Cryptocurrency exchanges without verification for withdrawal. How to buy bitcoins without verification and passport using cash or credit card. What is the difference between cryptocurrency exchanges

Hello, dear readers of the blog site. The cryptocurrency market is significantly different from other currency markets, primarily in that everything here seems to be unofficial. is not supported by anything and no one stands behind it (neither the state nor other structures). However, this does not prevent millions of people from making good money on bitcoins, litecoins, ethers and other crypto money.

One of the most powerful tools for earning are cryptocurrency exchanges. Yes, they are also all unofficial (there can be no others, because no one controls it), but the cash flows passing through them are amazing.

Many who are in the subject use exchanges (instead of or together with) to buy, sell and exchange bitcoins for other types of virtual currencies or ordinary (fiat) money. Here, however, everything is somewhat more complicated than in exchangers, but with a certain skill, you can sometimes save money when exchanging or earn money on speculation.

What are cryptocurrency exchanges and why are they better than exchangers?

Naturally, over the vast sea of cryptocurrencies, many services have arisen aimed at working with these currencies. Basically, these services are either exchangers or exchanges. There are already many hundreds of those and others on the market, but it’s still not clear how one differs from the other.

In fact, for example, you can exchange bitcoins for Qiwi both in the exchanger and on the exchange (sometimes even at the same rate). Yes, and the reverse operation will also be available both there and there. What is the difference? Why do we need exchanges if there are a lot of exchangers? Moreover, there are:

What is the point of stock exchanges? In short, then a profitable exchange is an exchange, and an operational exchange is an exchanger. If you want to save money and you have time to figure it out, as well as the opportunity to wait until a profitable offer arrives, an exchange is better for you. There is no time - look for the best exchanger at the rate (and).

Now to the point. The exchange simply provides a platform for transactions in many areas of exchange (for which ones it depends on the exchange you have chosen). The exchanges themselves take place between the participants of the exchange, and the exchange itself is needed in order to bring people together and give a guarantee that the transaction will be fair. On this, in fact, the exchange earns, taking a fraction of a percent of all transactions conducted through it.

You, as an exchange participant, you will be free to either accept one of the existing applications (orders) in the direction of exchange you need, or create your own application (on the conditions you need) and wait until someone wants to make a deal with you on it. The first option allows you to make a deal quickly, but the second option, instead of wasting time waiting, gives you a chance to exchange at a more favorable rate for you. That's all, and the rest is the details, which may vary on different exchanges.

How is the exchange going? Here you already interact directly with the service itself (and not with other people, as on the exchange). The exchange rate is set rigidly and within the framework of one exchanger it will be possible to change it for the better for you only by persuading the administration to meet you halfway. Although, you are free to simply choose another exchanger with a more favorable rate for you, but just do not forget to check it through the monitoring services mentioned just above (I repeat - and).

The owners of exchangers earn on the commission that is withheld from you during the operation, and your benefit often depends on its size. Usually, bitcoin buying rate in exchangers quite attractive, but the rates for its sale or the rates of other cryptocurrencies may no longer be as optimal as on best exchanges below.

So draw conclusions from your own experience. It is also worth considering that in some exchangers there is a cumulative discount "for volumes", for example, in these:

In addition, sometimes the dynamics of the natural change in the exchange rate of bitcoin, litecoin, ethereum and other cryptocurrencies is so rapid that while waiting on the exchange at the best rate, you can miss the moment when you could buy the same amount of crypto in any exchanger, but much cheaper.

This property of the cryptocurrency is high volatility, that is, the instability of the exchange rate, which should also be taken into account. But this is what attracts people here, because where else can you get 5000% income in a year? However, the high riskiness of investments is also an integral feature of making money on bitcoins (and others like them), because, in fact, it all looks like a long-term one, i.e. a bubble that will burst someday (and at least if it just deflates a little).

It is also worth emphasizing that money can be entered into the exchange in advance (by the agreed methods, which, by the way, can become a decisive factor when choosing an exchange for work). Therefore, exchanges here can be carried out instantly (until the course has jumped). Many exchangers cannot provide instantaneous. It turns out that on most exchanges you have a kind of virtual wallet (such as Poison or Qiwi), which adds efficiency to the work, which is especially important for successful speculation.

With regard to reliability. Exchanges are inherently a more serious service, which, in theory, should be more reliable than an exchanger (they act in different weight categories). In principle, this is so, but even top exchanges sometimes they close anyway (like, for example, BTC-e, Bter and BTCChina). Yes, and there are also enough projects aimed at deception, although there are not as many of them as among exchangers.

Below I will list 10 cryptocurrency exchanges which, in my opinion, are the best for residents of Runet to work in them. The exchange is still a very thin and sensitive tool, so it is better to work in it with the support of your native language so that there are no problems with communications.

There are also a number of other nuances that I took into account. For example, the popular Poloniex exchange imposed sanctions on Russians and blocked the withdrawal of money for them. Do you need it? I don’t, so we don’t pay attention to it in this review (we have it under retaliatory sanctions). There is also a problem with Chinese exchanges - some of them may close in the near future by decision of the authorities.

Again, the list of cryptocurrency exchanges below is not the ultimate truth and I will be glad to listen to your comments, making changes to this list (especially since over time this will still have to be done). Well, okay, less words - more action.

Exchange №1 - EXMO

For inexperienced users and those who only need to quickly exchange cryptocurrency, there is a mode "Exchange"(from the top menu), where, in fact, the simplest exchanger is implemented (although the funds are taken from your account on this exchange), which I have already discussed in detail in the article of the same name on this blog. A favorable exchange rate in EXMO is up to you (you can compare with some other popular exchangers).

Before starting work, I strongly advise you to familiarize yourself with the materials FAQ. Well, you can also watch the video above to make a “quick start”.

No. 2 - LocalBitcoins cryptocurrency exchange

LocalBitcoins- another exchange localized for a Russian-speaking user. If Russian is not turned on by default, then this can be done by scrolling the page to the end and finding the desired item in the menu at the bottom right. Well, figure it out.

The principle of its operation differs significantly from that discussed above. Here, money, in fact, is not entered or withdrawn into the exchange, but a direct exchange with a counterparty (the same user as you) is carried out. And it's all done by hand. You choose the application that suits you, carefully read the proposed terms of the transaction, make the payment using the specified details and wait for the counterparty to pay back.

Why then use this exchange if everything takes so long? Well, its advantage follows from the name Localbitcoins, which means exchanging bitcoins for that currency or electronic money that is used in your country and that is more convenient for you personally. Want to get Qiwi in exchange for your BTC? No problem. You can also get Poisons, and, conversely, exchange your Yandex money for bitcoins. For each such local direction, you will find many offers.

You will only have to choose the most profitable and reliable. The latter can be assessed by the number of transactions made by the counterparty (the first number in brackets after the nickname) and the percentage of successfully completed transactions (the second figure is ideally 100%).

This bitcoin exchange, in fact, implements the p2p principle, i.e. direct exchange between people (traders).

The exchange acts as a guarantor of the transaction (for this, 1% of the transaction amount is taken from the person who created the ad), i.e. provides protection against fraud. This is done by depositing bitcoins in the seller's account, creating a guarantee for the buyer in case the seller is dishonest. Once the buyer pays for the bitcoins, the funds will go to him, even if the seller runs away.

Indeed, the so-called "local deals" in LocalBitcoins guarantees no longer apply (this is when you physically meet with the seller or buyer who lives with you in the same city and pay in cash).

BitMEX - #3 Cryptocurrency Exchange

BitMEX is a Hong Kong officially registered cryptocurrency exchange designed for an active game (earnings on speculation, or rather, the exchange rate of bitcoin and a dozen other popular altcoins). Now this is perhaps the only tool on which you can earn money. both on the rise and fall of the cryptocurrency exchange rate.

Who knows what margin trading and leverage are (here, by the way, it has a ceiling of x100) - you definitely need to come here. There is support for the Russian language. And whoever doesn’t know, I advise you to watch this video (the essence and surroundings of the process are conveyed very intelligibly and “in a simple way”):

The exchange works with such popular cryptocurrencies as Bitcoin, Ethereum, Ethereum Classic, Zcash, Monero, Ripple, Augur, Litecoin, Factom and Dash. A very interesting product that has recently received Russian-language support.

I advise you to try BitMEX definitely on the tooth. Read and watch more details (there you will find a number of useful videos with life hacks) in the article provided by the link.

#4 Crypto Exchange - Binance

Binance– appeared only in 2017, but has already managed to gain high popularity among traders (it entered the top of the best on the go). Initially, it was created by professionals to meet the modern requirements of the market. It is located in Hong Kong and is subject to its laws.

It differs from its competitors primarily in the speed of work (quick a large number concurrent transactions). It also has a fairly low commission compared to competitors - 0.1%. And at the same time, high security standards are observed, without which it is now impossible to succeed in the cryptocurrency market.

You can also work with the exchange from your phone, which increases convenience and efficiency. There is support for the Russian language in the interface (possibly in technical support, but I have not yet had a chance to check this). In general, all this is not so surprising, because earlier the owners were developing software for such exchanges and now they decided to roll out their own product.

Here you can trade a very large number of coins, including BTC, ETH, LTC and BNB. The latter is its own tokens (something like a cryptocurrency for internal use issued by ) called BinanceCoins, which are circulated only on this exchange and are designed for the convenience of conducting transactions (if you pay a commission with them, you will receive a decent discount - pay 0.05% instead of 0.1%).

Binance stimulates trading not only with a user-friendly interface, but also with constant contests with the distribution of coins to active exchange participants. Basically, such contests are held to intensify trading on new points. By the way, it is decided which new trading pair to add based on the results of voting by the participants, which is buzzing.

BitexBook

Significant advantage of the exchange BitexBook is its legitimacy. It should receive its official status in April 2018 after registration at the High Technology Park in Belarus. Since BitexBook is still very young (created in February 2017), it only offers 2 cryptocurrencies at the moment: BTC and LTC. Exchange participants trade them in tandem with RUB and USD fiat money.

You can withdraw and replenish the balance in both fiat and cryptocurrency. Need only pass verification: at least indicate the surname, name and address of registration. In this case, it will be possible to work with Yandex.Money and WebMoney payment systems, Visa cards, MS. If you confirm the name and address with scans of documents, they will still allow you to withdraw money using WireTransfer. By the way, the exchange employees promise to process withdrawal requests within 1 hour. No need to wait 24 hours or more to receive money.

To deposit/withdraw cryptocoins, you can not report anything at all about yourself: an anonymous status will do. There are no limits for cryptocurrency deposits/withdrawals.

The commission for trading is only 0.1% for makers and 0.15% - 0.25% for takers.

Trading here is quite simple: the interface is fully Russified and intuitive. So even a beginner will understand the BitexBook exchange. To start trading, you need to create an order to buy or sell, specifying the value of the currency by market or by limit and selecting a currency pair. This is how the form for creating orders looks like:

You can also view the rate change chart for the selected pair (per minute, hour, day or month) and study the market depth.

To ensure security in Bitexbook, you can use several means:

- Create a list of "white" IP addresses;

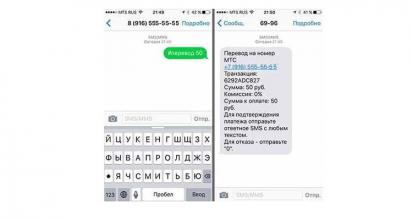

- Enable 2-factor authentication using the Google Authenticator app (the most secure way).

Set login confirmation by e-mail or sms using one-time codes;

Thus, at the start, the conditions for traders BitexBook very attractive, and the safety is on top (if you turn on the maximum protection yourself). Let's see how the exchange will show itself in the future.

2 more crypto exchanges worth getting to know better

- livecoin- another Russian-speaking user-friendly exchange (including Russian-speaking technical support and cash acceptance), which allows you to work with a huge number of currency pairs (more than 260 at the moment). What is nice, account verification is required only if you plan to replenish your account by bank transfers. But in all other cases, you can remain anonymous (someone may be important).

I/O options Money to the exchange account is not as much as in EXMO, but quite enough (, Capitalist, PerfectMoney, bank account and plus about a hundred more different cryptocurrencies). Remarkably, it is possible for residents of Russia and Ukraine to deposit money in cash through a courier.

Among the advantages, one can note the support that understands the Russian soul, already mentioned above, as well as the convenience of navigating the exchange (although all this is individual). There is also the possibility of using the so-called LIVECOIN CODE vouchers, which can be freely exchanged in many partner exchangers. Those. you can buy them in these exchangers, and then redeem them on this exchange to replenish your current account.

The transaction fee ranges from 0.18% to 0.02% depending on your trading volumes. All commissions and tariffs can be viewed at the link provided. Trading volumes on the stock exchange are very high and according to this indicator, it confidently enters the top five.

- KuCoin is a very young Hong Kong bitcoin exchange with an excellent interface, even slightly translated into Russian.

Now it is rapidly gaining momentum (the daily trading volume is already measured in hundreds of millions of dollars) and this is not surprising, because the development team here is very serious and authoritative.

You can trade on KuCoin ETH, LTC, NEO/GAS, OMG, QTUM, PAY, CVC, EOS, SNT, KNC, BTM, BHC and a number of other cryptocurrencies, the list of which is constantly updated. The transaction fee is minimal, but it can be halved further if paid with their own tokens (?) called Kucoin Shares (KCS). Deposit/withdrawal is very fast. Order execution is instant.

Holders of NEO crypto money will be pleased to know that GAS tokens are awarded in KuCoin for holding them at the end of the month. In general, the impressions of this exchange are very positive and its success is quite natural. I also want to draw your attention to the fact that their Kucoin Shares tokens (local currency) in themselves can be a good investment, because they grow in price by leaps and bounds.

Good luck to you! See you soon on the blog pages site

You may be interested

BITEXBOOK - the first legal cryptocurrency exchange BitFlip - an overview of the cryptocurrency exchange or how to invest in bitcoins through BitFlip Altcoin (altcoin) - what is it, the top most popular cryptocurrencies and what altcoins are worth investing in now BitMex - an exchange for earning on changes in the rate of cryptocurrencies (falling and rising) with a profitability ratio (leverage) up to x100 LocalBitcoins - a profitable exchange of bitcoins from hand to hand through the official website of the Local Bitcoin exchange CoinMarketCap - the official website of the CoinMarketCap cryptocurrency rating (Cryptocurrency Market Capitalizations) Tokens - what is it in cryptocurrency and other areas CoinPot - a convenient wallet for collecting cryptocurrencies from faucets, withdrawal without commission and the possibility of earning on mining  12 best bitcoin exchangers - where is it more profitable to exchange cryptocurrency for Qiwi and other electronic money?

12 best bitcoin exchangers - where is it more profitable to exchange cryptocurrency for Qiwi and other electronic money?

It is needed mainly in order to replenish an account and withdraw money through a card and many other, most reliable services and payment systems. But you can easily replenish your account without verification, and without problems and quite quickly.

Registration on the exchangeThe specifics of the replenishment process

There are a number of funding platforms available that allow you to fund your Exmo account without identity verification. Among them are:

- OKPAY;

- Money Polo;

- qiwi;

- Yandex money;

- Cryptocurrencies.

It goes without saying that with the help of bitcoin or ethereum, or any other crypto, you can very quickly transfer the necessary amount to the balance in dollar, ruble, hryvnia equivalent, or in euros or in Polish zlotys.

But we will consider the method of replenishment just with the help of a single European fiat currency, using the electronic payment system Payeer for this.

How to fund your account throughpayeer

This platform is very popular among private Internet investors who earn money both on HYIPs and on investments in various projects on the Internet, in cryptocurrencies and trading on online exchanges.

To top up euros using Payeer without account verification, click on the "Wallet" button and go to the selection of the specified currency.

Then you need to click on "Top up" and you can proceed directly to the process of transferring funds to your account.

Select the Payeer payment system from the list.

And then enter the minimum amount for replenishment in a special field.

As you can see, the minimum for replenishing an account in euros through Payeer will be 10 conventional units. Maximum for one transaction you can throw off 5 thousand euros. The commission is very small and amounts to only 2%, which makes this method the most accessible and profitable.

Then there is a transfer to the system website, where you need to select a currency for replenishment, and then go to your Payeer personal account and confirm the action. The money will be immediately debited from the account and very soon (mostly instantly) will go to your balance on the exchange.

This is how you can very quickly and without verifying your identity, replenish your account on Exmo, and then also withdraw money from this site.

09.12.2017

62 128

In the context of decentralization, cryptocurrency exchanges have become those resources where a significant amount of cryptocurrency funds in circulation is concentrated and where there is an active interaction between the participants of the system. In this article, we will understand what they are and how they differ from the user's point of view.

What are cryptocurrency exchanges and how do they work?

In functional terms, cryptocurrency exchanges are virtual resources where you can exchange one crypto-coin for another.

Many support the exchange of cryptocurrency for fiat money and vice versa, however,You can exchange anything on any exchange.

Exchange of one cryptocurrency for another is possible, if there is a corresponding pair on the exchange. For example, the presence of a BTC / LTC pair means that on this exchange you can exchange Bitcoin for . The absence of a pair will mean that it is impossible to do this here. Same with fiat money.

The principle of operation of cryptocurrency exchanges is quite simple and includes several stages:

- Registration. In most cases, this procedure is not fundamentally different from registration on other sites.

- Entering money for trading or exchange. Depositing crypto coins is usually free, while depositing fiat funds will often have to be paid (although not always). The exchange commission sometimes reaches 8%, but more often it is in the range of 1-5%. The size of the commission strongly depends on the chosen method of depositing funds: exchanges are usually not inclined to pay commissions of payment systems, therefore they include them in their commission, which increases the total commission amount to one degree or another.

- Creating an application (order) for the purchase and sale of currency. The user himself sets the desired price, for which he is ready to buy or sell the desired currency, and starts trading by placing his application in the general list.

If there is a person who is ready to make a deal at a specified price, it is concluded. If the price is not adequate to the market, the buyer may not be found. It may also not be immediately found if the user sells / buys an extremely unpopular currency.

Upon successful completion of the transaction, the user can withdraw funds from the exchange or leave them in the exchange wallet to perform other transactions.

Occasionally, cryptocurrency exchanges and individual accounts are hacked, so it is not recommended to store large amounts on exchanges and, in principle, money that is not required for trading. Sometimes the owners of the exchange themselves can suddenly freeze the account and / or “borrow” the user’s funds without a return, so you should choose an exchange for work very carefully, not succumbing to the temptation to use a little-known exchange for the sake of momentary benefits in the form of no commission or something like that.

As a matter of fact, Cryptocurrency exchanges earn mainly on commissions, the cumulative volumes of which can reach very significant figures as the user base increases and, in particular, attracts users with large capitals.

Why do we need cryptocurrency exchanges?

On cryptocurrency exchanges, you can meet traders, miners, investors, and just people who need to exchange money. All of them use exchanges either for the purpose of earning or for the purpose of exchanging funds.

Cryptocurrency exchanges can be used in the same way as stock exchanges, and traders earn on them in the same way.At this stage, they are significantly more profitable than their more traditional counterparts, since cryptocurrencies have a high value. Of course, if a trader in the traditional market earns good money on stock fluctuations that grow by, for example, 9% per year (and this is still a good indicator), then in the crypto market, where currencies can soar by 20% in a day, he will receive noticeable profit. Of course, if he has the necessary skills and experience.

Some traders play within not one, but several exchanges. So they earn not only on fluctuations in the exchange rate relative to others, but also on the difference in the exchange rate of the same currency on different exchanges. However, in the traditional market, traders do the same, so here, in general, there is nothing fundamentally new.

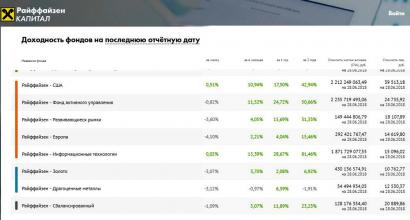

Investors behave on the stock exchanges rather passively. From time to time they buy foreign currency in relatively large quantities and put it in their portfolio. Sometimes they watch rate fluctuations: some crypto exchanges have convenient charts that allow you to track fluctuations in as much detail as possible, and investors use them to determine the most profitable investment.

Miners corny change less popular to more popular.

The logic is simple: it is often more economical to mine a less popular cryptocurrency now, but it is more reliable to build up savings in Bitcoin or. Not to mention the fact that if a miner wants to use the mined funds for their intended purpose, that is, for example, to pay in a store, then, for example, he has nothing to do - he needs dollars (yuan, euros, rubles) or at least Bitcoin. And in this case, he goes to the exchange in order to exchange the mined ZCash for another, more popular currency.

Occasionally, people appear on the exchanges who want to do the same, but with not mined currency, but obtained as a result, for example, of a trading operation. They use the exchange just as an exchange.

How are cryptocurrency exchanges different?

In general, exchanges work on the same principle, but they often differ in functionality and capabilities, trying to attract as many users as possible with their features.

The most important differences from the user's point of view are as follows.

- The choice of cryptocurrencies. On some exchanges, only the most popular currencies are traded, on others - tens and hundreds of pairs.

- Cryptocurrency withdrawal. Somewhere you can withdraw only Bitcoin, Litecoin and a couple of well-known currencies, and somewhere - dozens of types of cryptocoins and five more varieties of fiat.

- Ability to deposit and withdraw fiat money. Some exchanges work only with cryptocurrencies and do not offer such a possibility.

- Commission. Mainly charged for the conclusion of the transaction. Some exchanges take interest only from the buyer (from the taker), some - from both the buyer and the seller, i.e. the user who created the order (maker), however, other commissions may well be charged.

- User data. Some exchanges are limited to a standard email request, while others require you to go through a verification procedure, which may require scanned copies of your passport and / or other documents.

- Account protection. Somewhere a password is enough to enter, but somewhere you need to go through a complicated login procedure with confirmation of various data.

- Methods of depositing and withdrawing funds. On some exchanges, money can only be withdrawn through a couple of payment systems, while others allow the possibility of a bank transfer or crediting from/to a card.

- Daily trading volumes. Somewhere they exceed $2 billion, somewhere they do not even reach $10,000.

Some crypto exchanges offer additional features and bonuses. Among them:

- the possibility of margin trading, margin financing;

- detailed charts with Fibonacci levels and other trading tools;

- accrual of interest on deposits;

- referral programs;

- availability of mobile applications, etc.

Finally, there are such important parameters for each user as language(usually English; sometimes supported by others, including Russian) and efficiency of the support service(technical support itself is available almost everywhere, but not everywhere it works as expected).

Popular cryptocurrency exchanges: overview of opportunities

There are a lot of exchanges on the ear now, the media praise one or the other, and the user is lost: which one is ideal? Ideal, as elsewhere, no. The only question is whether the advantages outweigh the disadvantages.

Bitfinex- one of the largest in terms of trading volume today (about $ 2.6 billion per day), supports 65 pairs for exchange and the ability to withdraw in 26 currencies. One of the largest that support the Russian language. To withdraw dollars, user verification is required, for other operations, email is enough. In August 2016, it was hacked, but managed to recover thanks to the functionality, good technical support and good tools for traders.

Bittrex- one of the largest crypto exchanges in terms of the number of pairs (276 as of December 2017). The number of users is growing, and with them the daily trading volume, which has already exceeded $1 billion. To withdraw funds, you will need to verify your account. The few negative reviews are also related to withdrawal difficulties.

GDax has risen noticeably recently: as of December 2017, it is in 5th place in terms of trading volume (around $ 2 billion), negative reviews are one. Minus: only 9 pairs and 3 withdrawal currencies - Bitcoin, Litecoin and Ethereum.

Another good English exchange for those who need to exchange popular currencies is BitStamp. Daily volume - approximately $340 million, supports Bitcoin, Litecoin, Ethereum and Ripple. There are very few negative reviews.

Kraken- an interesting exchange, supports 47 pairs and withdrawals in 17 currencies, there is the possibility of margin trading, mobile app. It differs by a decrease in the commission in proportion to the growth of the user's turnover. The trading volume is $240 million. There are occasional delays.

Among users of the CIS, it has proven itself well EXMO. The daily volume is about $75 million, it supports 45 pairs and withdrawals in 13 currencies, including the ruble, hryvnia and even the Polish zloty, dollars and euros. There are few negative reviews, most of them come down to delays in the input-output of funds.

Another well-known in the Russian-speaking segment is Cex.io. Supports 22 currency pairs, output in 8 currencies. The trading volume is about $50 million per day. There are no commissions for depositing funds through a bank transfer (there is an account replenishment from a card). There is a referral program that involves 30% of the commissions of exchange transactions. Users occasionally complain about verification delays and even account blocking.

Poloniex Until recently, it was very popular, which was explained by the presence of 99 pairs for trading, the ability to withdraw 68 currencies, a good level of account protection, and a clear interface. Allowed to create pending orders, offered the possibility of margin trading and funding. But technical support responded slowly, there were failures. Since the beginning of autumn 2017, there have been many complaints about the freezing of accounts for unexplained reasons. Now the volume of trading on Poloniex has decreased.

Many talk about the stock market Yobit- leader in the number of couples (3925). Only the exchange does not become a leader in terms of trading volume due to negative reviews. There are many reports of account freezing, account blocking and other phenomena that prevented users from using their funds. Technical support occasionally responds and solves problems, but, as users note, the cases are rare.

A similar situation with livecoin, which is also well-known, not least thanks to the support of 364 pairs and the ability to withdraw 177 currencies. Alas, most of the reviews are complaints about the impossibility of withdrawing funds, blocking accounts and other problems that technical support does not solve.

How to choose a cryptocurrency exchange?

Choosing an exchange is the most reasonable, taking into account the fact that what will it be used for.

For example, investor It makes sense to focus on indicators such as:

- the amount of commission for input-output of funds;

- restrictions on the amount of withdrawal (if the maximum is less than the one you need to withdraw, you can lose on the commission);

- reliability, i.e. at least the absence of feedback that someone could not withdraw their $20 thousand;

- availability of required pairs;

- verification complexity.

But the protection of the account should not bother him too much: he will not keep money on the exchange.

Trader are, in turn, important:

- trading tools and detailed charts;

- a large number of couples;

- good protection, because he will always have part of the funds on the exchange.

And an ordinary user who just needs to exchange funds should pay attention to the following aspects:

- availability of the required pair;

- input and output speed;

- lack of feedback on the delay and impossibility of withdrawal;

- the possibility of withdrawal without a lengthy verification process with the provision of all kinds of documents.

Miner, unlike him, may well be verified, since he will perform the same operation regularly, but he should also pay attention to so as not to choose a new exchange later.

As practice shows, on exchanges that offer a very large number of pairs and withdrawal options, delays and failures occur. This is partly due to the large number of people who want to withdraw or exchange an unpopular currency, but sometimes this can be a "bait" that scammers use to catch victims.

We must not forget about general rules: look at the real facts (trading volume, trading volume fluctuations, reviews) and don't fall for big promises exchange owners.

Modern exchanges for working with allow you to exchange your coins for other currencies, as well as exchange with fiat money. And if ordinary exchangers work with huge percentages when converting to fiat and vice versa, then attractive conditions can be found on exchanges.

Representatives of the TOP-10 were selected according to a variety of criteria, such as commissions, turnover, the number of currencies and currency pairs, freedom of use, and other indicators.

1. Binance

Having appeared in 2017, Binance almost immediately found itself in the first positions. The headquarters is located in Hong Kong, which gives a certain confidence in the future. The creators of the site themselves - experienced investors and cryptocurrency miners, so the service took into account many user-friendly nuances.

The main advantages are:

- ease of use, availability of a Russian-language version;

- commission from transactions within the site is minimal - 0.1%;

- input can be carried out without any commissions;

- there is no need to pass verification, but it is desirable;

- 87 instruments for exchange are available, the list is expanding;

- there is a mobile app.

Ease of use and simplicity have become important additions to the low fees. There are no special problems in the reviews, we can talk about the highest reliability of this service, which is why it has gained a foothold in the TOP and has become a leader in such a short time.

2. EXMO

One of the leaders in the Russian-speaking market, the EXMO exchange fell in love with investors from the CIS countries. The user-friendly interface turned out to be an important advantage among most others. Also pleased with the presence of all popular and popular currencies in the asset of the service.

It is worth paying attention to such advantages of the site:

- only 0.2% commission from each transaction carried out within the system;

- the possibility of exchanging for fiat money and buying cryptocurrencies for rubles, dollars, euros;

- withdrawal of funds as quickly as possible - from 5 to 20 minutes;

- instant execution of operations, a few seconds for processing;

- high rating among users in Russia.

User reviews confirm that there are practically no failures and problems in EXMO, so the tool is in demand among beginners. But even experienced investors will find the best option for using the service's capabilities. The Russian version is the main one.

3. Bit Flip

The project was created in 2017, but already occupies high positions in all modern ratings. The Russian-language version remains the main one, the creators of the project are Russians. Considering the extensive experience of developers in the field of cryptocurrencies, the platform is quite convenient and has the necessary functionality. This makes it possible for every investor and owner of coins to receive the necessary services without any problems.

The important features of how BitFlip works are as follows:

- technical support is Russian, responds well and politely helps to solve all issues;

- there is a row Russian systems payments, such as , ;

- withdrawal and deposit of fiat money under a small commission - from 1.9%;

- minimum thresholds for the withdrawal of cryptocurrencies (for example, for Ethereum it is only 0.0001 ETH);

- very clear and simple interface, no additional knowledge is needed to use.

BitFlip does not intend to compete with the mastodons of the market, but the project has attracted its share of investors. Focuses on small investors and beginners. True, the commissions are quite high.

4. YoBit

The YoBit project also has a convenient Russian-language version without significant difficulties in use. The project supports work with an incredible number of instruments - more than 1000 pairs for trading and receiving speculative income. There are even those currencies that are not represented on any other exchange.

There are a number of important benefits to keep in mind:

- commission on YoBit is 0.2%, and this is quite an adequate option;

- high level of protection of verified accounts, there is no risk that you will be robbed;

- permanent lotteries, promotions and prizes for active users;

- convenient work for both holders and traders;

- fast execution of orders, a few seconds for any pairs.

There is live chat in the chat, where most of the participants are Russian-speaking. But YoBit has a number of disadvantages. For example, this project is not suitable for complete beginners who do not know anything about cryptocurrencies. In this case, you should choose a simpler tool.

5. Bittrex

Another well-known exchange operating since 2015. Reviews speak of a fairly high reliability and protection, not a single case of theft of cryptocurrencies from verified accounts has been recorded. Please note that in order to withdraw funds from Bittrex, you will need to go through verification. Many users are faced with the fact that the input is free, and in order to receive their funds back, the site required passport data.

The important factors of Bittrex operation are as follows:

- a fairly large variety of trading instruments;

- high-speed execution of orders, there are practically no hitches;

- commissions differ for each currency, in most cases they are low;

- security for verified users, but low security for others;

- high reliability and stability.

The problem for many residents of the CIS may be the lack of a Russian version. The site is only available in English. It is possible that because of this factor in Russia, Bittrex did not receive significant growth.

6. HitBTC

Created in 2013 in Britain, it is known for its high security against attacks and hacks. For all the time of work there were no problems and troubles with the work of the service. This exchange is used by lovers of bots for trading, as there are optimal conditions for such trading.

Among the important advantages of HitBTC are the following features:

- only major currency pairs, but excellent implementation of working with them;

- 0.1% commission for transactions within the system, which is quite adequate;

- the simplest interface, convenient use of all system functions;

- convenient analytics, constant news and tips for convenient trading;

- one of the few services with a demo trading mode for beginners.

If you want to get started with cryptocurrencies, it's time to look at HitBTC. Convenient use and low commission will be big advantages for you. Account security and good support will also make it easier to use the service.

7. Kraken

To date, the audience of Kraken has decreased somewhat, and the exchange has left the TOP-5 of the main ratings. The reason for this is the emergence of more convenient and easy-to-use competitors. At its core, this tool is quite convenient, has many important advantages. But using them all is quite difficult, and this is confirmed by the reviews.

Here are the main features:

- to this day, the service has maintained a high turnover and good speed;

- commissions are flexible, can be exchanged for some pairs with 0% commission, on average 0.2%;

- availability of functionality for robots, well-thought-out automated trading;

- improvement, constant improvement, fast and accurate technical support;

- mobile application and other interesting features for the user.

If you are just starting your journey into the world of cryptocurrencies, it is worth starting with other options for exchanges. But for an experienced user, Kraken will become one of the most the best services. Low commission good conditions and high speed of order processing will help you trade professionally within 56 currency pairs.

8. Bitfinex

One of the leaders in terms of trading volume and capitalization among all existing services. There is a good Russian-language version, a well-thought-out and simple interface. There are a lot of currencies, the turnover and the number of users are constantly increasing. This means that this tool may soon become the market leader.

Among the important advantages are the following features:

- excellent security, according to the developers, there are no risks of hacking;

- convenient graphical tools for analytics and forecasting of exchange rates;

- availability of support, news for better market analytics;

- comfortable applications that make it easier to trade and stay in touch;

- margin trading, tools for professional traders.

The service is convenient for many investors, holders, traders and other participants in the cryptocurrency market. For simple tasks, Bitfinex is the best fit, but also for experienced traders there are a number of advantages here. Therefore, this exchange consistently occupies a high position in the ratings.

9. Livecoins

This tool is convenient for working with fiat money. There is a deposit and withdrawal of dollars and rubles, so the service is perfect for buying crypto. In the CIS market, the site occupies an important position, without much difficulty displacing smaller competitors. The resource is quite convenient and has the following advantages:

- a huge number of pairs for trading and making a profit;

- there is a Russian language, the interface is quite convenient, there are no problems with understanding;

- reliable data encryption, which is confirmed by experienced experts;

- Russian-speaking support service, adequate response time to requests.

Among all the instruments in the direction of the BTC-RUB exchange, this platform has been ranked first for more than one year. Small commissions with a floating rate depending on the time of day and a pair of currencies allow you to easily exchange fiat money for cryptocurrency and vice versa. It comes out much cheaper than in exchangers.

10.Poloniex

Another well-known exchange that has lost several positions in the rankings in the last year. Nevertheless, it remains popular and active in the Russian-speaking market of cryptographic services. The main clients of the service are miners. For small amounts, there are very convenient conditions for exchange, storage and withdrawal.

Among the advantages are the following features:

- more than 100 active instruments for investment and trading;

- floating commissions from 0 to 0.25%, most pairs have a commission of 0.2%;

- very high level of security provided by the American team;

- The exchange is one of the leaders in terms of financial turnover.

The functionality is rather narrow, but for target audience he is the most attractive. Miners get the best opportunities to exchange their assets here. Of course, for large investors, Poloniex has faded into the background behind the market leaders, but in Russia the project remains in the top ten services.

|

Interface languages |

Transaction fee |

Trade tools |

Deposit/withdrawal of funds |

|

|

English, Russian, Chinese, Japanese, Korean, Spanish, German, French |

295 currencies, 121 active instruments |

only direct transfers to your cryptocurrency wallets |

||

|

Russian, Ukrainian, Polish, Chinese, main European languages |

BTC, USD, UAH, RUB, PLN, as well as major cryptocurrencies |

Payeer, AdvCash, MoneyPolo, Visa/MasterCard; input also via QIWI, OkPay |

||

|

Russian English |

major cryptocurrencies, as well as USD, RUB, EUR, UAH |

Interkassa, AdvCash, Payoneer, perfect money, QIWI, WebMoney, Payeer, Capitalist |

||

|

all known cryptocurrencies |

QIWI, Payeer, Capitalist, Perfect Money; withdrawal also to Visa, WebMoney, Yandex Money, mobile number |

|||

|

English |

272 trading pairs |

replenishment and withdrawal of BTC by direct transfers to your wallets |

||

|

English, Japanese, Korean, Chinese |

over 20 active trading pairs |

replenishment of USD or cryptocurrency by direct transfers, withdrawal of cryptocurrency to your wallets |

||

|

English, Japanese |

57 trading pairs |

USD, EUR bank transfers and deposits from cryptocurrency wallets |

||

|

Russian, English, Chinese |

56 pairs to trade |

bank transfers, input is also possible in AdvCash |

||

|

English, Spanish, Russian, Portuguese, Indonesian, Turkish, Italian, French |

9 pairs, including crypto with fiat |

Payeer, Perfect Money, QIWI, AdvCash, Capitalist, Visa/MasterCard and cryptocurrency wallets |

||

|

English |

over 90 trading pairs |

only direct transfers from cryptocurrency wallets |

Exchanges without verification

- BTC-E

- Poloniex

- livecoin

- YoBit

- HitBTC

- Cryptopia

Please note that verification on any exchange increases the security of the owner of the coins and allows you to expand the current withdrawal minimums in almost all cases.

Russian

- C-CEX

- Usercryptos

- Vircurex

Chinese

- BTC China

- OKCoin

- Huobi

- BitFinex

Ukrainian

- E-BTC

- BTC Trade

- OBI.CO

- UA-BIT

- BTCZoo

Belarusian

- Exrate

- Bitexbook

American

- Kraken

- Poloniex

- Bittrex

- Coinbase

Korean

- Bithumb

- CoinNest

- CoinOne

- YoBit

FAQ

We will answer the most common features of the exchanges so that you can make the right choice.

Is it possible to store cryptocurrencies on exchanges?

This is a popular question from new users to the support services of various sites. Most exchanges have implemented their own wallets, which store all the users' cryptocurrency reserves. Only a few allow users to exchange bitcoins and other coins without the intermediary of the exchange itself, but this is very insecure.

Therefore, the answer in this case is yes. Most popular exchanges allow you to store cryptocurrency on their facilities. But this is not the best and safest way to store large amounts. Store on them only the amount of coins that you are going to trade in the near future.

How to choose a good exchange?

The question of choice should be based on criteria that are important to you. For some, it will be security, for others, the cost of operations. It is best to choose an exchange based on a set of factors, which include such important criteria:

- the average commission and the history of its changes, the frequency of increase;

- the minimum amount of withdrawal and input of currencies in order to get the necessary flexibility;

- transaction processing time (better to look at user reviews);

- security, encryption, changeable addresses for each operation;

- positive feedback, a large turnover of funds every day.

If you are going to enter large amounts, pay special attention to the commission. Every tenth of a percent will be enough important indicator for you. Also pay attention to the possibilities of trading with the help of robots and other subtleties that are important for you individually.

How much can you earn on a crypto exchange?

This is a purely individual matter, and the amount of income depends on your trading skills. It is also important to consider the movement of the market. In one case, the user does not fully study the information on the analytics and buys coins at the time of their price decline. In this case, you will not be able to earn anything. If you study information from leading analytics agencies, look at the history of the movement of currency pairs, and also conduct technical analysis, you can earn an impressive percentage.

The history of recent years knows cases when investors earned millions of dollars by investing only a few thousand USD of their own funds. But for this it is important not to be afraid to take risks and be able to correctly interpret the data indicated in the analytical reports. Moreover, the crypto market can completely change in a few minutes after the release of one important news. So to make money, you should keep your finger on the pulse of events constantly.

How can I withdraw money?

Withdrawal of funds from each exchange has a number of features. For the above TOP-10 sites, we conducted a study and indicated ways to withdraw money. Many exchanges do not work with fiat money, so to withdraw funds, you will first have to withdraw cryptocurrency to personal wallets, and then exchange your coins for fiat money using exchangers or other services.

Also, the withdrawal is possible directly from sites that support the sale of coins for USD, RUB or EUR. There are a lot of such sites on the Russian-speaking Internet, some of them were in the TOP-10 of the most popular and high-quality exchanges and were presented higher in the ranking. The exchange of coins for fiat money is quite simple, for this you need to create your own application or accept an already placed order from another site user.

How can I find out on which exchange a certain cryptocurrency is traded?

The easiest way is to use the most popular and well-known exchanges, which give access to almost all known coins. For example, YoBit provides access to those tools that are not available on any other service. That is why this tool remains popular even after two stories of hacking and theft of accounts without verification.

You can find out where a specific rare currency is traded from its developers. This information is most often presented on the official website. If it is difficult to find it, ask a question in the search engine. Most likely, this issue has been discussed several times in specialized forums, and you can easily find the answer.

How to transfer cryptocurrency from exchange to exchange?

To some extent, all projects on the market are competitors. Especially if they work with the same cryptocurrency. Therefore, there is practically no direct translation anywhere. Most often, you will have to get a separate wallet or service for storing currency. You will then be able to withdraw funds from the exchange you used and then transfer your bitcoins or altcoins to another service.

It is best to use personal wallets for long-term storage. Hot storage on various online services is becoming more and more popular. Cold storage on hardware wallets is less flexible and only suitable for larger amounts. Remember that you will pay an additional fee for withdrawing funds from most exchanges.

Results

Until now, there are a number of users who are convinced of the dangers of cryptocurrency services for exchanging and trading coins. Therefore, they use traditional exchangers and pay a commission of 5-6% for each operation. This does not suit traders and those investors who earn on small transactions of exchange and sale of coins. You should not be afraid of exchanges, but it is important to follow certain rules of conduct with these sites.

In particular, it is best not to store all your savings on one exchange. Store in the services only the amount of coins that you use for trading. It is better to withdraw all funds for long-term investments to wallets and more reliable services. Exchanges are constantly being attacked and hacked, so it is better to verify your accounts, even if it is not an easy process. Otherwise, you will not have any significant risks and problems.

Bittrex customers have been complaining on social media that they are having trouble withdrawing funds, and this has been going on for weeks. Of course, every major platform periodically faces difficulties, but the exchange has not yet made any official statements on this matter.

The venue's Twitter hasn't been updated since November 30, and the Facebook page hasn't been updated since the summer. Not surprisingly, users began to worry. The main reason for the problem with the withdrawal of funds is the requirement for the support of the exchange to verify the identity. Most cryptocurrency exchanges require verification only for transactions with fiat currencies, so this development has confused many.

“This is a very serious problem. When you sign up for Bittrex, the exchange allows you to deposit funds into your wallet and even trade without verification. But then it is impossible to withdraw funds.

The exchange has been in existence since 2014 and is based in Las Vegas, with daily trading volumes hovering around $1 billion. Although Bittrex is not accredited by the Association of Private Enterprises in the United States and Canada to support consumer rights, the association's website has a separate page dedicated to handling complaints from the exchange's customers.

Users actively complain about problems with withdrawing funds from the exchange, noting that upon reaching a certain limit, the platform does not allow withdrawing money until verification is completed. Dissatisfied customers created a hashtag