Credit cards of the Khanty-Mansiysk Bank "Otkritie": all conditions in the review. Credit cards of Khanty-Mansiysk Bank Khanty-Mansiysk Bank apply for a credit card

Credit cards Khanty-Mansiysk Bank is provided to all Russians on favorable terms. A working person, student or pensioner is allowed to get a credit card.

Description of credit cards

Khanty-Mansiysk Bank issues debit and credit cards for each person depending on their needs. If the choice debit cards modest enough, there are many credit cards in the bank - 10 types. All of them have loyal conditions for receipt and use.

Each credit card from Khanty-Mansiysk Bank will allow a person to use borrowed funds in the amount he needs and at any time, regardless of location.

The bank issues cards according to such parameters that affect credit limit:

- size wages(this could be official salary, social benefits, part-time income, scholarship, etc.).

- deposit amount in Khanty-Mansiysk Bank.

- selecting a card category (basic, optimal and premium cards).

- desired speed of receipt (the faster the card is issued, the lower the limit on it will be).

Khanty-Mansiysk Bank issues credit cards for a maximum period of three years, and then the person will either be reissued an existing credit card free of charge, or the client will order a new banking product.

Credit cards have Grace period, during which you can use the bank’s money and quickly return it without overpayments. For each type of credit card, this period is set individually and cannot be changed at the request of the client. The big advantage of the Khanty-Mansiysk Bank is that it issues credit cards with money not only in rubles, but also in dollars and euros, which is rarely seen in the lending market.

Using a credit card is very convenient and has a number of advantages:

- Money can be used non-cash and returned without paying interest.

- It is possible to withdraw cash (but a commission is charged for this in the range of 2-4% of the withdrawal amount).

- ATMs and bank branches are located throughout the country in many cities, making access to money convenient and fast.

- The card is issued based on the needs and capabilities of the person.

- The credit card limit is calculated individually for each bank client, and even the maximum limit can be increased within reasonable limits.

- Credit cards have favorable and low interest rates compared to other banks, especially for salaried or reliable bank clients.

Types of credit cards of Khanty-Mansiysk Bank

Khanty-Mansiysk Bank can offer its customers ten types of credit cards:

When choosing a credit card, you should focus on personal preferences - the area of spending, their size. Then you can choose the most profitable product from Khanty-Mansiysk Bank.

Credit card terms

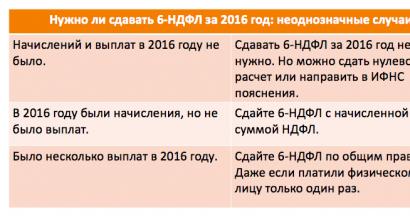

The table presents the main parameters that interest bank clients when choosing a credit card.

Comparing them and reading them short description each product, you can draw conclusions and choose the most comfortable option:

| Credit card name | Maximum limit, rub. | Minimum interest rate | Grace period |

|---|---|---|---|

| MasterCard Standard "Status" | 500 000 | 24% | 60 days |

| Classic Platinum or Gold | 500 000 | In rubles – 25%. | 55 days |

| 16,600 dollars and euros | In dollars and euros – 21% | ||

| MasterCard Gold | 1 million | 18% | 2 months |

| MnogoCard | 500000 | 25% | 55 days |

| Travel | 500000 | 25,9% | 55 days |

| Automap World | 500000 | 25,9% | 55 days |

| Gladiator credit card | 500 000 | In rubles – 25%. | 55 days |

| 16,600 dollars and euros | In dollars and euros – 21% | ||

| "Good deeds" | 500000 | 25% | 55 days |

| Rostelecom | 100 000 | 24% | 2 months |

| Instant card | 500 000 | In rubles – 25%. | 55 days |

| 16,600 dollars and euros | In dollars and euros – 21% |

What does the borrower need?

A person who wants to apply for a credit card at the Khanty-Mansiysk Bank must remember a number of requirements put forward by the organization to a potential client.

So a credit card will not be issued to a person:

- not a citizen of Russia with official registration in the country in the region where the bank operates.

- under 21 years of age.

- aged 65 years for males and 55 years for females.

- without official employment.

- without a minimum monthly salary of 15,000 rubles.

- with a bad credit history.

To prove their compliance with the requirements of the Khanty-Mansiysk Bank, a person must provide:

- passport, from which a photocopy will be taken and attached to the case.

- a second document confirming the identity of the bank client. This could be a driver's license, SNILS, foreign passport, TIN, etc.

- a certificate of current income in form 2-NDFL or according to a bank example.

How to get a credit card?

To obtain a credit card, a person must submit documents to the bank for review. There is a very convenient option for submitting documents – an online application. The form to fill out can be found on the bank’s official website on the Internet. There you need to provide all the information and submit your application. The bank will accept it for consideration and notify the client of the decision.

To obtain a credit card, a person must submit documents to the bank for review. There is a very convenient option for submitting documents – an online application. The form to fill out can be found on the bank’s official website on the Internet. There you need to provide all the information and submit your application. The bank will accept it for consideration and notify the client of the decision.

If the decision is positive, Khanty-Mansiysk Bank will send a credit card by mail, or ask the person to come to the bank branch closest to him. The processing time for an application usually does not exceed five working days.

Video

If a person needs to get a card urgently, then a personal application to the bank is suitable. You need to bring documents and contact a consultant for help, fill out a form on the spot and literally take the card right there.

Contacting a bank is convenient when a person has not yet decided which card he would like to issue, and then the employee will tell you everything and describe the pros and cons of various products.

How to block a card?

You can block the card in your personal account by submitting a request from the cards menu. Just select the credit card you are interested in and click on it, then a list of actions will be displayed.

You can also block your card by personally contacting a bank branch with your passport. The third option involves calling the hotline - 8-800-700-78-77 . You will only need to confirm your identity by giving a code word and passport details.

It should be borne in mind that it will only be possible to close a Khanty-Mansiysk Bank credit card if there is no debt on it.

You can find out your card balance in your personal account. You can also check it with an operator or bank employee. If the balance is zero, then you can safely close the card.

Credit cards from Khanty-Mansiysk Bank are popular among Russian residents for their benefits and large assortment. In this bank you can choose a credit card to suit every taste, choose the most tempting offer, and the card will be delivered directly to the post office or home.

plastic cards Khanty-Mansiysk Bank pension for pensionersKhanty-Mansiysk Bank offers representatives of the older generation a pension card, which compares favorably with cards for receiving pensions from other banks. The card for pensioners offers clients a number of interesting solutions and additional bonuses.

Vice President - Head of Retail and Small Business at KMB Otkrytie Alexander Dardanov said the following about issuing a card for pensioners: - “To become the owner new card You need to transfer your pension to a special bank account. This can be done at any branch of the Khanty-Mansiysk Bank without visiting the territorial division of the Pension Fund of Russia.”

The design of cards for pensioners is very original, and the photo pension card"KhMB Opening" looks like this:

Photo of pension card

How is a Khanty-Mansiysk Bank pension card issued?

What actions does a client of the Khanty-Mansiysk Bank need to take in order to apply for a “Pensioner Card” of the bank and receive a pension on it. To receive a pension on a pension card you must:- Go to a convenient bank branch (with your passport).

- Complete (fill out) an application for payment of a pension on the card.

- Next, with the documents necessary for calculating your pension and card details, contact the branch Pension Fund.

Service fees and accrued interest on the pension card account balance

The pension card of the Khanty-Mansiysk Bank "Otkrytie" has established preferential service rates and accrues interest on the account balance:

Pensioners are provided with free SMS notifications on all account transactions.

New modern remote services are available for pension card holders:

- Internet bank

- Mobile application for phone.

User-friendly interface, simple and accessible functions, wide selection financial instruments and counterparties allow you to make various payments and transfers, make payments for mandatory services at any convenient time.

In addition, the owner of a pension card automatically becomes a participant in the special program “Modern Pensioner”, within the framework of which he can take part in various incentive promotions or become the owner of special prizes, and obtain a “Respectful” loan on favorable terms.

Khanty-Mansiysk Bank specialists will always be happy to advise the client on any issue regarding the operation of the pension card or help him fill out an application for its registration by toll free phone: - 8 800 100-17-00

Today, Khanty-Mansiysk Bank credit cards are in demand among residents of the region and among individual citizens of the country. This is due to the fact that the procedure for obtaining a plastic card does not cause difficulties, and in addition, clients receive a grace period for using a credit card.

The bank is present on Russian market for more than two decades and has long occupied a strong position in its segment. There are about 170 branches within the country, where ordinary citizens and corporate users who wish to use certain banking services can turn. Today we will talk about existing types credit cards from KhMB, about the current interest rates and established limits for cash withdrawals and transfers.

As already noted, KHMB has long established itself as a reliable lender and partner in providing various types of services. Clients of a financial institution in 2019 can issue various types of cards, open deposits, and cash out money through the cash register. A particularly popular area in the bank's activities is the provision of credit cards. As an example, here are the types of credit cards that are available to citizens today:

- participants of salary projects;

- those who have bank accounts and those who do not;

- who opened a deposit in KhMB.

Each type of card has its own characteristics of use and a certain procedure for registration. Let's look at these characteristics in more detail in the next section.

Conditions for cards. Interest and limits

The conditions for obtaining and using a credit card largely depend on the type of card issued by the citizen. The interest rate is especially important for clients, since it will determine the amount of debt required to be repaid in the future. The type of plastic also affects the limit within which the holder can pay for purchases. The limits and rates that apply to different types of cards are indicated in the following table:

| Type of credit card | Annual rate, % | Limits |

| Salary plastic | 25 | Installed individually. Can reach 10-300 thousand rubles. |

| Plastic card of a client with an account in KhMB | 19 | The maximum amount can be 500 thousand rubles. |

| Card, Gold groups | 18 | Up to 1 million rubles. |

| Depositors' credit card | 26 | The limit is selected individually in the range of 10-500 thousand rubles. |

| Persons who received credit card first | 22 | Up to 1 million rubles. |

In addition to the listed types of credit cards, the bank can offer its borrowers other options for financial assistance. We are talking about cards issued jointly with partners:

- “Status” card from UTair airline at 29% per annum. Two cards are issued, and in the first the limit is 500 thousand rubles, and in the second - up to 1 million rubles;

- card from Rostelecom. The card limit is 300 thousand rubles at 29% per annum.

Taking into account the above options, you can easily choose the appropriate type of card and apply for a plastic card.

How to apply for a KMB credit card online and check the status of the application?

Like many other lenders, XM Bank Otkritie offers potential borrowers several ways to obtain credit cards:

- Personally visit the lender’s branch and submit an application of the established form together with the necessary documents.

- Send online application to a credit card at Khanty-Mansiysk Bank.

To use the latter method, simply register on the website and submit applications for consideration. Employees will double-check the data and send the applicant a card to the specified address. The receipt period depends on the person’s place of residence.

In addition to these advantages, one more advantage of the HMB credit card can be noted. The grace period for a credit card is two months and plastic is accepted at many ATMs and terminals. Customers will always be able to withdraw cash and pay for purchases. An additional service is SMS notification.

Many people want to see a reliable, respectable partner in a bank, with whom working will be convenient and comfortable. Should be preferred large organization with more attractive terms of service and lending, with an extensive branch network. One of these banks, representing the largest regional structure, is the Khanty-Mansiysk Bank.

About the bank

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Khanty-Mansiysk Bank is considered a universal credit institution federal significance. Operating since 1992 (more than 25 years), the institution can rightfully be considered one of the pioneers modern market bank lending. In terms of assets with a capital of 320 billion, it ranks 24th in Russia.

Currently, the bank has more than 170 branches in its structure. Reorganized in 2019 to the Otkritie Financial Corporation bank, the financial giant continues to operate under the Khanty-Mansiysk Bank brand due to its high recognition and good reputation, especially in the Yamalo-Nenets and Khanty-Mansiysk Autonomous Okrug.

Types of cards

The bank offers clients various programs in the field of retail lending, including the issuance of credit cards. The bank's wide range of credit cards ensures that the money needs of various categories of the population are met. The variety of types of credit cards is difficult to understand even for a seasoned expert.

Judge for yourself: in addition to the division into categories according to premium level - there are traditionally three of them: basic, optimal and premium segment, there are more than a dozen cards in each category:

- classic credit card;

- overdraft on a salary card;

- for clients with a bank account;

- “Status” card;

- “Travel” credit card for travel enthusiasts;

- automap "World";

- Gladiator credit card;

- "Good deeds;

- Rostelecom credit card;

- instant card.

All cards have both common features and their own specific features.

Terms and rates

Conditions for credit products vary depending on the features of the card chosen by the client.

Let's imagine comparative characteristics Khanty-Mansiysk Bank credit card tariffs:

| Classic Gold/Platinum credit card | Classic loan product with a limit of up to 500,000 rubles. Interest rate 19-22%. The loan can be repaid monthly, but not less than 5% of the principal debt. |

| Card "Status" | The credit limit is provided according to an individual scheme from 30,000 to 500,000 rubles. The annual rate is 24%, there is a grace period of 60 days. Cash withdrawal from card 3%, minimum 150 rubles. |

| Credit card "Travel" | The card is issued in three categories: basic, optimal and premium. Credit limit up to 500,000 rub. at 25.9% per annum. Bonuses are awarded for every purchase. |

| Automap "World" | The autocard allows you to receive cashback for paying for refueling and maintenance services from 2 to 6%, a credit limit of up to 500,000 rubles. |

| Credit card "Gladiator" | The card is intended for sports fans; upon receipt, 200-500 denarii are awarded at a time, which can be exchanged for tickets to a sporting event. Rate 25%, maximum loan amount 500,000 rubles. |

| "Good deeds" | The card holder receives a discount of up to 25% through the Disco affiliate program. The Platinum premium card allows you to get Priority Pass membership. The card is connected to SMS notification and Internet banking “Otkritie Online”. After each purchase, the bank from own funds transfers 0.4% to the Vera charity foundation. Interest-free cash withdrawal. |

| Rostelecom credit card | Loan amount 100,000 rub. Rate from 24% per year. The maximum loan term is up to 24 months. |

| Instant card | You can take out a loan using this card in any currency. For rubles, the rate will be 25% per annum, up to 500,000 rubles. In dollars and euros up to 16600 USD at 21%. Control over the status of the bank account is carried out around the clock, it is possible to remotely banking services. The card is connected to the customer support service. |

Credit cards are presented for every taste and best meet the interests of the general population. Everyone will be able to choose their own card.

Documents to be received

To successfully obtain a Khanty-Mansiysk Bank card, you should have the following documents on hand:

- For registration you will need a civil passport;

- any second additional document to choose from: SNILS, driver’s license, TIN, etc.;

- certificate of income in the form of a bank or.

It is worth noting that in addition to providing documents, the bank will check you for compliance with its requirements:

- having citizenship of the Russian Federation;

- registration in one of the regions where the bank operates;

- age limit for the borrower is 18-65 years;

- official employment;

- income at the place of work must be at least 15,000 rubles;

- positive credit history.

If you meet the stated requirements, the chance of getting a credit card is very high.

How to apply for a Khanty-Mansiysk Bank credit card

A card can be issued in two ways: by submitting a package of documents directly at the office or remotely via the website. Due to the reorganization of the bank, there are many more offices where you can quickly issue a credit card.

They can be viewed on the organization’s website in the appropriate section or call for consultation by phone hotline. The bank itself recommends submitting an application remotely in order to create the most comfortable conditions for the client and save personal time.

Is it possible to apply online?

The Khanty-Mansiysk Bank website allows for online application submission. According to the bank's rules, it is possible to issue a card without visiting the office. In case of a positive decision, it is provided free shipping map to 34 cities of Russia. Soon this service will be available to all residents of the country.

Before you begin the application form, you should decide on the type of card that best suits your needs. Next, in the card section, you need to indicate its category, select your preferred one payment system and proceed to filling in personal data.

The bank will ask the client to provide information about himself mobile phone, email and the city in which it is most convenient to obtain the card. After providing the specified information, the application will be processed. If additional information is required, the bank manager will contact you. The card will be delivered within a reasonable time in a way convenient for the client: by mail or courier.

Grace period

Using a Khanty-Mansiysk Bank credit card requires an interest-free period, just like cards from other banks. According to the bank's rules, the maximum grace period cannot exceed 60 calendar days.

This time interval (a full two months) is one of the longest in the Russian banking sector. For comparison, in Sberbank the grace period is limited to 50 days.

Redemption

Loan repayment is carried out using traditional methods used in modern stage retail lending. To complete the enrollment credit funds The card must be topped up on time.

Main ways to top up your card:

- in Internet banking or via mobile app from any other card;

- at a bank branch. When depositing an amount less than RUB 30,000. a commission is charged;

- via ATMs financial group"Opening". The advantage of using it is. That the service operates around the clock;

- through the affiliate network of Rapida LLC, connected at the cash desks of the Eldorado, M-video, Sibvez, etc. networks. Commission 1%, but not less than 50 rubles;

- through Eleksnet and QIWI terminals. Transfer fee 1.5%.

The credited money arrives on the card fairly quickly. We still recommend that you do not delay repayment until the last day of the grace period, since any failure in the operation of one of the systems will lead you to late payment, and, consequently, to the accrual of interest on the loan amount.

Khanty-Mansiysk Bank has been operating in the Russian market for more than 20 years and has taken a fairly stable position in its segment. At the moment, there are more than 170 of its branches throughout Russia, where both private and corporate users can use certain banking services. Their list also includes credit cards of the Khanty-Mansiysk Bank of several types:

- for users of salary projects;

- for clients holding a bank account for payments using plastic cards;

- for persons who do not have a bank account;

- for deposit holders.

Each card has its own characteristics, which are expressed in the conditions provided to the client. Let's look at them in more detail in this article.

Khanty-Mansiysk Bank credit card: conditions

Depending on what type of card a citizen uses, he is provided with different types of conditions. The loan rate is subject to changes. It indicates the amount of interest accrued per year from the date of opening the debt. Also, the type of card affects the limit, which indicates maximum amount, after spending which the client will no longer be able to pay for purchases.

- Persons using “plastic” intended for salary clients, a fairly low interest rate of 25% per annum is provided. At the same time, the credit limit is set individually for the client and can be up to 25%. The maximum value ranges from 10 to 300 thousand rubles.

- If the client does not receive a salary from the organization, but he has an account with this bank, then the conditions for him are slightly modified. Thus, the annual rate will be only 19%. Wherein, maximum rate the limit increases to 500 thousand. This amount can be doubled, but for this you need to issue a credit card belonging to the Gold category. At the same time, the rate will decrease by another 1%.

- Perhaps the most ambiguous conditions apply to cards for those who decide to open a deposit with the Khanty-Mansiysk Bank. On the one hand, the problem is the lending rate of 26%. But at the same time, such a credit card also has some advantages. Thus, the size of the limit is selected for each client individually and depends on the amount of the deposit that was placed with the bank.

- If a citizen has not had any contact with the bank before applying for a card, then he can receive a credit card with a limit of 10 to 500 thousand rubles. The credit rate in this case will be slightly higher than that of “payroll” or account holders. Its size will be 22% per year. But you can get more profitable terms, all you need to do is get a Gold class credit card. In this case, the limit will be one million rubles, and the rate will be fixed at 19%.

Other cards

The most common types of credit cards from the Khanty-Mansiysk Bank were listed above. But, besides them, this financial institution can offer its customers other types of “plastic”, developed jointly with certain companies.

Thus, together with the UTair airline, the organization issues two “Status” cards. Both products have an annual interest rate of 29%. Their difference lies in the limit, which can have a maximum size of 500 thousand or one million rubles.

The bank also cooperates with Rostelecom. If the card recipient is a client of this operator, then he can order a credit card with a limit of 300 thousand rubles. The interest rate is identical to that for “Status” cards and is equal to 29% per year.

How to get a card

Khanty-Mansiysk Bank, like many other financial firms, is developing with the times. Therefore, there are several ways to issue credit cards. To do this, you can contact one of the company’s many offices or go to the official website in the “Maps” section. There, the client can submit an online application for a Khanty-Mansiysk Bank credit card.

For the last method of registration, you need to register on the bank’s website, and then fill out a short application form. This paper will be sent to the organization’s specialists, who will double-check the specified data and send a response. After this, the card will be sent to its owner. The exact delivery time directly depends on the client’s place of residence.

Advantages of Khanty-Mansiysk Bank cards

Credit cards from Khanty-Mansiysk Bank have several advantages, thanks to which they look more favorably compared to simple loans or products of other banks:

- Each card has a grace period of 2 months, during which no interest is charged. As a result, the client can use the service without spending additional money.

- A credit card is always at hand and in an emergency it will help you get a large amount for short term. At the same time, the conditions will be much more favorable than in the same microfinance organizations.

- The cards work with many terminals, as a result of which you can pay with them in all stores where cashless payments are possible.

- Due to the large number of branches, as well as ATMs of the Khanty-Mansiysk Bank, credit card holders have the opportunity to withdraw amounts from their cards in the form of cash. In addition to the company’s equipment, clients can also use the terminals of the bank’s partners.

- An SMS notification service is provided with the card. Thanks to it, it will be easier for the user to monitor the movement Money on your account.