect identification of the payment.

The list of payment details with their decoding is contained in Appendix 1 to Rules No. 383-P.

The description of the relevant requisite is contained in paragraph 24 of Appendix 1.

According to the specified paragraph, this field of the payment order reflects the purpose of the payment and other necessary information.

The number of characters in this field should not exceed 210 (Appendix 11 to Rules No. 383-P). This rule applies, among other things, to the purpose of payment under the simplified tax system in 2017.

Therefore, in order to correctly identify the payment, the indicated field should reflect which particular tax payment (advance or other) is being made, and the period for which it is transferred.

Purpose of payment on the object of the simplified tax system "income"

Identification of the tax by the object of taxation applied by the payer is carried out not only by the field "purpose of payment", but also by the code budget classification, therefore, in field 104 of the payment order, the corresponding BCC should be indicated.

Purpose of payment for this object corresponds to BCC 182 1 05 01011 01 1000 110.

In the field "purpose of payment" when paying the STS for 2016, the following entry should be reflected: "Tax paid in connection with the application of the simplified taxation system (STS, income) for 2016."

Purpose of payment of the simplified tax system "income minus expenses"

As already mentioned above, in order to correctly identify the payment, it is necessary to reflect the CCC in the payment order. The purpose of the payment under the simplified tax system "income minus expenses" in 2017 corresponds to BCC 182 1 05 01021 01 1000 110.

As for the payment field “purpose of payment”, it should indicate: “Tax paid in connection with the application of the simplified taxation system (STS, income minus expenses), for 2016.”

Individual entrepreneurs on the simplified tax system must regularly pay advance contributions to the state budget. But unlike large companies with the status of legal entities, which often prepare reports and know perfectly well how to make all calculations, when and how to submit documentation, it is not so easy for an entrepreneur to form even payment order.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

What is worth knowing to make it easier for yourself? What details to enter in the payment order form of the simplified tax system (income) in 2020?

General information

When is a payment order used under the simplified tax system, what is it? Consider the main laws that you should focus on when making a form.

What it is?

It also contains a list of all the necessary details (Appendix 1). You should focus on the rules that are approved.

Such features should be taken into account by all payers of taxes and fees who transfer funds to the budget.

In accordance with the new law, the order specifies:

Previously, they entered in the paragraph to reflect the status 01, 08, 14. Now only 08 is indicated.

The indicator of line 21 has changed - they enter 5 instead of 3 ().

This is necessary for banking institution to make a payment. Paragraph 24 indicates additional information related to the payment of funds to the budget.

So, when paying the insurance premium, you can enter the short name of the FFS, FFOMS. When transferring the tax, it is worth indicating its name and the periods for which the funds are paid.

The number of characters used is a maximum of 210 (in accordance with Appendix 11 of the Regulation of the Central Bank Russian Federation dated 19.06.12 No. 383-P).

Item 22 should contain information about the UIN identifier. They simply write 0 if the payment is made personally by the payer, and not according to requirements ()

When filling out personal data, it is worth using the “//” symbol, which will separate the full name, address, etc.

In lines 8 and 16, the number of characters should not exceed 160 ().

Payment specifics

Despite the general procedure for filling out, there are some differences in the details when placing an order for advance payments, paying penalties and fines.

By advance payment

When filling out the “Tax period” line, it is worth paying attention that for USN taxes, the period is a year, and the billing period is a quarter, six months, 9 months.

But in paragraph 107, you do not need to indicate the period itself, but the frequency of payment. That is, information is reflected on how often the payer must pay tax in accordance with legislative acts.

For simplified taxes, this is a quarter or a specific date. For the quarter, the advance must be transferred by the 25th day of the month following the reporting period. This means that the quarter for which the amount of tax was paid should be indicated.

Photo: sample payment order 1

penalty

When transferring interest on taxes for previous years, it is worth specifying the tax period (year). If the penalty is for the advance payment of the current year, then enter the quarter.

Often, payers are in no hurry to pay a penalty in the current year. If the payment is made on a voluntary basis, then it will not be considered erroneous to indicate the TP indicator in the "Basis for payments".

Photo: sample payment order 2

When paying debts for penalties (tax simplified tax system "income"), pay attention to filling in the "Code" column in the payment order.

Photo: sample payment order 3

When requesting the IFTS for the payment of penalties, you should be guided by the following sample execution of a payment order.

Photo: sample payment order 4

Fine

In case of non-payment or incomplete payment of taxes, the simplified tax system will be charged a fine, but only at the request of the tax authority.

If there is a requirement, then find the UIN code in it. In the absence of such information, it is worth focusing on the following example of filling out an order:

Photo: sample payment order 5

If the UIN code is specified, then you need to rewrite this value in column 22. The indicator can be reflected in an alphanumeric designation.

Photo: sample payment order 6

Tax debt

There are some features when filling out a payment order form in case of debts.

The choice of details will depend on whether the payment is voluntary or on demand.

At the request of the IFTS

When issuing a payment document for the payment of debts to the simplified tax system according to the requirements of the Federal Tax Service, it is worth changing some details.

In addition, if the UIN of payments is indicated by the tax structure, then this value must be entered in line 22. If there is no UIN:

What does a sample payment for the simplified tax system look like with the object “income minus expenses” in 2017? Let's give an example of a payment order for the payment of a "simplified" tax, which contains all the correct details: the status of the payer, the CCC, the purpose of the payment, and so on. You can download a sample as an example.

When to pay tax in 2017

Advances on the simplified tax system with the object "income minus expenses" in 2017, organizations and individual entrepreneurs on the simplified tax system "income minus expenses" in 2017 must pay no later than the 25th day of the month following the expired reporting period (clause 7 of article 346.21 of the Tax Code of the Russian Federation ). If the day of payment of the simplified tax system falls on a weekend or non-working holiday, then the tax can be paid on the next business day following such a day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

In 2017, firms and individual entrepreneurs on the "simplified" system pay advance payments in the following terms:

- according to the results of the 1st quarter of 2017 - no later than April 25, 2017;

- according to the results of the half year of 2017 - no later than July 25, 2017;

- based on the results of 9 months of 2017 - no later than October 25, 2017.

Simplified tax for the whole of 2017 must be paid:

- organizations - no later than 04/02/2018;

- individual entrepreneurs - no later than 05/03/2018.

When the tax is considered paid

The day of payment of the “simplified” tax is the day when the organization or individual entrepreneur submitted a payment order to the bank to transfer the single tax from its settlement (personal) account to the account of the Treasury of Russia. At the same time, there must be a sufficient amount on the account of the "simplifier" for the payment (letters of the Ministry of Finance of Russia dated May 20, 2013 No. 03-02-08 / 17543).

The “simplified” tax in 2017 is not recognized as paid if the payment order for its payment:

- was withdrawn from the bank;

- contained incorrect bank details of the Treasury of Russia (treasury account number and name of the beneficiary's bank).

An example of a completed payment

When filling out a payment order for the payment of the simplified tax system “income minus expenses”, it is better for the taxpayer to ensure that the details are filled in correctly. As we have already said, some errors entail problems - the recognition of the tax as unpaid. However, there are errors (for example, KBK or OKTMO, data from the tax office) that can be corrected by submitting a payment clarification letter to your tax office. Below you can read and, if you wish,

Update. Please note that from January 1, 2017, the CCC for paying tax under the simplified tax system may change. Check this point out yourself. Better yet, generate such documents in accounting services or programs (just don't forget to update them in a timely manner).

Suppose that an individual entrepreneur wants to pay an advance on the simplified tax system of 6% for any quarter in cash, through SberBank. Where can I get a receipt?

Of course, if you use the program accounting(for example, “1C”), then this is done by pressing two or three buttons. What if there is no such program?

Then you can use the official service for generating such receipts from the Tax Service RF (FTS).

Important: after March 28, 2016, the type of this receipt may change as new rules for their execution are introduced. Accordingly, the pictures from the instructions may differ .. But the essence should remain the same: we carefully read the service instructions from the Federal Tax Service and carefully fill in the data for your IP.

Better yet, do it like this: buy an accounting program in which these receipts are updated by the developers.

How to generate a receipt for advance payment under the simplified tax system?

And select the service for generating receipts for individual entrepreneurs:

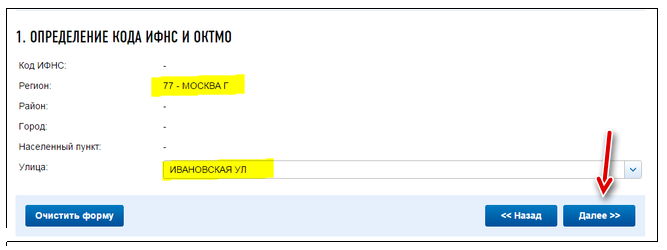

And we get to the following screen:

Here you need to specify the four-digit code of your tax. It is clear that not all IPs know him ...

If you do not know the code of your tax office, you can immediately click on the "Next" button and the system will automatically substitute it for your address.

Of course, we are talking about the address that is indicated in the IP documents. That is, this is the address of your registration on the passport.

Consider an example of filling out a receipt using the example of Moscow.

Here you need to indicate that the individual entrepreneur lives in the capital, indicate the street, and click on the "Next" button

As you can see, the system determined the IFTS and OKTMO code at your address.

- If we pay in cash through SberBank, then select "Payment document" in the drop-down list, and click on the "Next" button.

- If you pay from an IP account in a bank, then select "Payment order"

Since we are paying an advance on the simplified tax system, we select "Payment of tax, fee ..."

Here you will have to specify the so-called CBC. In short, this code indicates that a payment is made under the simplified tax system 6%. We need to write this code: 18210501011011000110

- We indicate that the payment is made by IP (code 09)

- Establishment of TP (payments of the current year)

- CV (quarterly payments

- We indicate the quarter you need and the year 2016.

Naturally, you indicate your advance payment number under the simplified tax system and the quarter of 2016 you need. Please note that an individual entrepreneur can pay taxes in this way ONLY on his own individual entrepreneur. This is written in red letters in the picture below!

Choose a payment method. If you choose the cash method of paying the tax, a receipt for Sberbank will be generated.

Once again, we carefully check everything and click on the “Generate payment document” button.

Important: a receipt marked by the bank (and a check) for payment must be kept. It may be required by the tax authorities during a possible audit.

Don't forget to subscribe for new articles for IP!

And you will be the first to know about new laws and important changes:

Dear entrepreneurs!

A new e-book on taxes and insurance premiums for individual entrepreneurs on the simplified tax system 6% without employees for 2020 is ready:

"What taxes and insurance premiums does an individual entrepreneur pay on the simplified tax system 6% without employees in 2020?"

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2020?

- Examples of calculating taxes and insurance premiums "for yourself"

- The calendar of payments for taxes and insurance premiums is given

- Common mistakes and answers to many other questions!

The Simplified Taxation System (STS) is one of the most common tax regimes. This regime, for the most part, is suitable for representatives of small and medium-sized businesses and has a special tax payment procedure. Therefore, the simplified ones are required to know the purpose of the payment under the simplified tax system for the year, so as not to have problems with the budget.

General Approach

So, in 2018, organizations and individual entrepreneurs will need to cover the final tax under the simplified taxation system for the previous 2017 year. Together with the submission of the relevant declaration, payment must be made before the end of March.

Usually, taxpayers of the simplified taxation system have on the agenda the question of the exact sum of money, which must be indicated in the payment order at the time of transfer of this tax. However, the purpose and period for which the tax is paid are also of great importance. Let's consider these questions further.

Mechanism of tax deductions

When paying tax under the simplified tax system, an organization or individual entrepreneur has the right to independently decide in advance from which object the tax will be calculated. It can be:

- only income on the simplified tax system;

- profit minus expenses.

More detailed information about such objects is given in tax code RF - chapter 26.2.

The total amount of tax that must be paid to the treasury is calculated by the payer himself. To do this, he takes the data of 3 reporting periods as a basis and determines the payment as a whole for the tax period - the calendar year.

The Tax Code indicates the exact terms for paying the simplified tax system based on their very purpose - intermediate (current) and at the end of the year. These are advances and the tax itself.

Please note that the tax is transferred based on the budget classification code. The entire list is listed in the Order of the Ministry of Finance of 2013 No. 65n.

Payment mechanism

There is a special order of relations between the organization that is engaged in conducting banking operations, and the payer. In addition, the main points regarding the payment order - namely, its form and related details - are given in the rules that were approved by the Central Bank in 2012 under No. 383-P.

Details play a key role in the payment security system. They are what is needed credit institution to correctly and accurately identify the payment. In addition, the details themselves guarantee that the payer will fulfill his obligation to pay the money.

In the event that in payment document there are shortcomings and / or inaccuracies (for example, an error when indicating the purpose of payment under the simplified taxation system), this may cause:

- erroneous transfer of funds;

- incorrect payment identification.

You can get acquainted with the list of payment details when transferring the simplified tax system for the year in Appendices 1, 2 and 3 of Rules No. 383-P.

In a specially designated field of the payment document, the so-called purpose of payment and other important information should be reflected. It is worth paying attention that the number of characters in this field is equal to or less than 210 characters. This rule also applies to the purpose of payment under the simplified tax system in the current year.