Early repayment of the principal debt. By what amount will the principal debt decrease after the “early term”? What is full and partial loan repayment?

Many borrowers try to repay the loan ahead of schedule, because in some cases this can significantly reduce the overpayment. According to legislative amendments approved in 2011, banks are prohibited from interfering with the early repayment of debt in any way - in particular, by levying fines or establishing a moratorium. However, some banks get around these restrictions by setting quite high minimum amount payment. Lawyers and bank representatives spoke about the most common mistakes that borrowers make when repaying a loan early.

Mistake number one. “My job is to deposit money, and the bank will sort it out”

A borrower who intends to repay the loan early must not only accumulate a sufficient amount, but also write a corresponding application to free form. As explains Chairman of the Board of Private Limited Liability Company for the protection of consumer rights "Sovetnik" Vyacheslav Kurilin, in the application it is important to indicate the amount of early repayment and the date of the transaction. The fact is that, in accordance with Russian legislation, the borrower actually has the right to repay the loan at any time, without the bank’s consent, but he is obliged to notify the financial institution about this at least 30 days before the date of the transaction. In addition, most banks have their own requirements for the minimum notice period for early loan repayment, which are specified in the loan agreement. It is worth noting that often employees of a credit institution deliberately recommend that borrowers not write a corresponding application, trusting them at their word - and this always backfires on the borrower.

According to Andrey Stikhin, manager of the Chelyabinsk branch of UniCredit Bank, some borrowers, based on the payment schedule, independently determine the amount of early repayment of the loan and transfer money to the account, without notifying the financial institution. “Customers do not notify the bank that this is an early repayment, but simply pay an increased amount of the monthly payment. Without notification from the borrower, the bank does not consider this an early repayment; the funds are simply written off monthly to repay the loan, but the amount/term of the loan does not change. This is important to understand,” he says. In addition, in case of full repayment of the loan, the borrower needs to sign a notice of early repayment; in case of partial repayment, an additional agreement to the contract, since in the latter case the size of the monthly payment also changes.

Mistake number two. “It seems that this amount should be enough”

A common mistake when repaying a loan early is the incorrectly calculated amount. “The amount for full early repayment of the loan must be calculated by a bank employee. The borrower can always find out the required amount by calling the bank's hotline. This amount must be credited to the client’s account in full and on the date specified in the repayment schedule. After making a full early repayment, it is recommended to call the bank and clarify whether the agreement is closed or not,” comments Head of the non-targeted lending department of Home Credit Bank Tatyana Arzumanova.

“There is a known case when the borrower decided to repay the loan ahead of schedule and deposited all the money into an account from which the amount of the next payment was automatically debited every month. But a few days before the write-off date, to be completely sure, she decided to check the balance to make sure there were funds in the account. For this service, the bank debited 15 rubles from her account. Accordingly, on the day of write-off, 15 rubles were not enough to fully repay the debt, and the bank did not make early repayment, but wrote off the principal and interest monthly for two years. And when the money in the account ran out, the bank informed the discouraged borrower about the accumulated debt and arrears,” says Vyacheslav Kurilin and adds that the consumer must independently clearly monitor the timing of debiting funds and their availability in the bank account.

Mistake number three. “The bank always correctly calculates the overpayment”

Often, banks, when repaying a loan early, reduce only the amount of debt on the principal debt, while continuing to charge the borrower interest on the entire initially provided loan amount. “For example, a person took out 200,000 rubles on credit, and after some time he decided to repay one hundred thousand ahead of schedule,” explains Vyacheslav Kurilin. - However, when repaying the loan, the bank withholds interest from the borrower based on the original loan amount - 200,000 rubles, which is prohibited by law. Interest should be calculated only on the amount of debt during the reporting period,” says the expert.

According to him, a number of banks even practice the appearance of early or partial repayment, telling the borrower not the amount of the principal debt for the current day, but the total amount of debt, including interest accrued for the entire period. It is quite simple to prevent yourself from paying extra interest: you need to ask the bank employee to name only the amount of the principal debt. “The bank charges interest only on the balance of the debt, therefore, as the principal debt decreases, interest payments for using the loan also decrease. Accordingly, the earlier the repayment is completed, the less the overpayment on the loan,” explains head of lending department individuals"VUZ-Bank" Olga Gorlova.

Mistake number four. “We need to pay off everything at once - both the loan and late fees”

As the Deputy Regional Development Director explains retail business office of Promsvyazbank in Chelyabinsk Lyubov Panova, on-lending gives the borrower the opportunity to obtain new loan for more favorable conditions to pay off the old one. It should be noted that in this situation, borrowers are advised to remember a simple rule - when repaying an old loan, you need to make sure that the deposited amount is used primarily to repay the principal and interest on it, and not as a late fee. It will be possible to pay off the penalty on the old loan after some time, since after the loan is repaid, the amount of the fine will no longer increase.

In addition, the resulting loan penalty can later be significantly reduced as a result of litigation with the bank. “According to Art. 333 of the Civil Code of the Russian Federation, it is possible to reduce the penalty if the borrower had really good reasons for delaying loan payments - for example, loss of a job,” notes Lyubov Panova.

Mistake number five. “Repaying a loan early is always beneficial”

According to Vyacheslav Kurilin, in fact, it is economically profitable to repay a loan ahead of schedule with annuity payments (that is, with equal monthly payments) only in the first half of the term, since in this case the borrower enormously reduces the amount of overpaid interest. “If the loan term has already exceeded half, then there is no point in repaying the loan early, because the person has already paid almost all the interest for using the loan. This is due to the annuity payment system, when the first monthly payments include interest for the last months of using bank funds,” the expert sums up.

With an annuity payment scheme. In both options, paid in advance by the borrower cash are fully used to repay the principal debt to the bank, but the loan parameters change differently after early repayment.

The first is reducing the loan term. The monthly payment amount is not recalculated.

The second is a reduction in the monthly payment. Cash deposited ahead of schedule by the borrower reduces the debt to the bank, but the bank does not reduce the loan term, but recalculates the amount of monthly payments downward.

Most banks allow the borrower to choose between both repayment options.

When using the first option, interest payments on the loan are reduced, but the monthly debt load is not reduced. The second option, on the contrary, involves a reduction in monthly payments, but interest payments on the loan are reduced insignificantly.

The option of shortening the loan term is beneficial for minimizing overpayments on the loan. From the point of view of reducing the debt burden, the optimal option is to reduce the size of the monthly payment.

If early partial repayment If the loan is a one-time loan, then the option of reducing the loan term allows you to save several times more on interest payments to the bank than the option of reducing the payment amount.

If the borrower has the opportunity to make partial early repayments regularly and there are no restrictions on their amount in the loan agreement, then both repayment options can be considered economically equivalent. If, during early repayment with a reduction in the payment amount, the funds saved each month are again invested in early repayment, then the savings on interest paid to the bank in both options will be the same. But at the same time, the scheme with a decrease in the payment amount is more flexible, since in the event of any force majeure circumstances, for example, a decrease in the borrower’s income, have a smaller monthly payment The loan is definitely more profitable.

1. The loan is in rubles, there are no restrictions on early repayment.

In this case, the use of both the first and second options for partial early repayment is almost equivalent. But it’s still better to reduce the size of the monthly payment and invest the savings again in early repayment.

2. The loan is foreign currency, there are restrictions on early repayment (for example, the amount of early repayment is limited to $500).

Here to achieve the same financial result If you select the early repayment option, you will not be able to. The scheme with a shorter loan term works more efficiently.

3. The loan currency is rubles, there are restrictions on early repayment, money for early repayment is irregular (for example, from an annual bonus or tax deduction).

The situation is ambiguous; you need to make a decision individually, assessing your own risks and priorities.

You can compare both partial early repayment options using mortgage calculator with the corresponding function.

Borrowers often have additional funds that allow them to repay their loan faster. What is early partial repayment of a loan and what is its procedure - further.

What is partial early repayment of a loan?

Partial early repayment is the excess of the amount of the payment made over the amount specified in the agreement. In simple words, if the borrower needs to pay 10 thousand rubles this month. as a monthly contribution, and he makes 15 thousand rubles, then the amount of 5 thousand rubles is an early partial payment. In this case, the bank reduces the balance of the principal debt (the body of the loan) and recalculates the interest for using the loan.

Contrary to the popular belief that early repayment is not allowed by the banks themselves, this is not the case. The Civil Code of the Russian Federation guarantees the borrower's right to repay debts to financial institutions ahead of schedule. However, the loan agreement may provide for penalties for this, so before signing, the loan agreement should be carefully studied.

Procedure for early loan repayment

The procedure for partial loan repayment is quite simple:

- Study the loan agreement. It must stipulate the bank's requirement to notify about the planned partial.

- If there is such a requirement, please contact hotline bank and find out which branch is best for you to contact for advice. As a rule, the repayment procedure takes place where you took out the loan.

- Approach the responsible manager and communicate your intentions. He will give you an application form “On partial early repayment of the loan.”

- If a form is not provided, then write the application in any form, indicating the amount of early repayment. Be sure to fill out the application in two copies, one of which you keep for yourself with the registration number and signature of the person accepting it. When partially repaying a loan from Sberbank or another financial institution, indicate in the application the date of the transaction and the account number from which the funds will be debited.

- Before depositing the amount into the cash register, notify the bank manager. This is very important, as the organization’s employees will need to prepare the relevant documents. The fact is that when paying a loan, the payment amount is first credited to your personal account, and only then to your credit account.

If you do not notify the manager of your intention to make an early partial repayment, only the amount specified in the agreement will be debited from your personal account. In this case, the balance will be written off next month, and interest on the loan will continue to accrue on the principal debt.

In case of partial early repayment, VTB will offer you two options:

- recalculate the loan repayment schedule with a reduction in the payment amount;

- shorten the loan term with the same schedule as specified in the agreement.

The first option is not suitable for mortgage lending. The fact is that the mortgage agreement, along with the payment schedule, is registered at the Companies House. Changing it requires mandatory registration with this department. Therefore, with a mortgage, you may simply have the loan term reduced.

Partial loan repayment: pros and cons for the borrower

This is a big plus for the borrower.

The client relieves himself of the debt burden and saves on interest, which is important in a crisis.

The disadvantages of early loan repayment will become noticeable when the exchange rate declines national currency. In this case, it is more profitable to invest additional funds in the purchase of foreign currency in order to pay a larger amount when its price rises. However, there is one “but” here. Most banks tie interest rate on a loan to the Central Bank rate, which, as a rule, grows in conditions of devaluation of the national currency. Accordingly, your future loan payments may also increase.

- Before deciding on partial early repayment of the loan, carefully re-read the agreement. Calculate how much you will save in the future on this operation, taking into account possible commissions. To do this, you can use the partial loan repayment calculator on the bank’s website.

- Be sure to check the loan balance after the transaction so that the funds do not get stuck on your account. personal account, but were transferred to credit.

- Control the accrual of interest; they must be calculated taking into account the amount of early repayment.

Repaying the loan in full and as quickly as possible is the dream of any borrower. Banks allow early repayment of loan debt, although this is not beneficial to them from a financial point of view. Read the article about different options and conditions for loan repayment.

Loan repayment schedule

With differentiated payments in the second half of the term, reducing their amount does not make sense. It is already quite small compared to the start of payments. And by shortening the term, you can achieve a reduction in the total amount of interest with a slight increase in payment.

Banks do not welcome any early repayment of a loan. In doing so, they lose part of the profit, although many include these risks as a percentage. Such clients are “registered” with the credit institution as undesirable.

Loan repayment account

Loan amounts are repaid by depositing them into a credit or current account opened in the name of the borrower. Several years ago, banks offered clients to replenish loan accounts directly upon repayment. When funds were deposited into them, the loan debt immediately decreased.

Currently, it is more common practice for borrowers to make payments to a current deposit account or to a bank card. They are linked to the loan account at the time of signing the loan agreement. Payments from current accounts are transferred to loan accounts on a certain day of the month according to a schedule.

You can replenish loan or current accounts in several ways:

- cash through bank operating windows;

- cash through or self-service devices;

- non-cash, debiting from a card or deposit;

- in online banking services.

Early loan repayment. Profitable or not?

Early repayment of a loan is not beneficial for banks, but is beneficial for borrowers. Financial organizations When issuing loans, they expect to receive annual income, which is lost when the loan is closed ahead of schedule. If the client decides to repay the loan or pay a large amount early, the bank must be notified.

It is beneficial to repay the loan early in the following cases:

- if it is received under very high percent(over 50%);

- a medium-term or short-term loan issued with mandatory annual insurance, for example, a car loan;

- the mortgage is issued for many years, during which the borrower’s material well-being may be shaken, and there will be nothing to repay the loan with.

It is not profitable to make early repayment:

- If the loan is taken out for a small amount or at a low interest rate. You won't be able to win much.

- If the loan is taken for the development of entrepreneurial activity. By withdrawing funds from circulation, the borrower puts his business at risk.

- If there are no available funds, and the client is going to pay off the debt, depriving himself of the opportunity to exist normally. The result may be depression, which is not worth any benefit from paying off the loan early.

To repay housing loans, the state provides the possibility of using maternity capital funds. It can be used to cover an initial fee, pay in full or the balance of the loan debt. The owner of the certificate for maternal capital must be a borrower or co-borrower on the mortgage.

To use maternity capital, you must contact the Pension Fund at your place of residence and provide the following documents:

- Certificate of registration of ownership of housing or a copy of the agreement for participation in shared construction.

- A certificate from the bank confirming the receipt of a mortgage loan.

- A certificate of the amount of principal and interest on the loan.

Early loan repayment agreement

If the borrower decides to repay the loan early, you must contact the bank and take all necessary measures in this case:

- At least one month before repayment, provide the bank with a notice of the upcoming closure or partial repayment of the loan, indicating the amount.

- Wait for a response from financial institution on the appointment of the day for depositing the amount. Money can be deposited into the account in advance, but no later than the specified time.

The conditions for early repayment are specified in the loan agreement.

There are situations when loan obligations are transferred to a third party. For example, it may be the debtor of the borrower (individual or entity). In this case, to repay the loan, the borrower issues an order for a third party to pay the debt. A sample of such a document is given below:

Credit obligations can be assigned to another person only if it has a confirmed receivable to the borrower. The bank must also be notified of the start of repayment of the loan debt by a third party.

Example notification:

Loan repayment calculator

Designed to calculate the repayment amount when early return debt. There may not be absolute accuracy in the calculation due to some banks charging additional fees for early repayment. In addition, the calculator does not take into account the amount of insurance, if one is issued along with the loan. To obtain the exact loan repayment amount, you must contact the creditor bank.

Calculator example:

Application for loan repayment. Sample

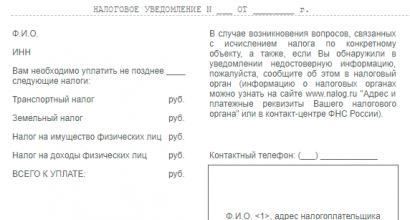

An application for early repayment of a loan is a document that is sent to the bank in order to notify it of the client’s desire to fulfill his obligations. Application forms can be obtained from the bank that issued the loan. The application is filled out by the debtor personally and includes the following data:

- Full name of the borrower;

- Name of the bank;

- requisites loan agreement;

- bank account number from which money will be debited;

- repayment amount.

The document is drawn up in two copies and registered with the credit institution. The bank employee who accepted the application puts on it the date of acceptance, registration number, position and full name.

Application example:

Is it possible to repay a loan with insurance?

Loan insurance is not required except for mortgages and some types of auto loans. But in most cases banks

impose insurance on any type of loans. If the loan is repaid early, the borrower has the right to return the remaining balance.

impose insurance on any type of loans. If the loan is repaid early, the borrower has the right to return the remaining balance. If the client contacts the bank within 1 month from the date of signing the loan agreement, he will be able to fully return the amount specified in the insurance agreement. If more than 30 days have passed, then the money can be returned, but minus the expenses incurred by the bank when applying for insurance. In any case, the returned money can partially or fully repay the loan. To do this, in the application for insurance refund, you must indicate the credit account for crediting the money.

When the client applies after closing the loan agreement, the money is returned by the insurance company upon application. If the insurer does not agree to return the funds, you should contact a credit lawyer. Most often, such cases in court are resolved in favor of the borrowers.

How to get a loan to pay off other loans

There are situations when shaky financial well-being does not allow the borrower to repay the loan on time. In this case, the procedure for refinancing at another financial institution can help. Currently, banks have special programs aimed at refinancing customer credit debts.

You can take out such a loan under certain conditions:

- absence ;

- no restrictions on early repayment.

The loan can be issued:

- In cash, if the client has an ideal credit history. The new loan amount may be greater than what is required for refinancing. A contract and payment repayment schedule are issued.

- By transfer to the client’s loan account at another bank.

For clients who are on the “black list” of defaulters, the refinancing procedure is not applied, or the loan is issued under strict conditions. These include:

- loan term no more than 1 year;

- pledge of real estate;

- increased interest rate.

The bank's review period for a refinancing application can be up to 3 months. During this time, the credit history and documents provided by the client are studied.

Loan repayment online

Most banks provide their clients with Internet resources for convenience and speed of transactions.

To gain access to online services, you must enter into a service agreement. It is enough to take your passport to the bank or call the hotline by phone. The connection operation is free. The client is given a login and password to use the system.

Through you can repay loans from your bank and others credit institutions. The commission for transactions depends on the tariffs of the credit institution, the amount and conditions of bank accounts. Amounts for loan repayment are credited by the recipient bank on the day the funds are received in the correspondent account.

Mobile applications have also become available, allowing you to repay loans anywhere and at any time. Mobile banking services are paid, with an average monthly commission of up to 100 rubles.

What to do after repaying the loan

In order to avoid being a debtor after repaying the loan debt, you need to take a document from the bank confirming full fulfillment of obligations. Certificate of loan repayment issued by a bank employee at the client’s request within two weeks. A sample is shown below.

It is imperative to make sure that the credit account is closed. Otherwise, the loan is considered active and is reflected in credit history as outstanding. Most often, loan accounts remain unclosed when a loan is repaid early.

Who provides loan repayment assistance?

Assistance in repaying loans is required in the following cases:

Legal advice on refinancing, restructuring and loan repayment is provided by consulting firms. have extensive experience in resolving disputes on lending issues and conducting cases in court. The sooner a debtor seeks advice, the fewer financial losses he will face.

- Before taking out any loan from a bank, you need to plan your budget for the next few years.

- For selection better conditions lending, it is worth familiarizing yourself with the offers of different banks.

- If difficulties arise with repaying the loan, there is no need to hide from the bank; it is more profitable to negotiate.

You've probably heard about partial early repayment of loan debt, but don't know what benefits it promises and what it is intended for? Do you want to save on interest and not pay a huge overpayment on the loan? In this article we will discuss in detail the issue of early loan repayments - and the benefits they give to the borrower.

Is it beneficial for the borrower?

Bankers don't like late loans- you probably know this from the news. One has only to listen to what measures are being taken in relation to borrowers who are in arrears.

But for many, an unpleasant discovery will be the fact that early closure of a loan - which would seem to be interesting to the lender - is not particularly welcomed by most of them. And it seems like it should be the other way around, but for some reason there are certain conventions and difficulties in the matter of quickly paying off debt.

Let's figure out why this happens.

There are two standard loan payment schemes: and differentiated. With the first method, most of the contribution goes to pay interest, and the principal debt is repaid insignificantly. With the second method, the payment amount is divided equally between paying interest and covering the principal debt.

When a partial deposit is made beyond the required amount, the money is used to cover the principal portion of the debt (the original loan amount). Let's look at an example of what this looks like.

Example: you have a consumer loan from Sberbank in the amount of 150 thousand rubles, issued for five years. The payment scheme is annuity. The rate for the use of funds is 23.9% per year.

Every month you pay 4,315 rubles under the agreement. The total debt is 266 thousand rubles, of which the overpayment for the use of funds is 116 thousand.

You paid regularly for four months, then unexpectedly received a large bonus. And you now have an additional 70 thousand rubles that can be paid towards the debt.

The debt at the time of payment was 240 thousand rubles. After receiving 70 thousand rubles, the creditor recalculates the current debt, since these funds cover the principal debt (150 thousand), and do not go to pay interest.

Thus, the amount of debt is reduced and interest is recalculated- as a result, the total overpayment on the loan decreases. If next time you have free cash, you can also use it for an early payment - as a result, the loan will become more profitable, and you will pay the lender much faster.

Therefore, the answer to the question of whether it is profitable to use this method is clear - it is profitable. Especially for those who pay not a consumer loan, but a mortgage loan.

On the pages of our website you will also find out what loans are offered and how profitable its offers are.

Do you want to know which bank is better to borrow from? consumer loan? We'll tell you about the best banking offers.

On our website you will also learn... We invite you to read the detailed instructions.