Zup 3.0 bonus calculation

Accountants know that payroll is a complex and responsible operation. It must be done strictly following labor and tax laws. In 1C 8.3 you can keep records of all types of income, benefits, and compensation. Read on to learn how to calculate salaries in 1C ZUP 8.3 Accounting step by step.

Payroll transactions are inextricably linked with personnel records. It all starts with hiring an employee. It is when registering a new employee that you indicate the data on the basis of which you will make calculations in the future. Details. It is also important to take into account personnel movements and dismissals of employees in a timely manner in the program. In 1C salary and personnel, you can calculate bonuses, sick leave, travel allowance, vacation pay, dismissal benefits, and many other payments. Read about payroll calculation in 1C 8.3 ZUP step by step for beginners in this article.

Step 1. Enter personnel data for employees in 1C

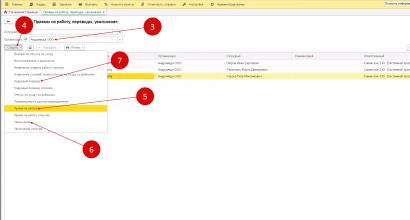

In 1C 8.3 ZUP, all personnel operations are located in the “Personnel” section (1). To register hiring, transfers, dismissals, click on the link “Hirings, transfers, dismissals” (2). A window for creating personnel transactions will open.

When hiring, you indicated the employee's salary and work schedule. Based on this data, the program will calculate wages for the month. Read on to learn how to calculate your salary.

Step 2. Make payroll calculations in 1C

On the home page, select the desired organization (1).

Go to the “Salary” section (2) and click on the “Payroll calculation...” link (3). A window for creating an operation will open. It shows all previously created accruals for the selected organization.

In this window, start sequential payroll and contribution calculations. Make sure the correct organization is listed (4). Click the “Create” button (5) and click on the “Salary and contributions calculation” link (6). A form for calculating salaries in 1C 8.3 ZUP will open.

Here, indicate the month of accrual (7) and enter the last date of the month (8). Next, click the “Fill” button (9) and click on the “Fill” link (10).

The “Accruals” tab (11) is filled with data on employees (12) and their salaries (13). Salary calculations are based on days worked. If an employee was hired or fired in the middle of the month, then 1C 8.3 ZUP will not accrue the full salary, but will calculate based on days worked.

In the “Personal Income Tax” tab (14) you see the calculation of personal income tax for each employee (15). The program automatically calculates personal income tax, taking into account the deductions specified when hiring. About.

In the “Contributions” tab (16) you can see the calculation of insurance contributions to the Pension Fund (17), Social Insurance Fund (18), Social Insurance Fund for Accidents (19), FFOMS (20). In 1C 8.3, salaries and personnel contributions are calculated automatically at the rates in force in Russia. For the Social Insurance Fund contribution for accidents, the rate is set in the accounting policy of the organization. To enter the accounting policy, click the “Open” icon (21). The organization card will open.

In the organization’s card, click on the “Accounting Policy...” tab (22) and select the “Accounting Policy” link (23). Your company's accounting policy will open.

In the accounting policy window, indicate the rate of contributions to the Social Insurance Fund for accidents (24). To save the data, click the “Save and close” button (25).

Step 3. Accrual of bonuses in 1C ZUP

In 1C 8.3 ZUP, bonuses can be calculated in two ways:

- In the document “Calculation of salaries and contributions”;

- In a separate document “Awards”.

Calculation of bonuses in 1C in the document “Calculation of salaries and contributions”

Let's say you have already accrued wages based on your salary, now you want to add bonuses to these accruals. Go to the created document “Calculation of salaries and contributions” as written in this article. Click the “Add” button (1) and select the required employee from the directory (2). Indicate the division (3), the type of bonus accrued (4) and its amount (5).

Go to the “Personal Income Tax” tab (6) and click the “Recalculate Personal Income Tax” button (7). Tax (8) will be recalculated taking into account the added premium.

Next, go to the “Contributions” tab (9) and click the “Recalculate contributions” button (10). Contributions (11) will also be recalculated taking into account the premium. To save data on award calculations, click the “Post and close” button (12).

Accrual of bonuses in 1C with a separate document “Bonus”

Go to the “Salary” section (1) and click on the “Bonuses” link (2). A window for creating an operation will open. It shows all previously created accruals for bonuses in 1C 8.3 ZUP.

In the window that opens, click the “Create” button (3). A form for calculating bonuses will open.

In it, indicate the month the bonus was calculated (4) and the last day of this month (5). Next, select the type of bonus to be awarded from the directory (6), click the “Selection” button (7) and select the desired employee (8). Specify the bonus amount (9) and the period for which it is calculated (10). To complete the operation in 1C 8.3 ZUP, click the “Perform and close” button (11). The bonus has been awarded.

The “Awards” document does not contain accruals for personal income tax and contributions. These taxes must be calculated in the document “Accrual of salaries and contributions”. To do this, go to the “Salary” section (12) and click on the “Payroll calculation...” link (13).

Go to the accrual document, which indicates the same month (14) as was in the “Bonus” document.

In the “Personal Income Tax” tab (15), click the “Recalculate...” button (16). Tax (17) will be recalculated taking into account the premium accrued in a separate document.

In the “Contributions” tab (18), click the “Recalculate...” button (19). Contributions (20) will be recalculated taking into account the premium accrued in a separate document.

Step 4. Pay your salary in 1C Salary and HR Management

Go to the “Payments” section (1) and click on the “Statements to the cashier” link (2). A window will open to create a payment from the cash register.

In the window that opens, click the “Create” button (3). A document for creating a payment will open.

In the “Statement to Cashier” window, indicate the month for which you are paying the salary (4) and click the “Fill” button (5). The statement will automatically be filled with amounts for payment.

The completed statement in 1C 8.3 ZUP shows the amounts to be paid (6) and the amounts of personal income tax to be transferred to the budget (7). To save and post the statement, click the “Record” (8) and “Post” (9) buttons. In order to print the payroll, click the “Print” button (10) and select the link “Payroll (T-53)” (11). A printable payroll form will open.

Basic entries for payroll and contributions

| Operation | Debit | Credit |

| Salary accrued | 20 (44,23,25,26) | 70 |

| Personal income tax withheld | 70 | 68 |

| Contributions accrued | 20 (44,23,25,26) | 69 |

| Wages paid | 70 | 50,51 |

And if you would like to check everything you read in practice, you can start filling out your settings, since we will no longer be interrupted.

So, if our organization will use a monthly bonus, we will activate the corresponding option and set the necessary settings. In my case, the bonus is calculated as a percentage of the current month’s earnings, but you can also charge bonuses in fixed amounts or use both types of accruals.

The quarterly bonus settings are initially similar to the monthly bonus settings. If we use it, check the box and select the calculation method, as in the previous example. I show that I will use a quarterly bonus with two types of accruals at once.

If we have indicated that we will pay a quarterly bonus, the next stage will be devoted to its detailed settings. The composition of calculations and documents in the program will depend on them.

My bonus will be accrued in certain months during the final salary calculation. This will occur in January, April, July and September.

The next stage is setting up the annual bonus. If we had not used the quarterly bonus, we would have gotten here right away, bypassing the previous step. The situation is exactly the same with the annual bonus. If we use it, its additional settings will appear at the next stage.

I will activate this feature in my database and will accrue annual bonuses in fixed amounts.

In my case, the annual bonus will be accrued during the final salary calculation as decided by management. And so everything here is similar to the quarterly bonus settings.

A one-time bonus can be accrued when calculating salaries or during the interpayment period. In the second case, which I selected in my database, employees will receive bonuses dedicated to certain dates. Such bonuses are paid regardless of the date of salary accrual and are fixed by appropriate orders.

We indicate whether we will use bonuses for harmfulness and length of service. I'll mark both. If you use a bonus for length of service, you can immediately configure the dependence of the percentage of the bonus on the employee’s length of service. To do this, click on the appropriate link.

In the window that opens, leave the basic settings as default. We only need to fill out a table with months of experience and percentage.

At my company, no allowances will apply to employees until they have worked for a year. After a year of work at the enterprise, the employee will receive a five percent bonus, and after thirty-six months (three years) - ten percent. The interest rate will not rise any further.

These settings will be automatically taken into account by the program, and it will itself apply the appropriate bonuses to employees when their length of service reaches the values specified in this example.

Now you need to save the changes and close the window. To do this, you can click the “Save and Close” button with your mouse, but I strongly recommend mastering the hotkeys. They are identical in all 1C:Enterprise 8 configurations, and in the future their use will greatly increase your speed of working with the program and make it more comfortable.

To save changes and close the current window, just press Ctrl+Enter. This combination is used quite often and I highly recommend memorizing it.

The Ctrl+S combination saves the entry, but leaves the window open.

If you just want to exit without saving the settings, just press Esc and discard the changes.

But let's move on. At the next stage, you can specify other allowances as a percentage of the salary and a fixed amount. They are entered manually and used later by the program. In my examples I will use additional allowances, but I will add them to the program later, when they are directly needed.

Next comes the compensation payment settings. I will add compensation for the use of private cars. I add a new line to the list using the Insert hotkey, although you can also use the button in the program interface.

I fill in the compensation I need, indicate that it is not subject to taxes and contributions, and establish the procedure for calculating it in a separate document. The cursor immediately jumps to a new line, offering to create a new compensation, but I remove it by pressing the Esc button.

Now we are setting up additional holidays. In my organization, I will provide study leave and additional leave to employees who suffered from the consequences of the disaster at the Chernobyl nuclear power plant.

I will also add two of my own types of additional leave.

The first is for family reasons. He has no additional conditions. The second will be given annually for harmful working conditions and will be fourteen days. During these days, accruals for compensation and deductions will be automatically added.

If northern and regional coefficients were specified in the organization’s accounting policy, the program will also automatically create additional vacations provided for by law in such cases.

We will set up additional payments up to average earnings. The first additional payment is used to calculate the salary reduction. The additional payment for sick days and its percentage are also established here. I enable both features, leaving the sick day copayment percentage at the default.

Now we will indicate information about downtime and absences from work. I will not have downtime, but absences will be recorded. This includes absenteeism and other absences due to unclear circumstances.

I will also include the provision of unpaid vacations.

At the next stage, we will set up the provision of financial assistance to employees. The first paragraph provides for a one-time payment, which is carried out by a separate order. The second point is financial assistance for vacation. The size for it is set in the number of salaries. The default value is one salary. I'm happy with this setup.

Now we need to set up other payments. My organization will use additional payments for part-time and temporary performance of duties, as well as payment for the implementation of the plan, both as a coefficient and as a percentage of sales volume.

In addition, I will activate the possibility of using one-time charges. These are accruals for which there are no special documents in the “1C: Salary and Personnel Management 3.0” configuration. They are created manually using a separate document for one-time charges.

Many enterprises, in addition to the established salary, pay their employees performance-based remuneration - a bonus. In this article we will look at how the 1C Accounting 8 edition 3.0 program reflects the calculation of bonuses to an employee. I will show it using the example of the “Taxi” interface, which is recommended by 1C.

The bonus itself is not calculated in the 1C Accounting 8 rev.3.0 program, so you can only indicate its size when calculating salaries.

In our example, the premium will be monthly and its amount will be fixed. In this case, it is enough to add the bonus once through “Hiring” or “Personnel Transfer” and in the future it will be filled out automatically in the “Payroll” document.

If the amount of the bonus changes from month to month, then you can either add a bonus to the employee through “Hiring” or “Personnel Transfer” with a certain amount, and then simply correct the amount in the accrual document. Or choose to manually calculate the premium in the document and enter the amount.

However, first the accrual type “premium” must be added to the “Accruals” directory.

To do this, go to the “Salary and Personnel” tab, select “More” and “Salary Settings”. In the settings, follow the “Accruals” hyperlink.

We create a new accrual using the “Create” button. We indicate the name and accrual code. We select the personal income tax code 2000. Type of income for insurance premiums - “Income fully taxable with insurance premiums.”

Type of expense under Article 255 of the Tax Code of the Russian Federation - pp. 2.

Check the box “Included in the accruals for calculating the “Regional coefficient” and “Northern surcharge” accruals.

We do not indicate the reflection method, because it coincides with the method of calculating the employee’s salary.

Click “Save and close”.

Next, we will add the “Monthly bonus” accrual to the employee. If an employee is just being hired, this can be done in the “Hiring” document, in which the first line indicates the employee’s salary, and the second line indicates the monthly bonus.

If a bonus is assigned to an employee who has already been hired by the enterprise, you can use the “Personnel Transfer” document, also located on the “Salaries and Personnel” tab.

In the document, check the “Change accruals” checkbox and add a new “Monthly bonus” accrual as the second line.

Now, when the employee is paid a salary, the monthly bonus will also be calculated automatically in the amount specified in the “Personnel Transfer” document.

In order to accrue bonuses to an employee, on the “Salaries and Personnel” tab in the “All Accruals” section, create the “Payroll” document and click on the “Fill” button.

After the document is completed, the monthly premium, personal income tax on it and contributions are calculated.

This is how you can calculate a bonus for an employee in the 1C Accounting 8 edition 3.0 program. And about how to hire a part-time employee, see

Initial program setup

When you first launch the 1C ZUP 8.3 program in the “Initial program setup” assistant, it is proposed to set the award settings separately for each type of award:

To set up premium calculation in 1C ZUP, you need to check the box for the required method.

Setting up a quarterly bonus:

Setting up an annual bonus:

Later, all the settings made can be checked and, if necessary, edited, in the list of types of accruals in the Settings section - then Accruals.

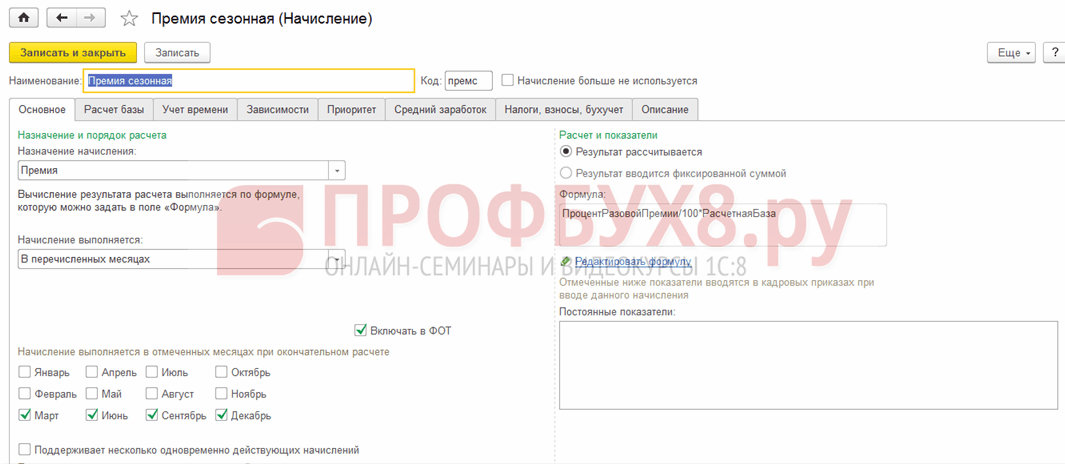

Setting up the accrual type Bonus

And if during the initial setup the use of a premium is not specified or the premium is calculated in a different way, then it can also be included in the accruals. To enter an accrual for the type of bonus, you can specify Bonus in the Accrual Purpose field.

Let's consider filling out an accrual with the type of assignment Premium:

- Name – name of the award for selecting the accrual in the documents;

- Code – a unique accrual code, can be either numeric or text;

- The Accrual is no longer used checkbox controls the visibility of the accrual in the list, since unused accruals are not reflected in the list:

Basic tab

- The accrual is carried out - set the method from the proposed list.

This field regulates the type of bonus and affects the visibility of elements on the form:

- Monthly – accrual is calculated monthly using the Payroll document, which can be scheduled;

- According to a separate document - the bonus is accrued by the Bonus document and cannot be planned, is of a one-time nature, and is usually an inter-settlement bonus;

- In the listed months - similar to the monthly one, only it becomes possible to specify the months by selecting them with checkboxes;

- Only if the value of the indicator is entered - is calculated by the document Payroll only if the indicator is established by the document Data for salary calculation;

- Only if the type of time tracking is entered - it is calculated using the Payroll document only if the type of time is specified. The type of time is set in accrual in one of the following ways:

- – In the document Data for salary calculation;

- – In the time sheet;

- – In the employee’s work schedule.

- Only if the time falls on holidays - it is calculated using the document Calculation of wages when working days fall according to the schedule or timesheet for holidays according to the production calendar.

Important! The last two options are rarely used for calculating bonuses in 1C ZUP 8.3, unless for a specific one, depending on these indicators.

- The Include payroll checkbox is set to generate a planned payroll for employees; it can only be set for the set values Monthly and In the listed months;

- Supports several simultaneous accruals - allows you to enter several identical accruals using different documents;

- Accrued when calculating the first half of the month - regulates the calculation of the premium in advance or only in final payment;

- Calculation and indicators are selected from two options:

- – The result is calculated – the formula is indicated below. If the formula contains the Calculation base indicator, then the list of charges included in it is filled in on the Calculation base tab;

- – The result is entered as a fixed amount – when choosing this option, the premium amount is entered manually by the user.

- Formula – to change or enter a formula, click on the Edit formula link;

- Constant indicators - all constant indicators for this accrual are indicated, which will be entered by personnel orders when choosing this accrual.

This tab indicates the period of the calculation base and the list of charges included in the calculation base:

Dependencies and Priority tabs

Dependent accruals and deductions are indicated, and the priority of accruals is set.

Makes it possible to set the accrual accounting method for calculating average earnings:

Options for taking into account bonuses when calculating average earnings in 1C ZUP are discussed in our video lesson:

This tab contains data for accounting and taxes, insurance premiums and reflection of accruals in accounting:

Tab Description

On the Description tab you can briefly describe the accrual.

Let's take a closer look at creating a formula for calculating bonuses in 1C ZUP 8.3. As mentioned earlier, to work with the formula you need to follow the Edit formula link:

The new window is divided into 2 parts. The upper part is the formula itself, the lower part is the indicators. The 1C ZUP 8.3 database already has several predefined indicators, but if you need to create another parameter, you must use the Create indicator command. You can transfer an indicator using the Add to formula command or by double-clicking on it.

When you create an indicator, a new form opens to configure it:

- Name and short name – the name of the indicator in the database;

- Identifier – a parameter that will be used later in the formula;

- Purpose of the indicator - select for which objects the indicator is set: for an employee, a department or in general for the organization;

Indicator type – regulates the dependence of the indicator on other indicators, selected from the proposed list:

- Monetary – enter the amount, which can be a tariff rate;

- Numeric – entered as a number;

- Numerical, depending on another indicator - an indicator that depends on the base indicator (selected from the same indicators) and for which its value will be determined according to the table described below;

- Numerical, depending on length of service - the value of the indicator will be determined according to the relationship described in the table for the selected type of employee experience:

If monetary or numerical, then you can indicate the frequency of use of the indicator:

- Constant – used as a constant indicator until canceled;

- One-time document Entering data for salary calculation, for example, the percentage of a one-time bonus. The value is entered and valid for a month;

- Individual values are accumulated - the sum of the values entered in the Data document for salary calculations, for example, for bonuses based on the amount of work performed;

- Entered during calculation - indicated directly in the accrual document: Bonus or Payroll document. For this type of indicator, data is not entered in advance:

If it depends on another parameter - length of service or indicator, then it is necessary to indicate a table of dependence on the parameter.

Important! The last value is considered inclusive, the initial value is not included:

Entering bonus parameters in 1C ZUP 8.3

One-time bonus with a fixed amount or a fixed percentage

To issue a bonus with a fixed amount or a fixed percentage based on the value of an indicator, you must specify in the accrual settings that the accrual is performed “Only if the indicator value is entered” and specify the formula in the formula. For example, “Size of One-Time Premium” or Percentage of One-Time Premium / 100 * Calculated Base for a fixed bonus or percentage bonus, respectively:

The value of this parameter is entered in the Data for salary calculation document from the Salary section, depending on the type of bonus. First, for the document Data for salary calculation, you need to create an Initial Data Entry Template in the Settings – Initial Data Entry Template section.

Important! With this document you can enter data for all types of bonuses: one-time, quarterly and annual:

You must select employees in the document or fill them in with the command Fill in employees for the selected organization and a specific division, if the latter is configured for output in the Initial Data Entry Template.

For each employee, you must indicate the bonus amount or percentage, depending on the type of document that is selected when creating:

To set the amount/percentage for all employees in the document at once, you must use the Fill in indicators command:

Monthly bonus

To set up a monthly premium in 1C ZUP 8.3, you must specify the use of accrual - monthly:

Bonus depending on the month of accrual

If the premium is calculated in certain months, for example, quarterly, annual or seasonal:

To do this, be sure to indicate in which months the bonus must be calculated and, depending on the indicators of the formula (one-time or permanent), enter documents Data for salary calculation, indicate in planning documents, or the value is already set in the calculation document itself.

Important! To calculate a quarterly or annual bonus in 1C ZUP 8.3, you must indicate in the accruals on the Base calculation tab the corresponding period for calculating the base, if the bonus formula uses the Calculation base indicator:

Entering constant indicators in planned accruals

To indicate a constant indicator (percentage or amount), depending on the bonus calculation formula, it is necessary to enter the indicator into the planned accruals. To do this, you must indicate the premium and its calculated indicator in the documents:

1. When employing or transferring an employee in personnel documents - Hiring and Personnel Transfer: in the Personnel section - Receptions, transfers, dismissals:

2. To enter bonus indicators for a certain period using the documents Assignment of planned accruals, Change of planned accruals in the section Salary - Change of employee pay:

3. To change on a permanent basis Change of remuneration in the section Salary - Change of employee remuneration:

4. As well as documents Transfer to another employer and Data for the start of operation for appropriate cases.

Calculation and accrual of bonuses in 1C ZUP 8.3

Bonuses at final settlement

The accrual of bonuses in 1C ZUP 8.3 is documented in the document Accrual of salaries and contributions from the Salary section.

To fill out the document, you need to fill out the header: organization and department, if the salary is accrued to a specific department, indicate the month the salary was calculated and use the Fill command. When performing this action, the document will be filled out by all employees for whom there is no accrued wages. To add one or more specific employees, you can use the selection button.

The document displays all accruals, additional accruals, benefits, recalculations, as well as deductions, taxes and contributions at once. If all data on indicators have been entered for the bonus, it is automatically calculated and displayed in this document:

In this article, 1C experts talk about setting up"1C:ZUP 8" ed.3types of calculation of bonuses - codes for types of personal income tax income and categories of income in the case of payment of a monthly bonus, one-time bonus and anniversary bonus (paid from the company’s profits) for correct reflection in personal income tax reporting.

How to set up “1C: Salary and Personnel Management 8” edition 3 so that in the calculation of 6-personal income tax it is possible to correctly reflect different cases of an employee receiving a bonus, taking into account standard deductions for personal income tax.

Income codes for accounting for bonuses

By order of November 22, 2016 No. ММВ-7-11/633@, the Federal Tax Service of Russia approved income codes: 2002 and 2003 for accounting for bonuses.

The need to divide the premium into income codes 2002 and 2003 raises the question of what is meant by the word “premium”.

From the point of view of the Labor Code (Article 129), a bonus is one of the types of incentive payments for wages. Article 135 of the Labor Code of the Russian Federation, which regulates the setting of wages, states that bonus systems are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law norms. Article 191 of the Labor Code of the Russian Federation lists a bonus as one of the means of incentives for work. There are no other mentions in the Labor Code of the word “bonus”, and, therefore, all bonuses assigned in accordance with the Labor Code of the Russian Federation are related to wages.

So, the order of the Federal Tax Service of Russia divided all bonuses into bonuses with the code:

- 2002 – amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues) ;

- 2003 - the amount of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues.

It is understood that remunerations paid from profits are not assigned for labor achievements, but are timed to coincide with anniversaries and holidays, and encourage sports or other creative successes. If the local regulations governing such remuneration do not use the word “bonus,” then such payments are classified as income with code 4800.

In a letter dated 08/07/2017 No. SA-4-11/15473@, the Federal Tax Service of Russia clarified that remunerations with income code 2002 include bonuses related to wages:

- bonuses paid: based on the results of work for a month, quarter, year;

- one-time bonuses for particularly important tasks;

- prizes in connection with the awarding of honorary titles, with state and departmental awards;

- remuneration (bonuses) for achieving production results;

- bonuses paid by budgetary institutions;

- other similar awards.

However, the Decree of the Supreme Court of the Russian Federation dated April 16, 2015 No. GK15-2718 distinguishes bonuses depending on frequency and establishes that bonuses related directly to wages must be paid in the same way as wages. The date of actual receipt of income on such premiums should be considered as the last day of the month for which the premium was accrued. Thus, the Supreme Court clarified how to qualify bonuses for production results (code 2002) with a monthly frequency.

Letter of the Ministry of Finance of Russia dated September 29, 2017 No. 03-04-07/63400 answers the question about the date of actual receipt of income from production bonuses (also with code 2002) but with a different frequency: one-time, quarterly, annual. For them, the date of actual receipt of income is set as the day when the money was withdrawn from the cash register or transferred from the company’s current account to the employee’s card.

How to set up types of bonus calculations in “1C: ZUP 8” ed. 3

Starting from version 3.1.5.170 in the 1C: Salaries and Personnel Management 8 program, edition 3, the settings of calculation types have been changed, which have Accrual purposes selected Prize. The date of actual receipt of income for the bonus is determined depending on Income categories. Income category indicated in the calculation type card on the tab Taxes, contributions, accounting and can take the following values:

- Salary;

- ;

- Other income.

For accrual with income category Salary as Dates of actual receipt of income in the 6-NDFL report, the last day of the month for which this accrual was made is established.

For other charges Date of actual receipt of income in the 6-NDFL report, this is the day of actual payment of income to the employee.

The categories available for selection are determined by the settings Type of income for personal income tax. If on the card Type of income for personal income tax flag set Corresponds to wages, That Income category can be selected:

- Salary;

- Other income from employment.

If Type of income for personal income tax Not Corresponds to wages(the flag is not set) then the following categories are available for selection:

- Other income from employment;

- Other income.

Setting up personal income tax types

Rice. 1. Setting up personal income tax income types

Rice. 2. Setting up a bonus for production results

Setting up income categories

For bonuses for production results, you should set Revenue code“2002” and, depending on the frequency of the award, select Income category from the options:

- Salary;

- Other income from employment(see Fig. 2).

Rice. 3. Setting up a bonus paid from the organization’s profits

For bonuses paid from the organization’s profits, special purpose funds or earmarked proceeds, it is necessary to establish Revenue code 2003.

Choice given Income categories from the following options:

- Other income from employment;

- Other income(see Fig. 3).

Rice. 4. Document "Award"

note that clarifying the category in this case is important for choosing the personal income tax rate for non-residents. A tax at a rate of 13% on such a premium for non-residents in accordance with paragraph 3 of Article 224 of the Tax Code of the Russian Federation is calculated in the program if Income categories - Other income from employment.

Let's look at examples of setting up bonuses in the 1C: Salaries and Personnel Management 8 program, edition 3, and how they are reflected in the 6-NDFL calculation.

Example 1

Monthly bonus with Income code"2002" and Income category“Wages” are calculated according to a separate document. The bonus is stated as monthly. The month following which it is calculated, for the purpose of determining Actual income dates– January 2018, indicated in the field Month(Fig. 4).

Consequently, in Section 2 of the 6-NDFL report for the first quarter of 2018, the monthly premium for January is displayed in the lines:

130: 10,000 rub.

140: 936 rub.

Example 2

One-time bonus with Income code"2002" and Income category

Example 3

An anniversary bonus for an employee in the amount of 10,000 rubles, configured in accordance with the above recommendations, was accrued and paid during the interpayment period on February 15, 2018

Anniversary bonus for an employee with Income code"2003" and Income category“Other income from employment” is accrued according to a separate document, similar to Example 1.

In Section 2 of the 6-NDFL report for the first quarter of 2018, the one-time bonus for January is displayed in the lines:

130: 10,000 rub.

140: 936 rub.

note, in “1C: Salary and Personnel Management 8” (ed. 3) it is not recommended to change the categories in the settings of bonuses accrued earlier. To avoid changes to already generated reports, it is recommended to create new calculation types.

From the editor . At the lecture “1C-Reporting for the first quarter of 2018 - new things in reporting, what to pay attention to” dated March 29, 2018, 1C experts talked about the features of preparing reports for the first quarter of 2018, including setting up bonuses. See part of the video “Features of preparing “salary” reporting in “1C: Salary and Personnel Management 8” (ed. 3).” More details – in 1C:ITS .