Which banks offer refinancing? Banks engaged in refinancing consumer loans. Features of the refinancing procedure

A loan is an excellent opportunity to acquire the necessary property and use it, gradually paying off the debt, rather than saving money for years for your dream. But sometimes the credit load puts a heavy burden on the family budget, “eating up” the lion’s share of it every month. You can repay existing loans using a targeted refinancing program.

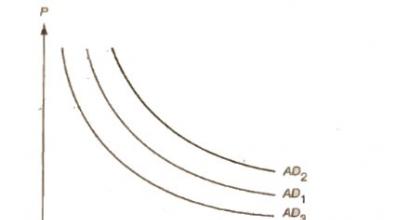

The meaning of the refinancing mechanism is that the borrower, entering into a new loan agreement for more favorable conditions, pays off one or more other debts. On credit market There are many refinancing products available. To choose the best option, it is important to know which banks refinance loans.

A properly selected refinancing program has undeniable advantages:

- reduction in loan interest;

- reduction of the mandatory monthly payment;

- combining all loans into one, if the loan is not the only one.

There is no need to remember different payment dates, plan cash expenses according to them, or visit different banks. Will be done once a month single payment to a single credit institution.

Refinancing, unlike restructuring, improves your credit history. Refinancing is reflected in the BKI report as early repayment debt. A new loan comes next.

It is possible to choose the most profitable program in the same bank where the old debt is, or in any other.

Which banks refinance loans and under what conditions?

Which bank can I get this service from? In the sector banking services there is strong competition. Banks are interested in luring bona fide customers. They willingly carry out other banks.

In turn, the financial organizations with which the agreement is valid are interested in retaining their clients, of course, provided that they are not malicious defaulters. These banks refinance loans to their reliable borrowers.

Many banks offer a wide range of programs. Some carry out targeted loans, mortgage loans, car loans. The list of banks involved in refinancing programs is quite extensive:

- Sberbank of Russia. There are no commissions for granting a loan. Rates vary between 17.5–28.5%. The credit period is up to 5 years, the maximum loan size is 1 million rubles. A new program has been launched, the rate of which is 14.9%.

- VTB 24. The product offered to customers has very favorable conditions: the amount starts from 100 thousand rubles. up to 3 million rubles, term up to 5 years, cost up to 17%.

- MDM-Bank. You can refinance in the field of car loans and credit cards. Loan terms - from 1 to 5 years, annual rate from 14.5%, amount - up to 2.5 million rubles.

- Raiffeisenbank. Can offer potential borrowers refinancing in ruble and foreign currency. It works at the lowest interest rates and with the longest terms, up to 25 years. Rate - from 12.5% per annum.

- Gazprombank. There are proposals for refinancing mortgages with low interest rate from 13%. A prerequisite is the presence of a surety or collateral.

- Rosbank. Lends loans to citizens in the amount of up to 1 million rubles, for a period of up to 5 years, at a cost of 14 to 19%.

- Rosselkhozbank. The loan limit is 1 million rubles, term - up to 5 years, annual interest - 21.8%.

It should be understood that the data provided by banks for refinancing programs is basic. For each client, the calculation will be individual in terms of terms, amount, and interest rate.

Having studied which banks offer the most favorable conditions, the borrower can correctly navigate and wisely choose the best offer for his financial situation.

Conditions and registration procedure

Before deciding to refinance debts, you should carefully study the loan agreement. If there is more than one, then study all available ones. There are banks where early repayment is prohibited, then refinancing is impossible. Many banks impose penalties for early repayment; in this case, you need to accurately calculate, or this is the path to a debt trap.

You also need to understand that if the borrower has an unimportant credit history or has late payments, then banks are unlikely to make a positive decision on his application. An already restructured property cannot be refinanced.

Banks do not provide on-lending to informal loans.

The conditions that almost all banks pay attention to are: loan payments for at least 18 months, the paid amount of the debt - at least 20%, at least three months left until the end of the loan term.

The requirement is optional, but banks welcome and willingly engage in on-lending to their clients - participants in the salary project of this institution.

Also mandatory conditions for participation in the program are:

- Russian citizenship;

- presence of registration (permanent or temporary) in the region where the bank branch is located;

- age limits (bank requirements vary, usually people must be no younger than 23 and no older than 60–65 years on the repayment date);

- official employment, duration of work in the last place - at least 4–6 months.

When a suitable financial institution has been selected, you need to submit an application, which can be done online. After the bank makes a preliminary positive decision, the potential borrower contacts the branch and provides an impressive portfolio of documents:

- passport;

- a second identification document (military ID, international passport, pension certificate, etc.);

- document confirming employment (employment agreement, contract, copy work book);

- documents confirming income, for example, certificate 2-NDFL;

- a certificate of the refinanced debt indicating the bank details and agreement number, a copy of the agreement;

- documents on ownership of any property;

- The application indicates current contacts (landline and mobile phone numbers).

Over a period of time, bank specialists analyze the data and make a decision. If all the necessary points are met, it is positive. The client submits an application to the previous bank for early repayment of the loan, then enters into an agreement with the new lender. The bank carrying out refinancing carries out operations without the participation of the borrower and pays off his debts by transferring money to creditors. The client still has a contract and a new debt repayment schedule.

When refinancing mortgage loan additional costs are required to determine the liquidity of the property and, accordingly, additional documents for the property.

Nuances to pay attention to

Clients often ask the question: “Why can’t I take out another loan with lower interest to pay off existing debts?” The fact is that in this case, when considering an application, a special banking program- scoring, assessing the reliability and solvency of the client. It compares the amount of all payments with the borrower's verified income. If the processing result is negative, the bank will not issue a loan.

It is necessary to participate in the refinancing program; it involves finding reserves to pay off debts by reducing the rate and increasing the loan term.

Modern lending institutions are customer-oriented and care about borrowers, but act in their own interests. Minimum bid may be compensated by them with large insurance, a commission for providing a loan, for payments, etc. Before concluding an agreement, you need to carefully study it for the presence of such pitfalls. Refinancing makes sense only when the terms of the new loan are actually, and not on paper, more favorable than the previous ones.

The reasons for what happened can be different: loss of work, reduction wages, unfavorably drawn up loan agreement and other circumstances. There is an excellent way out of this situation - refinancing loans from other banks; we will consider the best offers of 2018 further, and you can choose the best program option for you.

Top 8 best banks with profitable loan refinancing program

Below we will analyze banks that refinance loans in the Russian Federation, consider their conditions, and compare offers. You can write an application remotely in a few credit institutions and find out which of them will approve your candidacy. So:

"VTB BANK OF MOSCOW"

Refinancing a loan with another bank gives you the right to find the most acceptable conditions for you, and this lender can offer a very interesting program: the amount is up to 3 million rubles, the rate for today has been reduced and is 12,9 %

per annum, term - up to 5 years. Here, applications are approved for persons with Russian citizenship, aged 21-75 years, with at least 3 months of experience at their last place of work. They will refuse if there is a current delay and a debt of more than 30 days for the entire term of the loan. You can refinance credit cards, cash loans, mortgages, car loans.

"INTERPROMBANK"

Moscow Bank is engaged in refinancing several loans in any quantity, but in the amount of 45 thousand and above (maximum 1 million rubles). Loan term - from 6 months to 5 years, interest rates are low - from 12 %

per annum. There is no need to pay insurance or commissions. This is the best lender for citizens (age 18-75, including pensioners), whose permanent place of residence is Moscow.

"ALFA BANK"

Here, refinancing differs depending on the status of the applying client. Owners salary cards and employees of partner companies are given loans on more favorable terms (low interest, long term, larger loan size). We will take standard conditions designed for most borrowers: amount - from 50,000 to 3 000 000

rubles, deadline - up to 7 years, rate - from 11,99 %

per annum, reference of up to 5 loans is allowed, including loans for cards, mortgages, consumer products and others. The bank has the opportunity to receive additional money in cash.

"BINBANK"

BINBANK also refinances loans issued by other banks to individuals on good terms. At the moment, the organization’s specialists are holding a promotion that is valid until the end of this year. In the case of obtaining a cash loan or refinancing an existing loan taken from another company, the banking institution provides 90 days of interest-free use of borrowed money. General conditions: amount - from 50,000 to 2 000 000

rubles, deadline - up to 84 months. with a loan interest rate of 10,99 %

per annum.

"SKB-bank"

The bank can combine and repay up to 10 loans received from other organizations. The offer is really profitable: the rate is from 11,9 %

(the difference varies depending on the loan amount, you can take from 51,000 to 1 300 000

rubles), period - from 6 months. before 5 years. IN «

SKB-bank »

you can get some extra money.

"Sovcombank"

“Repurchasing” loans from this organization looks very tempting. It is possible to combine several loans into one; the borrower has the right to choose a debt repayment scheme (annuity/differentiated payment) and apply for a loan secured by an apartment. The largest amount among all banks from 700 thousand to 30 million rubles can be issued by attracting co-borrowers. The maximum term here is up to 360 months., rate - from 14,99 %

in year. For state employees, salaried and “reliable” clients there are discounts that make the product more profitable. The credit line is designed for residents in Moscow or the immediate Moscow region.

Tinkoff Bank

There is no direct program for consumer refinancing, but this bank’s unique loan offers make the transaction quite affordable. So, you can apply for a Tinkoff card, and the approved limit will allow you to cover part or all of your existing loans up to 1 000 000

rubles received from some other banks. Rate per year - from 14,9 %

Moreover, a bad credit history has virtually no effect on the lender’s decision.

"HOME CREDIT BANK"

An application for loan refinancing through this banking company can be a 100% lifeline in a difficult situation. Total rate 14,9 %

, amount - up to 1 000 000

rubles, deadline - up to 7 years. New loan can be issued as a refinance of a mortgage, personal loan, cash advance or auto loan.

In this section it is also worth mentioning the Housing Mortgage Lending Agency (AHML), which issues mortgages within government programs. The organization also has an offer to refinance existing mortgage debt, and here, perhaps, the lowest rates (9.5 to 10.5%), the term is up to 30 years, the amount is from 300,000 rubles. But there are strict requirements for the loan: no restructuring, insurance premiums- paid on time, overdue by more than 30 days - no, number of payments made - 12.

The main advantages of refinancing a loan at a bank

Loans for refinancing other loans cannot be obtained from all banks, but in Russia the number of such institutions is sufficient to solve the annoying problem with debts. Let's first understand what refinancing is and what its clear advantages are.

A refinancing program is the issuance of a new loan in order to pay off current debt resulting from non-payment, for example, consumer loans, car loans, and mortgages. This procedure is popularly known as “on-lending” and here are its main advantages:

- More favorable lending conditions - low interest rates. So, if you initially took out a loan at a high interest rate due to an urgent financial need, now you can correct the mistake and competently refinance the loan.

- Possibility to reduce monthly payment. This way of refinancing will help make financial relief, because... The term of the new loan will be increased if desired, but remember that in this case no one canceled the overpayment.

- Combining all loans into 1 common product. Many citizens living in the territory Russian Federation, have 2 or more loan obligations, issued by different banks. This is inconvenient, takes time to pay, and often leads to delays, so refinancing will make using the loan more comfortable. The correct name for such a combination is consolidation, and the loan itself is consolidated/consolidated. A consolidation loan can be of two types: secured and unsecured.

- Release of collateral from credit bonds. For example, a previously issued car loan secured vehicle, you can “outbid” with a product that does not require a deposit. This option is quite convenient when you urgently need to sell a car that is “under the supervision” of a banking organization. The same applies to mortgage agreements when it comes to the sale/donation of real estate.

- Changing the loan currency. This point is very relevant today, because... currency fluctuations lead to huge overpayments for borrowers. In rubles, the debt becomes less than in foreign currency. The refinanced project will help make the conditions better than the previous ones.

Relending loans: are there any disadvantages?

If you decide to refinance a loan, we should immediately note that this is not a simple procedure, although it is tempting. There are some features that should definitely be taken into account, for example:

- Refinancing small loans is not very profitable, for example consumer lending by card or in cash. Benefits in the face of cumbersome obligations long term executions by type of mortgage products.

- Additional expenses. Before submitting an application for debt reconstruction, bank clients need to carefully calculate everything (use the loan calculator, it is on our website). Sometimes the seemingly low interest rates of a new offer do not pay off, because the bank may charge a commission for its services, ask for documents, the collection of which will lead to cash outlays for the client, etc. As a result, the loan refinancing program will not make any sense.

- You can combine up to 5 current loans into 1 loan. This is the maximum number; if it is more, then you need to look for some other loopholes besides refinancing.

- You must obtain permission from another lending bank. It turns out that not all bankers are ready to “donate” their client to a competing company. Therefore, sometimes it is not always easy to get the necessary document from them, but the chances are real.

Let's consider some more banks where you can refinance a loan

- "SBERBANK"

This bank is the largest not only in Russia, but in the CIS countries. A consumer loan for refinancing loans from Sberbank is quite profitable: low and fixed rates - 13.9% and 14.9% (depending on the loan term), amount - maximum 3 million, repayment period - up to 5 years. It is permissible to combine up to 5 loans; you can take out an additional amount without increasing the loan payment per month. Sberbank specialists provide loans individuals, individual entrepreneur under this program, without requiring guarantors, collateral, or commission fees. - BANK OPENING"

In the line of offers banking institution there is a profitable “Mortgage Refinancing” program, which makes repaying a home loan less expensive for the borrower. Financial group can attract citizens under the following conditions: amount - 500,000-30,000,000 rubles (Moscow, Moscow Region, St. Petersburg, Leningrad region), 50,000-15,000,000 rubles (other regions of the Russian Federation), period - 5-30 years inclusive. - "GAZPROMBANK"

Consumer loans are easily refinanced by many banks in the country, but this lender is able to make the refinanced loan resistant to financial fluctuations. They offer special conditions for fulfilling obligations under other loan agreements, such as: rate - from 12.25%, term - up to 7 years, amount - up to 3.5 million rubles. For registration, you need multiple documents (passport, 2-NDFL certificate, insurance certificate, application form, etc. - the official website will inform you in more detail). - "MDM" BANK

The offer between the credit institution and the borrower is concluded on individual terms. The interest rate will be at least 13% per annum, refinancing funds are provided in the amount of 30 thousand to 2.5 million rubles. But there is an important point: for a requested loan in an amount over 750 thousand rubles, money is issued after the borrower provides a guarantor. - "POST BANK"

If you are looking for where refinancing is more profitable, then be sure to consider the program of a successful lender, which is Pochta Bank. Initially, you will need to leave your data in the form; a decision on your application will come very quickly. Conditions: rate - from 14.9% per annum, for pensioners - Special offers (low percentage), bankers issue additional money in cash. - "RAIFFEISENBANK"

When refinancing a loan with this credit institution, you will receive a significantly lower interest rate when considering housing loans. The rate here is 10.5% per annum, the term is from 1 year to 30 years, and maximum amount is 26,000,000 rubles. You can manage your loan remotely through Raiffeisen Online. - "RENAISSANCE CREDIT"

This lender may also be surprised by its favorable conditions among organizations that operate in the refinancing segment. By contacting here, you can actually get a reduced interest rate of 19.9% per annum. The loan amount reaches 500,000 rubles, repayment terms are at the borrower's choice: 18, 24, 36, 48 and 60 months. An online application sent to the bank will be reviewed within 10 minutes, i.e. already on the same day you will find out what the “verdict” will be on the loan in “express” style. Financial assistance here is issued without collateral or guarantors - with only two documents (passport and any other one of your choice), and if you want an even greater reduction in rates, you will have to collect a certain package of certificates. If you have the appropriate parameters, the percentages will be slightly reduced. - "ROSBANK"

Refinancing program consumer loans» in this bank is different for different categories of borrowers (for salary clients and employees of partner companies, conditions are more favorable). For ordinary citizens, the following conditions apply: amount 50,000-1,000,000 rubles, term - 12-60 months, rate - 15% - 17% per annum. It is possible to complete a transaction with a client with arrears on current loans, but insignificant.

How to get a loan for refinancing - general instructions

Are you already a client of one or more banks? This means they must understand the requirements of lenders for their visitors. Banks that refinance loans put forward the same requirements. They also need to know about your level of solvency, credit history status, etc. By the way, credit history in this case can be viewed from a different angle, i.e. a banking organization is able to make leniency and issue a loan to persons with a damaged reputation or minor delays (up to 25/30 days).

So, let's look at the step-by-step process:

- Study the list of lenders who refinance debts, read reviews about their work on third-party resources. Further in the review, you can see the rating of in-demand candidates who provide the necessary assistance.

- Contact the bank of your choice (someone else’s or yours), which in your opinion offers Better conditions on refinancing. You can submit your application online via the Internet.

- Collect the required number of certificates for the bank to assess your financial situation and wait for it to make a decision.

- If you have chosen a new one credit institution, where you want to apply for a loan for refinancing, you will need to obtain a documentary agreement from your “native” lender to carry out this operation.

- If approval is received from both parties, an agreement is signed, according to which all your old problems will be solved by the new lender, including organizational issues.

- If you decide to refinance with another bank, and the current loan is collateral (mortgage with state contribution/support, car loan agreement), you need to re-register the property with a new one banking company by re-registration of documents.

- Having completed the re-registration, you can pay off the loan at a low rate, i.e. on more favorable terms.

Banks engaged in refinancing microloans

As for the microfinance market, there is a slightly different “kitchen” at work here. Banking organizations that offer refinancing do not have a special program for refinancing microloans from microfinance organizations. However, situations are different, for example, there are 4 loans from different banks and 1 microloan from an MFO, but it is permissible to combine only 5 loans. You can try to contact one of the credit institutions and try to come to an agreement, but subject to meeting all banking requirements for the borrower (good CI, availability of work, etc.).

Not all borrowers manage to take out a loan on favorable terms, but awareness of this fact comes only after the loan agreement has already been signed, and monthly payments hit the family budget hard. But this is not a reason to despair, because there are many banks that are ready to issue loans to refinance loans from other lenders, on more favorable terms. For many borrowers, this is a real chance to improve their financial situation. Let's take a closer look at banks refinancing loans, and under what conditions.

What is the essence of refinancing?

Refinancing or refinancing is the issuance of a new loan on more favorable terms for the client. The size of monthly payments will be smaller due to a reduced interest rate and an increase in the term of the contract. In simple words– this is a new targeted loan, funds can only be used to pay off debts to other creditors.

With one refinancing loan you can close any loan, card, consumer, car loan or mortgage. Moreover, funds can be borrowed to repay several loans. Only for the bank, or more precisely, for most of them, it is important that at the time of concluding the agreement the borrower does not have overdue payments with other banks. That is, you should not waste time and violate your obligations to other creditors; it is wiser to think about refinancing in advance.

Loan for refinancing. Bank selection

Today, many banks with a refinancing and refinancing program are ready to offer their services to borrowers. But each lender has its own terms and requirements, which is most important when looking for a better offer. Therefore, we will next consider which banks refinance loans from other banks, what conditions the new lender offers and what is required from the borrower.

In some cases, there is no point in contacting a third-party bank, because many financial institutions offer refinancing of their clients’ loans on more favorable terms.

Sberbank of Russia

Here borrowers can apply for a loan to refinance loans from third-party banks and Sberbank of Russia. With one new loan, the client can cover up to 5 existing obligations to creditors.

So, what are the conditions:

- the validity period of the current loan agreement should not be less than six months;

- there must be at least 3 months left until the expiration date of the current loan agreement;

- at the time of submitting the application, the client should not have any overdue debt;

According to the bank’s terms, the interest rate is from 14.9%, available only for salary clients, maximum period up to 5 years, amount up to 1 million rubles.

By the way, here the amount of the new loan depends on the client’s preferences, that is, it does not have to be equal to the amount of debt to creditors. Or, in other words, with the help of a new loan, the client can not only pay off existing debts, but also receive a certain amount for personal needs.

Also among the advantages is the fact that no collateral or guarantee is required to obtain a loan. If the previous loan was issued with collateral, then after its repayment the encumbrance is removed.

Offer from Sberbank of Russia

How to borrow money: you need to come to the bank and leave an application. among the documents the borrower will need a passport, a copy of the work book, a certificate of income, loan agreements and a certificate of the balance of the debt. Within two days, the creditor reviews the questionnaire and makes a decision; if it is positive, you need to come to the branch and sign a new agreement. By the way, according to it, the interest rate will be 20.9 - 22.9%, but after confirmation of the intended use of funds, the rate will decrease to 15.9 - 17.9% per annum.

Rosselkhozbank

In this financial institution you can get a loan to refinance debts to other banks. One new loan can close several contracts at once. The terms of the new loan will depend on many factors, for example, for existing bank clients or responsible borrowers with a positive credit history, the rate will be reduced by 5-6%. Public sector workers have the opportunity to borrow money for preferential terms with a reduced rate. If you refuse insurance, on the contrary, the rate may be increased by 3%.

So, the interest rate depends entirely on the borrower’s solvency, his credit history, as well as the loan term and the availability of collateral. Minimum percentage 20.9%, maximum 24.9%. The loan amount here depends entirely on the borrower’s income; the lender himself determines the upper threshold based on the documents submitted; the monthly payment should not be more than 40% of income. To increase the loan amount, you can attract a co-borrower; his income will also be taken into account by the lender.

To receive a loan, you need to leave an application and attach all the necessary documents to it, including loan agreements and certificates of the amount of debt. If the decision is positive, you can come to the sales office and sign a new contract. After disbursing cash, you must pay off existing debts and provide documents to the creditor.

Offer from Rosselkhozbank

Please note that this is a targeted loan, so if the borrower does not confirm intended use funds, the bank can change the terms of lending unilaterally.

VTB 24

Here are the most favorable refinancing loan terms for the client:

- fixed loan rate for all borrowers – 15%;

- maximum loan amount is 3 million rubles;

- loan term up to 5 years;

- With one new loan you can close up to 6 loans and receive an additional amount for personal needs.

But there is also a significant drawback - the lender carefully selects borrowers. At the time of contacting the bank, the client should not have any current outstanding loan payments. In addition, there should be no delays with creditors at all over the last year.

VTB 24 Bank guarantees 100% approval of the application to a bona fide borrower, one who has not made late payments on loan obligations over the past 12 months.

Otherwise, the conditions here are the same, first you need a certificate of the balance of debt on current obligations, then confirmation of the expiration of previous loan agreements. The requirements for borrowers are standard: a passport with a registration mark and a certificate of income. The application can be submitted at the bank or on its official website, the processing time for the application is up to 3 working days.

Offer from VTB 24

BinBank

Another lender that offers clients a loan to refinance a loan in another bank on acceptable terms is BinBank. A distinctive feature of the program here is the loan term of up to 7 years. The interest rate depends on the amount, up to 300 thousand rubles - 20.5%, from 300 thousand to 3 million rubles - 16.5%. But these rates apply only to clients of lenders and public sector employees; for new clients, the rate will be 4% higher.

Conditions for obtaining a loan are standard. The client is required to have Russian citizenship, permanent registration in our country, age from 21 to 65 years and a permanent place of work. A prerequisite is an ideal credit history and no current overdue loans. Application processing time is up to 4 working days.

Alfa Bank

This bank provides loans only for refinancing mortgage loans. If you took out a mortgage, but the conditions do not suit you, then this is the place for you. Loan rate from 11.5%, further its growth depends on the life and health insurance of the borrower and the property. If you refuse to fulfill this condition, the rate will be increased.

So, what is the essence of this program: you submit an application, the bank repays the previously issued mortgage loan, the original lender removes the encumbrance from the property and you leave it with Alfa Bank as collateral for a refinancing loan. Minimum amount loan from 600 thousand rubles, and the maximum should not exceed 85% of the value of the collateral object.

Refinancing with current arrears

Surely there will be borrowers who will be interested in the question of which banks refinance loans with overdue payments. Indeed, according to the conditions of the creditors, at the time of filing the application, all current debts must be paid. But there are also lenders who are loyal to such clients, so we will consider them too.

Please note that the bank makes the decision to issue a loan individually for each client; there is no 100% guarantee that the bank will approve a refinancing loan for you with current overdue payments.

Home Credit Bank

This bank has always been distinguished by its customer loyalty; even customers with a damaged credit history, but without debts to other creditors, could easily take out a loan here. The lender covered the risks with high loan rates, which casts doubt on the benefits of refinancing, because its essence is to reduce the interest rate, and not vice versa.

Loan programs from Home Credit Bank

So, let's consider the conditions:

- contract term up to 5 years;

- amount from 50 to 500 thousand rubles;

- rate 19.9%;

You can use a loan to close any type of lending: card, consumer loan, car loan or mortgage, although the offered amount will clearly not be enough for it. To complete the application, come to the bank with all the documents, be sure to take a certificate of the outstanding balance on the current loan. If the decision is positive, the bank, after signing the agreement, transfers money to repay the debt.

Other options

As mentioned earlier, banks consider each candidate individually, so you can submit applications to several banks; there is at least a small chance that the lender will accommodate the borrower. By the way, there are banks that give loans with late payments, but no more than one month, such as AgroSoyuz Bank.

But if the situation is critical and there is nothing to pay, and you have not yet submitted an application for refinancing, then it is better to try to find funds to pay the current payment. Microfinance organizations will come to the rescue here, getting a loan of up to 30 thousand rubles will not be a problem, and on the day of application and without certificates. For many, this option will seem extremely unprofitable, but it is better than allowing for delays and reducing your chances of receiving a refinancing loan. In addition, MFOs often hold promotions to attract new clients and reduce interest rates for them.

Which bank is better to choose

There are really quite a lot of proposals: approximately half of the banks in our country refinance loans, and it is quite difficult to consider each proposal. The client’s choice mainly depends on the interest rate, because the lower it is, the lower the monthly payment. If this condition is fundamentally important to you, then choose the lender whose rate is fixed for everyone. If it is indicated that the rate is from a certain value, then most likely it is available to one category of clients, for example, salary recipients.

If you are a payroll client, depositor or former responsible borrower of any bank, for example, Sberbank, then it is wiser to start by contacting us here. Because for such potential borrowers, the lender will definitely have a better offer.

Apply to several banks at the same time to compare offers and choose more favorable conditions. To calculate your benefit, use loan calculator online, it is available on the websites of many banks.

So, refinancing loans from other banks will be a profitable measure only when another lender is ready to offer new conditions. And it will be especially inappropriate when the family budget is ruined by not one, but several loans, because it is much easier to pay to one bank. Just don’t allow delays; although banks fight among themselves for every client, irresponsible borrowers are always refused.

Which banks offer loan refinancing? Is it possible to refinance mortgages, consumer and card loans, and overdue loans? Previously, financial institutions were not engaged in this type of activity, but in the current crisis this unspoken rule is increasingly being violated; banks offer various refinance programs, making payments easier for clients and minimizing the risks of non-repayment.

Refinancing is targeted lending, in which the funds received in a strictly defined amount are used to repay an existing loan in another bank (or in the same financial institution). As a result, the client gets the opportunity to make payments easier, reduce monthly payments and interest, and the bank acquires a new client. Which bank is better to refinance a loan this year? It is impossible to give a definite answer; everyone’s programs are different, they are aimed at conditions that differ from each other. For example, if you need to refinance several consumer loans, including card loans, you must choose a bank that allows you to combine such loans into one, and then repay the issued amount in one payment.

Consumer and car loans

Which banks offer refinancing? consumer loan and loans to buy a car? The list is quite large, but best programs The following financial institutions offer:

- Rosselkhozbank (for 10 thousand-1 million at 21% and up to 5 years);

- Tinkoff (up to 750 thousand, rate 18%, term - 5-60 months);

- Opening (rate 19%, funds are issued in the amount of 30 thousand-500 thousand, maximum contract duration is 3 years);

- Sberbank (you can get up to a million at a rate of 17-25.5%, the agreement is concluded for a period of up to 5 years) ( how to refinance a loan at Sberbank?)

Which banks refinance loans for the purchase of cars or consumer goods, including card loans, if the debt amounts reach a million rubles? In this case, two banks can be distinguished that offer favorable conditions and interest rates: VTB 24 and Rosbank. However, the solution to the issue depends on the type of loan you already have, the balance of the amount, and the presence or absence of overdue payments.

- Rosbank works with consumer and car loans, offering refinance up to 1 million at 16-18.5%, the agreement will be concluded for a period of up to 60 months.

- VTB 24 is also engaged in refinancing consumer loans on the following terms: the amount issued is 30 thousand-1 million at 16-17.5, the agreement is concluded for 60 months-50 years.

Attention: Specified conditions basic, exact rates, volume Money, the duration of the contract depends on the balance of the debt, the value of the collateral, the age of the borrower and his level of income! After providing a package of the required documentation (each financial institution sets it independently), an offer is made to the client if the decision on refinancing was positive (on-lending is allowed).

Mortgage refinancing

Not all banks are involved in refinancing mortgage agreements, since such loans involve high risks for the financial institution itself. Among the best offers, the following should be noted:

- Rosbank offers refinance in the amount of 1.5 million-15 million, interest rate 12.75-19%. The contract is concluded for a period of six months to 60 months;

- VTB 24 prefers refinancing of internal, that is, its own, mortgage agreements, but there are also external programs: in the amount from 500 thousand to 75 million at 15-17%, terms 60 months - 50 years, conditions are offered individually after reviewing the provided documentation ;

- Alfa Bank also deals with mortgage refinancing, offering amounts up to 60 million at 17.6%, the maximum possible term is 25 years.

What to do if your loan is in arrears?

Previously, refinancing in the presence of a bad credit history was not carried out at all. But now, due to the large volume of non-repayments, some banks have begun to offer refinance programs for just such loans - with overdue loans. What is the benefit of the bank? It's simple - it allows the client to reduce the burden of monthly payments and reduces their own risks of non-repayment of the loan. Such a service cannot necessarily be provided by the bank where the loan was issued previously; some companies work with loans from other institutions.

How to get a refinance and what are the chances of it? Depending on the bank chosen, the client is subject to the following conditions:

- minimal violations (the delay should not be large);

- availability of collateral with adequate value;

- guarantor or co-borrower.

The choice of bank should be made based on the size of the future monthly payment and the amount of overpayment, the date of final repayment. Which banks refinance overdue loans? The list includes:

- SB (Sberbank of Russia);

- Rosbank;

- Gazprombank;

- BM (Bank of Moscow);

- Alfa Bank;

- Opening;

- VTB 24;

- Raiffeisen;

- Home Credit;

- Russian Standard and some others.

The conditions of each of them are different, they are aimed at satisfying different situations. For example, SB offers the option of refinancing external loans with a rate of 17-20% and the possibility of receiving funds in the amount of 15,000-1,000,000 (depending on the debt balance).

VTB 24 prefers to refinance its own loans, but on favorable terms with a rate of 15-17%. He can refinance third-party obligations, but extremely reluctantly, but it all depends on the availability of collateral and the balance of the debt.

When submitting an application for refinance at any financial institution, the client will be required to provide a number of documents:

- passport to confirm identity and place of registration;

- confirmation of income (form 2-NDFL);

- a certified copy of the employment contract/work book.

The complete list depends on the bank; some require confirmation of ownership, the conclusion of a guarantee or co-loan agreement. It is also necessary to remember that funds are not given to the client in cash; they are immediately transferred to the lender’s account for full repayment of the loan. From this moment on, new conditions come into force, which the client undertakes to comply with.

In an era of great competition between banks, profitable loan products are constantly appearing. Especially if the loan is large and long-term, the client is upset that he took out a loan at an inconvenient interest rate.

But there is a way out - this is refinancing. TO What banks do and what are the benefits we will consider in this material.

Due to an unstable financial situation, it may become difficult for a person to repay the loan. Or the client sees that new profitable offers are appearing, for example, on housing loans than the loan he took out previously.

If the borrower has several loans from different banks and it causes him discomfort to pay in different places. To meet customer needs or help bear financial burden and a product was created - loan refinancing.

The purpose of this program is to help people:

- This program will help close an expensive loan that is inconvenient due to high interest rates, a short term, and a large monthly payment. In such a situation, the bank offers a loan for the amount of the loan taken from another bank, but on favorable terms (low interest, long term, lower payment).

- Combine loans from different banks into one with a more favorable interest rate. In this situation, the bank closes the client’s debts on accounts in other organizations and opens a credit account in its own. The client benefits from the fact that it has become more convenient to pay in one place and the loan is cheaper due to the lower interest rate.

- With the help of refinancing, you can not only close an expensive loan or combine several into one, but also get an additional amount for personal expenses.

- With the help of on-lending, you can change the currency in which the loan was taken, which is very important in an unstable economy.

So, we can conclude that refinancing is an offer from the bank to close existing debts on more favorable terms.

An existing loan can be in any form: credit card, personal loan, mortgage, car loan. The offer of a financial institution gives the borrower the opportunity to reduce the cost of servicing the loan, and the bank acquires a new client in the person of this borrower.

Most loans on the market are issued at an interest rate of 20–30%, but you can find even higher ones. When refinancing, the annual rate can be reduced to 10–20%; this is beneficial if the client has not yet paid off a large amount of debt. Since the main repayment of interest goes into the first payments according to the schedule.

Why is this beneficial for the bank? For a financial organization, the most important thing is a conscientious client who pays his bills honestly. The likelihood that a borrower who has already paid the loan on inconvenient terms and will continue to pay the same loan, but on convenient terms, in another bank is much higher than just a new client who came for a loan.

Which banks refinance loans - full list and conditions

In Russia, not all banks offer such a profitable service as refinancing a loan existing in another organization. Before submitting an application, you need to compare all offers on the market.

LocoBank - offers to reissue a loan in the amount of up to 5,000,000 rubles, at an interest rate of 10.4%. The term of this loan will be up to 7 years, and no guarantors will be required.

LocoBank - offers to reissue a loan in the amount of up to 5,000,000 rubles, at an interest rate of 10.4%. The term of this loan will be up to 7 years, and no guarantors will be required.

The decision will be made from several hours to 3 days. After a positive decision, the applicant has the right to think for up to 30 days whether to agree to the terms of the loan or not.

In order to apply for refinancing, simply fill out the borrower application form on the official website.

After signing the contract, the entire amount is issued in a lump sum. This organization is just beginning to develop in the credit products market, so the offer is quite profitable. It should be noted that the rate starts at 10.4%, which means that the final decision may have a different figure.

– the unique offer of the product is that the interest rate is 11.99% -14.99% per annum, from the second year it is reduced to 9.99% interest on the balance of the debt.

Up to 5 loans from the same or different banks can be combined into one loan. In this case, this can be up to three large loans:

- Mortgage credit lending.

- Consumer loan.

- Car loan.

Or up to four credit cards simultaneously. But in comparison with the previous bank it is inferior in terms of the maximum loan amount. It cannot be more than 2 million rubles, with the minimum amount being 90 thousand.

The number of months of use of the loan cannot be more than 60 months, and the minimum is 13.

Plus, the bank provides the opportunity to receive free money for personal expenses.

In addition to all the advantages, if 3 months after the client receives a loan, the credit history bureau does not provide information that the borrower’s loans are closed, the bank increases the annual interest rate on the remaining debt by 8 points.

The same thing happens if the borrower does not provide a certificate of full repayment loans for which he received financial support. For payments not paid on time, Raiffeisen assigns a penalty in the amount of 0.1% of the overdue amount for each day of missed payment.

Requirements for the applicant:

- Citizen of the Russian Federation from 23 (from 21 is eligible for participants in bank salary projects) to 65 years at the time of debt closure.

- Availability mobile number and landline work telephone numbers.

- The main requirement is that the applicant must not be an individual entrepreneur.

Required package of documents:

- Completed applicant form.

- Russian Federation passport.

- Certificate of income in the form: 2-NDFL, 3-NDFL or in the bank form for a period of 3 months.

- Documents confirming employment: a copy of the employment contract (or contract for the military), certified and with a record that the employee is currently registered, a license to operate or a lawyer’s certificate.

- Documents confirming additional income (if any): a certificate in the form of a bank or 2-NDFL, a certificate of property and a copy of the lease agreement, a certificate of the amount of pension from the Pension Fund.

For clients receiving salaries on a Raiffeisen card, all they need is an application form and a Russian passport. The decision is made in one hour. An application for consideration can be submitted on the bank’s website.

You can also come to the branch or order a loan specialist to visit your home.

Zenit Bank offers to reduce the interest rate to 12.5%, although it is ready to reissue up to 5 loans from third-party organizations. The amount is up to 3 million rubles, and the period is up to 7 years. The bank also allows the applicant to receive money for personal expenses.

Documents needed:

- applicant's application form;

- Russian passport with permanent registration;

- certificate confirming income;

- additional document (SNILS, INN, Foreign passport of a citizen of the Russian Federation, driver's license);

- a copy of the work book/contract, all completed pages.

The application is considered by the bank no more than 2 days. The form is filled out on the website, then the applicant needs to call the bank itself at 8-800-50-59-733. If the decision is positive, the client needs to drive to the nearest Zenit office and sign the agreement.

Tinkoff credit systems – reissue loans to Tinkoff under the programs “Balance Transfer” and “Balance Transfer”. Everything happens by transferring funds from an account belonging to a bank credit card.

A distinctive feature of this offer is that in addition to a lower interest rate, the client also receives 4 months grace period on the card, within which you can pay off the debt without overpayments.

The advantage of the card is that after the debt is closed, the money can be spent again on purchases, services or other needs. Also, the advantage of the fact that this is a card and not a regular loan is cashback. That is, from each purchase using the card, the client returns 1% of the amount.

The main disadvantage of refinancing is that the maximum amount is 300 thousand rubles, and the interest rate is 8% per annum.

You can pay by card using payments convenient for the client, but they should not be less than the established minimum amount. It is formed from the total approved limit, and is no more than 8% of the total debt, but not less than 600 rubles.

The card can be issued by any citizen of the Russian Federation with permanent registration from 18 to 60 years. The only documents needed to obtain a card are a passport, and the application can be left on the official website.

VTB (VTB, VTB 24 and Bank of Moscow have merged into one bank since 2018) - the VTB group of companies offers to transfer all existing loans to them at an interest rate of 12.5% per annum. The minimum amount that can be received is 100 thousand rubles, the maximum is 5 million rubles.

The payment period will be 5 years; for corporate and salary clients, a period of up to 7 years is allowed. You can combine up to 6 different loans and credit cards, as well as receive an additional amount on top of your existing debt.

No guarantor or loan security is required; funds are transferred to accounts in other organizations - without commissions.

Conditions for refinancing:

- The applicant is a citizen of the Russian Federation with permanent residence in the region where the bank branch is located (the list of regions can be viewed on the official website).

- Package of documents: passport, SNILS, loan agreement that the applicant intends to refinance, original certificate in the bank form, 2-NDFL or free form for the last six months (for salary clients, proof of income is not required).

VTB also puts forward requirements for loans that the client wants to reissue with this bank:

- The balance of loan payments is at least 3 months.

- The loan was taken from a third-party organization, and not from BTB group banks.

- Loan in rubles.

- Over the past six months, the debt has been repaid regularly and at the moment there are no arrears.

You can re-register loans for movable and real estate, personal loans and credit cards.

In order to apply for funds, you need to go to the official VTB website, fill out an application form and wait for a response via SMS.

The money is transferred to the accounts of previously issued loans and in person if the client has left a request for an additional amount.

Sberbank of Russia - offers to reissue loans with a fixed rate of 13.5%. A nice bonus is that they do not require the client to provide confirmation that the borrower has closed the loans.

The maximum possible amount is 3 million rubles, for a period of up to 5 years and up to 30 if it is a mortgage restructuring. Can combine up to 5 credits from different financial organizations and make payments only once a month and in one place. Considering the large number of Sberbank branches and ATMs, this is very convenient!

Just like many other banks, you can take an additional amount for personal expenses.

In order to reissue loans, the following conditions must be met:

- Timely repayment of debt for the entire loan term (if the loan was issued more than a year ago, then within the last 12 months).

- No restructuring of the refinanced loan for the entire period of its validity.

- A loan from a third-party bank must be issued only in rubles.

- Requirements for the validity period of refinanced loans: Sberbank loans - at least 6 months from the date of conclusion of the loan agreement, loans from a third-party bank - without restrictions.

The client submitting the application must be over 21 years of age and at the time of repayment of the debt he must not be more than 75 years old. Also a prerequisite is permanent registration in the Russian Federation. The total work experience is at least 12 months and the current position holder must have at least six months of experience.

The applicant will need the following documents: passport, income certificate, loan agreements requiring restructuring. Sberbank may additionally request a certificate confirming that there are no overdue payments on existing loans.

When choosing the best offer, the borrower can pay attention to various indicators. If the goal is to close a large amount, then VTB and LocoBank are suitable. If a client is looking for a low interest rate, then the winners are Tinkoff, LocoBank and Raiffeisen Bank. Tinkoff also benefits from the fact that after transferring funds to repay the debt, there is still a grace period of 4 months.

Refinancing loans to pensioners

From the proposals presented above, pensioners can receive a restructuring of existing loans from Sberbank, VTB and Raiffeisen. For pensioners receiving a pension on a Sberbank card, when applying for refinancing at this bank, the applicant receives bonus conditions for a minimum interest rate.

There are also additional offers suitable for retirees.

Alfa Bank – lends to people under 75 years of age. The maximum amount that can be issued is 3 million rubles. The period starts at 24 months and ends at 7 years. Moreover, if the client expects to repay the loan for no more than 5 years, then the maximum amount that can be issued is 5 million rubles. The balance of the debt is subject to an interest rate of 11.99% per annum.

Alfa Bank – lends to people under 75 years of age. The maximum amount that can be issued is 3 million rubles. The period starts at 24 months and ends at 7 years. Moreover, if the client expects to repay the loan for no more than 5 years, then the maximum amount that can be issued is 5 million rubles. The balance of the debt is subject to an interest rate of 11.99% per annum.

Rosselkhozbank - issues funds up to 3 million rubles at 3% on the balance. At the same time, it can include up to 3 loans from other organizations and half of the amount can be taken in cash and spent on personal needs.

The unique offer is that you can choose the payment date, but there are a limited number of them (every 5th, 10th, 15th, 20th day of the month) and, unlike many offers, here you can choose a system for making monthly payments: annuity or differentiated.

Loan term up to 5 years. A passport and proof of income will be required.

In which bank is it possible to refinance if there is an overdue loan?

If the client delays payment of the debt, then the delay begins from the day following the write-off date. For such violations, pennies are assigned and paid for each day of current delay.

All payment histories are transmitted by the bank to the credit history bureau, and from there other banks take the information when deciding whether to approve a loan.

From which we can conclude that the presence of arrears affects the receipt of financial assistance from the bank.

So is it possible to reissue a loan if there are arrears? You first need to figure out which delays will not be counted:

- To restructure a loan, the bank evaluates the last 6-12 months of payment; if there was a delay earlier, it most likely will not be taken into account.

- Closed delays of less than 15 days will not influence the decision.

That is, problems during restructuring arise only with open loans. The thing is that the decision in this case is influenced by several factors:

- If the borrower pays poorly now, he will most likely pay poorly later.

- Difficulty in accurately calculating the balance of the debt due to the accrued pennies.

- Possibility of litigation due to prolonged delay.

What should a client do if he has an open debt and wants to sort it out?

First, he needs to contact the bank where he has an open debt. Perhaps the organization has offers to re-issue a loan with them. Change the payment number, reduce its size, or other proposals so that the client improves the current situation.

If the decision to change the bank is made, the bank will agree to refinance in the following cases:

- The client combines several loans and only one of them is in arrears.

- Open overdue for at least 30 calendar days.

- If the applicant receives a salary into an account in the bank to which he applies.

When applying for a loan to a client with an open arrears, the borrower must be prepared for the fact that the interest rate on the loan will be higher than the average for all offers.

List of banks ready to accept a borrower with a missed payment:

- Rosselkhozbank can make a positive decision for clients with minor overdue payments (no more than 30 days).

- B&N Bank can issue refinancing with an interest rate above 20% per annum on the account balance under conditions of arrears of no more than 30 days and an expanded package of documents.

- Citibank, on the terms of life and health insurance, and possibly also securing a loan, will accommodate the client halfway.

Even if the client receives a refusal from these organizations, then he has a way out to correct his credit history - MFOs, there is a very high percentage, short term and the amount does not exceed 1 million rubles. But, nevertheless, the MFO also provides the CI to the credit history bureau, and thus by paying off the microloan, you can improve your payment history and get a loan from the bank.

Selecting the best offer for loan refinancing in the following video:

Aug 30, 2018 Help manual

You can ask any question below