A man pays with a card. Why paying by card is more profitable and safer than cash. Cards are stronger and more durable than paper money

Non-cash expenses have long been firmly established in our lives. But some people still prefer to withdraw their entire salary in the old fashioned way and pay in cash in stores. But paying cashless with a card is profitable. And here are 7 reasons why.

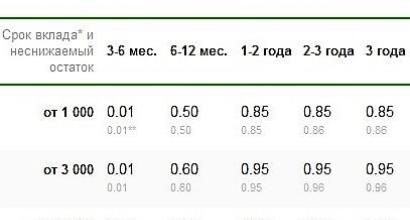

You will receive interest on the balance

Many large banks encourage their customers to keep as much money as possible on their cards by charging interest on the balance. For example, Tinkoff charges 6% per annum on the Tinkoff Black card, Otkritie – 5% on the Smartcard, and VTB – up to 8.5% on the Multicard. Even on the Halva installment card, you can earn money if you deposit funds in excess of the limit into your account - Home Credit Bank will charge up to 7.5% on them, depending on the amount.

Conveniently, banks charge interest daily. The client does not need to expect to maintain a minimum balance, as on a deposit - it is enough to continue to use the money as before. You can easily spend or replenish them. All calculations are performed automatically.

Flexibility in the use of funds and the advantages of a savings account make income cards an extremely popular tool.

Part of the funds will be returned in the form of cashback

To encourage customers to use their cards more often, banks offer refunds. Most often this is 1-2% of expenses and up to 40% for partners. If you choose the right one debit card with categories with increased cashback, you can save a significant portion of your money. And this is another argument why it is always better to pay with a card.

Good cashback programs offer:

- Tinkoff – 1% of all purchases and 5% in categories selected by the user;

- VTB – from 1% to 2% on all purchases depending on the amount of expenses and up to 10% in the categories Auto and Restaurants;

- Ak Bars – 1% on everything, 5% on entertainment and 10% on transport fares;

- Alfa-Bank – 1% on all purchases if you spend more than 20 thousand rubles on the card;

- Opening – 1-1.5% on any expenses.

Often cards with income on the balance also combine a cashback option. That is, you can store money on such cards and spend it - in the end, the profit will be approximately the same.

The bonus system will be activated

If the bank does not return “real” money in the form of cashback, then most likely it has a bonus system. Sberbank has it, Rosselkhozbank has Urozhay, VTB has Collection. You can purchase one of the many Tinkoff co-brands to save on purchases in certain stores.

The number of bonuses awarded depends on the amount of expenses and the client’s status in the system. As a rule, you can get 0.5%-5% bonuses on your account.

You can spend them in different ways, the most common options are:

- payment for part of purchases from partners;

- payment for banking services (for example, SMS notifications or monthly card maintenance);

- receiving compensation (return of that very “real” money - in this case, the bonus program acts as an analogue of cashback).

Each bank has its own conditions. Check them out - it is quite possible that they will come in handy for you, and you will get additional profit from your everyday expenses.

You can fly for free

Miles are a type of bonus program. Depending on the expenses incurred, free miles will be credited to your account, which can be used to pay for air tickets, rail travel, and even book hotels and rent vehicles abroad.

The most profitable programs offer:

- Promsvyazbank - World map without borders;

- Alfa Bank – Alfa Travel;

- Opening – Travel.

As a rule, 1 mile is awarded for every 50-100 rubles spent.

Air travel is quite expensive, but using mileage cards can significantly reduce costs. For example, according to Tinkoff map It is enough to spend 600 thousand rubles on the card within a year to get a free ticket from Moscow to Sochi and back.

You will transfer money instantly

Online banking allows you to send money in the blink of an eye. If you are a client of Sberbank or Tinkoff Bank, then you don’t even need to know the card number of the receiving party - you can send money to a second person by phone number.

If you use traditional cash, then to transfer you will have to look for an ATM, enter card or account details, pay a commission, etc.

With a non-cash transfer, money is transferred instantly, in most cases there is no commission at all, and the limit is sufficient for the average person. It’s not every day that you transfer 100 thousand rubles to your mother or friend!

You will receive all the benefits of online banking

In general, use mobile application or online banking will save you a lot of time when dealing with the bank.

Having a sufficient amount on your card account, you can:

- pay any bills without queues and the need to look for an ATM or cash desk;

- top up your phone and Internet and TV provider account remotely;

- repay taxes, fines, loans, credit cards;

- open accounts and deposits.

If you wish, you can even open a brokerage account and purchase shares directly from your card online.

All this will save a lot of time and money - because you no longer need to pay commissions to the operator for the work. Internet banking will do everything for you.

And another plus is templates and automatic translations. You can set up automatic replenishment of your account for loan payments or create a template with your data management company to pay for housing and communal services literally with a couple of mouse clicks.

Cost control will be activated

If you want to know where the money is going, but you cannot or do not want to keep track of expenses, then non-cash payment will help you. At the end of the month, your bank generates a statement that shows your main expenses, both by category and by individual store. If you wish, you can clarify the amount of expenses by day or week to understand how money is spent over time.

An analysis of cost control for 2-3 months can help you understand where you are wasting money and where you cannot do without these expenses. This will be followed by adjustments to expenses and an increase in the amount of savings.

Also, if you wish, you can install an application for maintaining a family budget on your smartphone. It will analyze SMS from online banking and sort out all expenses and income. Perhaps the functionality of such an application will be more useful and convenient for you than the built-in “analyzer” in Internet banking.

Conclusion

As you can see, using non-cash card expenses is much more profitable than simply withdrawing money and spending cash. You will be able to multiply your savings, save on discounts and cashback, accumulate bonus miles or Thank You, and also get access to remote banking services. Another convenient feature of plastic is the ability to analyze your expenses to understand where you can save your money.

The debate about which is better - cash or a credit card - has been going on for a long time without a clear winner. There are compelling arguments for each option, and the answer depends on who you ask.

The website Go Banking Rates describes why some people prefer to use cash and others prefer credit cards.

Credit is still a fairly new concept in the history of finance, which is why many people prefer to use paper money rather than pay for purchases with credit cards.

Here are some compelling reasons to always pay in cash:

- Accepted everywhere. You won't hear "Sorry, we don't accept cash here." You can pay with money everywhere, except on the Internet. You can always make a purchase wherever you want. And here credit cards Not accepted everywhere.

- Visible consumption. Many people prefer to use cash simply because when you make a purchase, you can visually see how much you have left and how much you spent.

- No interest or fees. The great thing about buying with cash is that you pay the cost of the item and that's it. There are no interest payments or fees at the end of the term. Paying in cash makes shopping much easier and cheaper overall.

- Freedom from debts By using cash, you will not be able to owe creditors.

- Safely. You will never become a victim of hackers, and your data will not be stolen. You don't have to worry about the safety of your personal financial information when you spend cash.

Benefits of credit cards

The average American household has $7,817 in credit card debt, according to WalletHub's 2016 Credit Card Debt Study.

Here are some benefits of credit cards:

- Large purchases. Imagine that every time you need to make an expensive purchase, you have to save for several months or wait for your salary until you have saved enough money. This is tolerable when you decide to upgrade your TV. But what if your car needs a new transmission or the roof of your house is leaking? You can't afford to wait that long. With a credit card, you can make purchases and then spread the cost over a longer, more manageable period of time. Many credit cards offer extended warranties with purchases. This means that if you use your credit card to purchase an item with a warranty, the credit card will extend that warranty for up to 3 years.

- Track expenses. You can track and then analyze your money expenditure. In this case, monthly and annual map reports will help you. This cannot be done with cash unless you keep receipts.

- Credit rating. In modern society it is difficult to do without a credit rating. Higher credit rating can provide good interest rate when you take out a mortgage or take out a loan for a car or study. The only way to build a good credit rating is to use a credit card.

- Bonuses. A credit card is more than just a piece of plastic in your wallet that you can use to pay for a product or service. It offers amazing opportunities to save money on purchases and earn rewards such as travel, cash back, gift cards and other goodies.

- Safety. Yes, this argument has been made about the benefits of cash, but credit cards have their own benefits. The fact is that if you lose cash, then everything is... write "lost." If you lose your credit card, you need to call the bank and block it, and then get a new one. In this case, you will not lose a penny.

stdClass Object ( => 309 => money => post_tag => dengi)

stdClass Object ( => 11346 => credit card => post_tag => kreditnaya-karta)

stdClass Object ( => 13992 => Educational program => category => poleznaja-informatsija)

stdClass Object ( => 20271 => cash => post_tag => nalichnye)

Read also on ForumDaily:

The security of contributions is guaranteed by using the highly secure Stripe system.

Always yours, ForumDaily!

Processing . . .

Paying with a bank card is much more convenient than cash, and it takes up almost no space in your wallet - unlike a pile of change and a stack of bills. In addition, today non-cash payments are possible not only in stores, but also in public transport, and very soon it will even be possible to withdraw money from a personal account at store checkouts. But still, in some cases, experts recommend forgetting about convenience and paying with “cash”. We tell you in what situations paying by card can be unsafe.

The card does not belong to you You are paying abroad

You are shopping online

Are you an entrepreneur?

You pay for an order from a dubious establishment

The card does not belong to you. Under no circumstances should you pay with someone else's card - even if it belongs to your spouse, mother or son. Of course, if you do not want to sort things out with law enforcement officials. The fact is that if the cashier notices a discrepancy (for example, you are a man and you are paying for a purchase with a card registered in a woman’s name) and asks for a passport, according to the instructions, he must call the police to the store. And the security will not allow you to leave the retail outlet until the law enforcement officers who arrive at the scene find out who you are and where you got the other person’s card from.

You are paying abroad

In September 2018, a law came into force in Russia that allows banks to block customer cards if remittance will seem suspicious to the operator. And first of all, these include transactions for an amount that is atypical for the cardholder or transfers made in an uncharacteristic place for him, for example, in the territory of another country. And as you yourself understand, staying abroad without a bank card is not the best prospect. Advice: prepare for trips outside of Russia in advance: call the bank and notify them of your departure. In this case, it is better to play it safe once again than to find yourself without a livelihood in a foreign country.

You are shopping online

Paying for purchases in online stores, especially unverified ones, is very dangerous. Firstly, the site may turn out to be a phishing site - with the help of such scammers deceive the owners bank cards all the necessary data, and especially inventive ones even “fake” popular resources so that you can’t tell the difference. Secondly, if a card is “lit up” on the Internet at least once, it is possible that its details will fall into the hands of criminals, which means that the money stored on it can be stolen at any time. In order to protect yourself, banks advise using a separate card for online purchases, to which you will transfer only the amount that is needed for the purchase right now. Another option is to get a special virtual card.

Over the year, the share of Russians paying for purchases only with bank cards has grown by more than a third – from 11 to 15%, a MasterCard study showed. The share of those who are willing to pay only in cash also decreased sharply: from 54 to 38%.

59% of the Russian population actively use bank cards, paying for purchases with them once a week or more often (an increase of 13% per year). Among the main incentives for cardholders to pay more often without cash, cardholders list convenience, high payment speed, security and the opportunity to receive a discount or bonus, the study says. Most often, cards are used in super and hypermarkets, convenience stores and online stores, the survey showed.

The MasterCard survey included Russians aged 25 to 45 living in cities with a population of 250,000 or more. The sample consisted of 1021 people.

This trend is confirmed by Central Bank statistics. In 2015, the number of payments by individuals on cards increased by 27.8%, and turnover on them by 11.9% in volume, according to the annual report of the Central Bank. In the total number of transactions using payment cards, the share of non-cash payments in 2015 increased by 7.3 percentage points to 74.7%, in the total volume - by 6.1 percentage points to 39.5%. These figures include information about payments by legal entities, but the Central Bank clarifies that the bulk are payments for goods and services by individuals.

Banks also confirm the growing popularity of cashless payments. “People pay more with cards because financial literacy is increasing, the acquiring network, salary projects, and loyalty programs are developing. As a result, people get used to cards and stop being afraid of them,” says a representative of Home Credit.

An important factor is the development of infrastructure for accepting cards not only in large cities, but also in the outback, notes Nikita Ignatenko, head of development of card products of the B&N Bank group: “Cards today are already accepted by many small stores located in small towns. populated areas" The development of card infrastructure was also facilitated by legislative changes - the obligation of retail outlets to accept cards, he recalls.

The convenience of making payments leads to an increase in the frequency of purchases, agrees a representative of Sberbank. And a card with additional functions gives clients additional income or a bonus (savings cards, space card, cashback), adds Alexey Golenishchev, director of electronic business monitoring at Alfa Bank.

Considering that people’s salaries are not increasing, but prices are rising, bank clients are increasingly using limits on credit cards, Golenishchev points out, “it’s more profitable to pay by credit card non-cash, since the withdrawal fee credit funds At an ATM, any bank charges a commission.”

People aged 25–45, residents of large cities with above-average salaries, are the most active in paying with cards, says Ignatenko.

The share of customers using the card only for purchases has grown from 25 to 73% over the past five years, says Alexey Shchavelev, director of the cross-selling department at OTP Bank. He points to two main reasons for this growth: increased financial literacy population by gaining experience in using financial products and increasing the share of service and trading enterprises accepting plastic cards to pay for goods and services.

Today it has become so common to pay for purchases made in stores using bank cards that fewer and fewer people use wallets.

However, such convenience can sometimes backfire. Many examples from life show that it is not always worthwhile to rely too much on cards.

Let us describe a completely typical situation. The wife went shopping with her friends, taking her husband’s bank card with her. Is there any difference here with cash?

At first glance, there is not the slightest difference - except that the option with a card often looks even preferable for some women (since you can spend significantly more). However, in such cases, lawyers recommend taking cash from your spouse.

By presenting a bank card issued in your spouse’s name at the checkout, you are actually trying to pay with someone else’s card. At least that's how it might look from the seller's side.

Here it can be argued that, according to the provisions of the Family Code, all funds that spouses receive during marriage are their common property. Accordingly, they belong to both of them. The same applies to the money that is credited to bank cards.

This is true, but there are also features of the application of banking legislation, which states that debiting funds from a client’s account is possible only on the basis of his own order.

Without such an order, the write-off of funds is allowed only in certain strictly specified cases: in accordance with a court decision or order of a bailiff. However, the use of bank cards by a spouse is not provided for among such exceptions.

Therefore, refusals of retail outlets in such situations to accept other people’s cards for payment are completely legal. Here we can give a typical example from judicial practice (according to the decision of the Central District Court of Kemerovo in case No. 2-8448/2015).

Having gone to the supermarket to buy groceries, the citizen collected the necessary purchases and went to the checkout to pay. Having started to put the groceries into bags, he gave the cashier a bank card for payment.

The cashier refused to accept the card given to her, since it could not belong to this buyer - it contained female data, and the buyer was a man.

The citizen stated that the card was issued to his wife, who is disabled. Since his wife has difficulty walking, he buys groceries himself. The money on the card belongs to his wife, who gave him the card and gave him the PIN code to make payments in the store.

The cashier responded by refusing to accept the card for payment, citing the relevant instructions from management. The citizen, in turn, decided not to give in and refused to withdraw the required amount in cash from the nearest ATM.

The store security staff became involved in the conflict. As a result, the man was detained and the police were called. The arriving police drew up a report on the attempted theft of food from the store.

The citizen was taken to the nearest police station, and then he also had to appear before a magistrate. Fortunately, he was able to explain the true circumstances of the case, so the charge of petty theft was dropped and the case was dropped.

After this, the citizen, in turn, decided to go to court, accusing the store of causing moral damage due to the refusal to accept his wife’s card for payment. But the court did not support him, considering the cashier’s actions completely legal.

Although the law does not directly prohibit the use of spouse cards, the court indicated that a bank card is a personal payment document , the right to use which exists only with the owner of the bank account linked to it.

Banking rules also directly prohibit transfer of the PIN code by the cardholder to third parties, including relatives. If the fact of such a transfer is discovered, the bank has the right to decline responsibility for the fate of the funds in the account.

Consequently, the law does not provide for transactions using a card if it is presented not by the owner, but by another person.

Therefore, when visiting a store with your spouse’s card, you should prepare in advance for the possibility of ending this trip at the police station.