Insurance of road cargo transportation. Cargo insurance during road transport: basic provisions. As described in the contract

Every day, thousands of goods are transported by road from city to city, from country to country. And along the way they face many dangers. Cars may go missing or get into an accident. The cargo may be lost marketable condition, get wet, it can be damaged, stolen, detained or even confiscated at customs.

There is only one way to somehow protect yourself from these risks. We will consider it in our article. And let's talk about cargo insurance during road transport, its tariffs, rules, conditions and features.

Car cargo insurance

This is a type of property insurance that protects the interests of the owner of the cargo in the event of damage caused by various incidents on the road. As part of the procedure, insured events are recorded and monitored, and compensation is paid to the owner when they occur.

To provide this type of service, the organization must undergo state licensing and subsequently comply with the rules describing the programs, the list of risks and the procedure for compensation of losses. There are many private and government organizations offering this type of transportation services. And cargo owners choose the institution and type of policy at their discretion.

The contract guarantees compensation for damage in the event of damage to the cargo or even its complete loss as a result of an accident. According to the current legislation in Russia, cargo insurance is not mandatory. But often, motor carriers refuse to sign contracts with clients if they have not taken out the appropriate insurance policy.

The object of the contract is usually:

The transported goods themselves, owned by an individual or legal entity.

Future profit from its sale.

Costs associated with transportation.

Insurance programs are divided into the following types:

With responsibility for all risks.

The institution pays compensation to the owner in case of damage or loss of cargo for any reason, except for generally accepted exceptions. The costs of general average are also reimbursed in accordance with the share of the insured, and all expenses for salvaging the cargo, reducing damage, determining the causes of harm, including payment for the services of various experts.

With liability for a private accident.

Money is paid in case of damage or loss of part (the whole) of the cargo that occurs in accordance with the incident from the list of risks.

These include: theft, damage or loss of cargo (all or only part) as a result of natural disasters, wrecks, road accidents, impacts on fixed and moving objects, explosions, loss of transport along with the goods. And also in case of damage during loading and unloading operations, etc. Exceptions are the same as in the previous case.

No liability for damage other than crash.

The main difference from the previous case is that losses for cargo damage are paid only when they occur during an accident vehicle.

The agreement also includes additional risks that are subject to compensation. These are contributions and payments for general average, expenses for salvaging goods, minimizing damage and establishing their size, provided that this risk is subject to compensation under the contract.

In addition, there are special insurance programs.

To receive payment, the owner of the goods must prove the occurrence of insured event, that is, the fact of its loss or damage. To do this, he needs to report the incident to the insurance company. And after 2-3 days, provide a written statement demanding payment of compensation. At the same time, a written claim must be sent to the motor carrier. If this is not done, the organization will not be able to pay the money.

Then you need to fill out papers confirming damage or loss of the cargo. In case of an accident, this will be a conclusion from the traffic police. And some agreements provide for the inspection of damage by an employee of the insurance institution or an independent expert.

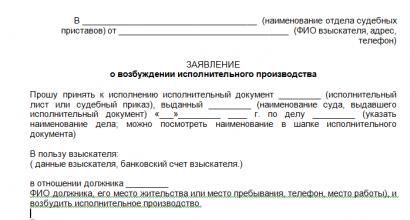

It is necessary to send the organization copies of the following documents:

Application for compensation for damage.

Contract for road transport.

Waybills with route marks.

Evidence that the driver tried to save the cargo.

Conclusions of state bodies.

Features of cargo insurance

The risks during road transportation are among the highest. Since there is a high probability of damage to the cargo in an accident or in other situations related to damage or theft of the delivered goods.

Insurance is carried out for the amount specified by its sender or recipient. But it should not exceed the actual value of the cargo. The value of the goods is determined by transportation documents.

The technology and terms of the agreement must take into account:

Features of the cargo delivery process. Products are divided into 18 groups, each of which has its own specific risk. For example, in metal it is corrosion. In addition, there are general risks. The most likely of which is the risk of theft.

The fact that there can be several carriers and modes of transport.

The fact that delivery can take place within the territory different countries Therefore, the contract must comply with the requirements of international law.

The policy comes into force from the moment the goods are shipped from the warehouse at the point of departure and continues throughout the trip.

There are specifics when concluding agreements on the transportation of containers. In their case, standard rules for road transport do not apply. And the contract is concluded under special conditions.

Imported cargo is considered insured until it arrives at the border. To transport it across the territory of another state, it is necessary to conclude another agreement. Although, subject to certain conditions, one agreement may be valid from the sender to the recipient's warehouse.

Read the contract carefully before signing. Since payment of compensation is unprofitable for the insurance company, the agreement may contain clauses that reduce or exclude payment. For example, a deadline for submitting documents when applying for a policy.

Insurance rates

The insurance rate for road transport is determined individually. This takes into account many characteristics:

Product: its group, quality of packaging, cost, volume of goods.

Machines: lifting capacity and overload.

Type and size of the franchise.

Availability of escort or security.

And many other parameters.

For example, at AlfaStrakhovanie in these cases it is only from 0.02 to 0.2% of the insured amount. For other auto insurers, these figures may be in the range of 0.01–0.7%.

Transport cargo insurance is a common type of insurance services. It is designed to effectively and reliably protect the interests of the cargo owner from potential damage, damage, loss or damage to inventory items during the voyage. In this case, the Client is reimbursed the full insured value of the goods or the amount by which it decreased as a result of the incident.

Cargo insurance can be provided by both the shipper and the carrier company. The transport organization acts as an insured, drawing up an agreement with the insurer, where the Customer is indicated as the insured person. This is one of the most convenient insurance options for the cargo owner - there is no need to look for an insurance company specializing in transportation if experienced logisticians will prepare the policy!

Cargo insurance during transportation

The terms of cargo insurance depend on the duration of the flight, the high cost, and the nature of the valuables being transported. We offer our Clients the most profitable option - with responsibility for all risks, with the exception of prescribed force majeure circumstances, providing the maximum level of protection.

Tariffs for cargo insurance are, as a rule, determined according to the declared value of transported goods and materials. Our company has a basic economical rate for insurance services - only 0.2% of the specified price of the cargo package! Please note that final prices (including for items of special value) may vary. To receive an accurate calculation of the transport and insurance tariff plan, please contact the company’s logistics manager and provide the specialist with the most complete information on delivery.

Cargo transport insurance

Cargo insurance rules prohibit issuing a policy for:

- Objects that pose a threat to the driver and vehicle.

- Having an increased hazard class according to ADR.

- Related to perishable products.

- Prohibited for transportation by the Charter of Motor Transport and the legislation of the Russian Federation.

Transport and insurance compensation for damage is also not made if it was caused due to the provision by the insured person of incomplete information about the goods, including the announcement of a value different from the actual cost of goods.

The cargo insurance contract is provided to the Customer by email and in the original. The amount of expedition and insurance costs is indicated when drawing up the application agreement. Its effect does not apply to any incidents that occurred before the start of goods delivery (loading into a vehicle) or upon its completion (completion of unloading from a vehicle).

Specify the product price, fill out the fields of the online application - and the manager on duty will tell you the insurance rate when you call back! Insure on a “New Level”!

The company "Independent Insurance Consultants" is an insurance broker that cooperates with a large number of insurance companies and has significant experience in insuring international cargo, as well as cargo on domestic flights. If you need quick and competent advice, if you want to find a partner who will completely relieve you of the problem of cargo insurance, then you have come to the right place.

Freight insurance

Currently, international cargo transportation has become the standard even for small companies. And it happens that almost all of the company’s assets are on one flight. But even for large enterprise Loss of cargo for any reason is an extremely unpleasant phenomenon. That is why today transport cargo insurance has become so relevant.

What can you insure your cargo against?

Each type of cargo, if insurance is voluntary and not mandatory, can be insured against a variety of risks. You can calculate the advisability of including certain types of risks yourself, based on common sense and personal experience. If you need guarantees, then an insurance broker will give you a more correct answer. Cargo insurance rules provide for mandatory insurance of dangerous goods and the responsibility of the cargo carrier when transporting passengers. But otherwise, you are practically free to choose an insurance program.

In addition to the fact that you have the opportunity to insure all or part of your cargo against damage or complete loss, you can also cover other losses incurred. For example, to insure the write-off and disposal of cargo, the costs of its transportation, and even include the risk of lost profits in the policy - each insurer offers its own conditions, but usually the amount of compensation for this risk does not exceed 10% of the cost of the cargo.

Applicable risks- traffic accidents;

- theft (including theft, robbery, robbery);

- taking possession of cargo through fraudulent actions of third parties;

- natural disasters;

- all kinds of damage to the cargo (breakage, breakage, chipping, etc.);

- loss of a vehicle along with its cargo;

- damage or loss of cargo as a result of the breakdown of a refrigeration unit as a result of exposure to both external and internal factors;

- risks associated with loading and unloading operations;

- risks associated with intermediate storage of cargo in warehouses, etc.

How to determine whether the assigned insurance price is fair?

This is exactly the case when an insurance broker is needed: he will help you curb the appetite of the insurance company by pointing out your strengths. After all, if you move cargo through a non-hazardous country and use the services of a reputable transport company, then you have a chance to get some discount. In addition, the insurance broker himself can guarantee you such a discount.

The cost of insurance may also be affected by the experience of the crew, the value of the cargo, that is, whether it will be of particular interest to “attackers and other third parties.” In addition, when insuring certain classes of cargo, for example, drinks in glass containers, you will not be paid for part of the lost goods.

What is a deductible and how does it affect the cost of insurance?

If you predict that part of your cargo may be lost due to transportation conditions, then you can indicate in the policy a deductible - a part of the cost of the cargo, usually from 0.1% to 3%, which you will not claim in the event of a loss. By establishing a franchise, you additionally save on the cost of insurance and can avoid the difficult procedure of collecting documents when settling minor losses. In addition, for some types of cargo transportation and types of cargo, the insurer itself will insist on a franchise.

Although the deductible is a certain limitation on the amount of insurance you receive, it also reduces the tariffs for cargo insurance during transportation, so in some cases this option may well be considered - your insurance broker will certainly give you such a recommendation.

Marine cargo insurance

Marine insurance for cargo transportation was one of the first to emerge, but is still in great demand to this day. Most often, cargo is packed in containers and fully insured against all risks. However, you can select and leave only the necessary ones. Basically, you should choose between a “total loss” or “partial damage” contract.

As with other types of insurance, it is possible to use a franchise and eliminate unnecessary risks, so marine cargo insurance is quite standard for cargo transportation.

Dangerous goods insurance

Insurance of cargo of a high hazard class is mandatory, however, in order to correctly determine the cost of insurance and tariff rates, you need to know exactly the hazard class of the cargo, the conditions of its transportation, packaging, and so on - your insurance broker will help you identify all these nuances. In addition, it is important to know that when transporting such goods compulsory insurance subject to Civil responsibility the cargo carrier who will serve this cargo.

General cargo insurance

If your company regularly deals with various companies, sending and receiving cargo around the world, then you will probably find cooperation with an insurance broker to be truly beneficial and convenient. By concluding a general cargo insurance agreement, you completely relieve yourself of all tasks of studying the conditions, filling out and collecting papers to calculate the cost of insurance premiums.

Insurance broker: all issues with cargo insurance are resolved

When it comes to transportation, domestic or international, it is a rather complex area. Especially when you consider that you often have to make quick decisions in order to defend the client’s rights. After all, “Independent Insurance Consultants” will not only allow you to save on tariffs when insuring cargo transportation, but will also provide an accurate assessment of the damage, even if the cargo is located abroad, and will be able to negotiate with insurance companies, no matter how many of them are involved in the process.

This is the only way to get guaranteed quick and adequate payments for the risks that have occurred. Dealing with insurance companies on your own can be difficult, even for very large companies with a sufficient number of lawyers on staff. So an insurance broker is a defender of your interests when insuring cargo transportation.

When transporting goods by road, there are a lot of risks that the cargo owner should take into account. During transportation, cargo may be damaged, spoiled or lose its properties. To protect your business from such phenomena, the cargo should be insured.

Cargo insurance is an effective way to reduce risk during transportation. But many companies still live by the principle “maybe it will blow through” and are in no hurry to insure their cargo. They think they are saving money this way, but they could end up losing a lot more. Damaged cargo often leads to multi-million dollar losses.

The customer can enter into a cargo insurance contract at any time before the start of its transportation. Insurance conditions depend on the type of cargo, route and other factors. All these conditions are specified in the insurance contract.

Types of insurance contracts

Any insurance company must have a state license and operate on the basis of special insurance rules. These rules describe the types of contracts concluded by the company, the list of insured risks and the procedure for indemnifying losses. These documents are identical for most insurers, as they are based on the Cargo Transportation Rules developed by the ICC - Institute Cargo Clauses (Institute of London Insurers).

You can insure cargo belonging to a legal entity, transported by any transport around the world; various costs associated with transporting cargo and even the expected profit from the sale of transported cargo.

The contract insures cargo against damage or complete loss during transportation by different modes of transport.

There are different types of insurance contracts:

Responsible for all risks

In this case, insured events are complete loss or damage to the cargo or part of it due to any event.

With liability for private accident

In this case, the insurance will compensate for damage or complete loss of the entire cargo (part of it) due to:

- Fire, whirlwind, storm, lightning (other natural phenomena specified in the contract), disaster, vehicle collision;

- Disappearance of transport without a trace;

- Accidents during loading, stowage, unloading of cargo.

No liability for damage

In this case, the insurance company pays money only for the complete loss of all or part of the cargo due to:

- Various natural disasters (fire, whirlwind, storm, lightning);

- Disappearance of vehicles;

- Emergency during loading, stowage, unloading of cargo;

- accident (collision with another car).

With responsibility for agreed risks

In this case, money is paid for damage or loss of all (part) of the cargo due to:

- Lightning, earthquakes, whirlwinds, storms, volcanic eruptions and other natural phenomena;

- Disappearance of cargo and vehicle;

- Damage due to precipitation;

- Theft, robbery, assault and other illegal actions of third parties;

- Damage to perishable goods due to failure of refrigerated vehicles;

- Other events specified in the insurance contract.

The insured amount is determined by the accompanying documents (bill of lading, etc.). Sometimes the sum insured may include expected profits, freight, commission and other transportation costs.

The cargo owner can insure a one-time shipment or enter into an insurance contract for a year if he frequently transports cargo.

The amount of the insurance payment depends on the chosen insurance rate and the amount of the insured amount, method of transportation, packaging, territory safety, security, transportation distance, insurance period and franchise amount.

Each contract contains a list of exceptional cases for which the insurance company is not responsible. Typically these are risks associated with military operations; with gross negligence or intent of the policyholder (violation of transportation rules). The insurer will not pay for any shortage of cargo if there is no visible damage to its packaging.

How to receive insurance compensation?

For the insurer to make insurance payments, the cargo owner will have to prove the occurrence of an insured event (the fact of damage or loss of cargo).

The customer must report the incident to insurance company. Within 2-3 days after the occurrence of the insured event, you must submit a written application to the insurer demanding payment of insurance compensation.

At the same time, a written claim must be sent to the carrier. If this is not done, the insurer may not pay the required amount.

Then you need to prepare documents confirming the fact of damage or loss of the cargo. In the event of an accident, such a document is the conclusion of the traffic police. Some contracts provide for mandatory examination of the nature of damage to the cargo by an employee of the insurance company or an independent appraiser.

The cargo owner must send the insurer copies of the following documents:

- application for payment of the insurance amount,

- transportation contract,

- waybills with marks on the route of movement,

- evidence that the carrier (insured) tried to salvage the cargo,

- conclusion of government bodies.

Thus, the cargo owner must assess the potential risks that could cause damage or loss of cargo and include them in the insurance contract. If all provisions of the contract are observed, he will protect himself from possible losses.

Insurance of transported goods is the main type of property protection for cargo owners. The service will help the policyholder avoid significant material damage, as well as large expenditures of effort and time.

According to Russian and international cargo insurance rules, the carrier bears limited liability for the transported goods. This means that only insurance protection is able to fully compensate for the cost of transported products in the event of their complete loss. This is especially true for international cargo transportation and when delivery is carried out by several transport companies.

What cargo insurance services do we provide?

Insurance coverage covers a wide variety of delivery methods.

- Car cargo insurance will help protect products when transported by any type of vehicle, regardless of power and weight.

- Protection of goods during rail transportation.

- Delivery by sea. Such cargo insurance is especially in demand during international transport.

- Air transportation in short- and long-distance directions.

Types of risks when insuring cargo delivery:

- loss;

- shortage;

- damage to part or all of the transported products;

- failure to meet delivery deadlines.

Cargo insurance rules provide protection for these risks due to accidents, natural disasters, negligence and negligence, as well as malicious intent of transport company employees or third parties. The probability of any of the above circumstances is quite high for any type of transport.

Dangerous goods insurance also compensates for damage that the transported object may cause. environment– in case of damage to the integrity of the packaging or for other reasons.

If fraud is detected (for example, if the transported products were insured twice), compensation is not provided.

Advantages of cargo transport insurance at Zetta Insurance

- To issue a policy, a minimum of documentation is required.

- The insurance sum, among other things, can reimburse the costs of customs clearance, forwarding, storage and other costs.

- A cargo insurance contract during transportation can be valid for a long time or apply to one transportation.

- Convenient payment terms.

- Organization of cargo insurance for any domestic and international destinations.

- 24/7 free customer support.

- Payments are made within 10 days after submitting all documents.

How to find out the cost of cargo insurance?

Zetta Insurance specialists will help legal entities select the optimal tariffs for any property and method of transportation. You can find out the price of cargo insurance for transportation by road or any other type of transport from your personal agent or by calling us by phone.