Possible difficulties when paying by credit card. All stores in Europe Change account name

Just yesterday, purchasing goods and services on the Internet, which seemed like something out of science fiction, has become an everyday reality. Today, with the help of the opportunities provided by the global network, we can easily top up our mobile phone balance, order food, buy movie tickets, household appliances and clothes. However, along with opportunities, the Internet also poses threats...

As you know, online purchases using a card are carried out using the details that are indicated on the payment card itself, namely: a 16-digit card number, the holder’s name, expiration date and a special 3-digit code on the back of the card, which is called CVV or CVC. By keeping these card details secret, you will protect yourself from losing money.

4 simple safety rules to keep your data from being copied:

In the vast majority of cases, people lose money on the Internet due to the so-called “friendly fraud” - friendly or household fraud, when the cardholder’s acquaintances, and sometimes even close people, enjoy the trust of the cardholder. However, professional Internet scammers are beginning to come up with more original ways to deceive gullible cardholders of their data. One of these is called “phishing.”

Phishing(from the English fishing - fishing, fishing) - a type of Internet fraud aimed at stealing the user’s personal data. In this case, scammers obtain data directly from the user, taking advantage of his inattention.

One of the types of phishing is the replacement of a genuine website with a fake one. The cardholder goes to the website, enters payment card information, after which it turns out that the site is fake.

Three simple rules will protect you from phishing

- Under no circumstances conduct payment transactions on sites unknown to you.

- Read the address bar on the payment page carefully.

- Install 3-D Secure or SecureCode on your card.

What is 3-D Secure or SecureCode?

3-D Secure is an XML protocol that is used as an additional layer of security for online credit and debit cards, two-factor user authentication. Visa developed it to improve the security of online payments and offered customers the Verified by Visa (VbV) service. Services based on this protocol have also been adopted by MasterCard as MasterCard SecureCode (MCC) and JCB International as J/Secure.

3-D Secure adds another authentication step for online payments.

3-D Secure should not be confused with the CVV2 code, which is printed on the back of the card.

What does the security code provide to ordinary cardholders?

- If previously you had to enter payment card details to make an online purchase, with 3-D Secure or SecureCode this is not enough. Now you need to enter a secret password, which you must remember in the same way as a PIN code. No one will be able to use the card data in the absence of its holder.

- An online store using these technologies guarantees its reliability, since Visa and MasterCard maintain their register.

- In addition, this technology also protects store owners, who can be sure that the card belongs to its owner.

This service is provided absolutely free of charge; in addition, its availability increases the limit of a one-time transaction on the Internet. Without any additional steps, you can make large sums of purchases online.

How to install 3-D Secure or SecureCode and how does it work?

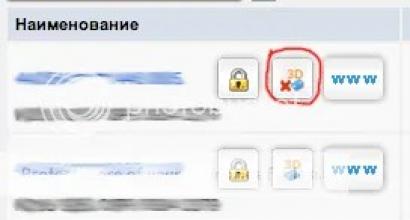

If you use Kazkommertsbank cards, you can install 3-D Secure or SecureCode on your card using the financial portal Homebank.kz. In the “Finance” section in the list of available payment cards, next to the name of each card there is a small icon with the inscription “3D”. By clicking on this button, you can get to the settings menu, following simple algorithms, set 3-D Secure or SecureCode in the form of a special “welcome” that will appear every time at the time of payment (this helps to easily determine the authenticity of the site) and a secret password that will be known only to you.

If you use Kazkommertsbank cards, you can install 3-D Secure or SecureCode on your card using the financial portal Homebank.kz. In the “Finance” section in the list of available payment cards, next to the name of each card there is a small icon with the inscription “3D”. By clicking on this button, you can get to the settings menu, following simple algorithms, set 3-D Secure or SecureCode in the form of a special “welcome” that will appear every time at the time of payment (this helps to easily determine the authenticity of the site) and a secret password that will be known only to you.

3DSecure and SecureCode work very simply. When you make a purchase online, you will be sent to a special Kazkommertsbank website where you will be asked to enter your unique password (like a PIN code at an ATM).

The following will help determine whether you have reached the Kazkommertsbank website:

- the page address should start like this: https://cardsecure.kkb.kz/;

- The page will definitely display the greeting you created when installing 3-D Secure or SecureCode.

In Kazakhstan, almost all online stores support 3-D Secure and SecureCode technology. Abroad, not all sites support this technology, but every year there are more and more of them. And in the foreseeable future, the use of these technologies will become a security standard.

3-DSecure and SecureCode are not a tribute to technological fashion, but a simple and reliable way to increase the security of your card on the Internet.

In the near future, 3-D Secure and SecureCode will not be configured independently by the client, but will be automatically installed on all new issued and reissued Kazkommertsbank cards.

Shop online with pleasure, buy securely with 3DSecure or SecureCode.

The article was prepared based on materials from KazkommertsNews.

Since February 26, 2015, Halyk Bank Kyrgyzstan OJSC has been offering its clients - payment card holders a new secure payment service on the Internet 3D Secure: Verified by Visa (for VISA cards).

What is 3D Secure?

3D Secure is an advanced technology developed by the Visa (Verified by Visa system) and MasterCard (Secure Code system) payment systems, which allows additional identification of the cardholder by entering a 3D Secure password. 3D Secure will significantly reduce the number of controversial transactions and the level of fraud on the Internet using payment cards.

How does 3D Secure work?

By making a purchase using 3D Secure technology, you receive new advantages in the process of making payments on the Internet. When making a transaction in an online store that supports 3D Secure technology, you will be asked to enter a 3D password that is known only to you. After entering the password, a secure connection will be established between the online store and the Bank and the data you entered will be identified. Payment for the purchase will be made only if the online store receives confirmation from the Bank that the identification was successful.

Many fans of online shopping regularly encounter a special 3D-Secure protection system, developed specifically for clients of the international payment system Visa, and later for MasterCard users. But what is 3D-Secure? How to connect it? What are its advantages and disadvantages? Is it really possible to bypass it? Does it save you from the machinations of attackers?

Where can you find the 3D-Secure system

The pages of online stores are full of bright signs, advertisements and attract with attractive offers and discounts. And here everything is clear: the owners of such virtual platforms use all possible methods to attract the attention of new and retain old customers.

It’s clear that rarely can anyone refuse tempting promises and reduced prices; besides, to make a purchase you just need to enter the details of your plastic card. But is it safe to shop online? What is 3D-Secure and How does it work? And is it capable of protecting you from unauthorized theft of funds from your account?

What is the 3D-Secure system?

3D-Secure is a special security protocol used to authorize a credit holder or during a payment transaction via the Internet.

This technology helps protect the seller and the bank from fraudulent transactions. However, it does not provide a guarantee for the safety of the funds of the direct owner of the plastic card.

How the 3D-Secure protocol works

Having a general knowledge of what 3D-Secure is, it is not difficult to imagine how it works. For example, you decide to buy a stylish clutch from an online accessories store that follows the above-mentioned security protocol. You have added an item to your cart and see pop-ups asking you to do the following:

- enter your payment card number;

- indicate the validity period (issue date (rarely) and expiration date (more often);

- cardholder's initials;

- indicate the security numbers (indicated on the back of the card).

And then there is an automatic redirection to the page of your issuing bank (the credit institution that issued and services this card), where you will need to enter an additional security code. That's what 3D-Secure is. Moreover, this code can be obtained in the following ways:

- via a message sent by the bank to the cardholder’s mobile contact number;

- by using a special one-time code card or device;

- by writing a permanent code, previously established and known only to the card owner and the bank.

How to connect 3D-Secure

Not all banks use such a security system; most often this is due to the high cost of its maintenance. This particularly applies to small credit institutions. The so-called veterans of banking (large banks with a well-developed retail network), on the contrary, adhere to this protocol and use it regularly.

In most banks that support a security system, 3D-Secure is connected by default, that is, immediately upon receipt and activation of a bank card. In other cases, to connect to the protocol, cardholders must describe their desire in the prescribed application form.

To do this, as a rule, you will need a passport and bank card information. In some financial institutions, the security system connection is done manually by the client. This is done using mobile or Internet banking (requires an IT device and access to the Internet).

What are the advantages and disadvantages of the system

The main advantage of the system is that all data entered by the client to identify his identity remains only on the server of his issuing bank and does not end up in the online store. The second important advantage is the use of a one-time password sent by the bank for authentication. But there is also an important disadvantage. Even such a password can be stolen and redirected to attackers using a special virus or spyware that gets onto your phone or tablet while viewing or downloading any information online.

And finally, one more minus. 3D-Secure is an optional system, so not all online stores can work with it. Read on to learn how to bypass 3D-Secure.

How to bypass the security system

As it turns out, the seemingly serious security system has a number of shortcomings that allow attackers to easily bypass it. In particular, most of the “card villains”, when stealing card data, try to make purchases in those online stores that do not support the security protocol. Let us remind you that in order for it to work, it must be supported not only by the seller, but also by your issuing bank.

When paying for goods in such stores, as a rule, you only need to enter the card number and the code located on the back of the card. By the way, some sellers, trying to protect their clients from theft of their contact information and money from the card, use a little cunning trick. They contact the issuing bank with a request to block a small amount in the buyer’s account; and then the cardholder should call the bank back and answer a number of clarifying questions for identification; hear the exact amount of blocking and tell it to the representative of the online store.

How to avoid encounters with scammers

As you can see, the 3D-Secure system cannot guarantee 100% protection for all participants in the transaction. However, this does not mean that every cardholder cannot prevent unauthorized theft of their own funds. On the contrary, everything is in your hands. It is enough to follow simple safety rules.

Firstly, try to regularly update your antivirus on the IT media used to make card payments. Secondly, try not to visit, let alone make purchases on, sites you are unfamiliar with, as scammers often organize fake web pages with the aim of stealing funds from credit cards.

Thirdly, set an individual limit for your credit card and download the appropriate bank mobile application for complete control of the status of your account. Fourth, carefully read the text of messages sent from the bank and security system. And finally, contact the bank immediately if your phone stops receiving the operator’s network, which indicates a possible reissue of the SIM card.

Now you know what 3D-Secure is, and you are also familiar with the pros and cons of this system.

Secure payment for goods and services on the Internet/online stores

Dear Clients of Kyrgyzkommertsbank OJSC, below you can familiarize yourself with the features of using passwords for Internet payments 3D Secure and Secure Code.

If you have any questions, please contact our number +996 312 333 000 (ext. 1)

- What is 3D Secure / SecureCode?

3D Secure or SecureCode is your own password required for secure Internet payments. When paying for a purchase in an online store that supports this technology, you will be asked to enter a 3D Secure/SecureCode password.

This operation is similar to entering a PIN code at an ATM. Thus, only you will be able to use the card to pay for goods/services online. With 3D Secure/SecureCode technology, online shopping becomes more secure.

Internet passwords 3D Secure / Secure Code are mandatory for Visa and MasterCard payment cards issued by Kyrgyzkommertsbank OJSC.

- How does 3D Secure / Secure Code work?

When making purchases online, as a final confirmation of payment, you will be redirected to a special page with a form for entering a 3DSecure password (if your card is VISA) or SecureCode (if your card is MasterCard) with a request to enter your secret password.

After you enter your secret password, the system will identify you and the payment will be confirmed.

- How to install 3D Secure / Secure Code?

Attention: this instruction is relevant only for Kyrgyzkommertsbank cardholders. Cardholders of other banks should contact their card issuing bank.

Setting a password for online payments is very simple and does not take much time.

- Enter the word “Full” in the SMS message and send it from the phone number associated with the card.

- Send a message to short number 900.

- After this, after some time you will receive a response SMS message stating that in order to activate the full tariff you need to send another message with a four-digit code (these four digits will be in the message).

- Next, you need to enter these same four digits and send to the same number 900.

- Receive a new SMS message confirming the service activation.

- the client must keep personal information secret from other users;

- You should not save passwords and your bank card details during the purchase;

- It is best to set certain limits on expenses and purchases per day;

- the linked phone should be kept with a password in an inaccessible place;

- It would be a good idea to periodically change the PIN code for your bank card;

- If information and personal data are compromised, you should block your card, change your passwords and call Sberbank for advice.

Go to the Payment cards section

Click on the 3DSecure / SecureCode icon, which is located under your card number

Create your own password and carefully enter it in the appropriate field.

Re-enter the password in the appropriate field, create and enter a unique greeting in the appropriate field and click “Next”

You will receive an SMS code to confirm the operation on your mobile phone number, enter it in the appropriate field.

If you enter the SMS code correctly, you will receive the following notification - “3DSecure / SecureCode activation was successful! Internet payment security has been increased!”

3D Secure technology from Sberbank PJSC is necessary to ensure the security of any financial transactions with electronic financial instruments. The main area of use of the technology is non-cash payments when paying for goods in online stores. Therefore, it is important to know how to connect Sberbank’s 3d secure and check whether this service is connected or whether it needs to be connected.

3D Secure uses a multi-layer data encryption scheme that uses passwords and a pair of devices to confirm the payment. That is, the bank card and the phone to which this card is linked will be checked.Description of technology and authorization

Sberbank, like any other banking organizations, uses measures to increase the security of its clients’ funds. Therefore, when performing financial transactions, users must enter the maximum amount of data from their bank card. Moreover, the same data that is marked on the map can be entered. This is the owner's first/last name, card expiration date and three-digit code.

One of the features of the 3D Secure system is passwords that can only be entered once. They apply both in the online application and during use. If the client has a mobile bank, then it is better to receive one-time passwords on his phone, and if he does not have one, get them through an ATM.

Since the bank uses 3D Secure to process payments, the developers have done everything possible to make the system easy to use. When receiving passwords through the terminal, the user will be given a receipt for 20 passwords. You need to store this paper with passwords as far as possible from the card, and when entering a password, you need to use them in the sequence indicated on the paper.

This is a reliable system, but it does not save you 100% from losing money. No bank can give such a guarantee.

The 3d secure system ensures secure payments using a card

Operating principle of the 3D Secure system

The 3D Secure technology itself was developed by the international SWIFT system, and now this technology is used in VISA. The hardware of the entire mechanism is classic servers located on providers, as well as cellular network equipment. This is a feature of how to connect 3 d secure Sberbank.

Security is achieved by storing card information on bank servers. Integration of the system with cellular networks is necessary to quickly block a bank card in case it is stolen or lost. In addition, data and information are duplicated many times.

The bank's servers are protected by screens with in-depth data filtering. When accessing them, there is a mandatory identification of the user and access using the data. In other words, not every user and not every computer will be able to access the information that is on the bank’s server. This allows Sberbank to more effectively screen out fraudsters.

Another significant detail of the protection scheme is automated attack detection. Detection is carried out using standard methods. For example, if information from a bank card is requested from an unusual phone number or an unusual computer.

How to check if there is 3D Secure

At the moment, the bank connects each of its clients automatically if the client has a debit or credit card. This is done through passwords sent to the phone via SMS. This measure was applied in order to increase the security of purchases made online. However, several years ago people were connected to such authentication only after writing a written application.

Currently, 3D Secure is not available if mobile banking is disabled. Therefore, to connect to 3D Secure, you just need to connect an economical or full mobile banking package. The difference between the economical and full packages is that with the economical package the bank will not send a corresponding message.

How to connect 3D Secure

The technology today is reliable. With this in mind, many bank card holders are thinking about how to connect Sberbank 3D secure to protect their funds.

Now this service is part of the standard package when issuing a bank card. Activation does not occur when you receive the card, but after making the first payment using it. After this, during each purchase in stores, a request to enable the service will pop up automatically. If this does not happen, then you can activate the service through your account or bank branch. What are the features of each method?

You can connect 3d secure through the Sberbank Online system

How to connect 3D Secure technology using the Sberbank Online service

3D Secure protection works in , which is why to connect you just need to select the appropriate 3D Secure connection option. Sberbank allows each of its clients to connect such protection free of charge, even taking into account the fact that the protection requires appropriate technical equipment.

If you need to make purchases where there is no 3D Secure support, then you can use a reliable, secure exchanger with a small commission. Also, if there is no protection, you can pay for the goods by standard bank transfer.

There is another way to pay for purchases in stores that do not have 3D Secure - this is to temporarily deactivate the service in your bank account.

Connecting to 3D Secure service using your phone

In order to activate an extended bank package with 3D Secure support over the phone, just follow these steps:

After this, when you pay on any website, you will receive free SMS messages with passwords to pay for your purchase.

The 3D Secure service is provided to bank clients free of charge, but for Sberbank itself such a mechanism is very expensive.

The 3d secure system and implementation for the use of credit cards will protect the funds of cardholders

How secure is the 3D Secure system?

As mentioned above, no bank can give a 100% guarantee that 3D Secure is safe to use. Technologies, software and attacks by hackers and other scammers are constantly being improved and updated, and users themselves do not always follow security rules when making purchases and entering personal data.

In order to improve the security of transactions, Sberbank has made several recommendations:

Is it possible to disable protection

Like other banks, Sberbank does not provide the opportunity to disable 3D Secure if it has already been connected personally by the user or by default when registering a card. And this rule is one of Sberbank’s fulfilled obligations in matters of ensuring the security of personal data and funds.

The 3D Secure system for protecting personal data and funds is a unique technology that represents a step-by-step identification of the user when making purchases in an online store. Therefore, such a system is important for every user, especially when making frequent payments. 3D Secure is activated independently, so you don’t have to worry about whether the card has such protection or not.