Home credit card benefits. Home loan bank card benefits - conditions, advantages and disadvantages of the card. Documents and requirements for borrowers - credit card holders Benefits

One of the leaders in the commercial banking industry, Home Credit, introduced a card with cashback up to 10% and interest on the balance. Is it true? Who benefits from registration and who doesn’t? Let us consider in detail whether it is necessary to issue a card and what is needed for this.

Card "Benefit"

Home Credit Bank provides new profitable offers, including the Pozla card. Let's start the review of the card with the positioning of the bank itself - “card of maximum opportunities”. Indeed, this plastic allows the owner to use a convenient payment system and earn money. The bank will charge the owner up to 10% on the account balance, 3% on a check in a cafe, restaurant or gas station, 1% on other purchases.

Design of “Benefits”

To receive a card, you must. There you will select the card type - Gold or Platinum, then fill in the necessary data, including:

- last name, first name, patronymic in full;

- Date of Birth;

- mobile phone;

- passport series and number;

- E-mail address;

- social network account (optional).

Previously, only regular bank clients could use the program, today everyone has the opportunity. You can apply for a debit or credit card (a similar opportunity is provided by). In the latter case, additional data, such as a social network account or income certificates, will increase the limit provided. After filling out the application, a bank employee will call the client, clarify his personal information and tell him about further actions.

Primary data processing takes no more than 30 minutes. The operator will tell you about a preliminary decision on credit plastic or inform you about the place and time of receiving a debit “wallet”. We'll talk about the terms of service for each type below.

Debit card: terms of service

Afterwards, you can pick up the finished card at an office convenient for you. You can view branches on the bank's website.

How much money back for purchases with a debit card? Benefits:

The maximum monthly accrual is no more than 2,000 rubles for the purchase of all goods and no more than 3,000 rubles. at the expense of gas stations and restaurants. Additionally, annual interest will be charged, it depends on the amount of the card balance. If the amount is less than 300 thousand rubles, and more than 5 purchases are made, then the charges are 7%. If there are less than 5 purchases, then 5%. If the balance amount is more than 300 thousand rubles, then savings for the amount exceeding 3%.

The issuance of plastic is free, and there is no one-time fee for annual maintenance. A debit card may have additional costs, which are presented in table form:

For clients receiving wages on a card (over 20,000), preferential conditions apply; no commission is charged for cash withdrawals from ATMs of other banks or for transfers to the account of another bank.

Credit Cards Benefits

A credit card differs from a debit card in that in this case the bank provides you with funds that you then need to return. When filling out the form, you must select the type of card: Gold or Platinum. The percentage of cashback you will receive depends on it. Let's present it in the form of the following table:

The contract specifies the conditions and terms of return. The Benefit card from Home Credit is considered one of the most advantageous lending offers. To receive one, you must fill out an online application. On the day of application, a final decision is made on loan confirmation and amount. There are several requirements for the borrower:

- must be a citizen or resident of the Russian Federation;

- age ranges from 21 to 64 years;

- the client must have a residence permit or permanent registration in the city where there is a Home Credit Bank branch;

- continuous work experience at the last place of work must be at least 3 months;

- You are required to provide a landline or mobile phone number.

This is a list of mandatory requirements; the following factors can increase the credit limit:

- stable salary (you can provide a certificate of income 2-NDFL or in the form of a bank);

- positive credit history (including in other banks);

- absence of unpaid traffic police fines and court debts.

During a visit to the company’s office, you must have a passport and 2 documents with you, this could be:

- SNILS;

- International passport;

- Driver license.

Copies of documents are sent by the operator for verification, after which a final decision will be made. It takes no more than 40 minutes to accept. Once the loan is approved, the borrower receives an instant issue card. The approved amount will already be on it; after a week you will need to contact the same bank branch to pick up a personal payment.

Conditions and tariffs of the credit card Benefit

The card is in many ways more profitable than its competitors. However, there is one important condition: the Benefit program is connected to the credit card. The bank charges 990 rubles for this. with gold type of plastic and 4990 with platinum. Other terms of service are shown in the table:

| Criterion | Gold | Platinum |

|---|---|---|

| Limit | Up to 300,000 rub. | Up to 300,000 rub. |

| Interest rate | 33.9% per annum (49.9% when using cash) | 29.9% (49.9% when using cash) |

| Interest-free period | 51 days | 51 days |

| Minimum monthly payment | 7% of credit debt, but not less than 1000 rubles. | 5% of credit debt, but not less than 1000 rubles. |

| Daily limit for cash withdrawals from an ATM | 10,000 rub. for cards with number 44609805 and 30 thousand rubles. for other cards | 10,000 rub. for cards with number 44609805 and 50 thousand rubles. for other cards |

| Daily cash withdrawal limit at the cash desk | 30,000 rub. for cards that start from 44609805 and 100 thousand rubles. for other cards | |

| Cash withdrawal interest | 4.9% of the amount of funds, but not less than 399 rubles | |

| SMS notifications | 59 rub. | 59 rub. |

| Second and subsequent reissue of the card | 200 rub. | 200 rub. |

In the future, the borrower can return funds to the card in a convenient way:

- Through ATMs or Home Credit Bank cash desk.

- Through any other bank, by contacting the operator.

- At Russian Post offices. Such a transfer can take 10-12 days.

- Through electronic payment systems Rapida, Eleksnet, Contact and others.

- Interbank transfer from card to card using account/card number. In the first case, the transfer will take 3-4 business days, in the second, the transfer will occur almost instantly.

The advantages of a credit card from Home Credit are the ability to top up with your own funds, that is, you can use it like a debit card, if necessary, spend bank funds and return them during the interest-free period.

Whatever card you choose, the Benefit program will allow you to receive significant bonuses. Let's talk about them in more detail.

What is "Benefit"

This is a loyalty program that allows participants to get back some of the money they spend. At the same time, unlike other banks, Home Credit accrues cashback even for ordinary household bills, including payment for housing services, mobile communications, payment of fines and taxes. The following are not eligible for bonuses:

- Money transfers;

- cashing out funds;

- purchase of lottery tickets, securities;

- casino accounts.

The remaining bonuses are divided into three types:

- Basic – accrued for all purchases at retail outlets;

- Special – points for paying bills at trade and service enterprises (gas stations, restaurants and cafes, from the “travel” section);

- Promotional cashback is a cashback, the conditions for receiving which always change; it accrues for online purchases from partners bank, as well as for checks falling under current bank promotions.

Let's calculate the benefits

Before applying for a Benefit card, you can find a benefit calculator. Enter the approximate amounts you spend on purchases, after which the system will calculate bonuses. One bonus is equal to 1 ruble.

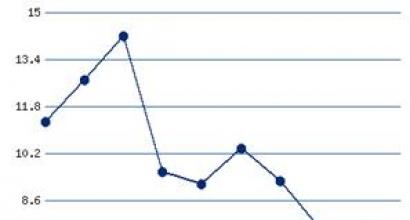

Let's calculate cashback for the Gold card with specific spending conditions. Monthly expenses – 30,000 rubles, of which 5,000 rubles. for gasoline, 5,000 rubles. for online purchases, 4000 rub. to pay bills in restaurants and 16,000 rubles. for everyday expenses, buying groceries. In this situation, the monthly return will be 930 rubles, per year the amount will reach 11,160 rubles. With a Platinum card, the same expenses will bring you 1,190 rubles monthly. and 14280 rub. in year.

Points are accumulated in a separate account, which can be managed using your personal account or mobile application. The average time of receipt is 5-15 days from the date of purchase, the maximum period for accruing points is 45 days.

Partners

It is profitable to make online purchases from bank partners; you can get up to 30% cashback for them. Your personal account contains personal offers that will be constantly updated. The minimum rates that partner stores have are stable; we present the most profitable ones in the table:

We also note that it amounts to 3.5% of the amount spent. There is only one exception; only the Clothing and Footwear categories are eligible for the program. However, additional promotions are often held that increase the benefits for purchases in the largest online market.

Using bonuses

1 point corresponds to 1 ruble. After receiving a card with the Benefit loyalty program, the client also receives a bonus account where cashbacks will be received. Management occurs through your personal account, in which you need to log in. Login is carried out through the company’s website from a personal computer or mobile phone.

Points can be used to instantly top up your mobile account or refund purchases. It turns out that a significant difference in the Home Credit program is that you do not pay for new purchases with points, but return money for old ones.

In your personal account, find the list of transactions, select the one you need, indicate the amount you want to return and confirm the operation. You can receive a refund of part of the funds or the full cost of the product (if you have enough points). You can also get your money back for paying utility bills. The average interest payment time is 2 weeks.

Spending bonuses is not available in three cases:

- The client has already sent a request to write off points and is awaiting a response;

- For this operation, the goods were returned and the payment was cancelled;

- The client is checked for illegal actions and fraud as part of the bonus program.

For one request, the client can convert no more than 100,000 points into rubles. Bonuses with an early validity period are used first; it is 12 months. Points that have not been used during this period will be expired and cannot be restored.

What you need to know

The scheme for receiving bonuses is clear: you make purchases, receive points, which you then convert into rubles. To make the mechanism even more transparent, let’s pay attention to some nuances:

- The period for accruing points may differ depending on their type and the conditions of the promotion.

- Neither type of points applies to the purchase of gems, bonds and other securities, lottery tickets or travelers checks.

- If the bank suspects a client of abusing the loyalty program, an audit may begin. The bonus account will be frozen until the circumstances are clarified, after which it will either be canceled or reinstated.

- If the bank credited cashback, but the purchase was cancelled, the amount is reset to zero. If it has already been spent, then the account acquires a negative balance, and the points will be written off during subsequent accruals.

- The Bank also reserves the right to write off points that were credited in error. If there are insufficient funds, the balance will go into minus.

- If the client terminates the contract, the crediting of points will cease from the moment it is signed by both parties. Bonuses accrued before can be used throughout the year.

Using your personal account

Participants in the Benefit program need a personal account to manage bonuses, as well as to receive personal offers. It displays not only cashback conditions at partner stores, but also individual rates.

To log into your personal account, you will need the mobile phone number to which your bank card is linked. Here you will see the entire history of purchases, accrual and write-off of bonuses. The expiration date of the points is also displayed, the system informs that some of the bonuses will soon expire. Please note that you can only convert points from your personal account; there is no such function in the mobile application yet.

Question answer

Many questions arise during the process of using the card; we will try to answer the most popular ones.

You made a purchase and still haven’t received points?

This is normal, bonuses do not come immediately. In some cases, the return period can reach 45 days. Pay attention to the terms and conditions of promotions provided on the site. You can also see the deadline for crediting bonuses from partners in your personal account. If after 45 days the points have not arrived, contact the bank via “Feedback” or call the hotline.

How to check your balance and find out your transaction history?

The bonus account statement can be viewed in your personal account via Internet banking, by phone or by visiting a company branch in person.

Is it possible to pay off loan debt with points?

You cannot pay for a loan payment directly with bonuses, but points can be converted into rubles, returning money for other purchases. You can dispose of them at your own discretion. Please also note that bonuses cannot be exchanged for points from other bonus programs.

Where to create a personal account, why is it needed?

Users of the Benefit program need a personal account to manage points, exchange them, track receipts and write-offs. Personal offers will appear here. You can connect to your personal account at the company office or by calling the contact center number.

If you forget your login combination, you will have to return to the office with the documents, since only you know the password. There you will be given a new one-time code, which you will change after your first login.

Expert opinion

The Benefit card is an advantageous offer for everyone. There are no restrictions on minimum spending; card servicing is no more than 99 rubles. per month, that is, 1200 rubles. in year. Active users will save a similar amount per month. It is especially profitable to pay with a card when purchasing air and train tickets, paying for services at gas stations and for goods in online stores.

Since there are restrictions on the number of monthly bonuses, we recommend that you first pay for large purchases that fall under special and promotional bonus categories.

There are several main advantages of the program compared to its competitors:

- bonuses are awarded for paying utility bills, taxes and fines (this is rare among similar offers);

- favorable rates on basic and special offers;

- the presence of partner stores where you can receive a significant amount of refund;

- points are converted into rubles at the rate of 1 to 1;

- The money received can be used without restrictions.

Installment card Freedom

Apply for a card Apply for a Freedom installment card

Debit Card Benefits

Apply for a card Apply for a debit card Benefits

Apply for a cash loan

Get money Apply for a cash loan

Card Benefit of Home Credit Bank

Today, cashback is very popular among the population, so financial institutions are trying to keep up with the times. HomeCredit Bank also issues credit cards with a cash-back feature on purchases. The client can borrow money from the bank, and for this he can also receive bonuses when paying for goods or services. The program is called “Benefit”, it is easy to join and save your money.

How it works

A credit card is a plastic medium on which the bank credits borrowed money for the user. Additional promotions and loyalty programs may be connected to the credit card. Thus, the “Cosmos” and “Successful Purchase” cards are connected to the Benefit program. What does this give? At the client’s request, the bank issues him a credit card with a loan, the minimum amount is 10 thousand, the maximum is 300 thousand rubles. The bonus program is designed exclusively for purchases; you can cash out this money, but it is not profitable. But when paying by card at any retail outlet, 1-1.5% of the amount spent is returned.

If you pay with a card for purchases in the categories “Travel”, “Cafe”, “Gas Station”, 3-5% will be returned to your account. You can get even more cashback from the program’s partner stores. These points are accumulated in a bonus account, then they can be converted into real money or spent in a store on the bank’s website without commissions. You can apply for such a card in Gold and Platinum status; the program conditions for them differ. What you need to know about cards with benefits:

- grace period: up to 51 days;

- annual service cost: for Gold - 990 rubles, for Platinum - 4990 rubles;

- borrowed money: up to 300 thousand rubles;

- All purchases are refunded, you can get up to 30% cashback;

- the grace period does not apply to cashed-out money;

- commission for withdrawing cash from your own or someone else’s ATM is 4.9%;

- annual rate: 29.8%;

- card issue: free;

- bonuses are exchanged for rubles in your personal account at the rate of 1:1.

Despite the paid service, consumer reviews confirm the benefits of the program. If you use the card only for non-cash payments and repay the debt on time, cashback covers all expenses and makes a profit. A significant advantage of the program is that points are awarded even for paying housing and communal services through the official Home Credit website.

How to get a card

To join the program, you need to obtain the preliminary consent of the bank, then pick up the finished plastic at the nearest HomeCredit office. To begin, leave an online application for .

On the portal, fill out a simple form and confirm sending.

After checking the data, the bank will notify you by phone about the decision. They immediately give a credit limit of 10 thousand, the amount will gradually increase if the client pays the debt on time. They may refuse a loan and offer a card with a zero limit; at first it can be used as a debit card; over time, the bank will open a limit. After confirmation, you need to come to the office in person and pick up your card.

Activation

To use your “Benefit” and receive points, you need to activate it. When you receive the plastic, you can ask an employee to do this. Credit card activation is also available on the Home Credit page.

On the portal you need to enter all the data step by step, after which a message with a PIN code will be sent to your phone. After this, the Benefit card becomes working.

How to use it correctly

The terms of use are simple: for all purchases on the Internet or in a store, you need to pay with a card and receive your points. Bonuses – save and spend on pleasant things. To avoid paying extra interest, it is better not to withdraw cash. It is also important to monitor the payment period and not miss the next deposit of money. To repay the loan, the client is given a grace period of 20 to 51 days. Depends on when the payment was made: at the end or beginning of the billing period (RP). When concluding the contract, the start date of the RP is indicated.

Amortization

For example, the start of the billing period is set to the 6th. On August 7, the client buys groceries for 2,000, then on August 16 pays for building materials for 3,000, and on September 3 pays for movie tickets for 500 rubles. RP falls from August 6th to September 6th, during which time you can spend money. And from September 6 to September 25 is the payment period, during this period you need to deposit all the money taken, in our case it is 5,500. At the same time, for all expenses he received cashback to the bonus account. After repaying the debt, the available limit is restored and you can use the money again.

You can top up your card through Home Credit cash desks or ATMs, terminals, or transfer money online from a debit card.

Partner stores

To get more money back, you can make purchases through an affiliate network. Partners are stores and organizations that offer increased cashback. Eg:

- the Sem+Ya grocery store chain will return 9.5%;

- the medical cosmetics brand VICHY gives 11%;

- children's goods store MyToys awards from 400 points;

- the network of clothing and footwear boutiques OSTIN returns 11%.

The list of partners changes frequently. Therefore, it is better to check the list of stores on the program website. When shopping online, it is important to go to the store from the website or personal account.

Personal Area

To always be aware of your account status, it is better to register for Internet banking. Through your account you can pay for utilities, mobile communications, and Internet without commission. It’s fast and convenient, and according to the terms of the bonus program for online payments, you will also get 1-1.5% back. Personal account Benefits of Home Credit Bank is a separate service where the user can view the account balance, recent transactions, and the date of the next payment. You can enter it by following the link polza.homecredit.ru and clicking the “Login” button in the upper right corner.

Enter the data in the form that appears and submit. A message will be sent to your phone with an access code to your account, enter it into a new block, and that’s it. In your account you can always see when and how much money to deposit on the card so that no interest accrues.

The Benefit program is a bonus offer with cashback. Despite the fact that the service is paid, the money returned from purchases more than covers expenses. Unlike competitors, Benefit from Home Credit allows customers to save at any retail outlet, not just from partners. The accumulated points can be transferred into real money and continue making pleasant purchases.

Interest is calculated and accrued on balances at the end of each day. Payment of earned interest occurs on the first day following the billing period.

The billing period in this case is one month. That is, you receive interest every month on the first day.

For every purchase you receive cashback under the bonus program « Benefit » . Cashback is awarded in the form of bonus points, which you can exchange for Russian rubles.

1 Point = 1 Russian ruble.

You can convert points into rubles through your personal account in online banking or mobile banking, indicating the required amount for conversion.

Cashback is awarded for all purchases in the form of points, 1 point = 1 ruble. All accumulated points can be converted into rubles in your personal account on the Home Credit website.

What is charged for:

For all purchases - in the amount of 1%. Credit usually arrives within 4 - 5 days from the date of payment. The maximum cashback you can receive per month is 2000 points.

The advantage of the “Polza” card is a large affiliate system of popular stores, for purchases in which the holder returns up to 30% from purchase. In addition, when purchasing products from partners, you are awarded additional promotional points. To do this, you need to pay on the online store website with a “Polza” debit card. Additional points are credited to the card from 1 to 70 days from the date of payment.

The card provides free service. To do this, you need to spend from 5,000 ₽ or keep a balance of more than 10,000 ₽. If these conditions are not met, 99 ₽ will be debited from your account.

Reissuing a card for the first time is free for the client, but all subsequent times will cost 200 ₽. In addition to the main “Benefit” card, you can issue up to two additional ones for the whole family with a total score. This makes it much easier to fulfill the conditions for free service and get maximum cashback for your spending.

The cost of SMS notification from Home Credit Bank costs 59 ₽/month.

« Benefit » can be used without entering a PIN code and pay for goods with one touch. To make a purchase, you simply need to present your card to a reader or terminal. The terminal will scan your data and the purchase will be made.

Such purchases can be made for amounts up to RUB 1,000. If the amount exceeds this value, then you will need to enter the card PIN code

Cash withdrawal. “Polza” allows you to make free withdrawals from any ATM without additional commission. This opportunity is given 5 times a month. All subsequent cash withdrawals are subject to a fee of RUB 100. The withdrawal limit is limited to RUB 500,000 per day.

- In your personal bank account, making a transfer to a card of someone else’s bank

- Withdrawal from Home Credit Bank ATMs

- Withdrawal through the cash desk of any bank

Home Credit currently issues quite interesting and profitable credit cards, the popularity of which is only growing every day. The main attention of potential clients is attracted by “Credit card with benefits” in the GOLD and PLATINUM categories.

In this review article, we will look at all the features and nuances of these cards, conditions and reviews, and also try to answer the question: “Is it worth getting a credit card with the benefit of Home Credit?”

Terms of service for the card

- Card type: VISA GOLD and VISA PLATINUM with PayWave contactless payment technology.

- Annual card maintenance: 990 rubles per year for a GOLD category card and 4990 for a PLATINUM category card.

- Grace period on the “Benefit” card up to 51 calendar days, honest and completely free.

- Maximum credit limit on the card can be 300 thousand rubles.

- Cash withdrawal fee is 4.9%, minimum 399 rubles.

Cashback on the card with benefit

The main advantage of the card is that when you pay with it in stores and in online banking, you can receive cashback points, which can later be exchanged at a 1:1 rate for rubles.

The cashback percentage varies depending on the card category. For example. With a GOLD category card, the bank pays cashback for purchases in “Cafes and Restaurants”, “Gas Stations” and “Travel” - 3%, and for other purchases, including in Internet banking, you can get 1% “porridge”.

As for the PLATINUM category card, here the accrual of bonus points is more profitable: for purchases in the categories “Restaurants and cafes”, gas stations and Travel you will be awarded 5%, and for other purchases you will receive 1.5 percent.

In addition, for any card category, when paying with card partners, you can receive a refund of up to 20%. The current list of partners and conditions for receiving bonuses can be viewed in the Internet bank.

When paying by card in online stores, do not forget to use the cashback service LetyShops, allowing you to additionally receive cashback for online purchases of up to 30%.

How to get a card to your advantage

To get a credit card with benefit you must satisfy minimum bank requirements to design a card, or rather:

- Be a citizen of the Russian Federation.

- Be at least 21 years of age and not older than 64 on the card issue date.

- Actually live in the region where the card was issued.

- Be employed in the region where the card is issued. Moreover, the length of service at the last place of work must be at least 3 months.

- You need a landline work number, as well as home and mobile numbers.

Documents you will need to provide:

- Passport.

- The second document to choose from is a driver’s license, SNILS or international passport.

Pros and cons of cards with benefits

Among the advantages, one can immediately highlight what catches the eye - this increased cashback 3-5 percent in certain categories and from 1 percent for other purchases. But the most interesting thing is that Home Credit gives cashback for paying for goods and services through Internet banking. This is one of the few banks that “pours porridge” for such operations.

Another advantage of the card is that the card can be obtained quite easily. That is, the card can only be issued using a passport and a second document.

The third plus is Possibility of receiving a card on the day of registration. After leaving an application on the bank’s website and receiving a decision online, you can come to a bank branch and receive an instant card. An excellent option for those who need a credit card urgently and without certificates.

As for the minuses, here we can highlight annual service fee, although if you actively use the card, the cost of service can easily be recovered.

In addition, Home Credit Bank is famous strict requirements for telephone numbers when applying for a card or loan. It is mandatory to provide a landline work phone number. Although many banks are more loyal to contacts in the questionnaire.

How to apply for a card from Home Credit

To apply for a credit card with benefit from HCF Bank, do this in two ways:

- Contact the department.

- Fill out the application online on the bank's website and get an instant decision. Then go to the branch for a card.

Is it worth getting a “Credit Card with Benefits”?

After reading this article and familiarizing yourself with the bank’s tariffs, everyone can draw a certain conclusion. Definitely, the card is worth getting for those who often visit entertainment venues, who have a car, and who travel frequently. You can earn quite an impressive cashback on spending in these categories with the card. The map will really be useful for you.

Also, this card can be recommended to those who quite often pay for goods and services in online banking (housing and communal services, cellular communications and other suppliers), because no other bank will provide bonuses for such transactions. And Home Credit does this. And this is a competitive advantage.

Perhaps you have already issued a card or are planning to do so, then share your experience and feedback about the card.