Return of insurance after early repayment of a loan at Sberbank: what you need to know. Loan insurance: how to get your money back When you can pick up insurance on a Sberbank loan

We all actively use the services of Sberbank and often have to borrow money for one or another need. Usually it is money for extremely important needs. When applying for a loan, we are offered to take out insurance for a loan - thereby the bank reduces its risks of late payments to the client and delegates possible risks to insurance company. Most clients are conscientious and return the loan funds earlier than the term indicated in the loan agreement, while insurance does not come in handy for them. But not everyone knows that in case of early repayment of the loan, insurance can be returned to your account.

Why do you need insurance

The institution of insurance is as ancient as the method of making a profit from lending money - in a modern way, banking. It is associated with the fear of losing funds in case of unforeseen circumstances:

death of the borrower;

His involuntary insolvency (bankruptcy, job loss, illness that deprived him of his main income, etc.);

Force majeure: (wars, depreciation national currency, natural disaster).

In any of the above cases, the credit institution (bank) gets the opportunity to at least partially reimburse the loans issued cash, but in most cases - lost profits. For this, the Sberbank Insurance program is used.

Compensation is made at the expense of the insurance company, which is usually an affiliate of the bank providing the loan.

In the vast majority of cases, when concluding a loan agreement, you will be asked to insure your life. In this case, the bank will not take into account the fact that your life has already been insured earlier in another insurance company. And the grounds for insurance could be completely different. Nothing to do with borrowing money.

It is important for the bank to impose an insurance contract in any case! As an indispensable condition for obtaining a loan. And not in any insurance company, but in a connected (affiliated) with a bank.

At the conclusion loan agreement and affixing signatures on documents, we recommend that you not be too lazy and read the contract for the provision of insurance services - as a rule, they turn out to be a subsidiary of Sberbank - Sberbank Insurance. An interesting paradox lies in the fact that you are not obliged to insure your liability, but at the same time you are subtly hinted that without an insurance contract civil liability You won't get a loan either. Therefore, we advise you to agree to insurance - pay off the loan ahead of schedule and return the money for unused insurance.

The amount of money to be returned for unused credit insurance is calculated on the basis of unused days under the insurance contract.

For example, you took a loan for 3 years and repaid it in 1 year - thus you have the right to return unused insurance funds for 2 years.

How to return insurance for a loan at Sberbank

Arriving at the Sberbank branch, you must write an application for a refund for unused insurance. In some branches, consultants may say that insurance can only be returned within the first 30 days after signing the loan agreement, but this is not the case. This happens mainly in small bank branches and as a rule this is designed for the elderly. Therefore, insist on seeking justice.

Credit liability insurance in case of consumer lending under Russian law is not mandatory and therefore the bank does not have the right to force the purchase of this insurance. They can inspire you to refuse in all possible ways, but immediately make it clear to the bank's consultants that you know the laws and stand firm in your position. You can safely refer to all possible arguments of the bank employees to the courts and the money for insurance will be 100% returned to you.

In what cases it is possible to terminate the insurance contract with the bank

An insurance contract imposed during the conclusion of a credit agreement as a mandatory condition, just like any other civil law contract, can be terminated ahead of schedule or terminated by a court decision. The insurance contract does not constitute an exception.

The basis for early termination will be the early repayment of the loan and ... As a result, the termination of the risk conditions for the credit institution (bank).

From the point of view of the lender - the borrower who repaid the loan and interest - she is absolutely indifferent. And if the borrower does not have enough knowledge or desire to terminate the imposed insurance contract, let him continue to pay further.

The Sberbank Insurance program, under which termination of the insurance contract is allowed - for many borrowers - is the best option for obtaining a loan.

What is required to terminate the insurance contract

The technique for terminating an imposed insurance contract is not complicated. For this it is enough:

Pay the annuity amount specified in the contract (monthly payment);

Conclude an agreement with Sberbank on early repayment of the loan;

Specify the conditions in the contract - (you will repay the loan with a lump sum payment or arbitrary shares before the expiration of the loan term.

Draw up a new payment schedule (debt repayment);

When depositing funds through electronic payments (via Personal Area) save data on payments made on electronic media. Also, do not delete the payment history from the personal computer.

For the bank - in any case, early repayment of the loan is unprofitable. But Sberbank is a credit institution with the participation of state capital, therefore it is forced to comply with all legal requirements.

Attention! There is an opinion that it is possible to return the insurance only if the loan is paid off ahead of schedule. This is not true! The insurance can be returned throughout the entire term of the loan and insurance. The only thing that remains unknown is how much will be returned.

Return of insurance in case of early repayment of the loan

Return of insurance in case of early repayment of the loan is much easier than any other cases. Everything is logical - the loan ended, you fulfilled your obligations to the bank and the insurance was not useful, despite the fact that it is still valid. Why not return the money for the service not fully used?

How to return the money in this case:

- We carefully read the loan agreement, it is best to involve a lawyer at this stage (the fact is that sometimes the agreement is drawn up in such a way that it bypasses Article 958 of the Civil Code of the Russian Federation and then it will not be possible to return the insurance even through the court)

- If the contract is ordinary without tricks, then we find out the company - the insurer

- We write applications addressed to the insurance company for the return of insurance (sample application above)

- Attach documents (list below)

- We personally submit it to the office of the insurance company, or if you live in a remote area, then we send the application by Russian post with a return receipt

- When submitting an application, we personally make sure that the insurance employee put a mark on acceptance

- If the employee refuses to accept the application, then we write a complaint addressed to the director with reference to Law 958 of the Civil Code of the Russian Federation

- If the director of the company also refused, then we write a complaint against the insurance company to all authorities (Rospotrebnadzor, the Prosecutor's Office, the Central Bank of the Russian Federation)

To return funds for insurance after paying off a loan at Sberbank, you must submit an application for a refund and related documents to the insurance company.

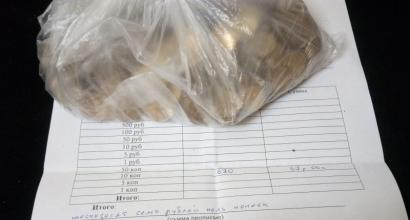

Insurance return documents(both in the case of a normal cancellation of insurance within 30 days, and in the case of a return of insurance upon early repayment of the loan):

- an application for the return of insurance on a Sberbank loan in any form addressed to the insurance company

- copy of the passport

- loan agreement (copy)

- certificate of absence of debt in the form of a bank

How much money can be returned for credit insurance

The amount of money that the bank will return to you under insurance depends directly on the number of days you have not used. We represent all insurance as 100%, divide it by the term of the loan and multiply the number of unused days by the cost of one day and get the amount of payments that the insurance company owes you.

Don't forget that insurance is subject to 13% withholding tax - so you'll get the amount described above minus income tax.

In more detail, we have the following:

- if you write an application for a refund within 30 days from the date of execution of the loan agreement, then you will be refunded the full cost of insurance

- if the application is submitted in the interval from 1 month to 3 months, then you should expect a refund of 50% of the cost insurance policy

- if the application is submitted much later than 3 months from the date of conclusion of the contract, then the cost of returning the insurance will be calculated in proportion to the days during which you used the insurance services

- in any case, you will lose 13% income tax on the cost of the insurance policy

With the return of insurance on a consumer loan, everything is now clear, but what about the return of insurance for a mortgage.

Termination of an insurance contract for mortgage lending by Sberbank

The most difficult thing from a legal and technical point of view will be to terminate the Sberbank insurance contract concluded when obtaining a mortgage loan from Sberbank. This is due to the fact that insurance companies have an independent methodology for calculating profits from incoming insurance premiums. Mortgage insurance in Sberbank is carried out on the same terms. The difficulty lies in the fact that real estate insurance with a Sberbank mortgage is not considered as a basis for early termination of the contract.

In case of non-occurrence of an insured event, the entire paid amount of insurance is converted into income of the insurance company. In the event that the policyholder wants to terminate the contract before the insurance period, the period specified in the contract is valid, for Sberbank it is 14 days. After this period, a refund is possible only in a very small amount - no more than 10-15% of the amount paid. IN judicial order it is unlikely that the terms will be challenged. The practice of accounting for insurance premiums and payments on them has long been established. Judicial practice has been developed, confirmed by repeated decisions of higher courts.

For a borrower who decides for the first time to apply for a loan at Sberbank, there are a few immutable truths to remember:

Most reliable bank Russia;

The highest interest on credit transactions;

You can lose all your money in your accounts if there is a writ of execution against you in the proceedings of the bailiffs.

Never expect a return on deposits - interest does not compensate for inflation!

An example of an application for termination of insurance on a loan

So, let's summarize the article. Any client of Sberbank can and has every right to return the money paid for consumer credit insurance, since creditor liability insurance in this case is not mandatory. Bank employees, when expressing a desire for a refund, may try to mislead you, but just don’t give up and hand them your signed application for a refund for insurance and you will receive monetary compensation within a few working days to your account after considering the application at the bank branch. Do not forget to take your loan agreement and passport with you to the bank branch.

In the case of a mortgage loan, property insurance is used - in this case, the purchased apartment and it is much more difficult to return the money for insurance here, since insurance with mortgage loan is mandatory.

As he sees, the return of money for unused credit insurance is a simple process, and everyone is able to return their money for the not fully used service of the bank's insurance company.

Related materials

For banks, lending is one of the main sources of income, so institutions do not want to take risks. are carefully checked. The company wants to make sure that the client has a sufficient level of solvency.

A financial institution may oblige a person to purchase a policy, the price of which reaches 30% of the total loan amount, which leads to an increase in the cost of the service. The law allows a citizen to independently decide on the need for a policy, if the service is imposed, for example on a loan from Sberbank.

Mandatory purchase of insurance is beneficial for the bank. By forcing the borrower to purchase the policy, the company is protected from the risks that could be faced if the person becomes incapacitated. The service provides protection against a different type of risk. The classic types of tariff plans are:

- property insurance;

- protection of life and health.

According to the terms of the contract, if a person stops working as a result of illness or being laid off, the obligation to close the debt to the bank is performed by the insurer.

A similar rule applies to the death of the client. CASCO, as well as a number of other services, allow you to protect the property that acts. If an accident or other accident occurs, the insurer will provide funds for recovery.

Is it necessary to agree to insurance or not

Banks are required to act in accordance with the law. The consumer protection law states that an institution does not have the right to impose the purchase of services, forbidding one from being received until a person pays for another.

In practice, not all clients are aware of this right. If a person has entered into a contract, he can terminate the agreement, incurring costs. A similar rule is present in the civil code.

The normative legal act prohibits compulsory insurance of property or health. The purchase of a policy acts as a voluntary service, the imposition of which is contrary to the norms of the current legislation.

The above rules do not apply to mortgages. The law governing the procedure for providing the service states that the borrower is obliged to insure the property acting as collateral.

How banks force the client to purchase insurance

There are a lot of ways to impose additional services:

- A financial institution may enter into an agreement with a borrower under which a potential client who receives funds from the institution automatically participates in the insurance program. The choice of the insurer and the opportunity to refuse is not provided.

- The loan agreement does not contain insurance obligations, however, Sberbank offers the consumer to sign a separate agreement.

The criteria according to which the service is considered imposed are determined by the Supreme Court of the Russian Federation. A violation occurs if the bank includes a condition in the contract that prescribes to insure life and health, and the above nuances are a mandatory necessity for obtaining money on credit. The policy is considered imposed if the company prescribes to conclude an agreement with a certain insurer and dictates the features of interaction with the organization.

The insurance contract must be provided to the borrower. In practice, consumers often do not receive a policy purchase agreement and terms of use. A person is not introduced to the nuances of using the service. The person signs in the appropriate column, confirming the study of all the features of cooperation. The chance to defend your rights in court is significantly reduced, so experts advise you to familiarize yourself with the terms of the contract before signing it.

How to correctly refuse Sberbank insurance

The amount of the insurance fee is quite large, and the borrower does not always have the necessary amount to receive the service. Financial institutions go to the trick, offering the size of the loan limit and forcing the client to pay the full amount. This entails an increase in monthly payments. A person has the right to refuse insurance until the conclusion of the contract.

It must be remembered that voluntary service and the borrower has the right to make their own decisions. If the company refuses to make concessions, you can stop working with it by contacting another institution. Today, there is high competition in the financial market, so finding an alternative is usually not a problem.

How to return insurance after receiving a loan from Sberbank

Even if the borrower is aware of the possibility to refuse the policy, often he agrees to use the service if there is a risk of refusal to issue funds. The law allows you to return funds after the conclusion of an agreement or the closure of obligations. Insurance is considered exactly the same product as others, therefore the borrower has the right to terminate the contract if 1 month has not passed since its conclusion.

Sberbank is considered the most democratic organization in this matter. Borrowers have the right to return the insurance in full within 1 month. If the period is exceeded, the amount is partially provided. Its volume is usually equal to about half the value of the total amount. From payment financial institution withholds the expenses incurred.

If a person wants to return insurance on a loan at Sberbank, you must personally visit the office and write an application, filling out the requirements in free form. The document is sent to the head of the department. The amount of the refund will be about 50% if more than a month has passed, but less than 90 days, because the remaining amount is used to pay off the costs incurred and connect to the insurance program.

The client is not obliged to make a decision hastily. The law allows you to return home with documentation and in a calm atmosphere to think about the details of the current situation. If a decision is made to return the insurance, the manipulation can be carried out without hindrance.

Return of insurance through the court

In practice, Sberbank may refuse to provide funds for one reason or another. If a citizen believes that the policy was illegally imposed, it is permissible to draw up a claim and submit documentation to the court. An alternative is the direction of papers to the FAS and Rospotrebnadzor. The Organization has repeatedly responded to questions regarding the imposition of insurance services by financial institutions.

If such a situation takes place, a person will be able to defend his rights, but initially he will have to prove that the purchase was not voluntary. If at the time of signing the contract a person had a choice, this will entail additional advantages for the bank.

Therefore, when drawing up a statement of claim, experts recommend performing an examination of the signed contract, evaluating the agreement for risks, and then compiling the evidence base.

Quite often it happens that, having issued a loan for a decent amount, the client after some time is surprised to find that he is reinsured and is ready to repay the debt much earlier than the due date. Then again you have to go to a financial institution (say, to Sberbank). oddly enough, not welcomed by any credit institution. And this is not surprising, because the sooner you repay the loan, the less profit the bank will receive.

Nevertheless, almost all banks allow their customers to return the money when they are ready to do it, however, sometimes for this you need to fulfill some additional conditions, for example, pay a fine or pay off the balance of the debt in full.

One of the few banking institutions which does not impose any additional requirements on its borrowers, is Savings bank Russia. We'll talk about him.

What is early repayment

So, let's go to Sberbank. Early repayment of the loan here can be done without additional conditions. You need to know that this service is full and partial.

The first is a situation where you immediately pay the entire amount of the debt, along with interest, and complete the loan agreement.

In the second case, the loan is repaid only partially. After depositing the desired amount (the excess of the debt remains outstanding, and the loan agreement continues.

To be honest, no matter what type of early repayment you use, it is still unprofitable for the bank and, of course, good for you. Five years ago, almost all financial institutions fined their clients for such actions, but in 2011 this practice was declared illegal (Articles 809, 810 of the Civil Code of the Russian Federation).

Annuity payment method

If you contact, or rather your actions in doing so, will depend on how exactly you repay your loan. If you have an annuity schedule, that is, you deposit the same amount into the account every month, then in order to prematurely pay off the debt, you need to:

- transfer a sufficient amount to the current account in advance;

- on the day when the next tranche is written off, obtain a special permission from a bank employee for early repayment of the loan;

- after depositing funds, ask a bank employee to develop a new payment schedule based on the outstanding balance;

- if you paid the entire amount, make sure that the loan is closed and ask a Sberbank employee to issue you a certificate confirming this fact.

If the loan has a differentiated schedule

If your payments are uneven, you will also need to visit credit organization(in our case - Sberbank). Early repayment of the loan in this case occurs approximately according to the same scheme:

- deposit a sufficient amount of money into the escrow account;

- we apply to a bank employee for permission to repay the loan (or part of it) ahead of schedule;

- we sign a special permit document;

- please recalculate the balance of the debt and form a new repayment schedule.

Attention! Despite the fact that Sberbank does not charge interest, penalties and fines for early repayment of a loan, you still need to adhere to certain conditions:

- you can start early payment on the loan no earlier than 3 months after its registration;

- make additional contributions to early return debt you can at any time, but the next mandatory payment you must make exactly in accordance with the schedule.

Pay off mortgage early

Now consider this question, Sberbank also does not set any restrictions on this matter, you can deposit any amount and even repay the loan in full.

Of course, it is unlikely that it will be possible to immediately pay off the entire debt, but smaller amounts can be paid quite regularly. There are two ways to recalculate the balance of mortgage debt:

- Reduce the amount of the monthly payment due to the previously paid additional amounts. This method is most often used when the client is not sure that the level of his income will not change in the future and he will be able to afford to pay significant amounts for a long time. The total term of the loan remains the same.

- Leave mandatory monthly payments at the same level, but reduce the loan term itself due to the resulting overpayment. This way is more popular, as it is believed that in this way it is possible to significantly reduce the overall overpayment on the loan.

In any case, before prematurely paying off debt obligations, it is worth carefully studying the contract. Perhaps it already prescribes all the methods and conditions for early repayment.

What do we have to do?

So, step by step instructions:

- We submit an application to Sberbank for early repayment of the loan.

- We fill in other documents, if necessary (the manager will tell you about this).

- We ask the bank employee to recalculate the unpaid balance or we do it ourselves using the calculator on the bank's website.

- We deposit money into our credit account.

One important point: if you are planning to make an early repayment (full or partial), come to the bank no later than 7 days before the date of the mandatory payment. Otherwise, nothing will work, the payment will go through as usual, and the premature repayment will have to be postponed to the next month.

Return insurance

If you return the money ahead of time, you can save more than just interest. You can also count on the return of insurance in case of early repayment of the loan (although not everyone knows about this).

First of all, you need to contact the insurance company (not the bank) and submit the following documents:

- passport;

- photocopy of the loan agreement;

- a certificate from the bank that the loan is fully repaid.

You will also have to write an application addressed to the head of the UK, where you indicate that you are applying for a refund of insurance in case of early repayment of the loan.

Before making a decision on the return of insurance, carefully read the contract. As you understand, no one likes to part with money, especially insurance companies, so there can be 3 scenarios for the development of the situation:

- Your money back will be denied. This happens with quite a large number of clients. The fact is that in many contracts somewhere small and “on the margins” the conditions are prescribed under which the UK protects itself from the return of funds. Only at the time of applying for a loan, few people pay attention to these small letters. You will most likely be able to return your money, only for this you will have to enlist the help of an experienced lawyer.

- SC will refund your money in part. Such a development of events is likely in the case when more than six months have passed since the insurance was issued. The SC usually insists that some of the money went to the fundraiser. If the amount you want to receive is large enough, apply for a written estimate of the expenses incurred. This will allow you to receive maximum compensation, however, as you already understood, you will also have to act through the court.

- Full refund. Usually, the UK returns all the money without question when the loan was repaid within 1-3 months from the date of registration. In this case, most likely, it will not reach the court, because the UK is unlikely to have any arguments.

Some nuances

There are a few other things to keep in mind when paying off a loan early:

- Before contacting the bank, try to make all the calculations yourself, the loan repayment calculator (on the Sberbank website) will help you with this. By filling in the appropriate fields and clicking on the "Calculate" button, you can see how much you still have to pay, the new (approximate) payment schedule and other useful information.

- Most often, it will not be possible to pay off the entire loan in the first month after registration, sometimes this cannot be done in the first 3 or even 6 months. Therefore, before applying for a loan, carefully read the contract, especially the part where it is written about early repayment.

- Use early repayment whenever possible, because it allows you to significantly save your money.

For many people, an unpleasant surprise when applying for a loan is the purchase of an insurance policy. Despite the fact that the law prohibits the imposition of related services, the recommendation to conclude an insurance contract is found in almost all banks. Few borrowers know how to return insurance on a Sberbank loan, this leads to a significant overpayment, since often the annual insurance premium about the same as a monthly payment.

Cancellation of insurance before receiving a loan

No financial institution, including Sberbank, can force a borrower to take out insurance. Why, then, do managers claim the opposite, even to the point of promising to refuse a loan? The reason is that with its help, the bank is trying to reduce its risks by shifting them to the insurance company. The more insurances an employee of the credit department of the bank issues, the greater the amount of his premium will be. The possible return of insurance on a Sberbank loan has little effect on the profit of a financial institution, since in most cases the borrower does not make such a claim.

Sample letter of claim for reimbursement

The availability of insurance can indeed influence the decision to issue a loan, but only if the assessment of the financial situation of the borrower is close to the limit. A candidate who has one or more of the following qualities will have no problem getting a loan:

- stable official income exceeding the amount of the monthly payment by 3 or more times;

- the ability to make a large down payment;

- the presence of expensive property that can be pledged.

However, it is not always possible to refuse insurance, sometimes this requirement is legislative, and the bank cannot provide a loan without it. This category includes loans for large amounts such as a mortgage or a car loan. In the first case, it is necessary to insure the property against accidents and fraud during the transaction, and in the second case, the safety of the car. Life and health insurance of the borrower or his workplace is exclusively voluntary.

Insurance is voluntary

Refusing to take out insurance does not make sense in all cases; loan conditions for an uninsured borrower can be much less favorable, and the amount of overpayment may exceed the amount of the insurance premium. In addition, he himself is responsible for the deterioration of his financial situation.

Borrower's rights

Sberbank quite rarely agrees to provide a loan subject to registration of only one type of insurance. In this situation, it is best to opt for a comprehensive insurance policy, since such a program is much cheaper. Usually the bank already has a partnership agreement, but the bank has no right to prohibit the client from choosing an insurance company, however, he can refuse to reduce the interest on the loan. It is desirable that payments can be made monthly, otherwise it will be difficult to deposit the amount immediately for the entire insurance period, so you will have to do it from loan funds on which interest is charged.

Is it possible to return insurance at Sberbank after the conclusion of the contract? Of course, but this procedure contains a number of features that must be taken into account. Before signing the agreement, you should carefully study it, and if you have questions, consult with a lawyer.

Return of insurance after early payment of the loan

Practice shows that it is far from always worth counting on compensation: the contract may contain a special clause regulating such a situation. It is quite legal to prohibit the return of the insurance premium, in which case the only chance to receive part of the amount is to prove that the borrower was misled in the process of signing the contract. To do this in practice is incredibly difficult.

If there is no such item, then you can receive funds, but early repayment of the loan at Sberbank does not guarantee the return of insurance. The fact is that the insurance payment may not be fixed, but floating, when its amount depends on the amount of debt. In this case, the amount of the last payment will be extremely small, so it does not make sense to return it. When the payment amount is fixed, you can request a refund for the remaining period. True, if contributions were paid monthly, then the amount of payments will be small.

To do this, you must contact the insurance company, providing them with evidence of the absence of debt to a financial institution. There is also a peculiarity here: the loan is closed by the bank not at the time of the last payment, but after some time, for example, a month, so it will not be possible to immediately return the insurance.

Cancellation of insurance after receiving a loan

In the case of Sberbank, the scheme for refusing insurance after the signing of the contract is quite effective. This is absolutely legal and does not negatively affect the credit history of the borrower. The bank provides the opportunity to cancel insurance within 30 days from the date of signing the contract to do this, you need to contact the branch and submit an appropriate application.

Do Sberbank loan insurance return in such a situation? Yes, but partial amount, only part of the fee will be returned, since for a certain time the client was still insured and could receive compensation. Consideration of the application can take a significant time (up to 30 days), so the amount paid as an insurance premium can be significant.

Refusal of insurance makes sense only if the loan agreement provides for an exclusively fixed interest rate, and contains no penalties for the uninsured borrower. Otherwise termination of an insurance policy can lead to significant financial losses. The best solution would be to consult with a lawyer, on the contrary, it is better not to trust bank employees, because all the information is provided by them orally, which means they are not evidence.

If the employees of the bank branch behave inappropriately, then you can complain to them on hotline bank, usually this has an effect. If such a step did not help, then you can write a complaint to Rospotrebnadzor and the Inspectorate for the Protection of Consumer Rights, but this should be done only if you are completely sure that you are right.

Return of insurance when paying a loan at Sberbank

It is almost impossible to return the insurance after paying the loan according to the schedule, since the insurance policy was calculated exactly for this period, respectively, the service has already been provided. The only chance is to find flaws in the contract, but since Sberbank only cooperates with large insurance companies, this is out of the question. Hiring a lawyer will only result in a waste of money.

There is still a situation where you can return insurance. The insurance policy can be declared invalid and a refund of the premium can be demanded if the likelihood of occurrence insured event disappeared. An example of such a situation is title insurance: the period for contesting real estate transactions expires 3 years after the signing of the contract, so there is no point in taking out insurance for a longer period. However, Sberbank does not try to artificially increase the term of insurance, especially since it is not he who receives contributions from the client, but the insurance company, so such terms of the contract can only be a mistake. In this case, it is not necessary to sue, it is better to first contact the bank branch.

Unfortunately, Sberbank does not guarantee the return of insurance after paying off the loan, and besides, trying to do this is far from always profitable. If the case goes to court, the claimant will be required to pay costs and fees, which may exceed the refunded premium. In addition, there is no guarantee of receiving payments, Sberbank has a staff of qualified lawyers, so it will not be easy to win a lawsuit.

When applying for a loan, each person seeks to choose the most favorable conditions under which the costs associated with the loan will be minimal. One way to save money is to avoid voluntary insurance or refund of the cost of insurance after the conclusion of such an agreement. You can refuse insurance at any stage of the contract, the only question is the amount that can be returned. How to do this for Sberbank customers, we will consider further.

What are Sberbank clients insured against?

When applying for loans, banks offer their customers to conclude insurance contracts. Sberbank has its own insurance company (Sberbank Insurance) and about thirty partner companies: it is their services that the bank's clients are offered to use in the first place.

In some cases, the conclusion of insurance agreements is mandatory (for example, when applying for secured loans, when property insurance is a necessity), in other cases, insurance is voluntary.

By concluding a voluntary insurance contract, the bank's client receives a guarantee that the insurer will fulfill its financial obligations in the event of an insured event - this may be the loss of the borrower's job (and, as a result, the deterioration of his financial condition), serious illness, disability and much more.

The borrower can take out insurance in case of one of the listed situations, or order a comprehensive policy that provides for all known insured events.

At the same time, insurance coverage increases financial burden on the borrower and, as a rule, leads to a significant overpayment on debt obligations. The amount of insurance depends on the size of the loan and the accrued interest. Sometimes the cost of insurance can reach 10-30% of the total loan.

Return of insurance after the conclusion of the contract

It may happen that when applying for a loan at Sberbank, the borrower was not warned of his right to refuse certain types of insurance, and he signed the contract without carefully considering its terms. But even by putting his signature on the document, the borrower may refuse insurance if he adheres to a certain procedure.

It may happen that when applying for a loan at Sberbank, the borrower was not warned of his right to refuse certain types of insurance, and he signed the contract without carefully considering its terms. But even by putting his signature on the document, the borrower may refuse insurance if he adheres to a certain procedure.

On April 4, 2016, changes took place in the legislation governing the procedure for the return of funds under insurance contracts. They determined that the client of the bank can return the amount of insurance in the amount of 100% if he submits an appropriate application within five days after the conclusion of the insurance contract, but the contract will not enter into force during this time.

Sberbank customers have more time to cancel an insurance policy, during which they can return the entire cost of insurance - 14 days are provided for this (the so-called "cooling off period").

If 14 to 90 days have passed, only a part of the amount will be returned to the Sberbank client, which cannot be more than 50% of the cost of insurance. If the period of 90 days is exceeded, the refund amount will be calculated based on the number of days during which the insurance contract was valid. Thus, the sooner the client submits an application for cancellation of insurance, the greater the amount that he will be able to return.

Cancellation of insurance should not affect the change in the basic terms of the loan agreement. In addition, the cancellation of insurance will not affect in any way credit history Sberbank client.

Return of insurance after early repayment of the loan

In case of early repayment of the loan, the term of insurance is reduced, respectively, the amount for unused days can be returned.

To do this, you need to prepare the following documents:

- statement;

- passport;

- loan agreement;

- insurance policy;

- receipts confirming the fulfillment of payments under the loan agreement;

- certificate of early repayment of the loan.

With these documents, you must contact the office of the insurer or the branch of Sberbank, where the application will be considered within 30 days. If a positive decision is made, the remaining amount will be transferred to the client according to the details specified in the application. It is possible to return funds in case of early repayment of a loan not only under voluntary insurance agreements, but also under collateral loan agreements.

Please note: in case of early repayment of the loan, you can return the remaining amount of insurance only under the current contract, so do not terminate the insurance contract until the funds are received.

Thus, the return of insurance funds is the right of every citizen, and Sberbank, as one of the leaders among financial institutions, ensures the implementation of this right for its customers. To use this right or not is up to the client.