Money market. What is the demand for money? The demand for money depends on

Demand for money– the number of means of payment that the population and firms want to keep in liquid form, i.e. in the form of cash and check deposits (keep a cash register).

Types of demand for money are determined by two main functions of money: 1) function means of exchange, 2) function means of storing value.

The first function determines the first type of demand for money – transactional.

Transactional demand for money(demand for money for transactions) - this is a desire economic entities hold a cash register for purchasing goods and services. People want to have enough money so as not to experience inconvenience when buying goods and paying for services

Nominal demand for money is the amount of money that people or firms would like to have.

Because money is held in order to purchase goods or services, the nominal amount of money needed in the economy changes with changes in prices.

From here, demand for money- this is the demand for real cash balances or, in other words, the amount of cash balances calculated taking into account their purchasing power.

From the equation of the quantity theory of money (Fisher equation): M

V

=

P

Y

Y

it follows that the factors of real demand for money (M/P) are the value of real output (income) (Y) and the velocity of circulation of money (V). Transaction demand for money (M/P) D Т R is equal to:

(7.9.)

(7.9.)

where Y – real income(volume of GNP),

n is the number of turnovers of a monetary unit per year.

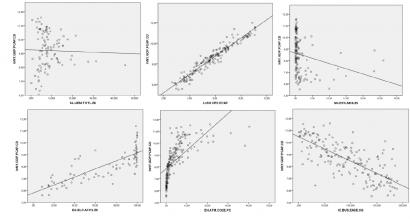

Transaction demand for money (M/P) D T R is reflected in Figure 7.3.a).

The point of view that the only motive for the demand for money is its use for transactions existed until the mid-30s, until Keynes’s book “The General Theory of Employment, Interest and Money” was published. In it, Keynes added two more motives for the demand for money to the transaction motive of the demand for money - the precautionary motive and the speculative motive.

Demand for money from a precautionary motive This is explained by the fact that in addition to planned purchases, people also make unplanned ones. Anticipating situations like these where money may be needed unexpectedly, people keep extra amounts of money beyond what they need for planned purchases. According to Keynes, this type of demand for money does not depend on the interest rate and is determined only by the level of income, therefore its schedule is similar to the schedule of transaction demand for money.

IN modern conditions the property of economic entities takes the form of a portfolio of assets: money, bonds, shares, etc. The property itself is the result of savings. When making decisions about saving, an economic entity must determine, firstly, what part of the income should be saved and, secondly, in what form to make its savings.

Money, unlike many forms of other assets, does not generate income. Their usefulness lies in absolute liquidity, that is, money as property (savings) can be converted into money for transactions (medium of exchange) at any time.

Demand for money as an asset (property)(speculative demand for money) is due to the function of money as a store of value, as a financial asset. However, as a financial asset, money only maintains value, but does not increase it. Cash has absolute (100%) liquidity (the ability to quickly and costlessly transform into any other assets), but zero profitability. However, there are other types financial assets

, for example, bonds that generate income in the form of interest.

Therefore, the higher the interest rate, the more a person loses by holding cash and not purchasing interest-bearing bonds. Consequently, the determining factor in the demand for money as a financial asset is the interest rate. In this case, the interest rate is opportunity costs of holding cash.

Thus, the demand for money negatively depends on the interest rate, so the speculative demand curve for money has a negative slope (Figure 7.3.b)).

Modern portfolio theory of money proceeds from the premise that each economic entity is faced with the task: what part of income to save, and what type of assets to turn savings into (real estate, securities and etc.). People form a portfolio of financial assets. Asset portfolio optimization comes down to comparing the income from the non-cash components of the portfolio with the benefit in the form of utility and convenience that subjects receive from holding cash.

ABOUT  The general demand for money consists of transactional and speculative demand (Fig. 7.3.c)).

The general demand for money consists of transactional and speculative demand (Fig. 7.3.c)).

Figure 7.3 - Types of demand for money.

Total demand for money:

(M/P) D = (M/P) D Т R + (M/P) D А = kY – hr (7.10)

Where (M/P) D Т R – transaction demand for money

(M/P) D A - demand for money as an asset (property)

Y – real income (GNP),

r – nominal interest rate,

k is the sensitivity (elasticity) of changes in money demand to changes in income levels,

h is the sensitivity (elasticity) of changes in the demand for money to changes in the interest rate (the parameter h in the formula is preceded by a minus sign, since the relationship between the demand for money and the interest rate is inverse).

Demand for money – the amount of cash balances that economic entities wish to hold under certain conditions.

7.1. Factors determining the demand for money

Quantitative theory of demand for money.

Developed by economists classical school in the 19th and early 20th centuries. quantitative theory, strictly speaking, studied the factors that determine the nominal value of total income for a given real value. But since the quantity theory also studies the question of the amount of money that should be in the hands of the population at each given level of aggregate output, it can also be considered a theory of the demand for money. It proceeds from the fact that money is needed only to service transactions for the purchase and sale of goods and services.

I. Fisher's equation of exchange. I. Fisher's version describes the objective factors that determine the demand for money. In an economy, there should be exactly as much money as is necessary to mediate all purchase and sale transactions occurring over a certain period of time.

During a given period of time, each monetary unit manages to service not one, but several purchase and sale transactions. The number of these transactions is described by an indicator called the velocity of money (v).

Velocity of money circulation ( v ) – the number of revolutions made by the money supply during a given period of time. Shows how many times on average each currency unit was spent on the purchase of goods and services.

Factors influencing the velocity of money circulation:

State of the payment system;

Payment method;

Payment traditions of society (for example, frequency of payment of wages), etc.

The listed institutional and technological factors are very inert and change very slowly over time, so the velocity of money in the short term can be considered constant.

This leads to the main conclusion of I. Fisher’s model:

Where is the amount of money circulating in the economy;

v – velocity of money circulation;

P – average price of each transaction;

T – the number of purchase and sale transactions taking place in the economy during a given period of time.

This expression is not an equation, but an identity; it simultaneously serves as a definition of the concept of the velocity of circulation of money, which means it is always fulfilled, and not only at some specific (equilibrium) values of the variables included in it.

Therefore, the amount of money needed by the economy is identically determined as:

However, the number of transactions is an indicator that is extremely difficult to evaluate economically. Therefore, for simplicity, we usually replace the number of transactions T with the real volume of total output Y, based on the proposition that usually the change in the number of purchase and sale transactions is approximately proportional to the total output:

Where z is the proportionality coefficient (its value is greater than one, since Y describes the volume of purchase and sale transactions only of final goods and services).

Then, instead of an identity, we get the equation:

![]()

Where Y is the volume of total output for a given period of time;

The velocity of circulation of money when purchasing final goods and services (shows how many times during a given period of time on average each unit is spent on the purchase of final goods and services - this is the meaning of the concept speed of money circulation modern economics), or .

This equation is called quantitative equation or exchange equation . The left side (MV) describes the quantity of money supply, and the right side (PY) describes the quantity of money demanded. They are equal to each other not at any value of the price level, but only at the equilibrium one. It is through changes in the price level that a correspondence is established between the existing volumes of money and commodity supply.

K. Marx's law of money circulation. K. Marx gives a more detailed formula that determines the economy’s need for money for a given period of time:

This formula is noteworthy in that it includes elements essential for taking into account the specifics of money circulation in Russia, namely: various types of non-payments (offsets, overdue debt, barter).

Cambridge version by A. Marshall and A. S. Pigou. Unlike I. Fisher, A. Marshall and A. S. Pigou studied not objective, but subjective factors in the formation of demand for money. They put at the center of their analysis the question of why economic entities do not spend all of their nominal income on the purchase of goods and services, but leave part of it in the form of money (cash balances).

Storing cash balances has certain benefits and costs.

Benefit -reducing transaction costs when purchasing goods and services.

Costs - the lost utility of those goods and services that could have been purchased with this money, since the utility of the money itself is zero.

By comparing benefits and costs, economic entities determine the optimal share of their nominal income that should be kept in their hands in the form of money. This share is called the liquidity preference coefficient.

Liquidity preference ratio – an indicator describing the ratio of the stock of cash balances to the amount of nominal income:

Where k is the liquidity preference coefficient of a given economic entity;

m is the optimal volume of cash balances of this economic entity;

P – price level;

I – real income of an economic entity.

For example, if k = 0.4, then the average stock of money in the hands of an economic entity is equal to 40% of its nominal income for a given period of time.

Consequently, the individual demand for money of a given economic entity:

Aggregate demand for money of all economic entities:

Where k is the weighted average value of the liquidity preference coefficient in the economy;

Y – total real income.

This equation is called Cambridge equation.

It is easy to notice the similarity of this equation with the exchange equation. This is not surprising since both equations are different versions of the same quantity theory of money. The consequence is the conclusion that liquidity preference ratio– the reciprocal of the velocity of money circulation (k=). It is clear that the more often money changes hands, the smaller the supply the population needs to keep to pay for purchases in the period between receipts of money.

Both versions of the quantity theory of money believe that the only factor determining the quantity of money demanded is total income. The amount of money demand depends on the amount of total income in a positive way.

Liquidity preference theory

The theory of liquidity preference was first formulated by Keynes as a development of the Cambridge approach to the analysis of the demand for money. Keynes expanded the ideas of his predecessors about the subjective motives that encourage economic entities to have a supply of money on hand.

Subjective motives of the demand for money according to Keynes

Transactional motive – the need for money to make current purchases, i.e. to use them as a means of payment. Like his predecessors, Keynes believed that this component of the demand for money is determined primarily by the volume of transactions carried out. But since the volume of purchases is proportional to income, the transaction component of the demand for money is proportional to income:

Where is the magnitude of the transaction demand for money;

Sensitivity of transaction demand for money to changes in nominal total income ( liquidity preference coefficient by transaction motive).

Precautionary motive – the need to have a certain reserve of money in case of unexpected expenses and unexpected opportunity make a profitable purchase. Keynes believed that the amount of money that economic agents hold for precautionary reasons is determined by the expected future volume of transactions, and the planned value of such purchases is proportional to income. Thus, Keynes came to the conclusion that the component of the demand for money determined by the precautionary motive is also proportional to income:

Where is the magnitude of the demand for money for the precautionary motive;

– sensitivity of the demand for money due to the precautionary motive to changes in nominal total income (liquidity preference coefficient for precautionary reasons).

Rice. 8.1. Demand for money:

1 – according to transactional motive (); 2 – based on precaution (); 3 – total()

In Fig. 8.1. graphs of demand for money are shown. Their relationship can be described by the formula:

PY = ()PY = kPY.

Where k is the sensitivity coefficient of the total demand for money according to the transaction motive and the precautionary motive to changes in nominal total income ( coefficient of liquidity preference for transaction motive and precaution).

=

Speculative motive - this is a new motive for the demand for money identified by Keynes. Not only goods and services circulate in the economy, but also profitable financial assets (securities), on which money is also spent. Due to this, households have a need to have a certain reserve of money intended for investment in profitable financial assets when such an investment becomes profitable. Therefore, the volume of speculative demand for money is determined by the population simultaneously with the decision-making on the volume of their investments in securities.

The task comes down to choosing the optimal structure of a portfolio (set) of financial assets. For this reason, the Keynesian theory of demand for money is also called

Costs portfolio theory of money demand.

Benefit When choosing the optimal share of money in the overall portfolio structure, economic entities compare the benefits and costs of storing a speculative stock of money:

– unearned interest income on securities that could have been purchased today with saved money. Their value is measured by the current yield of securities.

– interest income that can be received on securities in the future. It is measured by the expected future return of a security. Since costs and benefits are determined by the profitability of financial assets, regardless of their specific type, when economic entities decide the size of their speculative demand for money, all financial assets with equal profitability are absolute substitutes. Keynes therefore considered the behavior of economic entities in the proposition that they owned only one type of securities - government bonds. This allows you to simplify the analysis by excluding variables that describe risk. Hence, appointment .

speculative stock of money - - a security that is a debt obligation of a government in which the borrower (government) agrees to pay the bond a certain amount of money (interest income) at specified intervals until a specified date (maturity date), when the borrowed amount is returned to the owner of the bond (the bond is redeemed) .

Government bonds are fixed income securities. Depending on the method of payment of income, they are divided into two main types:

Discount bonds – bonds for which payment is made only on the maturity date, but which are included in the initial placement at a discount (discount).

For example, buying a bond with a nominal value of 100 rubles. (i.e., for which 100 rubles will be paid upon redemption) on the primary market at a price of 98 rubles. means receiving a discount income of 2 rubles upon repayment. Coupon bonds

– bonds sold on the primary market at par, for which the government periodically pays the holder a certain percentage of the par (coupon income) at specified intervals until maturity. For example, purchasing a 5% government loan bond with a face value of 100 rubles. for a period of three years guarantees the bond holder an annual receipt in the form of a coupon income of a fixed amount in the amount of 5% of the face value (100 rubles x 0.05 = 5 rubles), and at the end of the third year he will be paid not only the coupon income, but also 100 rub. par value at maturity of the bond.

Primary securities market - a financial market in which new issues of securities are sold after issue to their first buyers.

Secondary securities market

- a financial market in which securities are resold before their maturity date to those who wish to buy them when the initial placement has already been completed. In the secondary market, the purchase and sale of bonds occurs at the current market price, which is determined by the relationship between supply and demand for this type of bond. The equilibrium market price is always set at such a level that the bond's yield is equal to the market average.

The yield of a discount bond is, to a first approximation, estimated by the indicator

discount yield: Discount yield =:

The yield of a coupon bond is, to a first approximation, estimated by the indicator

Thus, the current market price of any bond and its yield are related by an inverse relationship and a one-to-one correspondence. Each value of the market price of a bond corresponds to only one value of its yield. It is this yield that serves as Keynes' theory as a measure of the interest rate.

The quantity demanded for bonds, like any other good that is not a Giffen good, depends negatively on their market price. And since the market price of bonds uniquely determines their yield, it can be argued that the amount of demand for bonds positively depends on their nominal yield I (Fig. 8.2)

Rice. 8.2. Demand for government bonds

When the bond price c decreases and, accordingly, its yield (interest rate) increases from i to i’, the demand for bonds will increase by the amount (). To satisfy the growing demand for bonds, the population will spend money from their speculative reserves to purchase them. Consequently, the volume of speculative demand for money will decrease exactly by an amount equal to the increase in demand for bonds: . Therefore, speculative demand for money will decrease when interest rates rise. Consequently, the amount of speculative demand for money is negatively related to the interest rate (bond yield):

In its simplest form:

Where is the volume of speculative demand for money at a zero interest rate;

Sensitivity coefficient of money demand at the nominal interest rate; shows how the speculative demand for money changes when the nominal interest rate changes by one point.

A graphical representation of speculative demand for money is presented in Fig. 8.3.

Fig.8.3. Speculative demand for money

The magnitude of the total demand for money is the sum of the magnitude of the demand for money for the transactional motive, the magnitude of the demand for money for the precautionary motive, and the magnitude of the demand for money for the speculative motive at each value of income and interest rate:

The graph of the total demand for money is shown in Figure 8.4. (curve 3).

The relationship of the graphs in Fig. 8.4 can be described by the formula:

Fig.8.4. Total demand for money:

Keynes believed that the total demand for money is very unstable, since it includes a speculative component, which depends on the interest rate determined by the unstable and unpredictable conditions of the securities market.

Consequently, the velocity of money circulation becomes unstable even in a short period. Its value is inversely related to the interest rate and fluctuates with the latter.

This section deals with the nominal demand for money (demand for nominal cash balances). The real demand for money (demand for real cash balances) is obtained by dividing both sides of the equation by the price level. If we remember that the nominal interest rate divided by the price level is the real interest rate of the bank, we get:

![]()

The graph of the real demand for money is similar to the graph of the nominal demand for money, with jnq the only difference being that the y-axis shows the value of the real interest rate, rather than the nominal one.

Money and financial markets. Walras' law for the financial market

The money market is a part (segment) of the financial market. The financial market is divided into the money market and the securities market. For a financial market to be in equilibrium, it is necessary that one of its constituent markets be in equilibrium, then the other market will also automatically be in a state of equilibrium. This follows from Walras’s law, which states that if there are n markets in the economy, and there is equilibrium in (n – 1) markets, then there will be equilibrium in the nth market. Another formulation of Walras' law: the sum of excess demand in parts of the markets must be equal to the sum of excess supply in other markets. The application of this law to a financial market consisting of two markets allows us to limit our analysis to the study of equilibrium in only one of these markets, namely - money market, since equilibrium in the money market will ensure automatic equilibrium in the securities market. Let us prove the applicability of Walras' law for the financial market.

Each person (as a rational economic agent) forms a portfolio of financial assets, which includes both monetary and non-monetary financial assets. This is necessary because money has the property of absolute liquidity (the ability to quickly and costlessly transform into any other assets, real or financial), but money has zero profitability. But non-monetary financial assets generate income (stocks - dividends, and bonds - interest). To simplify the analysis, let us assume that only bonds are traded in the securities market. When forming his portfolio of financial assets, a person is limited by the budget constraint: W = M D + B D, where W is the person’s nominal financial wealth, M D is the demand for monetary financial assets in nominal terms and B D is the demand for non-monetary financial assets (bonds) in nominal terms expression.

To eliminate the impact of inflation, it is necessary to use real rather than nominal values in financial market analysis. In order to obtain the budget constraint in real terms, all nominal values should be divided by the price level (P). Therefore, in real terms, the budget constraint will take the form:

Since we assume that all people act rationally, this budget constraint can be thought of as the aggregate budget constraint (at the level of the economy as a whole). And the real financial wealth of society (W/P), that is, the supply of all types of financial assets (monetary and non-monetary) is equal to: W/P = (M/P) S + (B/P) S. Since the left sides of these equalities are equal, then the right sides are also equal: (M/P) D + (B/P) D = (M/P)S + (B/P)S, from here we get that: (M/P ) D - (M/P) S = (B/P) S - (B/P) S

Thus, Walras' law for the financial market has been proven. Excess demand in the money market equals excess supply in the bond market. Therefore, we can limit our analysis to the study of equilibrium conditions only in the money market, which means automatic equilibrium in the bond market and, therefore, in the financial market generally.

Let us therefore consider the money market and its equilibrium conditions. As is known, in order to understand the patterns of functioning of any market, it is necessary to study supply and demand, their relationship and the consequences (impact) of their changes on the equilibrium price and equilibrium volume in this market.

Demand for money, its types and factors

Types of demand for money are determined by two main functions of money: 1) the function of a medium of exchange and 2) the function of a store of value. The first function determines the first type of demand for money – transactional. Since money is a medium of exchange, i.e. act as an intermediary in exchange; they are necessary for people to purchase goods and services and to make transactions.

Transaction demand for money is the demand for money for transactions, i.e. to purchase goods and services. This type of demand for money was explained in classic model, was considered the only type of demand for money and was derived from the equation of the quantity theory of money, i.e. from the equation of exchange (proposed by the American economist I. Fisher) and the Cambridge equation (proposed by the English economist, professor at Cambridge University A. Marshall).

From the equation of the quantity theory of money (Fisher equation): M x V= P x Y it follows that the only factor in the real demand for money (M/P) is the value of real output (income) (Y). A similar conclusion follows from the Cambridge equation. In deriving this equation, A. Marshall assumed that if a person receives nominal income (Y), then he stores a certain portion of this income (k) in the form of cash. For the economy as a whole, nominal income is equal to the product of real income (output) and the price level (P x Y), from which we obtain the formula: M = k PY, where M is the nominal demand for money, k is the liquidity ratio, showing what proportion of income is stored people in the form of cash, P is the price level in the economy, Y is real output (income). This is the Cambridge equation, which also shows the proportional dependence of the demand for money on the level of total income (Y). Therefore, the formula for transaction demand for money is: (M/P) D T = (M/P) D (Y) = kY. (Note: From the Cambridge equation one can obtain the exchange equation since k = 1/V).

Since the transaction demand for money depends only on the level of income (and this dependence is positive) (Fig. 1.(b)) and does not depend on the interest rate (Fig. 1.(a)), it can be represented graphically in two ways:

The point of view that the only motive for the demand for money is its use for transactions existed until the mid-30s, until Keynes’s book “The General Theory of Employment, Interest and Money” was published, in which Keynes discussed the transactional motive of the demand for money added 2 more motives for the demand for money - the precautionary motive and the speculative motive - and accordingly proposed 2 more types of demand for money: prudent and speculative.

Prudent demand for money (demand for money from the motive of precautionary demand for money) is explained by the fact that in addition to planned purchases, people also make unplanned ones. Anticipating situations like these where money may be needed unexpectedly, people keep extra amounts of money beyond what they need for planned purchases. Thus, the demand for money from the precautionary motive also stems from the function of money as a medium of exchange. According to Keynes, this type of demand for money does not depend on the interest rate and is determined only by the level of income, therefore its schedule is similar to the schedule of transaction demand for money.

Speculative demand for money is determined by the function of money as a store of value (as a means of storing value, as a financial asset). However, as a financial asset, money only maintains value (and even then only in a non-inflationary economy), but does not increase it. Cash has absolute (100%) liquidity, but zero profitability. However, there are other types of financial assets, for example, bonds, which generate income in the form of interest. Therefore, the higher the interest rate, the more a person loses by holding cash and not purchasing interest-bearing bonds. Consequently, the determining factor in the demand for money as a financial asset is the interest rate. In this case, the interest rate acts as the opportunity cost of holding cash. A high interest rate means high bond yields and a high opportunity cost of holding money on hand, which reduces the demand for cash. At a low rate, i.e. low opportunity costs of holding cash, the demand for it increases, since with low returns on other financial assets, people tend to have more cash, preferring its property of absolute liquidity. Thus, the demand for money negatively depends on the interest rate, so the speculative demand curve for money has a negative slope (Fig. 2.(b)). This explanation of the speculative motive for the demand for money, proposed by Keynes, is called the theory of liquidity preference. The negative relationship between speculative demand for money and interest rates can be explained in another way - from the point of view of people's behavior in the securities (bond) market. Modern portfolio theory of money comes from the theory of liquidity preference. This theory is based on the premise that people construct a portfolio of financial assets in such a way as to maximize the income received from those assets while minimizing risk. Meanwhile, it is the riskiest assets that bring the most big income. The theory is based on the familiar idea of an inverse relationship between the price of a bond, which is the discounted amount of future earnings, and the interest rate, which can be thought of as the discount rate. The higher the interest rate, the lower the price of the bond. Stock speculators benefit from buying bonds at the lowest price, so they exchange their cash by buying bonds, i.e. Demand for cash is minimal. The interest rate cannot be kept at a high level all the time. When it begins to fall, the price of bonds rises, and people begin to sell bonds at higher prices than what they bought them at, receiving the difference in prices, which is called capital gain. The lower the interest rate, the higher the price of bonds and the higher the capital gain, therefore, the more profitable it is to exchange bonds for cash. The demand for cash is increasing. When interest rates begin to rise, speculators begin buying bonds again, reducing the demand for cash. Therefore, the speculative demand for money can be written as: (M/P) D A = (M/P) D = - hR.

The total demand for money consists of transactional and speculative: (M/P) D = (M/P) D T + (M/P) D A = kY – hR, where Y is real income, R is the nominal interest rate, k is sensitivity (elasticity) of changes in the demand for money to changes in the level of income, i.e. a parameter that shows how much the demand for money changes when the level of income changes by one, h is the sensitivity (elasticity) of changes in demand for money to changes in the interest rate, i.e. a parameter that shows how much the demand for money changes when the interest rate changes by one percentage point (the parameter k in the formula is preceded by a “plus” sign, since the relationship between the demand for money and the level of income is direct, and the parameter h is preceded by a “minus” sign ", since the relationship between the demand for money and the interest rate is inverse).

In modern conditions, representatives of the neoclassical movement also recognize that the factor in the demand for money is not only the level of income, but also the interest rate, and the relationship between the demand for money and the interest rate is inverse. However, they still adhere to the point of view that there is only one motive for the demand for money - transactional. And it is transaction demand that inversely depends on the interest rate. This idea was proposed and proven by two American economists William Baumol (1952) and Nobel laureate James Tobin (1956) and called the Baumol-Tobin cash management model.

Money supply

The money supply is the presence of all money in the economy, i.e. this is the money supply. For characterization and measurement money supply Various general indicators, the so-called monetary aggregates, are used. In the USA, the money supply is calculated using four monetary aggregates, in Japan and Germany - three, in England and France - two. This is explained by the peculiarities of the monetary system of a particular country, in particular the importance of various types of deposits.

However, in all countries the system of monetary aggregates is built in the same way: each subsequent aggregate includes the previous one.

Consider the US monetary aggregate system.

The monetary aggregate M1 includes cash (paper and metal, i.e. banknotes and coins - currency) (in some countries cash is separated into a separate aggregate - M0) and funds in current accounts (demand deposits), i.e. checkable deposits or demand deposits.

M1 = cash + checkable deposits (demand deposits) + traveler's checks

The M2 money supply includes money supply M1 and funds in non-checking savings accounts (save deposits), as well as small (up to $100,000) time deposits.

M2 = M1 + savings deposits+ small time deposits.

The M3 money supply includes the M2 money supply and funds in large (over $100,000) time deposits.

M3 = M2 + large time deposits + certificates of deposit.

The monetary supply L includes the monetary supply M3 and short-term government securities (mainly treasury bills)

L = M3 + short-term government securities, Treasury savings bonds, commercial paper

The liquidity of monetary aggregates increases from bottom to top (from L to M0), and profitability increases from top to bottom (from M0 to L).

The components of monetary aggregates are divided into: 1) cash and non-cash money and 2) money and “near-money”.

Cash includes banknotes and coins in circulation, i.e. outside the banking system. These are debt obligations Central Bank. All other components of monetary aggregates (i.e. those located in banking system) represent non-cash money. These are debt obligations of commercial banks.

Money is only the monetary aggregate M1 (i.e. cash - C (currency), which is the obligations of the Central Bank and has absolute liquidity and zero profitability, and funds in the current accounts of commercial banks - D (demand deposits), which are the obligations of these banks) : M = C + D

If funds from savings accounts are easily transferred to checking accounts (as in the United States), then D will include savings deposits.

Monetary aggregates M2, M3 and L are “almost money” because they can be converted into money (as you can: a) either withdraw funds from savings or term accounts and turn them into cash, b) or transfer funds from these accounts to a current account, c) or sell government securities).

Thus, the supply of money is determined by economic behavior:

- The central bank, which provides and controls cash (C);

- commercial banks (banking sector of the economy), which store funds in their accounts (D)

- population (households and firms, i.e. the non-banking sector of the economy), who make decisions in what proportion to divide cash between cash and funds in bank accounts (deposits).

Even love has not driven as many people crazy as

speculation about the essence of money.

William Y. Gladstone (1809 - 1898),

Prime Minister of Great Britain.

There are three types of demand for money:

1 . Demand for money from transactions;

2 . Demand for money from assets (or as a store of value);

3 . General demand for money.

Demand for money for transactions.

People need money as a medium of exchange, that is, to purchase goods and services. Further households need money to buy goods, pay debts and pay public utilities. Businesses need money to pay for labor, materials and energy. The money needed for all purposes is called demand for money for transactions. The amount of money needed to conclude transactions is determined by the value of the gross national product. The more product is produced, the greater the mass of prices of goods produced, the more money is required to conclude transactions. The demand for money for transactions varies in proportion to the value of the gross national product. There is another indicator that affects the amount of money needed for transactions - the speed of their turnover. If each monetary unit makes 3 turnovers per year, then the amount of money needed for transactions will be three times less than the sum of prices and services.

There is a monetary circulation formula that determines the amount of money in circulation.

Quantity of money = sum of prices of all goods and services = value of GNP

From the formula it is clear that, Firstly, the amount of money needed depends on the size of the product produced and the prices of the goods. With the growth of gross national product (GNP) and rising prices, the number of banknotes should also increase. Secondly, an increase in the number of banknotes with a constant gross national product will lead to an increase in prices. Both features must be used when regulating money circulation. There should be no more money in circulation than the required amount. An excess of money over the required amount leads to inflation, a lack of money compared to the necessary leads to non-payments, overstocking, and a stop in production. Let us note that the amount of money required for the normal course of circulation can be calculated and predicted.

Demand for money as a store of value (demand for money from assets).

Perhaps no other function of money has been written about as much as the function of a store of value or accumulation of treasures.

An amazing property of money as a store of value is its ability to preserve for its owner the opportunity to receive life's benefits for many years. In this sense, money acts as “canned consumption”. These “canned goods” can be accumulated and then used at the moment when their owner so desires.

Of course, money is not the only form of treasure. This role is challenged by many other types of values: real estate (land or houses), works of art, antiques, jewelry, stamp or coin collections, and even wine cellars.

All these assets if necessary, they can be used to exchange some other goods for them.

Assets- everything of value that belongs to a person, company or state as property.

To use non-monetary assets, therefore, the owner must either find a way to directly exchange them for the goods he needs, or first convert non-monetary assets into money. The latter is possible only through the liquidation (sale) of assets.

However, if assets are kept in the form of money, then the task is extremely easier. After all, money can be used to purchase the necessary goods without any intermediate operations, i.e. directly. Money has a great advantage over other assets - it is absolutely liquid.

Liquidity - the degree of ease with which any asset can be converted by its owner into money.

Indeed, for selling a house, land plot or a painting by a famous artist (liquidation of property) requires time and considerable effort. Moreover, it is even difficult to say in advance how much money will be raised. For example, few people are able to accurately predict the results of auctions at the famous Sotheby's, where paintings by great artists are usually sold. Sometimes prices skyrocket, and sometimes canvases are removed from auction: no one wants to give even the starting, minimum price for them. Therefore, everything non-monetary forms treasures are much less liquid than money itself.

Therefore, saving money as such is in principle most convenient, since monetary savings can be used for spending immediately.

However, the ability to use money as a store of value is important not only for reserving part of current income for future consumption or gradually collecting a large amount for an expensive purchase. If money were not recognized by people as a store of value, it could not serve as a means of exchange.

In fact, it may take time from the seller receiving money for the goods sold to the purchase of something themselves. If all this time money does not retain its value, i.e. ability to serve as payment for new purchase, then no one will agree to accept them in exchange for material goods and services. The less a product is able to retain its value and suitability as a store of value, the less likely it is to become a monetary commodity.

It is characteristic that during the times of war communism in Soviet Russia, when the monetary economy collapsed and paper money lost its ability to serve as a store of value, people began to save in goods that were well preserved and did not lose their value over time. These goods were salt and matches.

But even if in monetary system In the country, everything is normal and the money put into circulation is recognized by everyone both as a means of circulation and as a means of storage, this does not mean that keeping savings in the form of money is definitely the best solution.

The accumulation of treasures in monetary form is fraught with certain losses for their owner. These losses arise from two reasons:

1. Lost opportunity to generate income. The money could generate income if invested in commercial operations;

2. Depreciation of money as a result of rising prices.

Therefore, choosing a form of treasure accumulation is difficult economic problem, which everyone has to decide: both professional economists and ordinary citizens who have managed to make at least small savings.

It can be concluded that money - a special product that:

1. Accepted by everyone in exchange for any other goods and services

2. Allows you to uniformly measure all goods for the needs of exchange and accounting, as well as

General demand for money.

The total demand for money is the sum of the demand for money for transactions and the demand for money from assets. The overall demand for money depends on the value of the gross national product and the interest rate. The money supply can be changed with the help of certain measures on the part of the government. The government must control the money supply, that is, the issue of both cash and credit, and manage the money supply to achieve certain goals. Let's take a closer look at the consequences of a change in the money supply and a change in the interest rate. In the money market, where supply and demand collide, demand is a relatively stable and predetermined value of the gross national product (in terms of the demand for money for transactions) and the interest rate (in terms of the demand for money from assets ). And the money supply can be changed by pursuing certain policies on the part of the government and the Central Bank. Changing the money supply has certain consequences. Let’s assume that a temporary equilibrium has been established in the money market at the moment; people have as much money in their hands as corresponds to their demand (desire), predetermined by the factors described above. We can say that as much money was put into circulation as corresponded to demand. Now imagine that the supply of money has increased. “If people were satisfied with the size of their money holdings, and the total money supply increased, then over time people will find that they have accumulated too much money and will try to reduce their actual money holdings to the desired level.” (Heine). They will change their cash reserves by changing the structure of their assets - for example, by buying shares of corporations or government bonds. An increase in the money supply will increase the demand for all other types of assets - financial assets and goods. This will lead to an increase in prices for goods, an increase in prices for bonds, shares and a decrease in the market interest rate for the use of money. The structure of assets will change until the marginal profitability of all types is the same.

If there is less money in circulation than the demand for it (the desire to have money in reserve), then people will again try to change the structure of assets. They will try to reduce their purchases, which will lead to lower prices for goods. They will also sell real estate, stocks, bonds, which will lead to a decrease in their market prices. This process will continue until the marginal benefit of all assets is the same. Interest rate for the use of money will in this case increase. Thus, by influencing the quantity of money supply, it is possible to influence many processes, since changes in the volume of money supply affect the state of the economy as a whole.

Equilibrium in the money market. Monetary aggregates.

Money is in constant movement. The cash form of money circulation is the movement of cash, i.e. coins and banknotes. Coins are an ingot of metal of a special shape and standard, banknotes are bank notes issued by the central bank of the country. Cashless form monetary circulation is associated with non-cash payments.

Monetary circulation is subject to a certain law, which determines the amount of money necessary to ensure commodity circulation in the country.

D + (R - K + P - V) / O,

Where D is the amount of money;

P - the sum of prices of goods to be sold, rubles;

K - sum of prices of goods sold on credit, rubles;

P - the sum of the prices of goods for which the payment period has already arrived, rubles;

B - the amount of mutually extinguishing payments, rubles;

O is the speed of money turnover in a given period of time.

The equation of exchange is a calculated relationship according to which the product of the money supply and the rate of turnover of money is equal to the product of the price level and the real value of the gross national product

M CH O = R CH N,

Where M is the amount of money in circulation;

O is the rate of money turnover per year, rubles;

P - price level of goods, rubles;

N is the real value of GNP, rubles;

R CH N - nominal value of the gross national product, rub.

The equation of exchange shows a relationship that leads to the fact that the amount of money in circulation will correspond to the real need for it. The state must support this relationship by pursuing the correct monetary and financial policies.

Currently, monetary aggregates are used to analyze changes in the process of money flow. Monetary aggregates - These are types of money that differ from each other in their degree of liquidity.

M o - cash in circulation;

M 1 = M o + means legal entities on settlement and current accounts + demand deposits individuals in commercial banks;

M 2 = M 1 + time deposits of individuals and legal entities in commercial banks;

M 3 = M 2 certificates of commercial banks + bonds of freely negotiable loans, etc.

To money turnover has not been violated, monetary aggregates must be in a certain equilibrium.

Using monetary aggregates, you can determine the speed of money turnover:

O = N/M 2,

Where O is the speed of money turnover, turnover;

N is the annual volume of GNP, rubles;

M 2 - monetary aggregate, r.