What is a deposit and how to make money on deposits? Bank Modern business standards – “Urgent replenishment”

Today, the most conservative and less risky method of investing money is bank deposit. Its essence is that you enter into an agreement with a bank under which you invest a certain amount of money for a specific period (time deposits) or without a term (demand deposit), respectively, at an agreed interest rate. By using bank deposits, you have the opportunity to receive not high, but guaranteed income obtained by investing your own capital.

Now on the market banking services, there are quite a lot of proposals for opening all kinds of deposits. Banks are trying to lure customers in every possible way: high interest rates, unique profitable programs, prize draws and gifts. And all this so that you make your deposits with them. But what types of deposits are there and how to choose a deposit that is right for you?

All deposits are divided into two groups: urgent and on demand.

Time deposit

Time deposits are opened for a specific period: 3, 6, 9, 12, 18, 24 and 36 months. The longer the period for which you deposited your savings, the higher the interest rate on the deposit. Today, interest rates on deposits are: in rubles - 9-13% and in dollars/euros - 5-8%. But you retain the right to receive funds on demand, but the bank in this case charges interest at the demand deposit rate, which is from 0.2% to 1% per annum.Also, time deposits are divided into several types:

- Standard deposit. At the end of the deposit period, interest is accrued to a separate account on demand. For example, by depositing 200,000 rubles into your account for 12 months, at 11% per annum, after a year you can withdraw 222,000 (200,000 from the main account and 22,000 from the demand account.

- Deposit with capitalization. On the principal amount, the bank charges interest once a month or once a quarter, while the interest is added to the principal amount of the deposit. In the next period, interest will no longer be accrued on the initial deposit amount, but on the amount with accrued income for the previous period. For example, you invested 200,000 rubles at 10% per annum. After 3 months, the bank charges 10% per annum for the first 3 months, i.e. approximately 2.5% - this comes out to 5000 rubles, and adds it to the principal amount. In the next 3 months, the bank is already charging interest in the amount of 205,000 rubles. etc. before the end of the contract.

- Multicurrency deposit. This deposit allows you to open accounts simultaneously in different currencies and, before the expiration of the agreement, freely distribute funds between them. For example, if on financial market, one of the currencies has begun to fall sharply in price, then you can transfer funds to an account in another currency, thereby saving your savings.

Deposit on demand

Demand deposits are another matter. Here you get the opportunity to save your savings in a personal account and receive accrued interest and, upon request, receive the required amount in your hands; you also have the opportunity to replenish your account. But interest rates on demand deposits are minimal and vary from 0.2% to 1% in rubles, because This type of deposit is very unprofitable for banks, due to the possibility of calling funds at any time. And for investors, such a deposit is also not very profitable because this type of income is not quite profitable, and it will not save money from inflation.Typically, demand deposits are used to transfer and receive funds (salaries, pensions and student accruals) or for their temporary storage, so that you can get your savings at any moment.

Perhaps this information will help you not to get confused when choosing a deposit and choose the bank deposit that is right for you.

It would seem that there is nothing to say about banks and bank deposits. Probably everyone has (or had) a deposit in a bank. Bank deposit is the most famous, accessible and simple investment instrument allowing you to receive a certain profit.

Bank deposits are the simplest and most accessible form of storing personal savings. Although the profit from the placement barely covers inflation, and in some cases even below it. However, this is more profitable than just keeping money at home under the mattress. The article will talk about how to choose the right bank deposit and what criteria you need to pay attention to first.

Why do you need a bank deposit?

- tool for storing money for a rainy day or emergency fund. Every person should have a cash reserve for any unforeseen situations. And bank deposits are the most optimal placement of funds due to their high liquidity.

- tool for achieving everyday goals— if you plan to invest money for a short period: from several months to 1-2 years. For what? Or you are planning and saving money for a specific purpose, be it a vacation, an expensive purchase - bank deposits are guaranteed to allow you to calculate the term and the final amount that you will receive along with interest

- short-term investment tool. If you plan to invest money in longer-term (and more profitable) financial instruments, but don’t yet have the required amount - deposits will help you accumulate it. Further, the accumulated amount can be invested further - in stocks, bonds, real estate, etc. depending on your goals and capabilities.

How to choose banks?

At first glance, this is a simple question. We chose the most reliable banks - open a deposit and sleep peacefully. But there is one circumstance. As a rule, in such reliable banks, interest rates on deposits are much lower than the national average. The difference can be 30-40%. How you don’t want to lose your already not very large profit.

On the other hand, banks with high interest rates on deposits have a risk of license revocation. Of course, this is not 100%, but there is still a small probability.

The law of the market is that the higher the profitability, the higher the risks.

What to do? What should I do?

Since all deposits are insured by the state (at the time of writing - 1 million 400 rubles), you can choose the most profitable deposit (but not at the highest rates, but 1-2% lower). And it is also advisable to distribute deposits across several banks (small diversification).

Which deposit should I choose?

Choosing the right deposit is one of the most important conditions when investing in a bank. What criteria should be used to select a deposit?

- Possibility of partial withdrawal of funds without loss of interest. In case of unforeseen situations, you may urgently need money. And withdrawing them from the account means losing all accrued interest. Even if you have one day left before the end of your deposit. Investing for short periods (3-6 months) is low interest by deposits. It is better to find a long-term deposit (1-2 years), for which the rates will be higher, with the possibility of partial withdrawal of funds without losing accrued interest.

- Possibility of deposit replenishment. For what? It doesn't matter why. Are you saving for a specific purchase, or are you planning to further transfer money to other financial instruments, or are you simply using the deposit as a financial safety net? By investing additional money, you not only increase your amount, but also receive additional income.

- Interest capitalization. This thing allows you to work not only with your money, but also the accrued interest (monthly, quarterly) also begins to generate additional income. Compounding interest on interest or is one of the fundamentals of investing. It is especially noticeable for long-term investment periods (10-15 years), but in 1-2 years it will allow you to earn an extra penny. A trifle, but nice. With help, you can see how additional income will grow due to the capitalization of interest.

- Fixed deposit rate. There is a trend in the country towards lowering the refinancing rate, and the interest on the deposit depends on its size. The situation at the end of 2014 and beginning of 2015, when the rate sharply increased by 1.5 times, was rather an exception to the rule.

You've probably noticed that the conditions for deposits in banks are quite strange. Strange in what way? There are, for example, 2 types of deposits: for 1 year with a rate of, say, 10% per annum and a second deposit, for six months - with a rate of 10.5%. Logically, it should be that the longer the deposit period, the higher the profitability should be.

And the consultant imposes on you the second deposit. The rate on it is higher, and even automatic prolongation (extension of the deposit after the end of the term).

The fact is that after six months, the rate may be reduced, and then for the same six months they will accept only 9.5% or even 9%. And accordingly, the extension will take place under new conditions, which may be worse than for the initial investment.

By choosing a deposit with a fixed rate for the entire term of placement, you will be protected from these small troubles and will be able to accurately count on exactly the amount of profit for which you have concluded an agreement.

Each person saves money for different purposes. However, what many people don't realize is that keeping your savings at home is not the best solution. Instead of generating income for their owner, they only lose their real value due to inflation. In addition, people often do not restrain themselves and spend money. However, deposits in Moscow will help you not only preserve your finances, but also increase them in accordance with the agreement.

Today this product is a universal investment tool. Unlike the stock or precious metals market, you do not need special knowledge or constant analysis of the economic situation. You simply find a suitable offer and sign the contract. Moreover, in most organizations there are no restrictions on minimum contributions, and if there are any, they are small.

The contract itself is very important, so you need to familiarize yourself with the text in person before signing it. To do this, ask the bank employees to provide a sample in printed or electronic form and carefully read all the points, especially those written in small print and marked with an asterisk. With the help of such tricks, unscrupulous organizations try to mislead a potential client and include conditions that are unfavorable for him in the agreement.

Description of important points

The main advantage of the service, in addition to a stable income, is reliability. Consumer accounts are protected by the state at the legislative level through the program compulsory insurance. Therefore, in the event of liquidation or revocation of the license, you will be paid compensation. However, it is limited to 1.4 million rubles, which does not prevent you from dividing the amount exceeding this limit and placing it in several organizations, eliminating various risks.

The next aspect we will look at is account types. The first one is urgent. In this case, you place funds for a certain period of time. Of course, you have the right to apply for early withdrawal, but with a high probability the bank will refuse to pay the accumulated interest. Wherein this type The deposit is divided into savings and accumulative, which is provided for periodic replenishment (popularly called a “piggy bank”).

The second option - on demand - comes at a low rate. The thing is that it is not profitable for an organization to keep finances for itself, knowing that the owner has the right to demand their return at any time. Such a product is preferred by that category of customers for whom the fact of reliability is enough, and potential profits are of little interest to them.

Online assistant

On the website you will find current products on the market. Reliable information is collected here, which our specialists check and update daily. By comparing services according to their main parameters - and this is the interest rate, opening cost and commission, you can make the right decision, and the ratings section will help you in choosing an organization. the site is the largest financial supermarket on the Runet, successfully operating for more than ten years.

Under what conditions can I open a deposit account in rubles? Which banks offer the best interest rates on deposits? How to calculate the profitability of a deposit?

Hello, dear readers of the HeatherBober business portal!

2. What criteria can be used to classify a deposit deposit - 3 main characteristics

It should be noted that when investing money in savings bank, you also protect your funds! All amounts up to 1.4 million rubles are insured unconditionally. Therefore, you can lose your savings by making deposits only in the event of a global financial cataclysm.

Let's consider how you can classify deposits for a more convenient and effective choice of financial investments.

Sign 1. According to the period of storage of funds

We divide our investments into urgent And demand deposits. The criterion in this category is time. you invest cash for a certain period with its own remuneration features.

A time deposit does not allow withdrawal or replenishment of the invested amount. Such investments are made for a strictly defined period and interest. If you want to withdraw your savings ahead of time, most likely, your interest rates will be reduced, or even a fine will be imposed.

Example

Pensioner Denis Ivanovich made a deposit in the bank for exactly one year, so that in a year he could use the accumulated interest to buy building materials. But bad luck, he needed money to repair his car before the end of the deposit. What to do? He went to the bank to collect his money.

At the bank, the manager nodded his head in understanding, shrugged his shoulders and began to process a refund with the minimum interest rate.

Demand deposits are also issued for a limited period, but with much lower savings rates. This is due to the fact that you can withdraw the required amount from your account at any time or completely close the deposit.

In order to attract customers, many banks are opening universal services. Such hybrid deposits have a fairly high interest rate (up to 12% and higher depending on the currency), but have a limited potential for withdrawing funds in demand. Most often this is some kind of non-reducible deposit amount.

Sign 2. By type of task

1) Savings deposits

The contribution is made in anticipation of a large purchase: a car, an apartment, a yacht. Perhaps you want to save a certain amount for a trip or simply need a small capital to finance a project.

Very often, such programs already exist within banks and sometimes have their own names depending on the purposes for which the funds are saved (car deposit, apartment payment). The point of a deposit is that you make contributions, accumulating the amount of money you need.

2) Settlement deposits

Focus on financial activities, saving, spending and replenishing your deposit. A distinctive feature is that there is a certain minimum balance on the deposit. Usually the lower deposit threshold is small, and you practically have the entire deposit amount.

You use all the services of the bank, you can use a current account at your own discretion, the only drawback is a certain period of time (most often from 15 to 20 days) when the invested amount can be withdrawn in full, except for interest (usually does not exceed 1%).

Designed for target customer groups. The deposit is made based on the accumulation of interest on the remaining amount from the replenishment. Let's imagine that you open a deposit for which you are credited wage. Interest is accrued on the portion of the amount that you have not spent in the current month.

Closing his time deposit, Denis Ivanovich drew attention to special offer bank and asked whether it was possible to re-register the deposit on other terms.

The bank accommodated the pensioner and gave him another deposit, from which he could withdraw the amount of money he needed, and interest was accrued on the balance.

4) Metal inserts

Gold money. In this deposit you turn your savings into precious metals. Just buy the desired weight of noble material and monitor its market value.

Interest on these deposits is accrued extremely rarely. Income is usually made up of fluctuations in the price of jewelry.

Sign 3. By type of funds

And the last group of contributions, at first glance, is quite simple, but it’s worth taking a closer look at it.

Usually people make investments in national monetary units, but when there are financial changes, they run to banks, withdraw their money and buy currency, which they sell again a little later, ultimately receiving the same original amount.

We divide deposits into:

foreign exchange (usually opened in euros or dollars);

ruble (have maximum interest rates);

multicurrency (the deposit is made in euros, dollars and rubles, there is the possibility of free currency conversion).

Interest on all deposits is accrued in the currency in which they were opened. For multi-currency deposits, accounting is kept for each currency separately.

When drawing up a new contract, the manager asked in what currency Denis Ivanovich would like to open his new account?

The pensioner scratched his ragged beard and decided to impress the manager with his wisdom:

There are two types of money: ours and not ours, but you can mix it too!? Make me a multi-currency! I will organize a small Forex on my account!

3. How to calculate the return on a deposit - 5 simple steps

If you decide to open a deposit, let's count how much profit it will bring us! You can go to the bank’s website and use a special remuneration calculator.

If this option causes mistrust or difficulties, then contact the representatives financial institution to clarify the scheme for calculating interest rates.

As Ostap Bender said:

Once upon a time there are some people wandering around the country banknotes, then there must be people who have a lot of them.

It is profitable for someone to borrow money, spend it, pay back the interest and put something in their pocket. And we will begin to count the profit that we will receive when opening a deposit.

Step 1. Specify the interest calculation scheme

Accruals occur daily, but the actual amount is usually indicated once a month.

Interest on the deposit can be calculated simplified or with. A simple scheme looks like adding the annual rate to the original amount, provided that we do not withdraw funds from the account.

It's a little more complicated with capitalization. In this case, interest is calculated on the deposit amount plus interest accrued for the previous period.

Step 2. Multiply the initial deposit amount by the annual rate

Let's play with the calculator and take 10,000 rubles for the initial amount. To see your net profit for the year using a simplified scheme, multiply by the annual rate (take 15%). Total, 10,000*15%=1500.

Step 3. Calculate income capitalization

The more often capitalization occurs, the more profitable is the deposit? Yes, but not always. With frequent capitalization, the annual rate decreases! And ultimately, the effectiveness of the deposit is leveled out.

To calculate capitalization, we need to add the interest received to the original amount and recalculate the interest again.

Example

Vitya opened a deposit for a period of one year and received a bonus from the bank in the form of a monthly capitalization of his deposit. The initial amount in the deposit account was 100,000 rubles and when closing the deposit, Victor expected to see 112,000 in his account.

Our investor was surprised to find 112,682 rubles in his account! Oh, Vitya, Vitya, you forgot that you received capitalization as a gift!

Step 4. Determine the effective rate

Please note that the effective rate only works when the deposit is capitalized and provided that previously accumulated interest is not withdrawn from the account. Thus, when calculating capitalization, we will be able to accumulate interest on the amount already added.

As we already know, when making a deposit we are informed interest rate. To find out effective rate(the percentage at which final calculations are made), we need to determine the number of capitalizations. The effectiveness of the bet will be proportional to this number.

For example, with an initial deposit amount of 10,000 rubles and an interest rate of 12%, you will receive 10,098 rubles in the first month and with monthly capitalization, the next interest will be accrued to you exactly on the last amount.

The rate with such a settlement system will increase its effectiveness to 12.06%, for the next month to 12.12% and so on until the deposit period expires.

Step 5. Calculate the final profit

S =N *(1+(Y *J /100*T )) A

- S - total amount;

- N - initial amount;

- Y - interest rate;

- J - number of days in the capitalization period;

- T - deposit term, number of days;

- A - number of capitalizations.

Screw this math! It could be simpler and clearer.

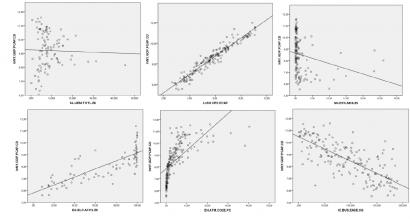

Let's make 3 different annual deposits of 1000 rubles each and compare the results:

So it becomes clear that before making a contribution, it is advisable to independently determine its profitability and look for alternatives to the proposed programs.

4. Who offers the best conditions for deposits - review of the TOP 3 banks with favorable terms of cooperation

Let's look at the leaders in attracting investment in Russia.

What interest rates for deposits do banks offer us and how they differ, read on.

has been working in Russia since 1990. Largest bank in the Sverdlovsk region, the leader of its region in terms of deposits. It has representative offices in more than 43 regions of the country.

The reliability of the bank is confirmed by the Deposit Insurance Agency, the National Rating Agency at the “AA” level, which indicates the highest creditworthiness of the organization. The Ural Bank for Reconstruction and Development is a multiple winner of Russian social achievement awards.

Presenter financial institution Ural offers its clients profitable deposits and deposits up to 11% per annum. Various bonuses and discounts, additional services await bank depositors.

You can get plus 1% to the rate by opening a deposit in the Ural Bank. Leave your phone number on the company’s website and they will call you back within 20 minutes to clarify the features of the deposit for the program you are interested in.

Deposits are easy to manage using online banking. Online payments are available to customers to pay for various utility and entertainment services. On the company’s website you can participate in all sorts of promotions and competitions with attractive prizes.

Largest bank Russian Federation. It has branches in all major cities and territorial districts of Russia. Serves all segments of the population and forms of business, providing the widest range of banking services.

On the company's website you can familiarize yourself with the terms and conditions of bank deposits and immediately register your investment. You can choose a deposit that is convenient for you online. It will help you clarify the nuances and features 24 hour service consultations and feedback.

Having a deposit in Sberbank, you enjoy various bonuses and discounts in the socio-economic sphere of activity of Russian citizens.

The joint stock company was founded in 2000. It represents a wide range of financial services and occupies a leading position in the agricultural sector of the economy. The Bank is developing investment and lending programs, focusing on the interests of citizens living in rural areas.

The bank operates in all regions of Russia and provides clients with the opportunity to manage their accounts from anywhere in the constituent entities of the Russian Federation. On the company's website you can view all available investment programs and ongoing promotions. If necessary, open a deposit remotely by submitting an application via the Internet.

5. How to open a deposit account correctly - 5 golden rules for a depositor

Opening a deposit is always associated with certain fears and risks. It seems that this is a very troublesome task - to go somewhere, to count something, and is the game worth the candle?

Let's look at how to invest your money with maximum efficiency and simplicity.

Rule 1. Do not choose a deposit solely based on the interest rate

The main criterion when choosing a deposit is the interest rate. The higher the bet, the more you can earn. But it is worth remembering that the bank has the right to change the interest rate depending on financial troubles.

Deposit rate is not Snickers, size doesn't always matter!

Apart from the interest rate, there are other factors that must be taken into account. In particular, the same capitalization that I wrote about above.

Rule 2. Make a choice in favor of banks with foreign capital

Such banks are stable and reliable. They have more long term work, which allowed them to reach the international level. The capital of such banks, placed in foreign exchange reserves, is more stable to shocks.

The vast majority of institutions with foreign capital are subsidiaries of foreign banks represented on Russian market. Due to sanctions and pressure on the Russian economy, it is much easier for such organizations to exist in the economic field of activity and at the same time offer attractive investment programs.

Rule 3. Divide funds into several deposits in different currencies

It would be reasonable to divide the contribution into several parts. This will allow you to freely convert money, managing exchange rate risks and leveling inflation processes.

Most multicurrency deposits are made in three units: rubles, euros, US dollars. Other currencies are used much less frequently, but still have their place.

Deposit (bank deposit)- this is the amount of money placed by a depositor in a bank for a certain or indefinite period. The bank uses the placed funds as working capital, which is used to make a profit. Regardless of the result, for the use of these funds, the bank pays the depositor a bonus in the form of interest.

During a crisis, this is the most reliable way to invest personal funds. All banks that accept money from the public for deposits are required to be participants in the state government, which guarantees depositors of such banks payment of compensation for deposits of up to 1.4 million rubles if any problems arise in this bank (bankruptcy or revocation of a license).

The shortage of liquid funds became the root cause of the crisis. Banks are taking serious measures to attract funds from outside. One of the measures is to increase interest rates across the entire line of deposits. Banks are beginning to actively advertise their deposits, attracting funds to the bank ordinary people.

Since during a crisis they have nowhere else to get money. By placing funds in a bank, you are guaranteed to receive your income. in the form of the interest rate promised by the bank.

Today you can easily find a bank deposit at 15-20% per annum in rubles, which seemed unrealistic just a year ago. These are pretty big numbers. And given the inflation rates, we can safely say that you will not only save your money, but also increase it.

Crisis is time profitable investments and shopping, including in the bank deposit market . Today you can both earn and lose on deposits. The result depends on the contribution parameters and your goal.

To make these words more clear, let's look at the table below:

- at an interest rate of 14% per year

In this example, we considered a bank deposit with an interest rate of 14% per annum, with monthly capitalization and the possibility of monthly additional contributions.

14% is the rate that existed before the crisis. In the spring of 2009, when the shortage of liquid funds in banks was especially sensitive, there were offers on the deposit market that were much more interesting than 14 percent per annum.

For example, I invested 250,000 rubles at 20% per annum for 200 days in one of the banks. Deposits in this bank are insured, so I have peace of mind about my money. After 200 days, the amount of interest accrued for the entire deposit period will be 27,397.26 rubles. Of which 958.90 rubles is tax. I will receive 26,439.36 rubles net.

Each bank has a fairly extensive range of deposits in its arsenal. As they say, for every taste and color. Although, often, this fact plays a disservice to banks.

This is explained simply. Most people in our country are financially illiterate. They don't even understand the banking instruments, and here they are also offered a wide choice.

However, a wide choice is not only a problem for banking structures. How many customers leave the store empty-handed just because they were offered too wide a choice!

For example, in the bank where I worked before, there were about 8 types of deposits, of which there were only two or three working ones. A similar number of deposits is more necessary to make sales.

This technique is borrowed from retail, where 20% of products generate 80% of revenue. Or to put it another way, 80% of the products are necessary for the main 20% to sell well. Therefore, if you decide to study the deposits of any bank, keep this in mind.

But let’s return to a detailed consideration of bank deposits. If we approach this issue from an anatomical point of view, then all contributions have a skeleton.

The skeleton is the very essence of the deposit. Namely, the opportunity to preserve and increase your funds with the help of a bank. But each contribution has different properties. Depending on these properties, they differ financial results. Properties are determined by customer needs. The properties of deposits are:

- Interest rate

- Capitalization of interest (order and cyclicality)

- Deposit term

- Deposit currency

Interest rate

The higher the interest rate, the better. The final amount of money you earn depends on its size. However, this is not a key indicator of the profitability of the deposit.

Possibility of replenishing the deposit during the term

For me personally this is important indicator, since I try to save 10-20% of my income every month. And if the deposit allows you to make replenishments, then I try to take advantage of it, since interest is accrued on the deposit amount. At the same time, some banks do not allow you to replenish your deposits, especially for deposits with a high interest rate.

Interest capitalization

This is one of key indicators, according to which you should choose a bank deposit.

This is one of key indicators, according to which you should choose a bank deposit.

Capitalization– this is when the interest earned is added to your initially invested amount of money.

The more often capitalization occurs, the higher the final deposit amount will be, since interest is calculated on the total amount.

There are the following types of capitalization: monthly, quarterly and capitalization at the end of the term. Although there are quite unique capitalization conditions.

For example, one of my deposits capitalizes twice a month. In the middle and at the end.

In the pictures you can examine in detail the principle of capitalization. For example, I took 100,000 rubles, at 14% per annum, for a period of one year.

There are also different procedures for calculating interest. They can be added to the deposit, or credited to a separate account, from which you can then withdraw them.

Deposit insurance

Here it is important to know whether the bank is included in the compulsory deposit insurance system or not, since.

Deposit term

This is a rather “tricky” parameter. Let's say you made a deposit for a period of three years at 15 percent per annum. The agreement of many banks states that in case of early termination of the deposit, the interest rate will be calculated at the rate of the “Demand Deposit” deposit, which usually does not exceed 0.5-1% per annum.

I rarely use deposits where the deposit period is more than a year. Circumstances change, conditions change, and it is important for me that I can quickly manage my money.

Deposit currency

IN Russian banks There are three main currencies in use: rubles, dollars and euros. The interest rate on deposits in rubles is usually much higher and fluctuates at 13-20% per annum at the time of writing.

In dollars and euros, the interest rate ranges from 6 to 9%. It is worth noting that people who made deposits in foreign currency before the crisis they made very good money. Considering that from November 2008 to the present day, the value of the euro and dollar has increased by an average of 30%.

Add to this the interest rate. Let me explain with my own example: on November 6, 2008, I opened a deposit in one of the banks, in dollars, at 9% per annum, for a period of 222 days. The deposit amount is $1000. I deposited 27,510 rubles.

Interest is calculated at the end of the term. It will be 1054 dollars, which in terms of rubles, at the rate of 31 rubles per dollar (dollar exchange rate as of May 23, 2009), will be: 32674. The yield will be about 18%. The contract expires on June 16, 2009.

Possibility of partial withdrawal of the deposit without loss of interest

This is another interesting parameter. If we continue to consider the previous example, I forgot to mention that my dollar deposit does not have the possibility of partial withdrawal or withdrawal of the deposit without loss of interest.

Otherwise, I would have withdrawn the money when the dollar was worth 35 rubles. This option will also be useful in other cases. For example, I have a deposit in another bank, where partial withdrawal is possible.

Free video course to help you with this.

Video for dessert: Unique transforming miracle cubes