What to do if the land tax has not arrived. Reasons why land tax does not arrive Why land tax does not arrive

A large number of property tax payers have already encountered a problem when tax notices did not arrive at their address or personal account. Most likely, this is the fault of the tax office. We tell you why this can happen and what to do in such a situation.

When should it come

Based on the requirements of the law, the last day when the tax office can send out tax notices in 2017 is October 18, 2017.

Thus, if tax notices have not arrived by this date (plus a few days for postal service of a registered letter with notification), it is too early to worry.

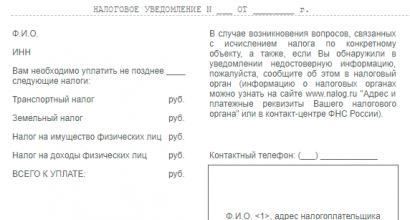

Let us remind you that to individuals who are obliged to pay tax for land, transport and/or their corresponding taxable property, the inspectorate must send out a consolidated notice on property taxes. Its form was approved by order of the Federal Tax Service of Russia dated September 7, 2016 No. ММВ-7-11/477:

Why it didn’t arrive: reasons

In practice, there are several main reasons why tax notices are not received.

A technical error

According to the law, a consolidated notice on property taxes is generated by a special computer program for tax officials. This happens automatically. At the same time, no one is immune from a failure in the program, as a result of which payers do not receive notifications about property taxes.

No obligation to pay

Another reason why a tax notice has not been received may be that the owner of the land plot/vehicle/other taxable property:

- ceased to be an obligated person (for example, sold a taxable object);

- has the right to a tax benefit, which exempts him 100% from payment (in this case, the inspectorate should not send a notification to the person at all).

Recently, taxpayers who own real estate have a new responsibility. According to clause 2.1 of Art. 23 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), taxpayers - individuals for taxes paid on the basis of tax notices are required to report the presence of real estate objects and (or) vehicles recognized as objects of taxation for the relevant taxes to the tax authority for their choice in the event of non-receipt of tax notices and non-payment of taxes in relation to the specified objects of taxation for the period of their ownership.

The specified message with the attachment of copies of title documents for real estate objects is submitted to the tax authority in respect of each taxable object once before December 31 of the year following the expired tax period.

At the same time, the same norm of the Tax Code of the Russian Federation establishes that a message about the presence of such a taxable object is not submitted to the tax authority in cases where an individual received a tax notice about paying tax in relation to this object or if he did not receive a tax notice in connection with the provision of tax information to him. privileges.

At the same time, pensioners as a preferential category are indicated only in the norms of the Tax Code of the Russian Federation regarding property tax (clause 10, clause 1, article 407 of the Tax Code of the Russian Federation). They are not listed among land tax beneficiaries (Article 395 of the Tax Code of the Russian Federation). However, by virtue of para. 2 p. 2 art. 387 of the Tax Code of the Russian Federation, municipal authorities have the right to establish such tax benefits for certain categories of taxpayers.

Thus, you may have acquired benefits for this tax since 2004 on the basis of regulations of the municipality in which the home is located. In addition, you are not formally required to submit information to the tax authorities about your rights to a land plot that is subject to taxation, since you previously received tax notices. Consequently, the tax authorities have information about whether you have an object of taxation.

However, you should not rely on the reasonableness of officials, especially since from January 1, 2017, legal norms come into force providing for significant tax sanctions in the event of failure to report to the tax authority information about taxable items in respect of which tax notifications are not received and taxes are not paid. This may lead to unpleasant tax control procedures, during which you will have to challenge the illegality of tax claims against you. An error in the database of tax authorities could be caused by a technical failure in the information exchange system between state registration authorities and tax authorities, or information about your land plot is not in the register of rights to real estate due to some other reason, for example, it was not transferred there from the cadastral registration authorities, BTI, etc., considering that you purchased the property back in 1998. It does not follow from the question that you have a certificate of state registration of rights to a land plot, issued in accordance with Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it.”

Therefore, you should check whether you have state registration of rights to land in the Unified State Register of Rights to Real Estate and Transactions with It (USRE) by requesting an appropriate extract from the Unified State Register and submit to the tax authority information about the presence of this object. You can carry out these procedures at multifunctional centers for the provision of public services (MFC) or “My Documents” centers. But first you should find out about the current tax incentives in your region from the administration or tax inspectorate. You may be in one of the preferential categories. Information about this should also be posted on the Internet on the official websites of the named bodies.

Property taxes for pensioners. Tax on a dacha house and land plot in New Moscow

Exemption from property tax

Pensioners do not pay property tax at all, but only for one piece of real estate of a specific type. Provided that this property is not used for business.

List of preferential real estate objects from the Tax Code:

Residential building or part thereof;

Apartment, share in an apartment, room;

Garage or parking space;

Premises for workshops, ateliers, studios;

Outbuildings with an area of no more than 50 square meters.

The benefit is provided not just for one object, but specifically for one object of each type: one apartment, one house and one garage at the same time. If a pensioner has two apartments, then he will pay property tax on one of them. And if there is an apartment or a house, then there will be no tax at all.

The basis for calculating the pension does not matter. This may not be an old-age pension, but a survivor’s pension or some kind of state pension. At the same time, a pensioner can work and receive a salary in addition to a pension, but there will still be a benefit.

If there are several objects. A pensioner can submit a notification and indicate for which object he wants to use the benefit and not pay property tax. If there was no application, the benefit will still be provided. It’s just that the tax inspectorate itself will choose an object that will be exempt from tax - the one where the tax would be the highest.

How to check. Now you can view your notification. Or help parents and grandparents figure out property tax: are their benefits taken into account and on what objects is the tax assessed? If you have questions or find any inaccuracies, contact the tax office through the website or come in person.

Benefit for 6 acres of land

Since 2017, pensioners have not paid land tax on six acres. It will be charged only for exceeding this area.

This benefit was introduced at the end of 2017, but it is valid from January 1, that is, it applies to the entire 2018 and subsequent years. It is given only for one plot, which is owned or held for life.

All pensioners also have this benefit, regardless of the basis of the pension. Check to see if this benefit is included in your tax notice. It operates in all regions.

Benefits under local law

There are also benefits under local law. Sometimes the area of the plot on which you do not have to pay tax turns out to be even larger. Or you won’t have to pay taxes on all real estate properties.

If a taxpayer's representative receives a pension

The benefit is given specifically to the pensioner, and not to the person who represents his interests or receives money for him. A pensioner is someone who has been assigned a pension. If a survivor's pension is assigned to a child, then the benefit is provided only for his property, and not for the property of the parent or guardian.

How to apply for benefits

If you retired in 2018 or someone close to you is entitled to a benefit, submit an application to the tax office. Confirmation of benefits is a pension certificate. There are no deadlines for applications for benefits in the Tax Code, but the Federal Tax Service advises submitting them before May 1 of the next year. If an application for benefits for pensioners has been submitted previously, you do not need to submit it again.

If you own several properties, it is worth submitting a notice of selection of preferential property. This must be done before November 1 of the current year, and then it will no longer be possible to change the object. An application and a notice are different documents.

If the benefit was not taken into account last year, although you were entitled to it, this also needs to be sorted out. Check the objects for which the tax has been calculated: sometimes there are technical glitches and there is still a possibility of an error. The tax office will review the appeal, clarify the data and correct the notice.

How to deal with property tax notices

Just in case, it’s worth checking your tax debt later: it will be reflected in the informers on the State Services portal. If you still have a debt, you can pay it off directly on the portal.

All taxpayers know that the time to pay land tax comes precisely when they receive a notification from the authorized body. But, unfortunately, for a number of reasons, a citizen may not receive a letter from the Federal Tax Service, which does not mean that he does not have to pay the mandatory fee. In fact, you can make a payment without a payment order, which means it’s worth answering the question of how to pay land tax if you haven’t received a receipt. Let's try to sort out all the options.

Why don't I receive receipts?

First of all, taxpayers should know that the tax amount must be calculated by specialists of the Federal Tax Service. That is, you shouldn’t make the calculation yourself because you still won’t get a real result. At the same time, the absence of notification does not indicate your exemption from property taxation. A receipt for payment of land tax by an individual may not have reached the taxpayer for several reasons:

- the taxpayer changed his place of residence and the order was sent to the old address;

- the land plot was not registered in Rosreestr;

- the postal employee lost a written notice that, on the one hand, is not the taxpayer’s fault, and on the other hand, does not serve as a reason for non-payment of tax for the Federal Tax Service;

- the taxpayer falls under the benefit, which means he does not receive notifications;

- the tax amount is less than 100 rubles.

Therefore, there are several reasons why a receipt may be sent to a taxpayer. But as mentioned earlier, the taxpayer must still take care of his obligations on his own, and at least take certain measures to find out whether he has a debt or not.

Please note that if the receipt was not sent by the Federal Tax Service employees, that is, the taxpayer did not receive the notification due to their fault, then he is not obliged to pay fines and penalties for late payment.

What to do if you have not received a receipt for land tax

Here the taxpayer has two options: pay the tax without a receipt or contact the Federal Tax Service directly. Let's consider all possible options for paying land tax if there is no receipt. First of all, you need to find out whether you have to pay a mandatory fee for the past year, whether you have benefits, and other nuances; only employees of the authorized body can answer these questions.

Official website of the Federal Tax Service: service for taxpayers

By the way, if you are an active Internet user, then you can check your tax debt using several remote services, in particular, Sberbank online, the official website of the Federal Tax Service, Yandex money, State Services, Pay taxes (Federal Tax Service service). On all of the above sites, you need to go through the registration procedure so that the system can identify you. You will need some documents, namely: passport, SNILS and TIN.

So, if you have discovered a tax debt on one of the above resources, then you need to pay it off as quickly as possible, because certain deadlines have been allocated for this, namely until December 1, then fines and penalties will be charged. You can make the payment online from your bank card, but be sure to print out the receipt, otherwise, in the near future you may receive a subpoena. Where the authorized body will demand payment of the fee plus fines, and the receipt will help you prove your innocence, because you made the payment, albeit late.

How to get a receipt

If you do not use the Internet, or do not have a bank card with which you can make payments, then it is wiser for you to contact the FMS office directly. If, at the time of application, the tax has already been calculated for you, then you will simply receive a duplicate receipt, with which you can make payment in any way available to you. Otherwise, when the taxpayer is not listed in the database, he needs to provide documents confirming his ownership of the land, a cadastral passport and an extract from the Unified State Register of Rights.

Please note that you need to contact the Tax Inspectorate at the location of the taxable object.

By the way, you can calculate the tax yourself and to do this you need to know the regional coefficient, the cadastral value of the land plot (information is posted on the Rosreestr website) and the tax rate. You can find out more about the calculations on the official website of the tax office; the fact is that for each region the formula for calculating the tax can vary significantly, because it is determined by local governments.

Tax check via Yandex Money

When you calculate the tax yourself, you will be able to pay the land tax without a receipt, provided that you know the details of the territorial division of the tax service. But, it is still wiser to contact the Tax Inspectorate, if you made a mistake in the calculation and do not pay a certain amount, then you will have to pay a fine for this in the future.

So, of course, it is possible to pay tax without a receipt, but you should not take the initiative, because these issues should be dealt with by a tax inspector. By the way, if you do not search for the receipt or do not take a copy, you may be summoned to court and accused of tax evasion, for which there is a fine.