How to claim a debt. How to repay a debt on a receipt yourself or through the court - step-by-step instructions. Procedural procedure for debt collection

Loans and credits are something without which modern life is unimaginable. Funds are used in difficult financial situations, in cases where a certain amount is needed to purchase property or open a business. However, this positive opportunity often turns into a nightmare for the lender. Debts are often not repaid. Sometimes the debtor's obligations can be very large, and therefore difficult to forgive.

How to repay a debt? There are legal and other instruments for this. They can be used individually or in combination. For each specific situation, the measure that will be most effective is selected.

How can I repay my debt?

Most debt collection issues are resolved at the pre-trial stage. Negotiations are underway between both parties, as a result of which a compromise option for the return of funds is found. This is the easiest way to get money. But it is not always working and, if a person does not want to give up the funds, the creditor can take more serious measures.

How can you force a debtor to pay money on your own?

Involves independent conflict resolution. A person needs to study the laws, consult with a lawyer and prepare a list of articles that the debtor violates. In this case, there must be documents confirming the existence of debt. Such documents may be an invoice, an act of acceptance of work or goods, or, for individuals, a receipt. Read how this happens on our website.

Involves independent conflict resolution. A person needs to study the laws, consult with a lawyer and prepare a list of articles that the debtor violates. In this case, there must be documents confirming the existence of debt. Such documents may be an invoice, an act of acceptance of work or goods, or, for individuals, a receipt. Read how this happens on our website.

Then, with a list of demands, the creditor turns to the person who has the debt. This is a measure of psychological pressure. It is required to notify the debtor of what measures will be taken if he refuses to pay the money.

Another independent measure is filing a claim. must contain requirements for the person, as well as the time frame within which he must pay the money. If the conditions are not met, you can proceed to the next stage.

Going to court is one of the most effective ways.

Trial

How to force a person to repay a debt? Going to court is one of the most effective ways. To initiate proceedings you need:

How to force a person to repay a debt? Going to court is one of the most effective ways. To initiate proceedings you need:

- Draw up an appropriate claim;

- Attach to the claim documents that confirm the existence of the debt and its amount;

- File a claim in a magistrate or district court. If the amount of the claim is less than 50,000 rubles, the issue can be resolved through a magistrate.

The method is effective because the bailiffs who will conduct the enforcement process have legal leverage over the debtor. For example, this is the seizure and sale of property, withdrawal of funds from wages. How are debts collected under writs of execution? A lawsuit will be most effective in the following cases:

- The debtor has assets, property, bank accounts from which money can be obtained;

- The statute of limitations expires, and the creditor has the last opportunity to resolve the case through the court;

- All documents confirming the amount of debt and late payments are available.

But solving the problem through the courts has many disadvantages. Until the defendant’s guilt is proven, the costs of conducting the case are borne by the creditor. This is a lengthy procedure that does not always solve the problem.

How to collect a debt by contacting unofficial law enforcement agencies?

How to get out of debt? Often a desperate creditor comes up with the idea of turning to unofficial structures to forcefully resolve the issue. However, this measure has not been relevant for a long time. Firstly, the time of gangs and authorities resolving issues through violence has already passed. Secondly, the influence of law enforcement agencies has increased, and the creditor may suffer serious punishment for his initiative.

In the event of illegal debt collection, the debtor has all the tools to bring those involved in the pressure to justice. This brings with it problems with the law and damage to your reputation.

Institutions that help collect debt from a person

This measure is appropriate both at the pre-trial and trial stages. The creditor can contact the following structures:

This measure is appropriate both at the pre-trial and trial stages. The creditor can contact the following structures:

- Security Service. A package of documents about the debtor is transferred to the company's security service. This may be personal information, information about relatives, if the latter is specified in the contract. Service employees try to contact the person and put pressure on him within the framework of the law;

- Collection agencies. This is the most popular measure to get money. The agency can only receive a portion of the amount owed. You can also sell the debtor's obligations to him. The intervention of collectors is very effective, because they themselves are interested in getting money.

The agency uses various psychological measures of pressure on the debtor. The range of his rights is quite limited, and therefore situations of violation of the law often occur in the process of pressure. The person who has the obligations, in this case, can file a lawsuit complaining about illegal actions; - Mediator service. Mediators are specialists who help resolve conflicts peacefully. They are responsible for finding a compromise between the two parties and conducting negotiations. Such services are becoming increasingly in demand. They are legal and beneficial for the creditor and debtor.

How to collect a debt? To do this, you can choose one of the listed measures, or combine them.

The creditor can turn to collectors in order to receive money after receiving the writ of execution. Since bailiffs do not always carry out their work efficiently, turning to the relevant structures will help speed up the process.

How to force a person to repay a debt? The lender has quite a few effective tools to get money. But to apply them, you must first familiarize yourself with the law:

- Firstly, these are the measures that are taken when funds are provided. The creditor can and must protect himself from the debtor’s dishonesty.

- Secondly, these are judicial and extrajudicial measures that allow the recovery of money issued earlier.

How to collect a debt? To do this, you can use the following levers of influence on the debtor:

You can repay the debt at the pre-trial and judicial stages.

You can learn more about how to repay a debt by legal means from this video:

How to collect a debt? The lender has a lot of leverage. Litigation is expensive in terms of time and money. Contacting debt collectors may result in their illegal actions, which will result in legal liability for the creditor. The best way out is to find a compromise with the debtor, since other methods have their drawbacks. At the negotiation stage, about 60% of debts are repaid. It's safe and really works.

In Moscow, the situation with unrepaid debts to the borrower is common. In case of non-repayment of a debt to a borrower, the law and the court protect the rights of the borrower and apply mechanisms for the debtor to repay the debt by court decision. The court defends the borrower's rights to return the funds lent to the debtor. Does the debtor have nothing to repay the debt to the borrower? The court instructs bailiffs to seize the property and sell the property. The debt of the debtor by court decision is repaid from the proceeds.

Important! A receipt (written agreement) to lend money to a debtor guarantees a court decision in favor of the borrower. If there is no receipt (written agreement) about the loan between the debtor and the borrower, it is problematic to prove to the court that the borrower lent money to the debtor. The borrower will need the assistance of a qualified attorney and strong evidence in court to force the debtor to repay the judgment debt.

Pre-trial collection of debt from the debtor

The borrower should try to solve the problem of non-repayment of the debt by the debtor with the help of a lawyer without going to court to recover the debt by court decision. The trial takes a long time, and a decision in favor of the borrower does not guarantee quick repayment of the debt by the debtor. The intervention of the borrower's lawyer shows the debtor that the borrower's intentions are serious. The presence of a lawyer motivates the debtor to repay the debt to the borrower or to seek compromises with the borrower that are convenient for the debtor and the borrower, without bringing the matter of debt repayment to court.

If a compromise between the debtor and the borrower on the repayment of the debt is found without going to court, it is important to document the agreement between the borrower and the debtor with the assistance of a lawyer or the borrower’s attorney. If the debtor continues to ignore the borrower's demands for repayment of the debt, the written agreement will become evidence for the court of the fact that the borrower has transferred money to the debtor, evidence of the debtor's refusal to fulfill the obligation to repay the debt to the borrower.

How to repay a debt by a court decision?

The debtor does not fulfill the borrower's demands and does not repay the debts? Then the borrower must apply to the court with a demand to seize the debts of the debtor by court decision. The borrower will need the help of a lawyer to draw up documents to claim the debt under a court decision in court and a quick court decision on repayment of the debt under a court decision.

A receipt (written agreement) from the debtor to the borrower for a loan of money is the basis for the forced collection of debts in court, guaranteeing the borrower a court decision in favor of the borrower and the collection of debts to the borrower by court decision from the debtor forcibly. The court sets the deadline for the debtor to reimburse the borrower. Within a specific period, the debtor must return the debts to the borrower according to a court decision. The court rarely takes the side of the debtor in the absence of compelling evidence that the borrower has transferred funds to the debtor.

The procedure for claiming debt by court decision

The debtor does not comply with the court decision and refuses to repay the debt to the borrower? The debt will be collected by bailiffs. Bailiffs withhold part of the proceeds until the debt is returned to the borrower. Bailiffs examine the property owned by the debtor, his financial assets. Bailiffs seize deposits, cars, land and real estate, valuables for the purpose of reimbursing debts and court costs. The property of the spouse is examined and the debtor's share is confiscated and the debtor's debt is paid, since property acquired during marriage is considered common.

Important! Bailiffs cannot seize housing to pay a debt from the debtor to the borrower if it is the only real estate, and also housing in which minors live or partly own cannot be alienated to pay the debt by the debtor to the borrower. Bailiffs cannot seize equipment from the social package to pay the debt from the debtor to the borrower.

Assistance from a lawyer in collecting debt through court

Every borrower will need advice from a qualified lawyer when recovering a debt from a debtor through the court. Lawyers at Pravosfera have extensive experience in litigation for debt repayment through the courts. Our lawyers guarantee compliance with the legal rights of the borrower and repayment of the debt by the debtor through the court.

To go to court and file an application to initiate a case, you will have to pay a state fee. Its amount will not exceed 60 thousand rubles, but it can still be quite significant. So, for example, for a debt amount of 50 thousand rubles, the state duty will be at least 1,700 rubles.

If the court accepted the case for consideration and decided on the need for compensation, you can count on success. True, the debtor has the right to appeal the court decision. If he does not plan to do this, the case goes to the bailiffs, and they begin enforcement proceedings.

For a receipt and about what? and in any case you are obliged to repay the loan. now figure out how. further. How to reclaim what was taken from Yes, yours. further. An acquaintance borrowed money without a receipt. He paid off the debt with household appliances because he had no money. Write to pay back the debt with appliances.

The bailiff service, as you say, collects the debt on the basis of a writ of execution, a court decision, or a resolution to initiate enforcement proceedings.

Before you demand that the bailiffs collect the debt from your debtor, you need to file a statement of claim in court, and there, if you prove that your debtor owes you (cases of receipts are very difficult), then you will be given a court decision, a writ of execution. With these documents, contact the bailiff service with an application to initiate enforcement proceedings.

Only after these actions will you be able to write to the prosecutor’s office and other authorities about the illegality of actions/inactions of bailiffs

How to claim a debt without a receipt

Can I demand repayment of the debt on a receipt earlier than it is agreed upon due to the fact that the debtor is hiding? Well, include a clause stating that the person who lends money has no right to claim it earlier than the period specified in this receipt, otherwise the debtor will.

You have the right to go to court to recover the amount specified in the receipt. At the same time, it is necessary to keep in mind the following: if the receipt does not indicate a specific date for repayment of the debt, then you need to contact the debtor in writing with a demand to return the money to you. after 30 days you have the right to go to court. the receipt does not have to be notarized, and witnesses are not needed either. the main thing is that the receipt is written or signed by the debtor, it indicates to whom, how much is owed, the date of issue of the receipt, etc.

How to claim a debt without a receipt

How to repay a debt without a receipt is a question that is gaining immense interest among the population every day. The Internet is full of advertisements: debt repayment, debt repayment, debt repayment and the like. Colorful offers beckon, especially since all possibilities have been exhausted. Here salvation is a colorful sign, like a straw to a drowning man. Is it worth applying for such services? Decide for yourself. It is not news that there are several ways to repay a debt, both legal and illegal. The most correct and sure thing is to repay the debt through the court, which, as a rule, is feared and with faith and hope they wait for a miracle with a full wallet that comes in a dream. Using an illegal method can lead to an illegal response! There is little choice.

Debt repayment legally, through court, without receipt. The decision was chosen correctly and there is nothing to be afraid of. All you need is a statement of claim, a receipt from the debtor, witnesses (if any), hope for success. You can draw up a statement of claim yourself, but there is a chance of getting it back to correct the shortcomings. Ordering from a legal consultation is expensive!

How to repay a debt without a receipt or witnesses - three methods to solve the problem

For example, divide the amount of debt over a certain amount of time. So it’s easier to return 500 rubles a month than 2000 at once. If there is no trust in the borrower, you can contact a notary (third party), who will document an agreement to repay the debt in installments.

- Audio and video recordings of conversations in which the borrower himself does not deny the fact that he owes money, as well as exactly how much.

- Recordings from voice recorders that confirm the fact that the borrower does not want to repay the debt, as well as the reason for this.

- Correspondence on the Internet, as well as SMS messages on the phone.

How to claim a debt without a receipt

Before contacting the police, you need to send an official letter to the debtor. In the letter you should write everything that was indicated in the email correspondence and in the telephone conversation. The letter must be registered so that you have notification of delivery to the recipient. You can also use telegram.

If you do not want to contact the police, then You can immediately write a statement to the court directly and do not wait for a decision from the internal affairs bodies. But in this case, you will have to prepare all the evidence of the debt yourself and, perhaps, even pay a good lawyer.

Repay the debt without a receipt

And you won’t have to carry out the following actions. But if the document has been received and the deadline for repayment of the debt has passed, you can now safely go to court with a receipt. Sample statement of claim you can look further. It is the receipt that is considered documentary evidence of the debt and is the basis for going to court.

To do this, you can invite the debtor to draw up a document with a real date, or the actual date of receipt of the loan. It depends on whether you intend to receive interest on the borrowed amount. In the case of interest, it is better to date the actual borrowing.

Is it possible to sell an individual's debt to collectors?

Collection agencies perform an important function - they are professional debt collectors. Until recently, their methods of influencing debtors were effective and brought results. Today, the activities of collectors are greatly limited by law, so not all agencies buy out bad debts.

Of course, buying debt is beneficial for collectors, especially when it comes to large amounts and high chances of collecting the debt. After all, before agreeing to a deal, agents carefully calculate all the risks and assess the solvency of the would-be borrower. And the higher the risks, the lower the transaction amount.

Are there ways to repay a debt without a receipt?

- all the circumstances of the situation that has arisen,

- time and place of money transfer,

- exact details of the debtor (full name, passport data, date of birth, place of residence),

- the amount of time that has passed since the day on which the debt was supposed to be repaid,

- requests for verification for crime.

Almost every sane person who finds himself in this situation understands that his chances of the debtor returning the money are slim. This is obvious and quite logical, because if the return of debt without a receipt becomes a precedent, imagine how many people will appear who want to raise money in this way, by fabricating imaginary debtors.

How to collect a debt from a debtor without a receipt

Did the defendant take possession of your funds through breach of trust? Does not repay the debt, taking advantage of the fact that you do not have documented evidence of the fact of the financial transaction. Yes it is. Consequently, he is a fraudster and will be held accountable to the law under this article.

Firstly, this is SMS correspondence. If you have one, you can print it out and have it certified by a notary - the court accepts and considers this kind of correspondence without any problems. However, this option cannot be called 100% reliable either, because... the debtor may begin to justify himself by saying that he did not have the phone at the time of such correspondence and that someone else sent the messages to the plaintiff. It is extremely difficult to prove or disprove the veracity of such statements, so for greater reliability it is recommended to prepare several types of evidence.

05 Aug 2018 207Debt obligations recorded in the receipt must be fulfilled, since the receipt, according to Article 810 of the Civil Code of the Russian Federation, is a legally significant document. If the requirements are ignored, the citizen can apply to the court to recover the debt.

We will tell you how to repay debts on a receipt, what methods are provided for this and what needs to be prepared. We will also consider what will happen if the court sides with the creditor, and answer pressing questions.

How to repay a debt on a receipt yourself - the procedure for pre-trial debt collection

Before going to court, the Russian must try to resolve the issue of repaying the debt under the receipt directly with the borrower.

To independently recover a debt, a citizen can use the following methods:

- Call the debtor by phone and remind them of their obligations to you.

- Meet with the borrower in person and demand that the issue be resolved peacefully.

- Send a registered letter to the debtor. Write in it that if the debt is not repaid within the period specified in the receipt, then you will go to court. If you plan to transfer the debt to a collection agency, then you can indicate this in the letter. Be sure to receive a notification confirming the debtor's acceptance of the letter.

- Send the claim to the borrower with written demands. You can indicate that in case of late repayment of funds, interest will be charged on the debt. They are determined depending on the refinancing rate (Article 395 of the Civil Code of the Russian Federation).

The letter or complaint should not contain emotions or insults towards the debtor. In the sent document, the citizen can write that he will go to court to further resolve the problem.

Advice: You can involve a lawyer in the negotiations - especially if the receipt was issued by a notary.

The specialist must explain to the debtor how important it is to pay off the debt and describe further possible problems which may occur in case of non-payment.

List of documents to the court for debt collection by receipt in court

There is a standard package of documents required when applying to judiciary in case of collection of a debt by receipt.

Of course, the applicant will have to formalize and draw up a claim. This is the main paper in which the meaning of the appeal is recorded, as well as the requirements.

Let us indicate what else should be included in the documentation package in 2018.

All original documents are provided to the court upon request. You can submit copies for consideration, and when you come to the court hearing, you can show them to the secretary.

Don't forget to take the original documents with you.

Please note , documents along with the claim can be considered by different authorities.

We will determine where you can submit documents and under what circumstances:

- To the world court. Documentation will be accepted if the amount of debt is less than RUB 50,000.

- To the district court. Documents will be accepted when the amount of debt exceeds 50,000 rubles.

As a rule, when you come to the secretariat in person, you will be informed whether the statement of claim will be accepted or not. If accepted, you must submit the documents listed above. If they don’t accept it, you’ll have to go to another authority.

It’s another matter when documents are sent by mail. Then you will learn about the refusal to consider when you receive a return letter from the court.

You will also be able to bring some papers if you suddenly forgot them. This is not possible when applying by mail.

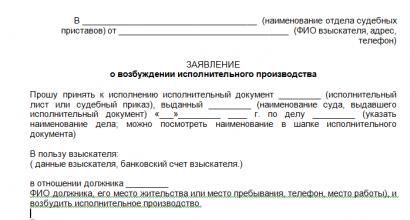

The procedure for collecting a debt by receipt through the court - step-by-step instructions

To claim a debt against a receipt, go through pre-trial procedure to resolve the issue, the citizen can go to court.

To do this, you must follow these instructions:

Step 1.

Prepare a documentation package. Step 2

. Write a statement of claim. In another article we will look in more detail at how to do this. Step 3

. Contact the judicial authorities. Select the authority that will accept the documents and the claim. You can come to court in person or send papers by mail. It is imperative that the person accepting the claim must sign on your copy of the statement of claim to confirm acceptance. Step 4

. Pay the state fee. The secretary will provide you with the details. Step 5.

Wait until the day the court hearing is scheduled and take part in the proceedings. The plaintiff must be present, but the defendant may not come. Step 6.

Receive a court decision and writ of execution. Step 7.

Contact the FSSP office and submit the writ of execution to the employees.

If the court makes a decision not in favor of the plaintiff, then you can file an appeal - and challenge this result.

The court's decision on the return of money from a debt receipt is in your favor: when and how should the debtor repay the debt under the law? Once the judge rules in your favor, time must pass for the document to become legally binding. The court decision will enter into legal force only.

after 1 month

- During this time, the plaintiff can do nothing, but then to claim the debt he must:

- Contact the bailiff service office in your city or district.

- Provide employees with a writ of execution.

Please note Wait for the bailiffs to return the funds from the debtor. By law, they must complete enforcement proceedings within 60 days, but in practice this period becomes long, for example, due to the insolvency of the defendant-borrower.

that the defendant will repay the debt through the bailiff service, not in person.

Some advise informing the bailiff about the possible property of the debtor so that the process of collecting the debt proceeds faster. The situation is such that bailiffs interact mainly with the debtor, while the plaintiff remains on the sidelines - and may even wait for years for payment of the debt.

Alternative and simplified methods of collecting debt by receipt

A Russian who does not want to collect a debt through a court may resort to another method of collection Money. An alternative option is the assignment of rights, or the sale of debt through a private company.

The citizen must prepare all documents and contact the organization engaged in debt repayment. Today, there are a lot of companies that are ready to buy out debts.

The procedure goes like this:

- A citizen contacts the company and provides documentation.

- Next, an assignment agreement must be concluded with him. It specifies all the conditions for the transfer of rights.

- The organization then pays the client the debt in full or in part, depending on the contractual terms.

If a citizen appealed to the judicial authorities and a decision was made, then FSSP employees will handle the claim, and it will not be possible to sell the rights to repay the debt to collectors.

Is it possible to repay a debt using a receipt if the debtor has nothing?

Debts will be claimed by bailiffs - and they, in turn, when a person has absolutely nothing, act like this:

- They interact with the defendant-borrower, find out what funds he has, and in what amount.

- Determine whether the borrower has property.

- They repeatedly remind the citizen to repay the debt.

- They may be held administratively liable and forced to pay a fine in case of non-payment and failure to comply with the requirements of officials.

- They can recover property if the amount of debt is large.

Any fact of transfer must be recorded by bailiffs.

If a person has nothing at all - no money, no property - then he will definitely be held accountable and forced to perform forced labor. The severity of the punishment depends on the amount of debt and the diligence of the citizen.

If the bailiffs do not do their job, then you can complain about them to the Prosecutor's Office or a higher authority of the FSSP.

There are often cases when acquaintances or friends ask for a loan of money, and few people think of bothering with receipts or witnesses to the loan.

The way society has developed is that nothing is spared for friends and acquaintances, but the consequences of such a loan can not only ruin friendships, but also affect the financial situation of the “savior” himself.

Oral agreements have their own dangers, as they do not provide guarantees that the debt will be repaid.

This practice exists even among families, but if it is 10-20 rubles, the loss is small, but if the amount exceeds 1000 rubles, it makes sense to think about it. We will find out further why people cannot or do not want to repay a loan, as well as how a debt can be repaid legally without a receipt and witnesses.

How to collect a debt from a debtor without a receipt? If the fact of transfer of money was not recorded and documented by a third party, debt collection becomes a real problem.

It is extremely difficult to prove when you lent to whom and how much if there is no evidence. However, human rights activists argue that legislation can support and also create all the conditions for the debt to be repaid.

There are three main methods of debt collection that have legal grounds. Among them:

- a statement to the police about fraud;

- trial;

- settlement agreement.

It is recommended to use these methods of debt repayment, since they are not only legal, but also do not pose a threat to the life and health of the borrower (as is the case when using the services of collection services).

The most cruel and dangerous for both parties are the services of debt collectors. For a certain amount, specially trained people are ready to literally knock out money and find it where there is none. It is better not to get involved with organizations that operate illegally and can harm the life of the borrower. Be that as it may, no amount of money can replace a good friend and comrade, not to mention relatives. Let's consider ways to collect funds that are more effective and also operate within the law.

When collecting a debt, it is extremely important to take into account the moral side of the situation. If the person who owes money is really in a difficult financial situation and does not deny this, you can try to negotiate.

For example, divide the amount of debt over a certain amount of time. So it’s easier to return 500 rubles a month than 2000 at once. If there is no trust in the borrower, you can contact a notary (third party), who will document an agreement to repay the debt in installments.

The best option is to contact a notary, who will draw up a settlement agreement, indicating the rights and obligations of the two parties, indicating:

The best option is to contact a notary, who will draw up a settlement agreement, indicating the rights and obligations of the two parties, indicating:

- loan repayment period;

- sum;

- consequences that entail liability in case of refusal to further repay the debt.

You can also draw up a receipt in which the borrower himself indicates that he borrowed money from a specific person (indicating his full name and surname, year of birth and actual address), and also undertakes to return it within the specified time frame. The document is valid after certification by a notary, and can also later be used in court as material evidence.

If, on the contrary, a person is hiding, has changed his place of residence, or is deliberately avoiding contact, then a trial cannot be avoided.

First of all, you need to try to come to an agreement on your own. This will not cause further discord in the relationship, nor will it ruin the reputation of both parties. Law enforcement is a last resort when the situation is truly out of control and requires third party intervention.

There is no need to be afraid to stand up for your rights. Many people are ready to forgive a large sum to their debtor, just to avoid the situation becoming public.

In addition to the fact that the money will be returned, you can also claim moral compensation, which the borrower will definitely pay if his guilt in failing to pay the debt is established by the court.

Contacting the police

If the borrower, without substantiating the reason, refuses to repay the debt, you can contact the nearest police station and write a statement about fraud, in which you indicate in detail all the details of the situation.

If the borrower, without substantiating the reason, refuses to repay the debt, you can contact the nearest police station and write a statement about fraud, in which you indicate in detail all the details of the situation.

Within a certain time, it will be considered, and the borrower will be summoned for questioning, the result of which will determine the further course of action.

During the interrogation, if the borrower categorically denies the fact of borrowing money, the investigator will transfer the case to court, where further proceedings will be carried out.

Usually, the police department makes the borrower understand the seriousness of the situation, as well as the burden of responsibility that awaits him in the event of further refusal to collect the debt. If, even after these convictions, “things are still there,” then the court will deal with further proceedings.

Statement of claim to court

Let's look at how to collect money from a debtor without a receipt through the court.

Let's look at how to collect money from a debtor without a receipt through the court.

If the amount is serious, and the borrower behaves boorishly, categorically refusing to return the money received as a loan, you can skip the previous point and go straight to court.

It is advisable to support the judicial statement with any evidence, among which you can use:

- Audio and video recordings of conversations in which the borrower himself does not deny the fact that he owes money, as well as exactly how much.

- Recordings from voice recorders that confirm the fact that the borrower does not want to repay the debt, as well as the reason for this.

- Correspondence on the Internet, as well as SMS messages on the phone.

The more evidence is collected, the faster the debt collection case will move forward. It would also be useful to know that the borrower is quite capable of repaying the debt. This may be evidence in the form of a certificate from the place of work about wages for the last 3 months, as well as photos of purchases made during the loan.

Usually the defendant is explained in detail that he will not only return what he owes, but also moral compensation for what is happening. This is quite enough to sign a settlement agreement, as well as agree on a debt repayment scheme in the presence of third parties. The prospect of paying what you owe and also compensation for moral damage is not particularly encouraging, forcing you to think about your own behavior and repay the debt as quickly as possible, putting an end to numerous disputes and trips to court.

You need to understand that in some cases it is extremely difficult to prove that the borrower owes money. This significantly aggravates the legal process and can also make its outcome not in favor of the plaintiff.

Let's look at two key factors that significantly influence debt collection:

- Presence or absence of evidence. If in court there is nothing to present except a claim with the stated situation, the probability of debt repayment sharply decreases to 12%.

- The behavior of the borrower, as well as his denial or agreement to repay the debt. If a person is friendly, but due to the current difficult financial situation, he does not have the opportunity to return the entire amount, you can always compromise by agreeing on the timing of the return of the money. If the fact of the loan is not recognized, the case may be closed due to the lack of corpus delicti and evidence.