Sub-count 10 5. See what “05 count” is in other dictionaries. "Receipt of spare parts from the supplier. Reflection of the debt to the supplier under the contract in rubles."

Materials are a type of organization’s reserves, which include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials (clause 42 of Order of the Ministry of Finance dated December 28, 2001 No. 119n). To account for them, the Chart of Accounts and the Instructions for its application provide for active account 10 “Materials” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Subaccounts 10 accounts

The chart of accounts for account 10 provides for the opening, in particular, of the following sub-accounts:

| Subcount to count 10 | What is taken into account |

|---|---|

| 10-1 “Raw materials and materials | - raw materials and basic materials (including construction materials - from contractors) that are part of the manufactured product, forming its basis, or are necessary components in its manufacture; - auxiliary materials that are involved in the production of products or are consumed for economic needs, technical purposes, or to assist the production process; - agricultural products prepared for processing, etc. |

| 10-2 “Purchased semi-finished products and components, structures and parts” | Purchased semi-finished products, finished components (including building structures and parts from contractors), purchased to complete manufactured products (construction), which require costs for their processing or assembly |

| 10-3 "Fuel" | — petroleum products (oil, diesel fuel, kerosene, gasoline, etc.) and lubricants intended for the operation of vehicles, technological needs of production, energy generation and heating; - solid (coal, peat, firewood, etc.) and gaseous fuels |

| 10-4 “Containers and packaging materials” | All types of containers (except for those used as household equipment), as well as materials and parts intended for the manufacture of containers and their repair (parts for assembling boxes, barrel staves, hoop iron, etc.) At the same time, trade organizations take into account containers under goods and empty containers on account 41 “Goods” |

| 10-5 "Spare parts" | Spare parts purchased or manufactured for the needs of the main activity, intended for repair, replacement of worn parts of machines, equipment, vehicles, etc., as well as car tires in stock and circulation. In this case, car tires (tire, tube and rim tape), which are on the wheels and in stock with the vehicle, included in its initial cost, are taken into account on account 01 “Fixed assets” |

| 10-6 "Other materials" | — production waste (stumps, scraps, shavings, etc.); - irreparable marriage; — material assets received from the disposal of fixed assets that cannot be used as materials, fuel or spare parts in a given organization (scrap metal, waste materials); — worn tires and scrap tires, etc. |

| 10-7 “Materials transferred for processing to third parties” | Materials transferred for processing to third parties, the cost of which is subsequently included in the costs of production of products obtained from them |

| 10-8 “Building materials” | Materials used directly in the process of construction and installation work, for the manufacture of building parts, for the construction and finishing of structures and parts of buildings and structures, building structures and parts, as well as other material assets necessary for construction needs (subaccount is used by developer organizations) |

| 10-9 “Inventory and household supplies” | Inventory, tools, household supplies and other means of labor that are included in funds in circulation |

| 10-10 “Special equipment and special clothing in the warehouse” | Special tools, special devices, special equipment and special clothing located in storage areas |

| 10-11 “Special equipment and special clothing in operation” | Special tools, special devices, special equipment and special clothing for use (in the production of products, performance of work, provision of services, for the management needs of the organization) |

Receipt of materials is reflected as a debit to account 10, and disposal as a credit. At the same time, account 10 corresponds with various accounts depending on the source of receipt or direction of disposal of materials.

Typical accounting entries for account 10

We present in the table some typical accounting entries using account 10:

| Operation | Account debit | Account credit |

|---|---|---|

| The receipt of materials is reflected (if account 15 “Procurement and acquisition of material assets” is used) | 10 | 15 |

| Reflects the release of materials from the main production | 20 "Main production" | |

| The production of materials by auxiliary production is reflected | 23 “Auxiliary production” | |

| Materials received from supplier | 60 “Settlements with suppliers and contractors” | |

| The purchase of materials through an accountable person is reflected | 71 “Settlements with accountable persons” | |

| Materials received as a contribution to the authorized capital | 75 “Settlements with founders” | |

| Reflects excess materials based on inventory results | 91 “Other income and expenses” | |

| Materials written off for the construction of fixed assets | 08 “Investments in non-current assets” | 10 |

| Materials transferred to main production | 20 | |

| Materials assigned to general household needs | 26 “General business expenses” | |

| Materials written off to correct defects in production | 28 "Defects in production" | |

| Recorded write-off of materials in a trade organization | 44 “Sales expenses” | |

| Cost of materials sold written off | 91 | |

| A shortage of materials was identified as a result of an inventory count. | 94 “Shortages and losses from damage to valuables” |

- (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; solicitor selling on behalf of... ... Financial Dictionary

check- to take into account, to invent at someone else’s expense, there is no money, to live at someone’s expense, to take into account, to someone else’s account, to someone else’s account, not to count, to end the account, to end the account, to take words at one’s own expense, walk around at someone's expense, reduce... ... Synonym dictionary

Capital account- (capital account) 1. Account into which investments in land, buildings, structures, machinery and equipment, etc. are recorded. 2. Budgeted expenditures for major items, especially in public sector financial plans... Financial Dictionary

Check- (account) 1. A document indicating the debt of one person to another; invoice. A person providing professional services or selling goods may invoice his client or customer; solicitor selling on behalf of... ... Dictionary of business terms

Vostro account- (vostro account) A foreign bank account in a British bank, usually maintained in pounds sterling. compare: nostro account. Finance. Dictionary. 2nd ed. M.: INFRA M, Ves Mir Publishing House. Brian Butler, Brian Johnson... Financial Dictionary

DEPO NOSTRO ACCOUNT- an active analytical securities account opened in the accounting records of the domiciliant's depositary. This account is intended for accounting for securities deposited or for accounting with a domiciliary depository, or securities registered with the registrar on... ... Legal encyclopedia

Accounting Account 20 Main Production Dictionary of business terms

Vostro account- (vostro account) A foreign bank account in a British bank, usually maintained in pounds sterling. compare: nostro account. Business. Dictionary. M.: INFRA M, Ves Mir Publishing House. Graham Betts, Barry Brindley, S. Williams... Dictionary of business terms

INVOICE- an invoice issued by the seller in the name of the buyer and certifying the actual delivery of goods or services and their cost. Issued after final acceptance of the goods by the buyer. Contains details of the sale transaction, including volume (quantity... ... Great Accounting Dictionary

ACCOUNT(S), REPORTING- (account(s)) Report on activities (operations) for a certain period. Accountability means the obligation to prepare and provide the following reports: company directors are accountable to shareholders, and British ministers are accountable for the performance of... ... Economic dictionary

ACCOUNTING ACCOUNT 20 "MAIN PRODUCTION"- an account designed to summarize information about the costs of the main production, that is, production, the products (works, services) of which were the purpose of creating this enterprise. In particular, this account is used to record costs: ... ... Dictionary of business terms

Within the framework of the article, the necessary minimum of regulatory and methodological requirements for organizing competent accounting on account 10, in the “Materials” section, is presented in a condensed form. An employee must know these theoretical foundations for account 10 “Materials” in order to perform his labor functions according to the professional standard “Materials Accountant”.

The article examines:

- Main features of an accountant's work with an account 10;

- Key points of working with the score 10, score 15, score 16;

- Practical recommendations for working with subaccounts of account 10;

- Rules for recognizing materials as part of inventories;

- What should an accountant indicate in his accounting policy for working with account 10;

- Recent changes in legislation for small businesses to simplify the recording of transactions related to the acquisition of materials (in connection with the updated edition of PBU 5/01 and PBU 6/01, effective from June 20, 2016);

- Testing, using practical examples, a new normatively permitted approach to the registration of materials only at the supplier’s price for small enterprises;

- Changes to accounting policies after June 20, 2016 small businesses that have decided to simplify accounting for the registration of materials.

Advantages of the article:

- The article provides everything necessary for competent and conscious work according to the professional standard “Materials Accountant”;

- The article will be useful for novice accountants;

- Helps to understand the wording of the elements of the Accounting Policy embedded in the 1C accounting programs in terms of working with account 10;

- Accessible language of presentation.

When an organization receives this or that item on an invoice, the novice accountant is confused and cannot understand how to take the acquired values into account. Materials? Fixed assets? Goods? To which account or subaccount should I capitalize?

This article is intended to provide an opportunity to better understand the features of accounting on account 10 “Materials”. Of course, no one has repealed legislative and regulatory documents. However, not everyone can interpret the normative language in the correct way.

So, let's talk about account 10 “Materials”, consider the key points necessary to understand accounting on this account, and the practical side of accounting methodology.

In order to reflect something on account 10 “Materials”, you need to make sure that this “something” has the right to be accepted on this account.

Since there is no separate definition of such a category as “Materials” in accounting legislation, it is necessary to first clarify the essence of the terms - Materials, inventories, goods and materials.

The name itself indicates the essence of this category of accounting object. Whatever the organization is engaged in: business or non-profit activities, to ensure this activity it will need:

- Property that forms the material basis of the organization’s final product (basic materials);

- Property that contributes to the labor process itself (auxiliary materials);

- In addition, a certain set of things is needed in order to organize the work process itself, that is, to implement the management function.

And in order to ensure the continuity of the various stages and processes of work, you need to stock up on these things: create reserves in the required reasonable quantities and ensure their safety in storage areas. Therefore, this kind of property is accepted for accounting as inventory.

During the operating cycle, materials are consumed, losing their original material form, and the cost of the materials used is fully included in the cost of the final product. Thus, these materials have already become part of the product and their life cycle as materials in the organization has ended. And now we can talk about them only by talking about the cost of expenses in the form of materials in one unit of production, in 1 hour of repair work performed, in 1% of any services provided. The original material form has disappeared and in an altered state, in fragments, the materials are now present in the final product of the company.

Taking into account all of the above, we will not make such a mistake and will not charge the purchased electricity to account 10 “Materials”. Yes, it has a unit of measurement “kW”, it is used in production activities, but it does not have a material form, it cannot be placed in a warehouse and stored, it cannot be transferred from one department to another.

And one moment. All property owned by an organization, classified as materials, is included in the composition of goods and materials (inventory assets). The word value indicates that materials can be sold in themselves and used for production, the final product of which, if sold, will bring profit, that is, they are an element of economic wealth.

Summary

The accountant will take into account such assets as materials as inventories and assign them to account 10 “Materials” if they, having independent value and not as part of any thing:

- Will be used as materials necessary for the production of products, performance of work, provision of services, changing shape, composition, condition;

- Will be used, as a rule, in accordance with established standards or business practices;

- They completely disappear and their value is completely transferred to the manufactured product, work or service provided;

- Or, finding themselves unclaimed, they will be sold, although the material assets originally received were not intended for sale.

Main legislative and regulatory acts governing the category “Materials”

The rules for recognizing materials as part of inventories and their accounting are regulated by:

- The norms of the Federal Law of December 6, 2011. No. 402-FZ “On Accounting” in the latest edition;

- PBU 5/01 “Accounting for inventories” (as amended on May 16, 2016);

- Methodological guidelines for accounting of inventories;

- PBU 1/2008 entitled “Accounting policies of the organization.”

This is the minimum that is required of an accountant who is a candidate for the inventory area of any organization.

Having determined that the received items belong to the “Materials” category as part of the inventory, we have the right to reflect them on account 10 “Materials”.

Now there is a new task - to correctly organize accounting in accordance with the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for using the Chart of Accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, as amended on November 8, 2010 No. 142n).

General understanding of account 10 “Materials”

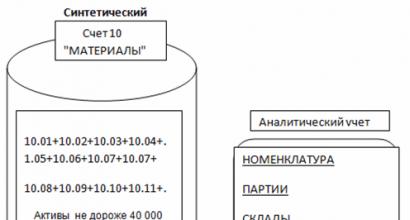

Accounting account 10 is a synthetic account “Materials”, designed to summarize information about the availability and movement of the entire set of materials, that is, all materials as a whole. The amount on the account is indicated in monetary terms.

This account belongs to the active category, which means the opening balance will be in the debit of the account, all receipts will be in the debit of the account, and expenses and deregistration will be in the credit. The ending balance will be in the debit of account 10. A negative amount on Dt 10 will indicate an error.

Schematically, in the context of economic events, this can be depicted as follows:

To reflect the variety of materials that an accountant has to work with, analytics, that is, a detailed description, must be opened for the account. In 1C software products, analytical accounting goes through the names of subaccounts.

Components of analytical accounting

Nomenclature

Records are kept for each item. If materials are received, the names of which are indicated in one unit of measurement, for example, in rolls, and for use on site a certain number of meters is required, then one unit of measurement will be converted to another. In 1C accounting programs this can be done through the dismantling mechanism.

Parties

Batch accounting means that records are kept for each receipt document, indicating the date and document number.

Warehouses

Warehouse accounting means reflecting information on storage locations in a normative manner; materials must arrive at the warehouse under the financial responsibility of the employee. Even if there is no warehouse as such, materials still arrive somewhere. It is necessary to record the storage location in the Accounting Policy, giving it a name, for example: “Office”.

Divisions

This analytics reveals information about where costs arise. For example, if stationery for the office has been received, the place of use of the materials is indicated - “AUP”, etc. This analytical accounting is required when using 1C software products.

Very important! Without indicating the department (that is, where, in fact, the purchased will be used), the 1C accounting program will not carry out the procedure for closing the month.

Important! The equality of analytical accounting data with the turnover and balances of synthetic accounting as of the last calendar day of each month must be maintained.

Subaccounts for the 10th account, classification of materials into subaccounts and practice of working with them

By account 10, subaccounts are opened. In the chart of accounts they are indicated by a dot. The prefix "sub" means subordinate. That is why all subaccounts act as components of account 10.

Let's get acquainted with the subaccounts for the 10th count. The names of subaccounts and their number in the standard plan are predetermined. The Instructions for the chart of accounts provide a list of types of materials that are reflected in each subaccount.

Let us immediately make a reservation that the list of types of materials recommended by the Instructions for the chart of accounts — not hard. The criteria for assigning purchased materials to one or another subaccount are quite conditional. The numbering of subaccounts of the synthetic account 10 Materials in the standard plan is arranged in order of importance in the production cycle of the enterprise. Therefore, it is necessary to understand the basic business process that takes place in a company, as a result of which the final product is manufactured and then sold.

Each organization must independently determine which subaccount to account for purchased materials by analyzing its production cycle.

How to analyze? For example, where should I take my stationery?

There are no clear guidelines. As a matter of business practice, materials are taken into account in subaccount 10.09. For analysis, you need to start from the statutory activities of the company. Why was the enterprise created, what is the specific final product measured in, what role do stationery play in this:

- In the consulting industry, stationery is a very important part of the production process. We decide to reflect the receipt of stationery on subaccount 10.01

- It’s the same in the education sector.

Let's say you are an accountant in a commercial kindergarten. Where should I take the sheets? Children's sleep is part of the educational production process. You decide to reflect 10.01 on the subaccount.

The decision made is fixed in the Accounting Policy through a working chart of accounts, which specifically lists the subaccounts used and describes what will mainly be included there.

Subaccount 10.01 “Raw materials and supplies”

Availability and movement are taken into account here:

a) Property that forms the basis of the final product being manufactured(products, works, services). They are necessary components of a unit of production, a unit of work or services provided.

This is how an enterprise conducting contract construction activities will reflect building materials. But, if the company itself occasionally builds something, then these building materials will be registered in another subaccount - 10.08.

An enterprise providing consulting services (accounting, legal, marketing, etc.) has the right to show office paper on this account, since as a result of the influence of intellectual work this paper has lost its original shape. The knowledge of specialists has turned into valuable information displayed on paper. However, many accountants reflect such materials on account 10.06.

As a rule, basic materials are consumed in direct proportion to the amount of the final product produced. Understanding this, you establish in your accounting policy what is primarily reflected in this subaccount as part of the main materials.

b) Raw materials.

Raw materials are usually called products from agriculture and the mining industry.

c) Auxiliary materials, who also participate in the main production process, playing an auxiliary role. They act on base materials to impart certain properties to the product.

Let's say a company produces Christmas tree decorations, then dyes and chemicals will be auxiliary materials. The consumption of auxiliary materials may not be directly related to the amount of the final product.

Understanding the above, you can easily determine the types of materials that need to be reflected in subaccounts. The decision is fixed in the Accounting Policy and in the working Chart of Accounts. Do not perceive the working Chart of Accounts as a formality, “tie” it to the production process in the company.

Subaccount 10.02 “Purchased semi-finished products and components, structures, parts”

Subaccount 10.03 “Fuel”

Fuel is conventionally divided into:

- Technological - for the technological production process;

- Engine - fuel for engines, the so-called fuels and lubricants or fuels and lubricants;

- Household - for heating.

Get 267 video lessons on 1C for free:

If you have service vehicles or various units (petrol mowers, gas generators), then fuel and lubricants will be required. Fuels and lubricants include:

- All types of fuel - gas, diesel, gasoline;

- Lubricants - oils, lubricants used in the process of repair, maintenance and operation of vehicles;

- Brake and coolant fluids.

On this account it is necessary to provide accounting for each unit and each vehicle.

A practical example of reflecting transactions for the purchase of fuel and lubricants using fuel cards, indicating key accounting points, is discussed in ours.

Subaccount 10.04 “Containers and packaging materials”

It is customary to record items used for packaging, transportation and storage of various materials and products on this subaccount. Containers include bags, boxes, boxes, barrels, cans, bottles, etc.

We often see bottles mounted on a cooler. This is just a container. Containers can be returnable, like these bottles, or non-returnable: you open the packaging and you keep it. There are subtleties of accounting for these two types of containers.

Subaccount 10.05 “Spare parts”

Here we reflect the materials that are used to repair and replace worn-out parts of machines and equipment.

Subaccount 10.06 “Other materials”

This subaccount reflects returnable waste, that is, remnants of raw materials, remnants of basic and auxiliary materials, purchased semi-finished products that were formed from materials during their processing into a finished product. The waste has lost its original properties, but has not turned into garbage (sawdust, trimmings). Returned materials still have some value. They can be used within the organization or sold, for example, by forming kits for children's creativity. Also here you can reflect office and household items that are not directly used in the main production cycle.

Subaccount 10.08 “Building materials”

If you build and repair something and this is your main activity, then construction materials are charged to account 10.01. But if an enterprise, for example a developer, purchases materials to give to the contractor, then this type of materials is reflected in account 10.08. Do the same if construction is not the main activity of the organization.

Subaccount 10.09 “Inventory and household supplies”

- Household supplies are items for general household purposes.

- Inventory is a technical item that is involved in the production process and the general economic cycle, but cannot be classified as fixed assets.

For example, office equipment and other objects that will be used for more than 12 months, and the company does not plan to sell it in the future.

Here you can reflect low-value and wearable items, fixed assets, less than 40,000 rubles.

Subaccount 10.10 “Special equipment and special clothing in warehouse”

Special tools and special devices are technical means that have individual (unique) properties and are intended to provide conditions for the manufacture (production) of specific types of products (performance of work, provision of services).

Special clothing includes personal protective equipment for workers, special shoes and safety devices. It includes overalls, suits, jackets, trousers, dressing gowns, short fur coats, various shoes, mittens, glasses, helmets. Workwear is used in large quantities in hazardous industries, in construction, and in clearing companies.

Main idea: Workwear is intended for use by an employee when performing a job function. Let us immediately make a reservation that branded clothing does not fall under the concept of workwear.

Accounting for workwear must be organized in the manner determined by the Methodological Instructions.

Subaccount 10.11 “Special clothing in use”

The name speaks for itself. A special group consists of low-value fixed assets. On the one hand, they are used in the organization for more than a year, and on the other hand, their cost is insignificant.

Currently, the value limit for accounting purposes is RUB 40,000. The company has the right to approve a cost limit for classifying such fixed assets as inventory items in order to take them into account in accordance with the standards set out in PBU 5/01. The fact of this approach to accounting for low-value fixed assets is enshrined in the Accounting Policy. Otherwise, regulatory authorities will consider low-value items as fixed assets.

And here’s how the 10th account for subaccounts looks in the 1C 8.3 Accounting program:

Balance sheet for account 10 “Materials”

General understanding of the balance sheet

Over the course of a month, or even more so a year, an accountant accumulates a lot of transactions. All these postings are included in the posting journal in a form convenient for analysis and work. In a grouped and summarized form, the information enters the accounting registers.

The most commonly used register in accounting practice is the turnover balance sheet (SAS), which is a general report, that is, a consolidated report.

The balance sheet is a table that groups information about the beginning and ending balances and the turnover of each account for the reporting period. Based on this report, it is possible to analyze the situation for each specific date, and not just at the end of the reporting period.

The main features of the SALT and the nuances of its formation on a count of 10

The balance sheet for account 10 has its own characteristics, since account 10 is one of the few that, according to the standard chart of accounts, must be maintained:

- For individual items;

- Quantity;

- Storage locations, because the same material can be stored in different warehouses.

The specificity of the formation of SALT for account 10 lies in the variety of items, warehouses, materially responsible persons and a large volume of primary documents. The SALT is first generated for each warehouse, then all statements for warehouses are collected into a consolidated SALT.

The balance sheet for account 10, generated in the context of warehouses, shows the balances of material inventories for each financially responsible person.

SALT can be compiled both for individual subaccounts of account 10, and for synthetic account 10 as a whole. Data on the balance of the synthetic account from the balance sheet is transferred to the balance sheet.

Account 10 is active - this means that the account balance can only be a debit balance; a credit balance is not allowed and indicates an error.

So, the balance sheet for account 10 contains:

- Balance at the beginning of the period in quantitative and monetary terms;

- Income in quantitative and value terms, which reflects the receipt of materials, called debit turnover;

- Expenses in quantitative and monetary terms, which reflect write-offs (for example, for production, for sales) called credit turnover;

- Balance at the end of the period in quantitative and monetary terms.

Let us consider, using an example, the main points associated with the formation of SALT. In particular, how the procedure for receipt and write-off of materials occurs, and how these movements are reflected in the SALT.

Formation of SALT for subaccounts of account 10 “Materials” using an example

Let’s say a newly formed company, Delovoi Tsentr LLC, which is subject to the general taxation regime, is making cosmetic repairs to its own building. In December 2016, a certain amount of necessary materials were purchased for these needs. At the beginning of the month, the warehouse already had balances for some items of materials. Conditional figures are given in the table.

In the same month, 60 kg of white enamel and 5 kg of yellow enamel, released from the warehouse, were used for repairs. We will determine the cost of the materials consumed and create a balance sheet for December 2016 in the information base of the accounting program 1C Accounting 8.3.

To simplify, let’s assume that the company did not purchase any other materials. Both the receipt and disposal of construction materials necessary for the cosmetic renovation of the business center were carried out within the same warehouse.

Additional Information. At the beginning of 2016, before starting work in the 1C program, the provisions from the document “Accounting Policy of the Company Delovoy Center LLC for 2016” were moved to the Accounting Policy section for accounting and tax purposes. As a result, the 1C program recorded the following elements of accounting policy:

- The actual cost of incoming materials is formed on account 10. The subaccount is determined by the type of incoming materials. Construction materials are primarily reflected in subaccount 10.08 of account 10 “Materials”;

- The valuation of a unit of materials upon disposal is carried out using the average cost method;

- The enterprise is a small business entity and does not apply the provisions of PBU 18/02 in case of differences in accounting and tax accounting data.

Example solution.

1. Procedure for receipt and write-off of materials.

As a result of entering data from primary documents on receipt (invoice from supplier) and disposal (request-invoice), the 1C accounting program, based on the settings of the elements of the company’s accounting policy, generated accounting records (entries). The accountant must analyze the transactions for the correct indication of the material code, the warehouse through which the movement of materials took place, and balance sheet accounts.

After the check, the accountant makes a request to the 1C program to generate a balance sheet for subaccount 10.08 “Building materials” of the synthetic account “Materials”. SALT is generated automatically, based on the primary documents entered into the accounting program.

The result is presented in the table. The information in the table is given as a whole for subaccount 10.08 and for the positions of each analytical component:

2. Reflection in SALT of the movement of materials according to subaccount 10.08 of account 10.

Coming. Columns 5 and 6 of the SALT table reflect the receipt of materials for the month in quantitative and cost terms, respectively.

From the table we conclude that in December 2016 the company purchased 100 kg of white enamel and 30 kg of primer; there was no arrival of yellow enamel.

The valuation of received materials is reflected in column 6. This shows the cost at which the materials were received from the supplier.

The amount of turnover on the debit of subaccount 10.08, that is, the sum of all receipts on the debit, amounted to 23,000 rubles, which translated into professional accounting language means: the debit turnover of subaccount 10.08 amounted to 23,000 rubles in December 2016.

Consumption. Columns 7 and 8 of the SALT table reflect the consumption of materials for the month, also in quantitative and cost terms, respectively. From the table we conclude that in December 2016 the company used 60 kg of white enamel and 5 kg of yellow enamel for repairs. The accountant entered these quantitative indicators into the information base from the document “Invoice-requirement”.

Where exactly did these cost figures in column 8 come from? The fact is that in column 8 of SALT, the valuation of retiring items of materials is determined according to the calculation included in the Accounting Policy. According to the conditions of the problem, the valuation of a unit of materials upon disposal is carried out using the average cost method. Let's check. Is it so:

- For the position “white enamel” - line 1, column 8. The cost of 60 kg of consumed white enamel will be: ((20000+4120)/(20+100))x60=12,060 rubles. Yes, this is exactly the figure that the 1C program set;

- For the item “yellow enamel” - line 2, column 8. The cost of 5 kg of yellow enamel leaving the warehouse is calculated in a similar way. Since there was no income, the cost of the discarded 5 kg of yellow enamel: 2000/10*5=1,000 rubles. Yes, this is exactly the figure that the 1C program set.

- From the “primer” position we see that there was no consumption.

As a result, the total turnover on the loan of subaccount 10.08, that is, the sum of all expenses on the loan amounted to 13,060 rubles, which translated into professional accounting language means: the loan turnover of subaccount 10.08 amounted to 13,060 rubles in December 2016.

Subaccount balances. SALT also generated balances for each purchased item both at the beginning of the period of interest and at the end.

Thus, the balance (remaining) at the end of December 2016 for all positions totaled 20,820 rubles. This means that at the end of December 2016 the company had inventories of construction materials in the amount of RUB 20,820.

Since, according to the conditions of the problem, there is only one warehouse, there will be no consolidated SALT. It is in this amount that the category of goods and materials “Materials” will be reflected in the balance sheet asset as part of working capital at the end of 2016, since there were no other subaccounts according to the conditions of the example.

Schematically, the current work of an accountant in the inventory area can be represented as follows:

Acceptable simplifications for accounting for purchased materials

Let's consider accounting innovations for small and non-profit organizations, effective from June 20, 2016. By order of the Ministry of Finance of Russia dated May 16, 2016. N64н (effective from June 20, 2016) amendments were made to PBU 5/01, 6/01, 14/2007, 17/02. The changes expand the range of simplified methods of accounting for small businesses and non-profit organizations (NPOs) that have the right to simplified methods of accounting and reporting.

What are the criteria for small businesses?

Summarizing information on several federal laws regarding small businesses, we obtain information about the size of a business that can be classified as small. Here is the table:

The circle shrinks for organizations subject to audit. This limiting factor must be taken into account. In addition, organizations are excluded that mainly involve intellectual work and, as a result, there is a large consumption of paper and office equipment. Housing cooperatives and the like are subject to exception, where there are traditionally many deviations from accounting rules.

The status of a small business entity is not assigned. It is formed by the Federal Tax Service independently on the basis of reporting and information from other authorized bodies. A unified register of small and medium-sized businesses will be created based on information on income and the average number of employees of companies and individual entrepreneurs.

Here are the amendments that affect the accounting procedure for materials:

- PBU 5/01 “Accounting for inventories” - clause 13.1, clause 13.2, clause 13.3, clause 25;

- PBU 6/01 “Accounting for fixed assets” - clause 8.1, clause 19.

As a result of the amendments, the accounting methodology for small businesses and non-profit organizations changes.

This is why we talk about “assumptions”. The fact is that PBU 1/98 “Accounting policies of organizations” divides the main methodological provisions into assumptions and requirements. The word “assumptions” means “considered possible,” that is, the amendments listed above are forced permissions given by the Ministry of Finance to deviate from the methodology for small businesses and NPOs as a preference for their development.

Thus, after June 20, 2016. all organizations in their accounting for the category “Materials” continue to follow the requirements of the provisions of PBU 5/01 and PBU 6/01, and small ones can deviate from the generally accepted methodology if they register through the Accounting Policy.

Now allowed:

- Valuation of purchased inventories at the supplier's price;

- Simplified write-off of inventories for management needs;

- A separate norm provided for micro-enterprises. Micro-enterprises can recognize the costs of production and preparation for sale of products and goods as part of expenses for ordinary activities immediately in full amount as they are acquired.

- One-time write-off of the cost of production and business equipment;

- Estimation of the initial cost of fixed assets based only on the supplier price and installation costs. Other acquisition costs are expensed;

- Do not create a reserve for reducing the value of material assets.

In the language of specialists, this approach to accounting is called “Now we will recognize expenses more often than create assets.” For a novice accountant, all of the above points mean that when materials are received from suppliers, there is no need to post Dt 10 Kt 60, which essentially means the materials arrive at the warehouse, and then when released from the warehouse, post Dt 26 (44,20,23) Kt 10. Now it is allowed, bypassing count 10, that is, bypassing the warehouse, to immediately show consumption (use).

Let us show in the diagram the traditional accounting of the initial cost of purchased materials and the new accounting, which can be used everywhere by small businesses and non-profit organizations:

Please pay attention! Tax accounting for materials and fixed assets has not changed.

As a result, those enterprises that maintain tax accounting according to the general taxation system will have differences in accounting and tax accounting, which must be documented by postings in accordance with the requirements of PBU 18/02.

Therefore, it is imperative that in the accounting policy it is necessary to declare the legislative opportunity given, again, to small businesses, not to apply the provisions of PBU 18/02. The wording in the accounting policy may be as follows: “The provisions of PBU 18/02 are not applied for tax purposes.”

Restrictions on the use of innovations in accounting

It is extremely important that you can use the methods described in the following examples only in two cases:

- The nature of the organization's activities does not imply the presence of significant balances of inventories. To do this, you can set the level of materiality for this case in the Accounting Policy.

- If the acquired inventories are intended for management needs.

In addition, all of these new regulatory assumptions in determining the cost of materials for small businesses and non-profit organizations cannot be applied by default. All innovations are of a permissive nature. Therefore, in order to switch to a simplified methodology for accounting for materials, it is necessary to draw up an order on changes made to the Accounting Policy for accounting purposes and prescribe a new method for determining value.

The procedure for switching to a new accounting methodology

Let's consider the obligation to make changes to the accounting policies of small businesses and non-profit organizations when deciding to switch to a new accounting methodology.

The amendments made to accounting standards PBU 5/01, 6/01, 14/2007, 17/02 come into force on June 20, 2016. An organization can switch to simplified accounting from any date, for example, from 07/01/2016. or from 01/01/2017 An enterprise can take advantage of only part of the innovations.

Here is a fragment of the order to amend the Accounting Policy for the purposes of accounting for a certain organization, a small business entity:

Practice using the new methodology

Let's consider the procedure for maintaining accounting after changes to the accounting policies of small enterprises and non-profit organizations using examples with postings.

Example 1. Valuation of purchased inventories at the supplier's price.

Let’s say the Clearing Company purchased 10 snow shovels at a price of 1,400 rubles. and 10 pieces of brooms at a price of 430 rubles. and ordered delivery. Delivery cost 4,000 rub. For the sake of simplicity, let’s agree that everything was purchased without VAT. The company is classified as small, the tax regime is OSNO. There is a point in the accounting policy that the actual cost of inventories is reflected according to the method through account 10 “Materials”. Suppliers' invoices are paid on the day of delivery. Changes to the accounting policy were made from July 1, 2016.

Let's make transactions before and after changes to PBU 5/01:

Here are some explanations for the entries made before the changes were made to the Accounting Policies:

- According to postings No. 8, No. 7. Materials are sent to production for use. According to the accounting policy of this enterprise, costs are accumulated on account 20;

- According to postings No. 1, No. 2. For a clearing company, the cleaning process is the core of the production process. Therefore, the cost of purchased inventory items is included in subaccount 10.01;

- By wiring No. 3, No. 4. Before the innovation, delivery costs are distributed in proportion to the cost of the items. For shovels: 14,000/18,300x4,000=3,060 rubles, for brooms, delivery will be 4,300/18,300x4,000=940 rubles.

Here are some explanations for the entries made after changes to the Accounting Policy:

- According to wiring No. 3. Inventory and equipment are not distributed among product items in proportion to their cost. But this only applies to small businesses. All other enterprises must take into account the price and other associated costs as part of the actual cost of purchased inventories.

Example 2. Simplified write-off of inventories for management needs.

Oblako LLC (a small enterprise) purchased 5 boxes of printing paper for a fee from a supplier with a total cost of 3,000 rubles. excluding VAT (for ease of posting), 5 packs of pens with a total cost of 400 rubles. and 2 hole punches with a total cost of 300 rubles. Let's assume that there were no other office income. The purchased goods and materials in the amount of 2 boxes of paper and 2 hole punches were given for use to the structural unit - accounting. The supplier's invoice has been paid. The day of delivery and payment passed simultaneously. OSNO tax regime. According to the company's accounting policy, the formation of the actual cost of inventories occurs on account 10, office supplies are reflected on subaccount 10.9. Changes to the accounting policy were made on July 1, 2016.

Small businesses now have the right to include such costs as expenses for ordinary activities in full as they acquire inventory. Thus, this will greatly simplify the accounting of office supplies.

Let's make transactions before and after changes to PBU 5/01 for the reporting month:

Explanations for entries made before changes were made to the Accounting Policies:

- To wiring No. 2, No. 3, No. 4. According to the company’s accounting policy, purchased inventory and materials for office purposes are usually accounted for in subaccount 10.09 “Inventory and household supplies.” On this account, the company accounts for office and household items that are not directly used in the production process.

- To wiring No. 5. Inventory and materials are transferred for consumption and use for management purposes, but the fact of use must be documented. To do this, an expense report is drawn up, according to which used inventory items are written off. The act is drawn up in the department to which these materials were issued. The form of the act is developed by the company independently, or you can use a unified document in form M-11. But the form of the act also needs to be fixed in the Accounting Policy. To automate the procedure for writing off used inventory items, you can create a form for external processing of the act using programming tools and use it in the 1C program through the mechanism of additional processing. Typically, an accountant prepares reports on the use of stationery on a ten-day basis.

- To wiring No. 6. According to the company’s accounting policy, general business expenses are included in the cost of production using the direct costing method, that is, they are accumulated in a separate subaccount 90.08 “Administrative expenses”.

Explanations for entries made after changes to the Accounting Policies.

- To wiring No. 2. Now regulatory assumptions according to PBU 5/01 allow the entire amount of inventory items to be attributed immediately to costs on the day of purchase. Then they are included in expenses for ordinary activities according to the method defined in the Accounting Policies, in this case using the direct costing method.

Of course, it is necessary to remember about drawing up acts for write-off as a result of the actual use of inventory and materials for management needs.

Example 3. Estimation of the initial cost of fixed assets only based on the supplier price and installation costs

Let's see what an accountant should do if after June 20, 2016. the organization will make the above changes to its accounting policy and will evaluate purchased inventories only at the supplier’s price, and low-value fixed assets purchased for a fee (less than 40,000 rubles) only at the supplier’s price and installation costs without including additional costs. Let's make accounting entries using the example of low-value equipment that falls into the category of household equipment. Let's see what entries will be made in accounting and tax accounting.

Please note that the generated initial cost of low-value equipment according to tax and accounting data will be different.

Let’s say that the organization Orion LLC, a small business entity, uses OSNO, is engaged in the production of windows, and is a VAT payer. 08/27/2016 a machine worth RUB 42,834 was purchased, incl. VAT 18% - 6,534 rubles. Supplier invoice available. The cost of delivery of the machine was 5,000 rubles. without VAT. The cost of consulting services for setting up the machine is 8,000 rubles. 08/28/2016 the machine is put into operation (we do not provide information on payment to concentrate on the main thing).

Additional Information. In accordance with the accounting policy of the organization:

- The limit on the value of fixed assets for accounting purposes is RUB 40,000. Objects valued below this amount are recognized as inventories.

- The organization uses the right to simplify accounting for fixed assets - the initial cost of fixed assets when purchasing them is formed only by the price of the supplier and installation costs. Additional expenses are included in expenses for ordinary activities in the period in which they were incurred (clause 8.1 of PBU 6/01).

- The organization uses the right to simplify accounting for inventories. The initial cost of purchased inventory includes only the supplier's price. Other costs directly related to the acquisition are included in expenses for ordinary activities in full in the period in which they were incurred (clause 13.1 of PBU 5/01).

- The provisions of PBU 18/02 are not applied and accounting entries are not made for the amounts of differences between tax and accounting accounting.

- General business expenses accounted for on account 26 are written off monthly to account 90.08 using the direct costing method.

Solution. In this example, I would like to emphasize that entries are made taking into account the provisions of the accounting policy. To transfer this example to real life one-on-one, make sure that the above points are present in your accounting policies. If you do not use the preferences given to small businesses in terms of fixed assets and inventories, then the postings will be different.

So, let’s create accounting entries for simplified accounting of low-value equipment:

Explanations for entries made after changes were made to the Accounting Policies.

To wiring No. 1. Accounting. Guided by the new rules of approach to the formation of the initial cost of purchased equipment, enshrined in the accounting policy, we will separate the cost of the machine at the supplier’s price and additional costs.

The cost of the machine will be 36,300 rubles. Since the cost of the object does not exceed the limit of 40,000 rubles established in the accounting policy, we make a decision based on the norms of PBU 6/01 and reflect the machine in accounting as part of the inventory, registering it under subaccount 10.09 of account 10 “Materials”.

To wiring No. 1. Tax accounting. In tax accounting under OSNO, the value of property is formed taking into account all costs. In our example, having previously added up all the components, we understand that the cost of the purchased equipment will be 49,300 rubles, VAT is not included. In tax accounting, the threshold for classifying equipment as depreciable is 100 thousand rubles. (Clause 1 of Article 256 of the Tax Code of the Russian Federation). That is, this machine cannot be recognized as a fixed asset and the cost at the supplier’s price will also be attributed to subaccount 10.09 of account 10 “Materials”.

To wiring No. 2. Accounting. Since the organization is under the general taxation regime, the VAT presented on the invoice and allocated in the invoice is attributed to the accounting account 19.03.

To wiring No. 2. Tax accounting. The VAT presented on the invoice goes into the tax register “VAT presented”. After all the conditions for deduction (reduction of obligations to the budget in terms of VAT) are met, VAT will be removed from the account on account 19.03 and assigned to Dt 68.02. The VAT amount will then appear in the Purchase Book, and then in the VAT Declaration in terms of deductions.

To wiring No. 3. Accounting. We have the right to make a VAT entry Dt 68.2 Kt 19.03 if the criteria set out in Article 172 of the Tax Code are met:

- Acquired assets are necessary for carrying out production activities subject to VAT (as specified in the example conditions);

- Accepted values are accepted for accounting on the balance sheet account;

- The organization has a supplier invoice with a highlighted VAT line and correctly executed.

To postings No. 4 and 5. Accounting. For accounting purposes, costs are immediately included in the expenses of the current period. The costs of delivery and consulting services will be included in the expenses for ordinary activities in full.

To postings No. 4 and 5. Tax accounting. The cost of the property is formed taking into account all the costs associated with the acquisition of this object. Thus, for tax accounting purposes (by convention we have a general taxation regime), costs are included in the cost of equipment. In this case, we attribute it to 10.09, as if clarifying the cost of the object. As a result of all costs charged to account 10.09, the cost of the machine in the tax accounting information base will be 49,300 rubles.

To wiring No. 6. Accounting. The cost of the machine included in the inventory will be written off at the time of its commissioning. Costs are now accounted for on account 26 (links are given in the table).

To wiring No. 6. Tax accounting. According to clause 1 of Article 256 of the Tax Code, a machine cannot be recognized as depreciable property (the cost limit for inclusion in fixed assets is 100 thousand rubles), therefore its cost can be included in material expenses after commissioning in full.

To wiring No. 7. Accounting. The machine was deregistered within the framework of existing rules and transferred to the financially responsible person, but it is actually used, operated, and in order to ensure further control over its fate, it is advisable to record the machine on the off-balance sheet account MTs 04 “Inventory and household supplies in operation.” The machine will be written off from this off-balance sheet account upon disposal, that is, when it will no longer be in use.

To wiring No. 8. At the end of the month, account 26 is closed. It is closed in accordance with the method specified in the accounting policy. The example shows the method. Costs are included in expenses in full in both accounting and tax accounting, since they are documented and the machine was purchased for use for production purposes.

This section does not discuss the disadvantages of the new methodology, but they exist.

Let's sum it up

This article examined the basic legal requirements for accounting for business transactions under account 10 “Materials” and the algorithm for an accountant’s actions in the most common business situations. The acquired knowledge will allow you to avoid making annoying mistakes that lead to additional taxes.

The information obtained in this article, adapted to specific economic situations within a particular company, will form the basis for understanding the specifics of working with account 10 “Materials”. You will be competent in matters of accounting for materials (from the Latin competere - to comply, to approach - a range of issues in which you are well versed). We wish you good luck!

Account 05 "Depreciation of intangible assets" is intended to summarize information on depreciation accumulated during the use of the organization's intangible assets (with the exception of objects for which depreciation charges are written off directly to credit bills 04"Intangible assets").

The accrued amount of depreciation of intangible assets is reflected in accounting under the credit of account 05 “Amortization of intangible assets” in correspondence with the accounts of production costs (selling expenses).

Upon disposal (sale, write-off, transfer free of charge, etc.) of intangible assets, the amount of depreciation accrued on them is written off from account 05 “Amortization of intangible assets” on credit bills 04"Intangible assets".

Analytical accounting for account 05 “Amortization of intangible assets” is carried out for individual objects of intangible assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of intangible assets necessary for managing the organization and drawing up financial statements.

Account 05 "Amortization of intangible assets"

corresponds with accounts

| by debit | on loan |

|

04 Intangible assets |

08 Investments in non-current assets 20 Main production 23 Auxiliary productions 25 General production expenses 26 General expenses 29 Service industries and farms 44 Selling expenses 79 On-farm settlements 97 Deferred expenses |

Application of the chart of accounts: account 05

- How to take into account the costs of developing a store design

By debiting account 04 “Intangible assets”. Depreciation on intangible assets is reflected... using account 05 "Amortization of intangible assets"... The following entries are made in accounting: Debit 08-5... use" to account 04 "Intangible assets". Depreciation is calculated by the legal owner...

- Changes to Instruction No. 157n: accounting for non-financial assets

The result of the current period. Accounts for non-financial assets Let us recall that the account in which...)" 3 "Depreciation of investment real estate" 4 "Depreciation of machinery and equipment" 5 "Depreciation of vehicles..." 6 "Depreciation of production inventory... "Depreciation of biological resources » 8 “Depreciation of other fixed assets” 9 “Depreciation of intangible assets” 50 1 “Depreciation of real estate...

- Accounting for the costs of creating and maintaining the AU website

For depreciation of fixed assets and intangible assets" Account credit 0 104 39 000 "Amortization of an intangible asset - other... useful use was determined by the institution's commission - 5 years. According to paragraph 1 of Art... %; 2) for compulsory health insurance – 5.1%. The amounts of insurance contributions are calculated..., allocated for compulsory pension insurance; – 5,100 rub. (RUB 100,000... x 5.1%) - in terms of funds allocated... 000 2,303 10,000 5,100 22,000 Accepted to...

- Trademark and trademark: how to take into account?

Account 08 “Investments in non-current assets”, sub-account 08-5 “Acquisition of intangible assets”. Intangible... Debit 83 Credit 05 “Amortization of intangible assets” The amount of additional valuation of intangible assets, ... intangible assets must be reflected separately in accounting. Amortization of intangible assets The cost of intangible assets... with a certain useful life is repaid through depreciation...

- The Unified Chart of Accounts has been changed

From asset impairment. According to clause 5 of this standard, impairment of an asset is understood as... a decrease in the value of an asset exceeding... 39 “Depreciation of the value of intangible assets - other movable property of an institution due to depreciation” 114 ..., replaced by: account 10440 “Depreciation of rights to use assets "(instead of "Depreciation of leased items"); account 10640 “Investments... To reflect such calculations, account 20696 was introduced; 5) 209 83 “Calculations for...

- Non-financial assets: accounting entries adjusted

Institutions. Fixed assets According to paragraph 5 of Instruction No. 162n in the new edition... of operations with intangible assets, analytical accounting accounts are used, account 0 102 00 000 “Intangible assets”, provided for... the appendix shows the following analytical accounting accounts for reflecting intangible assets: Intangible assets – other movable... removed the list of analytical accounts for the accounts of fixed assets, intangible assets, non-produced assets, depreciation, inventories...

- Changes have been made to Instruction No. 157n

104 29 Amortization of intangible assets – especially valuable movable property of the institution 104 39 Amortization of intangible assets – other... objects.” Excluded accounts. Some accounts were excluded from the Unified Chart of Accounts: 102 40 “Intangible assets - items...” 104 59 “Amortization of intangible assets as part of treasury property” 104 54 “Amortization of intangible assets as part of... to this point in paragraph 5 of Instruction No. 157n a new paragraph has been introduced...

- Review of amendments made to Directive No. 65n for budgetary institutions

Credits, advances, credits provided at the expense of funds from targeted foreign loans (borrowings... of persons received in foreign currency; 5) by subarticle 295 “Other economic sanctions... subarticles: 421 “Amortization of intangible assets”, which includes the amounts of reduction the value of intangible assets as a result of... their depreciation; 422 “Impairment of intangible assets”, according to which...

- Performing an asset impairment test

Sports, some objects of non-financial assets (fixed assets, intangible assets, non-produced assets) may have signs...) signs indicating impairment of the asset (with justification); 5) decision of the commission. Determination of fair... value of individual (similar) objects of non-financial assets); 5) data on the current (average) market... ., accrued depreciation - 800,000 rubles. This equipment was purchased through income-generating...

- Application of new standards in accounting for non-financial assets

000 Depreciation – property in concession The names of the following accounts have also been adjusted. Account number Account name... with a decrease in the value of the asset (Clause 5 of the Federal Accounting Standards for Impairment of an Asset). Signs of impairment of an asset are identified by the entity... the cost and costs of disposal of the asset. 5. Calculated loss from... loss from impairment of fixed assets, intangible assets, non-produced assets and business transactions reflecting...

- Innovations in accounting for non-financial assets

In fixed assets (fixed assets), intangible assets, non-produced assets (in particular, expenses for... from depreciation of rights of use for these objects should be reflected using accounts... assets associated with the calculation of depreciation on operating lease accounting objects (p 12.5 ... non-financial assets - corresponding analytical accounting accounts of account 0 401 10 190 (instead of accounts 0 ... non-financial assets - corresponding analytical accounting accounts of account 0 401 20 280 (instead of account 0 ...

- Application of budget classification in 2018

Such activities, and the property acquired from these incomes go to...; c) purchase (manufacture) of special products; 5) fees for membership in organizations... the cost of fixed assets, intangible assets, non-produced assets are now included in subarticles 411... “Depreciation of intangible assets” Refers to the amount of decrease in the value of intangible assets as a result of their depreciation 422 “Impairment of intangible assets” Refers ...

- We use new KOSGU

1.1, Appendix 4, Appendix 5, Appendix 7, Appendix 10 and... 1.1, Appendix 4, Appendix 5, Appendix 7, Appendix 10 and... KOSGU types of budget expenditures (Appendix 5 of the Instructions). So: Article 290 KOSGU...” and sub. 421 “Amortization of intangible assets” and 422 “Impairment of intangible assets”, respectively. In the articles of KOSGU... subst. 271 “expenses for depreciation of fixed assets and intangible assets” description “transfer to... in digits 1-17 of these accounts, analytical code according to the classification criterion...

- Changes to the Unified Chart of Accounts and instructions for its use

It has been established that in digits 5 - 17 of the account number it is necessary to reflect zeros if... accounts 0 106 00 000, 0 107 00 000, in digits 5 ... - 17 account numbers zeros are reflected. Also in... that the accounts of the section “Non-financial assets” of the Unified Chart of Accounts (corresponding accounts of analytical accounting, account 0 100..., depreciation costs of fixed assets and intangible assets used directly in the creation of an intangible asset, initial...

- We reflect the loss from asset impairment on the accounting accounts

From depreciation of fixed assets, intangible assets, non-produced assets and business transactions, reflecting... 00 000 The amount of accrued depreciation on an object that has undergone dismantling is reduced... the amount of depreciation accrued on an object is reflected 0 401 10 172 ... rub. The amount of depreciation accrued on it is 522,000 rubles. Since... rub.; – the amount of depreciation accrued on the object is 609,000 rubles; – residual... 000 “Impairment of non-financial assets”. 5. Operations on account 0 114 000 000 ...

What is taken into account on account 05 in accounting

The purpose of account 05 in accounting is to reflect information about the amount of depreciation accrued during the use of an intangible asset.

Transferring the value of non-current (in our case, intangible) assets to the cost of manufactured products, work performed, services provided or, in other words, attributing such value to expenses is depreciation.

Intangible assets are property that does not have a physical form, with a useful life of more than 12 months, acquired by a business entity to generate income. Each intangible asset must be defined as a property unit with an appropriate initial cost.

NOTE! Accounting for intangible assets themselves is carried out on account 04 provided for in the chart of accounts.

Account 05 is passive, therefore, depreciation is calculated on the credit of the account, and written off, for example when an asset is disposed of, on the debit.

There are no lines in the balance sheet for making entries specifically for accounts. 05. It must be remembered that line 1110 is formed as a debit balance on the account. 04 “Intangible assets” minus the credit balance on the account. 05. Thus, the residual value of intangible assets is shown.

Don't know your rights?

How to organize analytics for account 05

The chart of accounts does not assign specific subaccounts to a specified account. However, in the explanations to it there is a note that the construction of analytical accounting according to the account. 05 should provide the ability to obtain data on the depreciation of intangible assets necessary for the purposes of management accounting, as well as the preparation of accounting reports. How to organize analytics by account. 05, each business entity decides for itself. You may need to open subaccounts for this account. The accounting policy must contain a working chart of accounts, and it is necessary to list in it those subaccounts that are necessary for maintaining correct accounting.

Readers will learn how to correctly draw up accounting policies under different taxation regimes fromthis Andthis articles.

Depreciation of intangible assets: methods and nuances

Amortization of intangible assets on account 05 in accounting can be calculated in one of the following ways:

- linear;

- reducing balance;

- proportional to the volume of products (works, services) produced.

But in any case, for correct calculation it is necessary to correctly determine such indicators as the initial cost of intangible assets and useful life. Note that even a small mistake will lead to disastrous consequences - distortion of financial statements or incorrect calculation of income tax. Therefore, you must be very careful when determining these indicators and when directly calculating the amount of depreciation.

What postings are made with the participation of account 05

Here are examples of transactions that are compiled using the agreed account 05:

- Dt 20 (23, 25, 26, 29, 44) Kt 05 - depreciation on intangible assets depending on the place of use of the asset itself.

- Dt 97 Kt 05 - calculation of depreciation for intangible assets used in work, the costs of which are taken into account as deferred expenses.

- Dt 83 Kt 05 - additional charge of depreciation on intangible assets as a result of revaluation (in the event that the cost of intangible assets was revalued upward).

- Dt 05 Kt 04 - write-off of depreciation in cases of disposal of intangible assets. Such cases include write-off, sale, and liquidation of an intangible asset.

More different entries often used in accounting can be found inthis material .

So, in the article we said that the reflection of accumulated depreciation on intangible assets occurs on account 05, the subaccounts to which the economic entity determines independently in order to build correct accounting. We found out how depreciation is calculated on intangible assets and gave examples of accounting entries using account 05.