How to reduce the credit limit on a Sberbank card. Reducing the limit on a Sberbank card

The Sberbank credit card limit is the maximum available amount for the borrower, which he can use as needed, restore (in whole or in part) and withdraw again during the entire period of the agreement. In Sberbank, the limit directly depends on the card category.

Limits for Sberbank credit cards

It is not difficult to apply using the available means today. The main difficulty is determining the credit limit that can be used. It is important to make the calculation as accurately as possible so that ultimately the expenses on the credit card do not exceed the income that will need to be used to repay the debt to the bank.

For a number of Sberbank credit cards, the limit is set at 300,000 rubles for borrowers who apply on a general basis, and 600,000 rubles for clients to whom a personal offer is made.

These include: co-branded Aeroflot (Classic/Gold) and charity Podari Zhizn (Classic/Gold). Credit limits for other categories of Sberbank credit cards:

- Gold (Visa, MasterCard): up to 600 thousand rubles.

- Classic and Standard (MasterCard and Visa): up to 300 thousand rubles. on a general basis, up to 600 thousand as part of a personal offer.

- Youth credit cards: up to 200 thousand rubles;

- Instant (Visa, MasterCard Momentum): up to 200 thousand rubles.

Potential borrowers should understand that the maximum possible credit limit specified for a specific credit card will not necessarily be available to him. Sberbank can reduce it based on the data provided, or the client himself wants to reduce it.

Changing your credit limit

The amount that the bank is ready to issue is usually determined individually by credit experts, taking into account all significant factors (category of the borrower, his solvency).

Upgrade your credit card

If you already have a credit card issued by Sberbank, you can increase (increase) the limit only under the following conditions:

- The amount approved individually is less than the maximum possible for this card;

- The borrower's circumstances have changed (he has become salary client bank, opened a deposit).

- Over a long period, the borrower has proven himself to be a reliable client who fulfills his obligations to the bank on time. In this case, you should contact your bank to find out if you can increase your credit card limit.

If you use a card with an approved credit limit with the maximum possible amount, you can contact the bank with a request to issue a credit card of a higher level.

You will have the opportunity to increase available amount lending, if, for example, instead of Classic you apply for Gold. You may need to provide additional evidence that your financial well-being allows you to take on greater obligations than those you already have.

Let the bank know that your financial situation has improved - this is a way to increase your credit card limit

Let the bank know that your financial situation has improved - this is a way to increase your credit card limit A new credit card may be more expensive to service. Become familiar with the tariffs and terms of use before concluding an agreement.

Reduce approved amount

It is possible by credit card Sberbank to reduce the limit if necessary. If the amount of the approved loan exceeds your needs or your financial situation has worsened, you can reduce it. To do this, it is enough to write a corresponding application.

It is important to remember that you can reduce the available amount on a credit card under certain conditions:

- After considering the application from the client, Sberbank may reduce the limit, but it will be impossible to increase or increase it again.

- The debt to the bank at the time the client applies to reduce the loan must be fully repaid.

If you do not agree with the increased loan amount on your card, contact a bank employee and leave an application to reduce the limit

If you do not agree with the increased loan amount on your card, contact a bank employee and leave an application to reduce the limit When the limit on the card has increased, but the conditions for its provision remain the same (the bank informs you about the changes via SMS), you can independently limit yourself in spending if you consider exceeding it unreasonable or unacceptable for your budget.

Note: the bank can increase the credit limit unilaterally if it is convinced that you are a reliable borrower.

Conclusion

At Sberbank, the credit card limit is set in accordance with the category of the credit card (the maximum possible) on an individual basis. For existing clients Special offers, which give the right to an initial increase in the credit limit. If necessary, the borrower can increase (increase) or decrease the limit with the consent of the bank.

Are you interested in the question of how you can reduce the limit provided on a Sberbank of Russia credit card? Today we will give you some recommendations on how exactly you can perform this action.

Indeed, today many clients of this banking organization are faced with the need to change the credit limit on their card. Let us remind you that this means the amount that the client can use; the bank will not provide you with more than the stipulated limit. borrowed funds.

Money with a tape measure wrapped around it over a white background

One of the advantages of this type of service is the fact that the credit line is revolving. In other words, once you have paid off your existing debt, you will be able to use them again from the next day.

Finding out the amount of borrowed funds available to you is very simple: it is stated in the agreement that you signed. If under any circumstances you do not have access to the contract, for example, in case of its loss or damage, then you can obtain the information you are interested in by phone hotline bank at 8-800-555-55-50 (free call).

How to increase the limit? There are several ways to do this, detailed descriptions of which you will find below:

- Contact the branch where you are served in person and write an application for an increase in the amount. As a rule, this opportunity arises for those who have a good credit history, repay their debts on time, and can also confirm their solvency by providing a certificate of income in Form 2-NDFL;

- Automatic promotion. Most often it happens once a year for those clients who actively used their credit cards and repaid their debt on time. The more you spend on your account, the greater the chance of the amount increasing.

But what if you don’t want to increase, but rather decrease the amount? Let's talk further:

- Automatic reduction – occurs in the opposite situation, i.e. in the event that the client has not shown himself at his best, i.e. allowed the occurrence of outstanding debts and arrears, did not deposit money on time, hid from banking services, etc.;

- Upon application - according to the instructions of Sberbank, the client has the right to contact the branch where he received the card and write an application to establish a minimum limit, i.e. the amount that was initially determined for him by the terms of the contract. We draw your attention to the fact that for this an important condition must be met: you must not have credit card debt. You also need to remember that after such an operation you will not be able to request a further increase.

An alternative for such a service is to apply for a monthly spending limit, a ban on cash withdrawals or use only in a certain country, which will significantly reduce your costs. The first option is most often used: you do not change the amount available to you, but simply limit your possibilities for expense transactions.

This service is temporary, and if in the future you no longer need it, you can also submit an application and remove all restrictions.

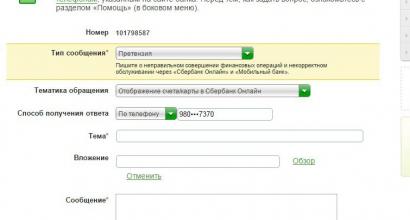

Please note that all the operations listed above occur only after the credit card owner personally contacts the bank office, via telephone or the Internet; nothing can be changed in the terms of the agreement!

If you have problems reducing your credit card limit, you can call the Sberbank hotline for prompt advice.

If you want to know how to get a loan without refusal? Then follow this link. If you have a bad credit history and banks refuse you, then you definitely need to read this article. If you just want to get a loan for favorable conditions then click here. If you want to apply for a credit card, then follow this link. Find other posts on this topic here.

kreditorpro.ru

How to reduce the credit limit on a Sberbank card: ways to reduce it and tips for borrowers

There are situations when Sberbank clients want, but do not know, how to reduce the credit limit on their card. If there is a need to reduce the loan limit, then this is not difficult to do.

Ways to lower your credit limit

Borrowers rarely resort to the opportunity to reduce the size of the loan received from the bank. But if this needs to be done, then the client is given several options. In this case, he must personally appear at the Sberbank branch with a passport.

Reduce the limit using an application

You must write an application to reduce the limit on the use of funds on your credit card. This is legal and does not contradict the bank's instructions. You should contact the office where the card was issued and ask to change the loan limit to the minimum, which is determined in the terms of the agreement. The bank will approve this application only if the borrower does not have any debts on the card.

Important! You should know that in the future the loan will not be increased at the initiative of the lender.

The review will take from several working days to a week, after which the applicant will be notified via SMS, or the information will become available in personal account client.

Limit payments

At any branch of Sberbank you need to write a statement asking the bank to set a limit on monthly spending, as well as a ban on cash withdrawals. You can limit this feature to only a specific country. This will help not only in solving the problem of how to reduce the limit on a loan received on a Sberbank card, but will also allow you to reserve the right to increase it in the future.

To get qualified advice from a specialist on how to change the amount of an allowable loan on a Sberbank credit card, just call financial institution and find out all the intricacies of this process.

Sometimes the borrower does not ask the question of reducing the level of the loan, but also fulfills obligations to the bank in bad faith, namely:

- doesn't pay on time cash to pay off debt;

- allows for delays and the occurrence of outstanding debt.

In this case, the bank has the right to independently reduce the size of the previously issued loan to such unscrupulous cardholders without warning of this intention.

zaim-bistro.ru

How can I reduce the credit limit on a Sberbank card?

Some Sberbank clients are looking for a way to reduce the credit limit on their card. In order to find the best solution to this issue, it is necessary to consider all possible options and study them in more detail.

Why do you need to reduce the limit?

In many banks, the provided credit line is renewed, that is, the client who made the payment will be able to use the same funds again the next day. In addition, the maximum limit provided credit funds may increase every time, judging by the reviews, this does not always suit borrowers.

Dissatisfaction can arise for several reasons:

- The influence of the human factor. Having received a significant amount, a person cannot always resist the temptation not to spend it all at once. But the debt will then have to be repaid.

- Interest rate. In some banks, interest on a loan is charged not on the balance of the debt, but on the entire limit. As a result, the client is forced to pay much larger amounts than expected. Sberbank does not have such a practice, but some people do not know about it.

- Safety. In the event of loss or theft of a card carrier, fraudsters will be able to use borrowed funds, and that is why additional insurance against such situations is necessary.

However, according to general rules, banks cannot increase the amount of available funds on a credit card without the consent of the borrower. As a rule, its maximum limit is indicated when concluding the contract.

Ways to reduce the limit

The banking institution itself can reduce the available line in the following cases:

- with systematically outstanding debt;

- when hiding from bank specialists;

- in case of non-payment of existing arrears.

Many Sberbank clients are looking for opportunities to reduce their credit card limit. Reducing the limit is a procedure that means reducing the amount of possible borrowing. To do this, there are several ways, which we will analyze in detail. The need to reduce the limit on a credit card arises when the client is not confident that he will be able to repay the amount of money provided by the bank in a timely manner.

In most banks, the credit line is renewed immediately after the client makes a payment on the loan debt. Funds become available for re-withdrawal the next day. Borrowers who repay funds to the card on time have the opportunity to automatically increase the limit. However, judging by customer reviews, such a service is unacceptable. Why? There are the following reasons for this:

- Human factor. As soon as a client has a large amount of money in his hands, not everyone will be able to resist such temptation. Although the debt has to be repaid, and with interest, borrowers in most cases fall for this temptation.

- Interest rate. In most banks, interest for using a loan is not calculated on the balance of the debt, but on the total amount of the limit. That is why the borrower has to pay a decent amount than he expected. This option is not practiced at Sberbank, but often clients do not know about it, so they are afraid of large loans.

- Safety. If the card is lost, fraudsters can use the funds on it. The scammers will have to return the cashed amount to the client if he does not block the card in a timely manner.

According to general innovations in banks, they do not have the right to increase the credit on a card without the positive consent of the borrower or without his notification. When drawing up the agreement, the maximum loan limit is stipulated, which in individual cases can be increased by decision of the bank itself.

How to reduce a loan at Sberbank

The bank independently reduces the loan amount if the following situations arise:

- The client has a history of systematic non-repayment of debt.

- If there is concealment from the bank.

- If the borrower does not pay the existing arrears.

If such situations exist, the bank will automatically lower the credit limit, and in some cases, may close it altogether. The bank does not undertake to notify the borrower about the decision to reduce the loan amount or to close it altogether.

This is interesting! If the borrower wants to use one of the above methods to reduce the loan amount, then this is not the most the best option. Indeed, in addition to lowering the limit or completely blocking borrowed funds, the borrower will receive additional problems in the form of unfavorable credit history. This story is transmitted to all banks, so take a loan from others banking institutions it won't be possible anymore.

A credit limit is the money a loan lends to a bank. It is renewable: when the client uses it and returns the money, he can use it again. This process can go on ad infinitum.

A credit limit is necessary to borrow funds when needed. On the one hand, this is very convenient: if you need money, you don’t need to run around looking for it, collecting a bunch of documents to apply for a loan, etc. Here you just need to use your credit card and make the desired purchase. On the other hand, the presence of money always stimulates the client to make purchases, sometimes not exactly what he needs. It is easier to spend money than to pay it back - this is why disputes arise about the infinity of debt repayment.

What is a credit limit?

This is a set amount of money that the bank has provided to the credit card owner for permanent use. When you receive a credit card, you already have the Nth amount of money on it. Without even refilling own funds, a person can already make purchases and withdraw cash. The borrowed amount must be returned on time to avoid paying extra interest and fines.

When providing a limit, the bank also provides Grace period. This is a period of time during which the client can use money from the card and not pay any interest. Typically it reaches 50-60 days, and the methods for calculating it may vary among banks. Proper use of this option will allow you to use borrowed funds free of charge and repeatedly. If the client does not meet the grace period, the bank begins to charge interest.

Thus, the credit limit is:

- Installed on a credit card.

- You can use it to make purchases or withdraw cash.

- The money must be returned within the established time frame.

- The limit is renewable.

Credit card without a credit limit: myth or reality?

When ordering credit card The bank provides a credit limit. If the bank denies the limit, then the card is simply not issued. But there are cards with a zero credit limit. Most often they are called debit. An example is Visa card Platinum B&N Bank.

This card is debit-credit card instant issuance (or in a personal form). At the time of issue, the card is issued with a zero limit. Within a couple of days, by decision of the bank’s credit committee, a credit limit may be set on it, of which its owner will be notified by call or SMS. In this case, the card will become a credit card. But also the limit may not be set, and the client will be able to use it only as debit card(or a credit card with a zero limit). In fact, all bank cards are credit cards. To make it easier to distinguish between them, we identified credit cards with a zero limit and called them debit.

What limit can be set on a credit card?

The size of the limit depends on the client’s solvency. As in calculating the amount of loans, all income and expenses of clients will be taken into account here. If solvency allows, then the bank offers an increased limit (from 100 thousand rubles), and if not very much, then an average limit (50-100 thousand rubles). If the client is not solvent, then the limit may be denied to him. The calculation principle also differs among banks. Typically, a card payment should not exceed 25% of income minus other payments.

For example, a client receives 50 tr. He has a loan for which he pays 10 thousand rubles. per month, a child for whom expenses are based on the minimum wage, for example, 8 tr. Total net income per month is:

Net income = 50 tr. — 10 t.r. - 8 tr. (for a child) - 8 tr. (for yourself) = 24 tr.

Based on the requirement “no more than 25% of income”, the minimum payment on the card remains:

Minimum payment=24 tr. * 25% = 6 tr.

If the minimum payment is 10% of the limit, then the limit can be provided in the amount of about 60 tr:

Credit limit=6 tr. * 10 = 60 tr.

Owning real estate, a car, or a deposit can help increase your credit limit.

Credit limit calculator

The credit limit depends on your net income and minimum payment

You can calculate the limit using a special calculator

What card limit will you be approved for?

Average income, month

Expenses, months

Min. payment

up to 950,000 rubles

How to increase your credit limit?

This can be done differently in different banks. For example, you can submit an application to VTB 24, attaching a certificate of income, availability of property, and sources of additional income. Within 3 days, the bank makes a decision to increase the limit or refuse it. In B&N Bank, the limit is increased by the bank unilaterally with its constant use and return without delay. Thus, the limit increases:

- Upon provision of documents confirming solvency.

- With active use of bank funds.

Where can I see the size of my credit limit?

- It is prescribed in individual conditions when receiving a credit card.

- When you request a balance at an ATM, the receipt will indicate the amount of funds, taking into account the credit limit. For example, the client has 1 tr. your money and 50 tr. limit - the balance will show 51 tr.

- In the bank branch on the card statement.

- In Internet banking. For example, in B&N Bank it will be listed in the “Cards and Accounts” section in the upper left corner.

Can the bank reduce the credit limit?

Such cases also happen. It's connected with:

- The occurrence of outstanding debt.

- The emergence of a risk of non-repayment of a debt, for example, the bank became aware of a layoff in the organization where the client works, etc.

The reduction occurs unilaterally. This is stated in loan agreement. If desired, the client can independently request to reduce the credit limit. For example, the bank has set a limit of 300 rubles, but the client does not use this amount and is afraid of losing the card. In this case, the client writes an application to reduce the credit limit and indicates the desired amount.

Thus, a credit limit is a necessary option for everyday payments. If necessary, you can always use it and not have to look for where to borrow money. You should use it wisely, because the funds taken must be returned back.

Some Sberbank clients are looking for a way to reduce the credit limit on their card. In order to find the best solution to this issue, it is necessary to consider all possible options and study them in more detail.

Best loan offers:

Why do you need to reduce the limit?

Credit cards from Sberbank.

In many banks, the provided credit line is renewed, that is, the client who made the payment will be able to use the same funds again the next day. In addition, the maximum limit of loan funds provided may increase each time, judging by the reviews, this does not always suit borrowers.

Dissatisfaction can arise for several reasons:

- The influence of the human factor. Having received a significant amount, a person cannot always resist the temptation not to spend it all at once. But the debt will then have to be repaid.

- Interest rate. In some banks, interest on a loan is charged not on the balance of the debt, but on the entire limit. As a result, the client is forced to pay much larger amounts than expected. Sberbank does not have such a practice, but some people do not know about it.

- Safety. In the event of loss or theft of a card carrier, fraudsters will be able to use borrowed funds, and that is why additional insurance against such situations is necessary.

However, according to general rules, banks cannot increase the amount of available funds on a credit card without the consent of the borrower. As a rule, its maximum limit is indicated when concluding the contract.

Ways to reduce the limit

The banking institution itself can reduce the available line in the following cases:

- with systematically outstanding debt;

- when hiding from bank specialists;

- in case of non-payment of existing arrears.