VTB bm personal. VTB personal account. VTB personal account for individuals

The service allows you to: in any country in the world, with access to the Internet, around the clock:

- receive information about the balance issued by VTB Bank (Belarus);

- make payments in the “Settlement” system (ERIP) and arbitrary (that is, according to details);

- instantly transfer money to another payment card;

- track deposit data and repay (Belarus);

- view payment history, receive account statements and card transactions.

How to connect to VTB Bank Internet banking

Connecting to VTB banking is quick and convenient for the client. You should go to the website i.i-vtb.by and follow the link “Connect to Internet banking”. You will need to enter a login (from 6 to 15 characters, it cannot be changed later), mobile phone number, identification number (indicated in the passport), code word (indicated when registering a bank card) and verification code (symbols from the picture).

Then you need to carefully read the Rules for the provision of services and the Agreement for remote banking services(available in full version via the links at the bottom of the page) and check the box next to the word “Agree.” Click the “Submit” button.

The system will check whether such a login exists in the system and compare the entered information with the information stored in the bank. If everything is in order, confirmation of successful registration will appear on the screen. On mobile phone You will receive a message with information about the “Access Password” requisite.

Registration in VTB Internet banking is also available at information kiosks. After entering the PIN code, you need to select the “Internet banking: registration” item in the “Payments” menu. Then enter your login and access password and, after checking the data, click the “Pay” button.

The password must contain from 8 to 30 characters, of which at least 2 letters of the Latin alphabet; necessarily numbers. It is better to create complex passwords that alternate numbers with lowercase and uppercase letters. You can change the password later.

Login

You can access your bank card accounts and transactions from the page i.i-vtb.by.

The menu inside the VTB Internet banking system is relatively simple, consisting of only 5 items.

The “Portfolio” section stores information about VTB Bank (Belarus) payment cards and loans. Unfortunately, you cannot open, top up a deposit or transfer interest accrued on a deposit to a card online.

Here you can request a statement, block a card, set a ban on transactions on the Internet without using 3D-Secure, change the PIN code, set limits on transactions, rename cards, set auto-payment priority, etc.

The “Operations” section involves making payments, as well as a very convenient “One-button payment” option. This setting specifies a list of operations that take place in one click with one confirmation with a session password. Here the client tracks the payment history.

In the “Services” menu you can set up favorite payments and auto-pay. The payment statistics are unusual and new on the market for similar services in Belarus. The window in the form of a diagram will display information about which payments are made from the card most often and which ones require the most funds. In the “Services” subsection, SMS banking connection is available.

The “Bank” section allows you to quickly contact employees, displays information about ATMs, tariffs, etc.

The “Profile” section stores the client’s personal data. This is where you can block access to the service and change the password.

How to pay utility bills through VTB Internet banking

Through VTB Bank banking you can pay for utilities, Internet, telephone and even open a deposit account (do).

During the operation, you can add the payment to “Favorites” or to “Last Paid”. This will save you a lot of time next time.

To confirm payment, you must enter a session password - it is sent to your mobile phone via SMS.

Utility payments are grouped in the section “Apartment fees, water, other utility services.” To pay, you need to know your personal account number, enter the amount, and confirm the transaction with your session password. Just 4 steps and no queues. Without leaving your home or office.

How to protect yourself from scammers when paying for services online

The bank cares about the safety of clients and protects their personal information, however, the user must remember the rules that will ensure the safety of work in personal Internet banking.

Allowed to enter Personal Area only from a device on which the operating system is updated and high-quality antivirus software is installed software(it is important to update the database regularly).

You need to check that the address bar really says “i.i-vtb.by”, the HTTPS protocol is in effect, and the site’s certificate is valid.

You should reliably protect your password from disclosure and loss, change it regularly (at least once every 90 days), and not allow the browser to save login data.

After finishing work, you need to press the “Exit” button.

VTB 24 online- service from one of the major banks Russian Federation VTB 24. 99% owned by VneshTorgBank, the bank is engaged in retail operations, lending individuals, as well as small and medium-sized businesses. VTB24 has retail network with more than 1000 branches throughout the Russian Federation.

In order to use Internet banking, you need to go to the official VTB website at https://www.vtb.ru and in the upper right corner click on the “VTB Online” button. You can also directly go to the login page for your personal account using the link https://online.vtb.ru. On the page that opens, you will be required to provide your username and password. The login is your card number or UNK (unique client number).

After entering the details from VTB Online, you should click on the login button, and then confirm your login with the code from the SMS.

Online bank VTB24, entrance to the account for individuals

To connect to the VTB24-Online system you need to visit any branch of the bank. To register for online banking, you need to have identification documents with you. Registration of connection to VTB24-Online is free!

All users of the VTB Online Internet Bank can make any payments and transactions with their bank accounts at any time and anywhere where there is access to the Internet. Using the account simplifies all procedures related to transferring funds, monitoring balances, repaying loans, and opening deposits.

The interface of the account is intuitive for the user and allows you to quickly understand the bank’s product line. Account settings allow you to select certain notification settings individually for each bank client. The account is equipped with a “News” section in which account users can find out about all the promotions and messages sent by the bank. From your account you can make a call to bank employees and consult on any questions related to the operation of your account.

For those who have registered in the account for the first time, there is a separate section “VTB Online Review”, which will help a newbie understand the specifics of the account’s operation.

VTB-24 personal account, online account capabilities

- Payment of utility services, cellular communication, Internet, long-distance calls, satellite TV, taxes and traffic police fines;

- transfer funds without restrictions between your accounts and cards and payments to other types of accounts;

- transfers to any VTB24 clients;

- online currency exchange;

- opening deposits;

- repayment of loans;

- control of account balances;

- generating statements of your accounts;

- registration of insurance;

- purchase valuable papers on the stock exchange;

- control over balances using SMS and email;

- purchasing precious metals online directly from your VTB-24 personal account.

In their VTB online account, users have full opportunity to manage their accounts, bank cards, carry out transactions between your accounts and to interact with other accounts of both the VTB24 Internet service and other banks and financial organizations.

Mobile application Token VTB 24 online

The VTB24-Online token is a mobile application for generating passwords for logging into the VTB24-Online system, as well as for confirming and carrying out transactions in your personal account. The token is convenient and easy to use, installation takes a few minutes and does not require a visit to the bank, but is carried out by the client independently. The token works offline, that is, without mobile or Internet connection.

Be sure to install applications from the official store - AppStore, Google Play or Windows Store!

Client-bank online VTB24: login to your personal account

Blocking access to VTB 24 Online

If you exceed the limit of authorization attempts in your VTB 24 online personal account, the system will automatically block you for 30 minutes. You can then try again.

If the repeated authorization attempt limit is exceeded, access to VTB Online may be blocked. In this case, we recommend contacting technical support.

VTB Bank of Moscow has developed a personal account for the convenience of clients in managing accounts and personal savings. This service is available to all legal entities and individuals via computer or telephone.

What is required to log into your personal account?

The Internet banking system is a convenient program for individuals that allows them to conduct business and simply control financial transactions remotely. Your personal account is only available online, so the service must have access to the Internet.

To use your personal account and log in, a person must use:

To enter your personal account, you will need to enter your username and password, and you will only be able to receive them after registration.

In banking, many useful functions are available to private clients, so you need to register in the system as soon as possible and start actively working in your personal account at VTB Bank of Moscow.

Registration in the system

Only clients of VTB Bank of Moscow can activate the personal account service. To do this, you will need to register a card, agreement or any other document confirming that the person is a client of the bank. There are three ways to register:

You can always choose the most convenient and affordable way registration in your personal account. Once you receive your login details, logging in will be easy.

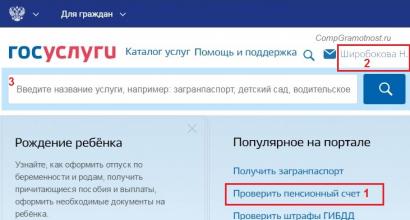

How to log into your VTB BM personal account?

To enter your personal account in the VTB Bank of Moscow system, you must perform the following actions:

- Go to the bank’s page via computer or via phone to the mobile application.

- Open the “Personal Account” section on the computer at the top right, and on the phone the page opens automatically.

- Enter your login and password.

- Receive an SMS with a verification code on your phone.

- Enter it in the required field and log in.

Mobile bank

A special application from VTB Bank of Moscow is suitable for all operating systems of mobile devices. You do not need to download it through any electronic service; you need to download the application from special stores (AppStore or PlayMarket).

Otherwise, you can download a fake and get a virus on your device, and in the worst case scenario, attackers can use the client’s personal data and gain access to his financial accounts.

When logging into your personal account, the user will always receive an SMS notification with an access code. Therefore, the contact phone number should always be at hand, and if the number is changed or lost, you will need to personally notify a bank employee.

How to restore access if you have forgotten your password?

If a client of VTB Bank of Moscow has forgotten the password for his personal account and wants to regain access to the system, he can easily do this one of the convenient ways:

- Arriving at a bank branch with a passport. This is necessary so that the employee can make sure that he is transferring personal data directly to the client, and not to a third party who is trying to deceive him to gain access to the person’s money.

- By calling the number hotline. Here, to identify the user, you will need to provide passport data and a code word. Therefore, when registering with a bank, it is better to come up with a word that is difficult to forget, but also not known to others, since you can still get a photocopy of your passport, but you cannot read your thoughts.

VTB Bank of Moscow cares about its clients and their safety and never transfers personal data without verifying the person’s identity.

Access recovery form

Access recovery form Personal account features

VTB Bank of Moscow decided to create a personal account for its own convenience, as well as for the convenience of clients. This saves time for everyone - customers do not have to queue at a branch or ATM for trivial minute transactions, branch employees can devote more time to helping people complete documents, rather than spending it on a regular bank transfer.

Your personal account allows you to carry out many operations with your accounts and finances, view offers from VTB Bank of Moscow and select the most profitable ones. A personal account saves users time, makes their life more convenient and easier. Depending on the person’s status in the bank (for individuals and legal entities) there will be different services provided by your personal account.

Services for individuals

- Gaining access to cards and accounts.

- Checking the balance and receiving reports on all transactions carried out.

- View transaction history in online mode.

- Receive notifications to your phone (if the notification service is activated) about all actions being carried out at the moment.

- View types of deposits, evaluate their benefits, select the required deposit using a calculator.

- Online opening of a deposit without a personal visit to a bank branch.

- Opening and closing accounts.

- Opening new cards, or releasing existing and new cards.

- Payment for housing and communal services, replenishment of telephone, Internet, various accounts.

- Translation Money between your Bank of Moscow cards, as well as to other cards and accounts of third-party banks.

- View loan offers from the bank, select and apply for a loan online without visiting the bank.

- Currency conversion.

- View exchange rate, as well as the securities and precious metals market.

- Purchasing precious metals.

- Setting up automatic payment for regular deductions without the direct participation of the bank client.

- Saving templates for various operations for ease of implementation in the future.

- View information about the nearest ATMs and bank branches.

Services for legal entities

- Create and save templates for documents.

- Transfer and view documents online.

- Transferring salaries to employees of the organization, connecting them to the salary project.

- Obtaining data on all bank accounts, balances and completed actions.

- Recall of documents during automatic configuration.

- Processing of acceptances.

Many actions from the first category are also available to legal entities, provided they have a certain account (debit or credit). All bank clients can conduct transactions and have access around the clock. The system is perfectly debugged and works without failures. If temporary difficulties or misunderstandings arise, you can always contact the technical support center, where the hotline staff will explain everything to the user in a clear manner.

Video

conclusions

VTB Bank of Moscow offers clients a convenient service - a personal account - perfect for constant monitoring and increasing their savings. Time is money, and time saved and time well spent is even more money, and the bank tries to provide a person with only the best.

The remote self-service service for individuals from VTB Bank of Moscow allows you to perform all basic financial transactions without leaving your home. Now bank clients can manage their accounts and cards, as well as pay for goods and services online, make instant money transfers and apply for loans or deposits. The security of transactions is guaranteed by a secure connection on the site and confirmation of payments via SMS passwords.

Advantages and opportunities of online servicing of VTB Bank of Moscow

By connecting to the service, you can:

- Activate new cards and activate the SMS information service;

- Close accounts and deposits, as well as block cards;

- Instantly pay for any goods or services;

- Apply for a deposit or loan for more favorable conditions online;

- Pay off credit debts;

- Get 24/7 access to your finances for free;

- View the history of funds movement and issue a card or account statement;

- Make money transfers with low fees and pay utility bills without interest.

How to register in your personal account at VTB Bank of Moscow

Before registering on the site, you need to activate the Internet banking service:

- Visit any bank branch with your card and passport to fill out an application to activate the service.

- In the Internet service agreement, indicate your mobile number, with which you will make payment transactions.

- Activate SMS notification via a trusted phone number to receive passwords at a bank office, ATM or hotline.

Registration of new users is carried out according to the following instructions:

- Go to home page official website of VTB Bank of Moscow and open the section for online services “Internet Banking” and click the “Register” button.

- Select the registration method - by card number, account number, deposit number or loan agreement.

- Enter the number of the current client agreement for online services.

- Create a login or provide your email address and password.

- Provide answers to security questions to further restore access if the card is lost.

- Confirm your registration by entering a one-time code from an SMS sent to your mobile number.

- Upload a photo of the cardholder and click the button to save the data.

Video instruction

How to log into your personal account at VTB Bank of Moscow

If you have forgotten your password for your personal account, use the special link on the login page on the VTB Bank of Moscow website. Enter your username or email address, after which you will receive an email with a temporary password to restore access. To change your password, you can use the personal account settings menu.

Mobile applications of VTB Bank of Moscow: where to download and main functions

With help mobile banking you will have access to:

- Money transfers;

- Information on loans, accounts, cards, deposits and mortgages;

- Payment for any services;

- Payment of fines and parking;

- Search for bank branches and ATMs, as well as information about their operating hours;

- Replenishment of cards, electronic wallets and repayment of loans;

- View your balance and transaction history.

You can activate the mobile banking service by phone, at an ATM or bank branch.

After installing the software, you need to go through a simple authorization procedure by entering your username and password for your personal account.