What does a Belarusbank silver card give? Belarusbank gold cards. Additional privileges include:

Visa Gold of Belarusbank and MasterCard Gold are among the prestigious “plastic”, combining the highest quality, comfort and reliable service. Cards in this category are chosen by customers who are accustomed to enjoying the benefits of cashless services.

How much does it cost to get such a card? This depends on whether the client plans to receive at a branch or through online banking services.

You can use a card with a special status not only in Belarus, but also in other places where service machines operate banking systems Visa, MasterCard.

The following additional privileges are offered:

- Connecting to the World of Privilege loyalty program.

- Legal assistance or health care for connecting to a well-known banking system.

This international map plays a role at the same time both savings and checking. The client’s benefit increases from profitable purchases in different places that offer loyal service for such a Belarusbank plastic card. Using your money freely, you can still earn money and up to 0.5% per annum.

Tariffs by card

When using Belarusbank visa gold, there is a loyalty program, which is limited to specific conditions.

Relate plastic cards with a gold background to international products – this indicates that that not only discounts are provided on the card, but also unlimited payment for services.

| Loyalty offers that are valid for constant use of Visa and MasterCard Gold | Bill, dollars | Account, growing. rubles | Account, Belarusian. rubles |

|---|---|---|---|

| Registration at a banking institution | 45 currency units | 2300 | 65 |

| Registration through the use of various banking services | 60 | ||

| Reward for servicing cards with a validity of 3 years when issued at a Belarusbank branch | 55 currency units | 3150 | 85 |

| Registration through the contact center or M-banking | 75 | ||

| Insured deposit for a non-resident | 500 currency units | 37 000 | 1100 |

| Deposit to the personal account of another person | 250 currency units | 18 500 | 550 |

| The amount of loyal interest accrued on account funds | 0,1% | 0,1% | 0,5% |

Possibilities

The Belarusbank gold card differs from standard banking products and has expanded capabilities.

You can take advantage of its benefits regardless of location, so if you often have to travel or go on business trips, then it’s worth applying for it.

The card is issued to clients with expiration date:

- 2 years.

- 3 years.

Users of such a card special features available:

- Carrying out auto payment.

- Mobile banking.

- Useful SMS notification.

- Obtaining the necessary statements of your personal account.

- Making online payments and transfers.

Pay attention to additional services from the Visa system

Pay attention to additional services from the Visa system Knowing what Visa and MasterCard cards are, you can make contactless payments anywhere, where the reading machines operate and receive additional privileges along with this. The higher the cost of services, the more additional bonuses will be credited to the client’s account.

Unlike other payment products, plastic with a golden sheen from Belarusbank will constantly work for the card holder.

How to apply?

Applying for a mastercard/gold visa means opening a bank account. Can do it client from 14 years old using the following step-by-step actions:

- Contact the nearest Belarusbank office.

- Provide standard documents.

- Enter into a valid contract.

- Fill out a form using a special form, on the basis of which a personal card is issued.

Card design methods

Application on the website

The following can be connected to the new master card/gold visa:

- Online banking.

- SMS banking.

- TVbanking.

Useful video:

Advantages of the card

Common cards have a special design there are noticeable advantages, for which they are chosen in all cities of the country.

Pay attention to the loyalty program and discount program

Pay attention to the loyalty program and discount program Having such a card with you, you can not only buy whatever you want, but also use other great offers.

| Advantages | Distinctive features |

|---|---|

| Contactless payment technology | Some operations are carried out without entering a password and receiving a receipt |

| Convenient free SMS notification services | Receive notifications about expense transactions, as well as about payments made in Internet banking |

| An additional card is issued at a reduced cost | By agreement |

| Receiving discounts using the current system “Wow! Discounts" | Calculated individually for the client |

| Safe shopping in many services that support Visa and MasterCard services | Can be used in any city in the country |

| Receiving discounts in hotels and trade organizations | Bonuses are credited to the account and used by the client at his discretion |

Card production time

In Moscow, St. Petersburg, Novosibirsk, Yekaterinburg, Nizhny Novgorod and other large cities, the card will be ready in 2-3 working days; in the regions, production and delivery will take from 3 to 10 working days. For delivery to remote locations settlements It may take up to 15 business days. Exact dates are available.

When issuing a card, only working days are taken into account. If you order it on Friday evening, the production time will be counted from Monday.

You can see if the card is ready and when it will be delivered to the office in Sberbank Online in the “Cards” section.

What documents are required to receive a card?

To pick up the card, bring with you your passport or other document that was used to apply for the card. To receive a card for another person, you need a notarized power of attorney.

I am 14 years old. Can I open a card myself or do I need an application from my parents?

Yes, you can do it yourself. You only need a passport, no statement from your parents. The card can be issued from 14 to 25 years of age. It is more convenient to order a Youth Card online.

Fill out a simple form and wait for an SMS about the readiness of the card and the address where you need to pick it up. Then come to the bank at a convenient time and don’t forget to grab your passport.

What is the price Youth card?

The cost of the card is 150 rubles per year. The first year's commission will be debited only after receiving the card. It is issued for three years, so every year the Bank will write off a commission of 150 rubles. You will learn about payments from SMS notifications.

Can I choose my own design for the card?

Yes you can. Upload your image, photograph, choose a ready-made option or draw your own. Submit your application . The service costs 500 rubles, the fee is charged upon receipt of the card and reissue. Please read carefully when you start uploading images because there are restrictions.

I am already 27 years old and I have a valid Youth Card. Under what conditions can I use it?

You continue to use the card under the same conditions as before.

Where can I apply for a Youth Card?

You can apply for a card on the Sberbank website by filling out a simple application, or at the bank’s office. If you are already our client, you can order a card from Sberbank Online.

How to start receiving THANK YOU bonuses?

After receiving the card, you must register in the “Thank you from Sberbank” program. The easiest way to register: send an SMS to number 900 with the text THANK YOU 1234, where 1234 is the last four digits of the card number.

You can also register for the program at personal account Sberbank Online and at a Sberbank ATM - find the “Thank you from Sberbank” section and follow the prompts.

Bonuses are awarded automatically when paying by card - their number depends on the level of privileges.

It should be remembered that bonuses are awarded only when paying for goods and services. This does not happen when withdrawing cash from ATMs. But when you pay for purchases remotely in online stores, bonus Thank You bonuses are credited to your account.

How can I find out my card details?

To find out the details, go to mobile application Sberbank Online find the desired card and click "Show details".

Another way: in your Sberbank Online personal account, go to the “Cards” section and find the card you need, then “Card information” → “Transfer details to the card account”.

Bank cards such as visa gold and mastercard gold, as a rule, are intended for individuals who have a high level of income and often visit foreign countries. Such clients have increased demands on the quality of service, and they are willing to pay for this level. Gold cards are not issued by the bank right away; first you need to become, at a minimum, a regular customer.

International payment system VISA International has developed quite a lot of offers that are valid in various countries specifically for cardholders VISA Gold. You can learn more about these services on the Russian website www.visa.com.ru. Offers include: first-class shopping, unique travel, expensive restaurants, great vacations and much more. Each cardholder will definitely find what he needs.

The list of benefits and privileges for VISA users is being updated with new exclusive offers.

All the latest news and current information are published on the official website www.visapremium.ru in Russia.

Gold cardholders also have access to an expanded range of services. It lies in the fact that customers can choose offers that are convenient for themselves, both in our country and abroad, for example, these are:

Discounts for payments using a card;

- receiving gifts when shopping in boutiques, hotels, restaurants, when renting a vehicle;

- receiving invitations to closed fashion shows, sales, and various cultural events.

In order to take advantage of these offers, you need to pay for purchases with your MasterCard Gold card at partner companies as often as possible.

There is a MasterCard collection - Favorites. It contains interesting offers from the bank's partner companies (hotels, restaurants, beauty salons and others).

Other advantages of VISA Gold and MasterCard Gold cards

The advantages of banking MasterCard cards Gold and VISA Gold can also be called the following:

Payment for goods and services via the Internet;

- payment for goods and services around the world in trade service centers that accept such cards;

- guarantee when booking hotels, when renting Vehicle and ordering other services;

- SMS banking, Internet banking, SMS notification;

- receiving cash through ATMs and terminals;

- blocking the card if it is lost to ensure the safety of funds on the balance.

The Gold prefix to a bank card gives its owner a certain status. Bearers of these means of payment have the right to receive services at a higher level. They allow you to book hotel rooms around the world, gain access to VIP lounges at airports and have other benefits that are included with the card.

Belarusbank issues special cards in two versions: MasterCard Gold and Visa Gold.

Special tariffs

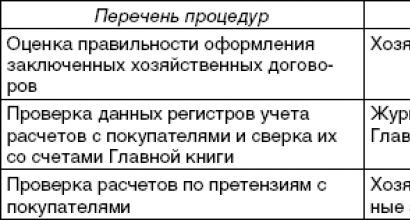

For the special conditions and privileges that the card has, the bank client must pay a certain cost for servicing the card. All information about the cost of the product can be obtained from the table:

Regardless of the currency unit of the account, the bank receives a fee for its servicing only in Belarusian rubles. The cost of service may vary depending on the type banking product. All tariffs can be found on the bank’s official website.

Regardless of the currency unit of the account, the bank receives a fee for its servicing only in Belarusian rubles. The cost of service may vary depending on the type banking product. All tariffs can be found on the bank’s official website.

What privileges does the Gold card give its owner?

Each owner of MasterCard Gold and Visa Gold can count on special conditions and privileges. These include:

Each owner of MasterCard Gold and Visa Gold can count on special conditions and privileges. These include:

- Possibility of contactless payments. They are provided for an amount of no more than 20 rubles in national currency.

- Possibility of booking rooms of any class in hotels located anywhere in the world.

- Purchasing plane and train tickets through the Internet portal.

- Providing .

- Free connection.

- Receive cash-back up to 5% when paying by card with loyalty program participants. The program applies not only to the territory of Belarus, but also to other countries.

- Receiving various discounts and benefits when registering in the affiliate program “Wow! Discounts! ".

- Refund of at least 5% of the amount of plane or train tickets purchased online.

- Obtaining an additional card with a significant discount provided by the bank.

In addition to the very tangible advantages of Gold class cards, their owners receive other additional privileges. Among them, one can especially highlight participation in the “World of Privileges” program or receiving medical and legal assistance in foreign countries.

How to get a Gold card

Product registration is simple. To do this, you should contact any branch of Belarusbank. You should have a civil passport and a certain amount of money to pay the bank fee.

Product registration is simple. To do this, you should contact any branch of Belarusbank. You should have a civil passport and a certain amount of money to pay the bank fee.

You can pre-issue a card:

- On the official website of the bank. To do this, you need to fill out a special application.

- Request a call from a bank specialist to complete it.

Despite the seemingly high cost of maintenance and issue, Gold class cards allow their holders to almost immediately feel their special status.

Contactless payments

Pay for purchases in one click thanks to payWave technology. 1. The Bank has the right to unilaterally change the Rules and/or Conditions of the Program (the list of trade (service) organizations in which a bonus is accrued when performing non-cash expense transactions; the amount of the bonus; minimum amount one non-cash expense transaction; maximum amount bonus during the period (month/calendar year, etc.) and/or terminate the Program. 2. The bank is released from the obligation and may not pay a bonus within the framework of the affiliate (bonus) program in cases provided for by the Program Rules.

Safety at its best

A special chip protects your finances 1. The Bank has the right to unilaterally change the Rules and/or Conditions of the Program (the list of trade (service) organizations when performing non-cash debit transactions in which a bonus is accrued; bonus amounts; the minimum amount of one non-cash debit transaction; the maximum bonus amount during the period ( month/calendar year, etc.), and/or terminate the Program. 2. The Bank is released from the obligation and may not pay a bonus within the framework of the affiliate (bonus) program in cases provided for by the Program Rules "Your bonus"

Internet payments

Pay with your card on the Internet by connecting 3-D Secure.

Special offers from Visa

Internet banking

Monitor account balances, make payments, open deposits from your smartphone, tablet or computer.

Apply for your card once or twice

2. Pick up at the branch.

Don't forget to bring your identification document with you passport/residence permit/refugee certificate

They can issue a card individuals from the age of 14 years.

Rates

|

Account currency |

||

|

Decor Visa cards Gold (validity period – 2 years) at a bank establishment |

||

|

Registration of a Visa Gold card (validity period – 2 years) through Internet banking, M-banking, bank website, Contact center, information kiosk |

||

|

Issuance of an additional Visa Gold card (valid for up to 2 years) |

||

|

Registration of a Visa Gold card (validity period – 3 years) at a bank institution |

||

|

Registration of a Visa Gold card (validity period – 3 years) through Internet banking, M-banking, bank website, Contact center, information kiosk |

||

|

Registration of an additional Visa Gold card (validity period – up to 35 months) |

||